–Hafeez Shaikh says after announcing a historic package, govt now striving to ensure transparent distribution of relief money

–Says all sales tax refunds will be cleared within a week

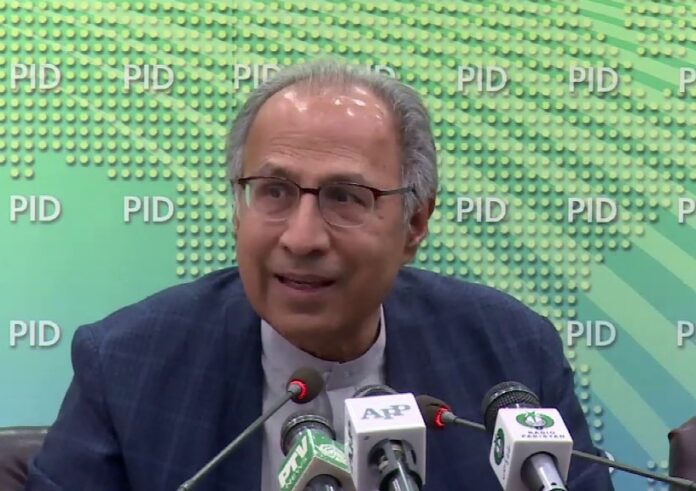

ISLAMABAD: Adviser to Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh said on Thursday that the government was taking all possible measures to safeguard the masses from the economic impact of Covid-19 pandemic.

Addressing the tax refund cheque distribution ceremony on Thursday, the adviser said that the government had announced the historic Rs1.2 trillion relief package to achieve three particular objectives: provision of security, food and cash to the deserving people.

He informed that the prime minister had already inaugurated a Rs150 billion programme under which 12 million families across the country would be given cash (each family would be given Rs12,000).

“One-third of the country’s population would benefit from this initiative.”

Secondly, he said, in order to protect the business community, which was being badly hit by the closures of global markets, the government had taken five big decisions, including the provision of Rs200 billion to those employees who were faced with unemployment threats or other difficulties.

He mentioned that the government had also announced Rs100 billion for the SME sector employees and owners, saying that currently if they were facing issues in repaying principle amount or interests, they would be given relaxation.

Hafeez Shaikh said a total of Rs100 billion was being refunded to people, particularly businessmen and exporters, while the government had also set aside another Rs100 billion to bear the burden of deferred payments on account of electricity and gas bills.

“People don’t need to pay their bills immediately and they can defer them for up to three months.”

He said an amount of Rs70 billion was released by the government to the reduce prices of petrol, diesel and other imported oil.

“The government has exempted food products from all types of duties and importantly, it will procure wheat of around Rs200 billion only to ensure that the farmers are facilitated and the demand for agriculture products is increased,” he added.

Talking about refunds, the adviser said that Rs100 billion were being refunded in four different ways, including Rs30 billion refunds of Drawback of Local Taxes and Levies (DLTL) through the commerce ministry and Rs10 billion through the FASTER sales tax mechanism.

Similarly, he added, Rs52 billion would be paid as the sales tax refunds to non-exporters, whereas Rs15 billion were being provided in duty drawbacks.

“This brings the total to Rs107 billion, distribution of which will be completed within a week.”

Terming it a historic achievement, he remarked, “I want to say to the PM that it is contribution of your government that no sales tax refund will remain payable.”

He said that the federal government was in regularly contact provincial governments in order to ensure that the relief package money was being spent transparently and was reaching those who are affected by the Covid-9 situation.