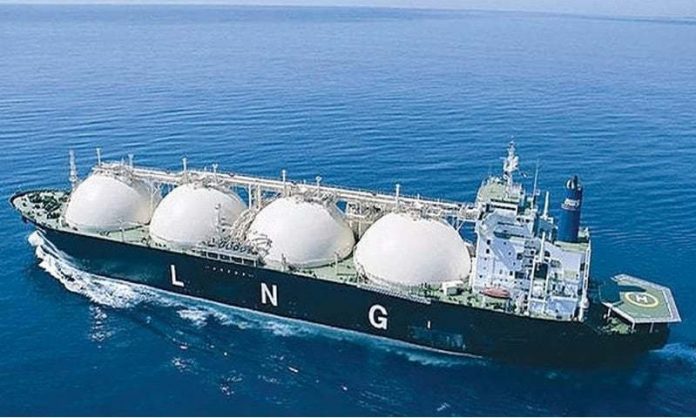

Pakistan has decided to initiate talks with Qatar over the future of liquefied natural gas (LNG) supplies, primarily due to the price opening clause set to be triggered in March 2026 under two long-term LNG agreements.

The News reported that a high-level delegation led by Federal Minister for Petroleum and Natural Resources Ali Pervaiz Malik will visit Qatar by the end of August. The key objective of the visit is to finalise the Annual Delivery Plan (ADP) for LNG cargoes for 2026.

The discussions come amid growing concerns over an LNG glut in Pakistan, exacerbated by the power sector’s failure to utilize the gas in accordance with existing contracts. This decision to initiate talks early was made to avoid further complications, as five cargoes, initially scheduled for 2025, have been deferred to 2026.

Under current agreements with Qatar, Pakistan imports nine LNG cargoes per month, including five at 13.37% of the Brent price and four at 10.02% of Brent. These agreements were designed to ensure a steady supply of RLNG for power plants in Punjab.

However, due to the power sector’s failure to utilise the gas, Pakistan has been facing increased pressure on its LNG system, with large volumes of LNG being diverted to the international market for sale, including cargoes imported from ENI.

As per the report, Pakistan’s agreements with Qatar and ENI differ significantly in terms of profit sharing. In the case of the ENI contract, both profit and loss from LNG sales to the international market are shared with Pakistan.

However, under the Qatar agreement, if LNG is diverted, any profit is not shared with Pakistan, and losses are borne entirely by the country.

The upcoming talks will focus on the price opening clause in March 2026, when Pakistan will have the option to reduce its LNG imports under the existing agreements. The talks will also aim to negotiate new prices for remaining cargoes based on prevailing market conditions.

Meanwhile, the LNG glut has caused significant issues for Pakistan’s gas sector, with the power sector’s underutilization of RLNG resulting in dangerously high pressure in the main RLNG pipeline.

As of August 3, 2025, the pressure had reached 5.170 bcf, with the potential risk of the national gas network bursting. To prevent a crisis, authorities have had to shut down gas wells producing 350-400 mmcfd.