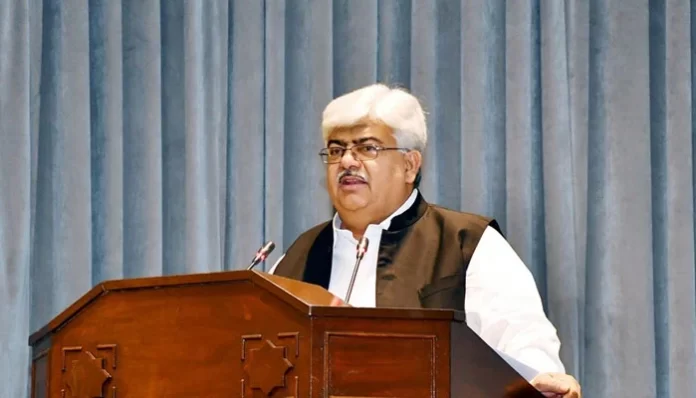

Federal Board of Revenue (FBR) Chairman Rashid Langrial disclosed that only 12 Pakistanis declared wealth exceeding Rs10 billion in their tax returns last year. The revelation came during a National Assembly subcommittee meeting chaired by PML-N lawmaker Bilal Azhar Kayani, focusing on proposed restrictions on property transactions for individuals with unverifiable wealth sources.

Langrial emphasized the need to link economic transactions with personal wealth, stating, “Only 12 individuals declaring assets over Rs10 billion does not reflect the true wealth of Pakistanis.” He compared the situation with India, where over 100 individuals hold wealth exceeding $3.3 billion, with Mukesh Ambani topping the list at $119.5 billion.

The government has proposed new measures requiring property buyers to justify purchases based on declared assets, aiming to curb tax evasion and money laundering. Under the proposed rules, a person can only buy property worth 30% more than their declared assets. The FBR suggested exempting assets worth up to Rs50 million from reconciliation requirements to encourage voluntary declarations.

Arif Habib, a prominent business leader, expressed concerns about the proposal, stating it could disrupt property transactions and leave buyers vulnerable to exploitation. “The draft bill is dangerous, especially at a time when businesses are already investing heavily in gold and dollars due to economic uncertainty,” Habib noted.

FBR data revealed that 1.7 million property transactions occurred last fiscal year, with 93.7% valued below Rs10 million. Only 2.5% of transactions, or 41,801 cases, would be impacted by the proposed legislation. Langrial defended the initiative, stating, “Our objective is to target only 2.5% households.”

However, Ashfaq Tola, president of Tola Associates, cautioned against overhauling the entire real estate sector for a small segment of transactions. “If the FBR cannot manage 41,801 cases without disrupting the system, it raises serious concerns about its efficiency,” he said.

Lawmakers also voiced concerns over the potential misuse of powers and questioned the effectiveness of existing measures, such as blocking SIM cards and utility connections for non-compliance. Some warned that the new rules could encourage money laundering and further destabilize the real estate sector.

During the meeting, it was revealed that 735,000 property transactions occurred in the first half of the fiscal year, with 500,000 involving non-filers. The FBR admitted that post-purchase audits have been largely ineffective, with a success rate of just 3%.

Langrial acknowledged the challenges, admitting that many filers fail to declare newly acquired assets in their returns. He suggested reducing taxes on property transactions to encourage compliance and revive the real estate market, subject to government approval.

The subcommittee is expected to meet again on Thursday to finalize its recommendations. Early discussions indicate the panel may propose waiving the requirement to justify the source of property purchases below Rs10 million.