In the recent budget announced by Muhammad Aurangzeb, it has been advised to decrease the tax rate levied on the salaried class of the country. It was expected that the decrease in the tax rate would be much higher, however, the suggestions that have been made leave much to be desired.

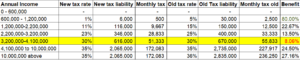

Under the taxation policy proposed, it has been suggested to keep annual income below Rs 6 lakh untouched. This means individuals earning less than Rs 50,000 per month are exempt from income tax. In terms of the next slab, individuals earning between Rs 6 and 12 lakhs of annual income or monthly income between Rs 50,000 and 100,000 would see a marginal tax rate of 1% which has been slashed from 5% seen previously. This would mean that an individual was giving Rs 30,000 in tax in previous year which has been decreased to Rs 6,000 this year.

For individuals earning between Rs 12 and 22 lakhs of annual income or monthly income between Rs 100,000 and Rs 183,333, the tax rate has been decreased from 15% to 11%. The last tax slab to be revised sees people earning between Rs 22 and 32 lakhs of annual income equating to monthly income between Rs 183,333 and Rs 266,667 end up paying 23% rather than paying 25% on their additional income above 22 lakhs.

The top two slabs of individuals earning between Rs 32 and 41 lakhs or monthly earnings between Rs 266,667 and Rs 341,667 have been left untouched at 30% while the last slab of individuals earning more than Rs 41 lakhs or monthly income above Rs 341,667 will see their income taxed at 35%.

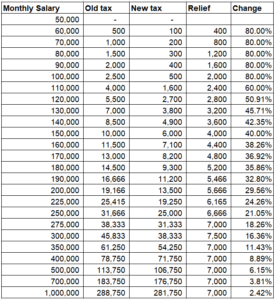

Based on the slabs of new taxes, the biggest benefit will be extracted by the individuals who get between Rs 6 lakh and 12 lakhs as they will see their tax liability fall by 80% by the new taxation. Even though this should be seen as a huge change, the fact that this will only benefit individuals earning less than Rs 100,000 per month shows that this will prove to be a small relief.

The relief given to the remaining slabs shows that the highest benefit from the new regime will be given to the individuals earning more than Rs 1 crore annual income with a relief of 27% while the lease benefit will accrue to the individuals earning monthly income of less than Rs 341,667 as they will see their income tax bill reduce by only 8%. If all slabs are seen as equal, the average of the relief will come to around 29%, however, the majority of the salaried persons will see little benefit of the new tax policy.

If monthly income is considered, it can be seen that the highest benefit is accrued by the people earning less than Rs 200,000 per month as they get 80% in income relief. As income goes above Rs 300,000 per month, the benefit shrinks to only 16% and keeps on decreasing to only 2.4% when incomes reach Rs 1,000,000 per month.

It was expected that the Finance Minister would look to provide a larger relief to the majority of the salaried class as recent figures show that the salaried individuals will end up paying 5 times higher tax compared to exporters and retailers. In the first ten months of Financial Year 2024-2025, it was seen that the salaried class paid Rs 430 billion in income tax. Just a year ago, the same class paid Rs 368 billion in taxes as well which was by far the biggest source of income for the Federal Board of Revenue (FBR).

Out of the total tax collected, the salaried class will end up paying more than 10% of the total collections in the recent year and with only a slight decrease in the taxation, it can be expected that the next year the ratio will remain similar to the one seen this year. In contrast, traders ended up paying 6% of the total tax collections. Based on the collections in Financial Year 2023-24 and the current year, it is expected that the government will end up collecting 56% higher tax collections from this sector and the trend has been to squeeze this sector as much as possible.

While other sectors of the economy look to evade paying taxes through retaliatory measures, FBR has handed down its own responsibility of collecting tax to the companies who are seen as withholding agents and withhold part of the salary at source before they pay out the salaries to the individuals. This leaves no option to both the corporations and individuals in terms of evading or under-representing their income which is done by the other sectors of the economy.