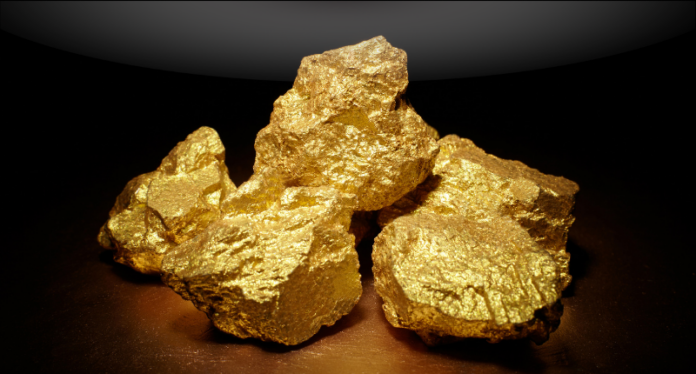

Gold prices slightly rebounded on Wednesday, after posting their sharpest decline since 2020 in the previous session, as investors purchased on the dip amid broader economic uncertainty and expectations of U.S. rate cuts.

Spot gold was up 0.3% at $4,134.37 per ounce, as of 0803 GMT. U.S. gold futures for December delivery climbed nearly 1% to $4,147.10 per ounce.

Bullion, which has seen multiple record highs this year, dropped to $4,003.39 earlier in the session, extending losses after a 5.3% plunge on Tuesday when it marked its sharpest daily drop since August 2020.

“That correction was necessary as the market has been well and truly overbought, trading off its own momentum,” StoneX analyst Rhona O’Connell said.

“We are still in an era that is fraught with uncertainties, and that will most likely mean that any substantial dips … will generate fresh buying interest.”

Investors are awaiting the U.S. Consumer Price Index (CPI) report, due on Friday, which could offer insights into the Federal Reserve’s trajectory for rate cuts.

A Reuters poll of economists suggests the Fed will lower its key interest rate by 25 basis points next week and again in December, though opinions remain divided on the long-term outlook for rates.

Meanwhile, a planned summit between U.S. President Donald Trump and his Russian counterpart Vladimir Putin was put on hold on Tuesday, while uncertainty persists over a possible meeting between Trump and Chinese President Xi Jinping.

Gold, which tends to perform well in a low-interest-rate environment, has surged 57% so far this year. Bullion is poised for its strongest annual performance since 1979, supported by geopolitical and economic instability, U.S. rate-cut expectations, and robust ETF inflows.

In other metals, spot silver edged 0.2% higher to $48.84 per ounce, recovering slightly after a 7.1% slide on Tuesday.

Platinum fell 1.4% to $1,529.52, while palladium gained 0.7% to $1,417.68.