In a surprise move, Prime Minister Imran Khan announced a massive cut of Rs10 per litre in the price of petrol and diesel, and Rs5 per unit in the price of electricity in his televised address to the nation today. Along with this there was a slew of announcements of further tax cuts, increase by Rs3000 in the allowance given under the Ehsaas program, interest free loans to small farmers and mention of another possible amnesty scheme, with details to be revealed later. Profit has learned that the move carried the assent of the Economic Advisory Council of the government.

The announcement comes weeks after Pakistan won a hard fought restart on its IMF facility that was in suspension since March 2020. After protracted wrangling that lasted for months, the government had conceded to the IMF demands to hike petrol and diesel prices by raising the collections from the Petroleum Development Levy to Rs 30 per litre by June, and raise power tariffs to end the accumulation of the circular debt.

With this announcement those commitments now hang the balance, casting a cloud over the newly resumed program. “There is no such thing as the IMF in this country any longer” says Hafeez Pasha talking to Profit. “The reality is that the fund program is no more.”

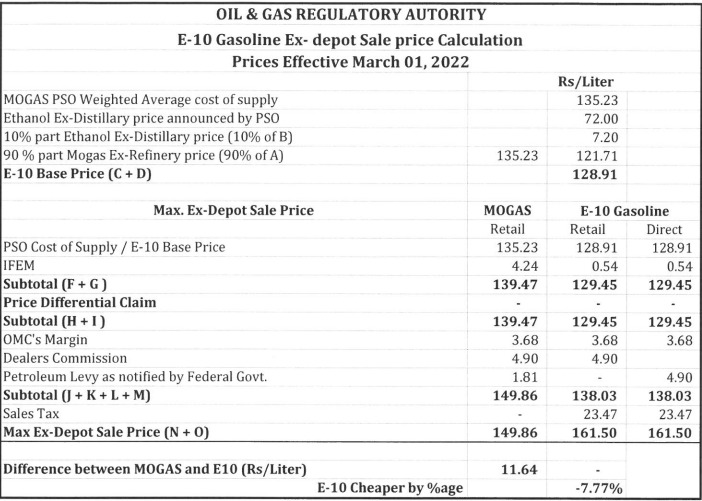

(New price notification for petrol prices. Petroleum levy has been reduced to Rs1.81 from Rs17.92, which absorbs the increase in crude prices over February and also reduced the price of one litre by Rs10)

A member of the Prime Minister’s Economic Advisory Council, who could not speak for attribution, told Profit that in his opinion, Finance Minister Shaukat Tarin must have obtained prior assent from the IMF before moving on this package. “I would be very surprised if Tarin has not already okayed this by the IMF” he said, adding that he did not know for a fact whether this was done or not. “But knowing him, I would be very surprised indeed if he has not first passed it by them and got their nod.”

Speaking on a TV show later at night, finance minister Shaukat Tarin said “we have taken this step after thinking it through”. He said it cannot be financed through debt, nor by adding an expenditure burden for the government. The total cost of the package was revealed by him to be between Rs250-300 billion.

Talking about the financing plan, he said some funds can come from the Public Sector Development Program, some funds are lying in the Ehsaas Fund due to overbudgeting, some from “leeway that the IMF had given to us in Covid funds”, and some from funds lying with “our oil companies” in undisbursed dividends over the last three years that he estimated totaled Rs1.3 trillion most of which had to be used for circular debt reduction but some will be used to finance this package.

He assured the anchor that the fund program will not be disturbed. “Whatever steps we take, we get their advice first” he said. “Their concerns are to keep the fiscal targets, not bring on too much debt on our books, we are not bringing any debt on our books as a result of this”. He also pointed out the excess revenue collection figure of Rs280bn. “We should be fine” he assured the anchor.

The petrol and diesel price reductions could cost the government Rs120 billion by June, he estimates based on a quick calculation. The power price reduction could cost Rs50bn, plus Rs10-15bn in lost revenue. “The subsidy on small loans” he continues, pointing to another of the measures announced by the PM, “could cost close to Rs40bn over two years, then the internship program Rs50bn (annual), allowance Ehsaas increase is another Rs25-30bn.”

Confusion surrounded the mechanism by which these price reductions will be obtained. In a tweet, Energy Minister Hammad Azhar said the price reductions will be absorbed first in the development levy charged on fuel and later via direct subsidy.

“On the instructions of the PM, Fuel Cost Adjustments that have been incurred in electricity bills (due to rise in prices of imported fuels) since last few months to the tune of Rs 4-5/unit will be absorbed by the govt henceforth for residential/commercial consumers” he tweeted shortly after the speech. “Similarly, petrol/diesel prices to be reduced by Rs 10/litre. This will be achieved by reducing PDL in the short-term but by a funded subsidy in the long term.”

Oil marketing executives were sceptical about the resort to direct subsidy, however. “Around 4-6 months ago they tried something similar” a senior oil marketing executive tells Profit. “And within two weeks they had to reverse the whole thing, but in the meantime a tab was built up with the OMCs and the refineries that to this day has not been settled.”

Apart from the mechanism, confusion also swirled about the impact this will have on the commitments made in the IMF program. In that program, the government had specifically committed to raising collections through the Petroleum Development Levy as well as power tariffs.

“[W]e will raise by PRs 8/liter the PDL and we commit to raise the PDL by PRs 4/liter per month for the remainder of FY 2022 until the maximum of PRs 30/liter is achieved” the Letter of Intent for that facility says. The IMF staff had noted that Pakistan “just recently caught up with passing through pending power tariff adjustments” and was committed to further hikes in the months ahead.

“Staff stressed that the regular implementation of tariff adjustments in line with established formulas is critical to lend credibility to the newly independent energy regulator” the staff report notes, referring to the new powers given to the power sector regulator and tariff setting body, Nepra.

“The EFF is now in jeopardy, clearly” says Mushtaq Khan, who served as Principal Economic Advisor to the State Bank Governor before setting up a private macroeconomic consultancy of his own. “With three months of uncertainty on global commodity prices given what’s happening in Ukraine, this is way too heavy a fiscal burden” he adds.

“Getting this past the IMF is going to be tough. It makes me wonder about what their back up plan is. If this unhinges business sentiments about the future, it could have repercussions for the stock market, but even more importantly, the FX market.”

The financial markets were similarly left wondering how the government intends to finance these measures, and what it means for the future of the fund program. “There are tough times ahead for investors” said Fahad Rauf, head of research for Ismail Iqbal Securities. “The move will be negative for all the three markets, debt, stocks and foreign exchange. Debt market yields are likely to rise immediately” he says, referring to secondary market yields on government paper, while “some investors in stocks might see the positive, but the broader direction for the economy is not positive. FX market is already under pressure, we are on course to hit an all-time high deficit in the CAD, rupee was already under pressure, and this could only escalate things on that front.”

🧵The govt of #Pakistan has found a specific #fiscal space of 250 Bln, which is being channelised to provide relief in #energy prices. Here is the break down #PMIKaddressToNation

— Abid Qaiyum Suleri (@Abidsuleri) February 28, 2022

The reduced price of fuel and power will help consumers and industry in the short term. But the impact of its financing burden is likely to hit the exchange rate hard. Everybody Profit spoke with agreed on this point. As such any disinflationary impact will end up being self defeating. Everybody also agreed that this was a political move more than anything else, coming from a government under pressure from the rising political temperature in the country.

“This is purely election mode coming up” says Rauf. “The looming no confidence vote is weighing on the PMs mind”.

Best observation but last 12 rupees increase and now decrease 10 what does it means, i think in this govt regime prices increased. although prices increased worldwide but this govt has no check and balance