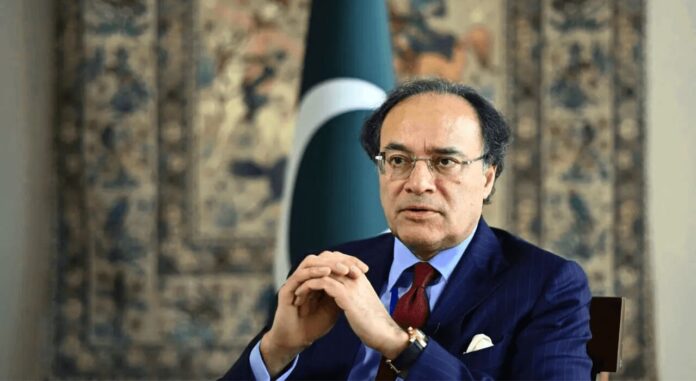

ISLAMABAD: The government is urging the insurance sector to expand its lending activities beyond traditional banks to meet the increasing demand for financial services. This was emphasized by Federal Minister for Finance and Revenue, Muhammad Aurangzeb, during a meeting with the CEOs of Pakistan’s leading insurance companies.

The finance minister reiterated the government’s commitment to supporting the insurance sector, recognizing its significant potential for private sector investment. He stressed the need for innovation, increased productivity, and further growth to strengthen the sector’s role in the national economy.

The discussions focused on how the insurance sector could further contribute to various areas, including the health system, investments in Pakistan Investment Bonds (PIBs), capital markets, and long-term investment opportunities. The minister assured the delegation that the government would continue collaborating with industry leaders to ensure the sector’s sustained prosperity, emphasizing its critical role in Pakistan’s economic landscape.

The delegation presented several key proposals aimed at boosting the growth and productivity of the sector, highlighting its current size, with assets worth Rs2.9 trillion and employing 20,000 direct and 234,000 indirect individuals. They also noted the sector’s contribution of Rs613 billion in gross written premiums and Rs373 billion in claims paid to date.

Minister Aurangzeb expressed his appreciation for the delegation’s insights and assured them that their proposals, particularly those related to taxation and policy measures, would be thoroughly considered. He also mentioned that the consultative process for the upcoming federal budget had been expedited this year, with over 90% of the process already completed.

The finance minister emphasized that the Federal Board of Revenue (FBR) is carefully reviewing all proposals to ensure that the impact on the economy and revenue is thoroughly assessed, with the goal of implementing policies that will drive the growth of the insurance sector and other key economic sectors.