LAHORE: Everything seemed to have worked out in favour of investors on Thursday. Indices rallied, volumes surged and foreign investors closed as net buyers in the last session. The market was up from the start and flew higher and higher with increased market participation.

SECP’s decision to withdraw the 5 per cent cash liquidity condition on mutual fund industry was welcomed by investors and the industry alike. The industry sources claimed the benefit of withdrawing the condition of 5 per cent cash will directly benefit the investors of mutual funds industry as the companies can now use the entire amount for the investment and earn a profit on it.

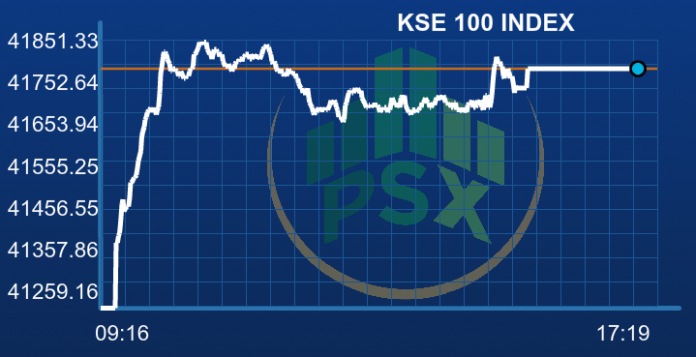

The benchmark KSE 100 index jumped to an intraday high of 41,851.33 with the addition of 592.17 points. It settled with 531 points gain at 41,790.16. The KMI 30 index added 1.64 per cent or 1,191.26 points to its bag and closed at 72,787.72. The KSE All Share Index appreciated 293.35 points with 289 advancers and 84 decliners.

The market volumes improved by over 60 per cent on Thursday. Total volumes were recorded as 97.35 million on Wednesday which stroked 161.74 million today. Sui Northern Gas Pipeline Limited (SNGP +0.59 per cent) led the volume chart with 10.49 million shares exchanged. Aisha Steel Mills Limited (ASL +5.16 per cent) followed with 9.10 million and Azgard Nine Limited (ANL +7.95 per cent), volume 6.10 million.

The engineering sector topped both in terms of cumulative sector volume, 22.28 million, and addition to sector market capitalisation, 3.24 per cent. International Industries Limited (INIL +5.00 per cent) touched its upper circuit breaker and so did Amreli Steels Limited (ASTL +5.00 per cent). Aisha Steel Mills Limited (ASL +5.16 per cent) also hovered around day’s maximum possible levels.

The refinery sector jumped 3.05 per cent to its market capitalization. Byco Petroleum Pakistan Limited (BYCO +5.06 per cent) gained the most and Pakistan Refinery Limited (PRL) clinched 3.61 per cent.