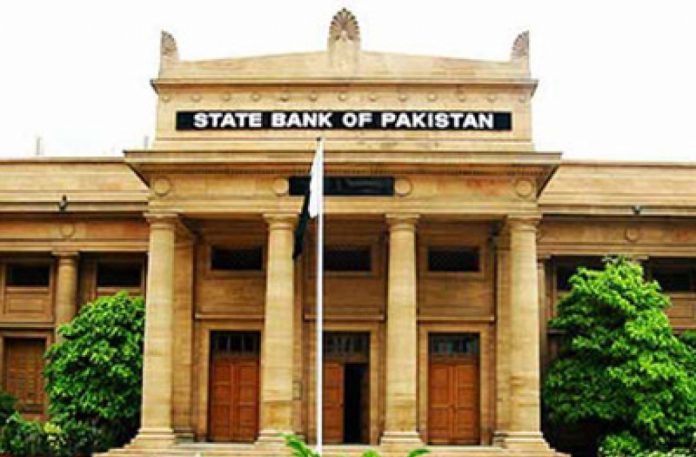

The State Bank of Pakistan (SBP) on Friday projected that the real Gross Domestic Product (GDP) growth of the country will be in the range of 5-6 per cent during the current fiscal year 2016-17.

The 2nd quarterly report of the SBP said, “The latest projections indicate a 5-6 per cent growth in the real GDP during 2016-17, which is expected to be higher than the last year.”

The SBP has released its second quarterly report for FY17 on the state of Pakistan’s economy today, in which it says that the overall economic environment remains conducive for growth, on the back of accommodative monetary policy, increase in development spending, and CPEC-inspired activities.

The report has also noted the improvement in investors’ confidence, as reflected in an uptick in private sector credit, especially for fixed investment purposes, foreign interests in Pakistani companies, and increased production of consumer durables. Similarly, a surge in import of machinery and raw materials also points to a robust industrial activity and buildup of future productive capacity.

The major contribution is expected from the rebound in agriculture and the increased pace of work on infrastructure and energy projects. In particular, the completion of early harvest energy projects under the CPEC is expected to provide an additional boost to industrial growth. These expectations are in line with the continuing robust trend in private sector credit and import of machinery and raw materials.

The growth in the industry, though likely to fall short of its target, is expected to maintain last year’s level, the quarterly report said. The textile industry, the largest sub-component of the LSM, is expected to post some recovery in the 2nd half of the fiscal year 2016-17, as exporters’ cash-flow constraints may ease following the recently announced export package, it added.

The commencement of operations of new power plants and the sustained increase in LNG imports are expected to help electricity generation and gas distribution to maintain last year’s momentum. Similarly, as indicated by strong trends in cement and steel production, the growth in the construction sector is likely to remain robust in 2016-17 as well, it added.

The report further said that the services sector, though showing a mixed trend. is expected to achieve its target growth rate for the year. The current trends in trade, especially imports, higher production and sale of commercial vehicles, a substantial increase in bank credit, flourishing housing schemes, and rising internet subscription, all suggest a vibrant services sector. Incorporating these developments; increase in agriculture production and sufficient food supplies, stable exchange rate, and a limited pass-through of rising international commodity prices to domestic prices are expected to keep inflation low and stable, the report claimed.

Importantly, in the case of oil prices, a less-than-warranted increase in domestic motor fuel prices would limit its direct and second round impact on CPI inflation.

Moreover, the recent increase in investment demand as reflected by the widening of twin deficits may not have an adverse impact on inflation in the remaining months of 2016-17. Therefore, full year average CPI inflation is expected to remain 4 to 5 per cent.

In view of strong growth in imports and taking stock of developments in international commodity prices and global economic trends, the current account deficit is likely to increase, however, the country’s foreign exchange reserves will remain at a comfortable level, the report said.

Some gains in exports due to the recently announced export package are expected to be offset by the muted remittance growth. Declining number of migrant workers going to the GCC (reflecting stressed fiscal conditions in these countries due to low oil prices), the pound sterling’s depreciation against the US dollar, and stricter regulatory controls in the US, are the main factors that will likely keep remittance inflows close to last year’s level.

Given the actual fiscal deficit of 2.4 per cent of GDP in the first half, and keeping in view that the deficit is usually higher in the second half, the full-year fiscal gap will be higher than the target of 3.8 per cent. This projection incorporates the impact of the recently announced export package, and assumes no significant change in the current pace of revenue collection in the absence of additional revenue generating measures.

On the other hand, expenditures are likely to remain elevated due to the government’s commitment to complete most of the power and infrastructure projects by the end of 2017-18, also aiming to improve the security environment.

According to the report, the growth in Large-scale Manufacturing (LSM) recovered in 2nd quarter 2016-17 with an increase in production of food, cement, steel, pharmaceuticals, automobiles, and electronic industries. The growth in agricultural sector is also expected to rebound on account of the higher production of cotton, sugarcane, and maize and increased prospects for wheat harvest.

The report highlights that the current account deficit has almost doubled compared to the last year. This was due to a surge in growth-inducing imports along with non-realization of CSF and decline in exports and remittances. On an encouraging note, the report acknowledges that the foreign inflows – FDI, loans, and Sukuk issuance – were little more than sufficient to finance a higher current account deficit. The report, nevertheless, highlights the need to contain the current account deficit to manageable levels to sustain external sector stability.

While the report terms sustained increase in development spending as commendable, it also underscores the need to enhance revenue collection.

The report shows that average CPI inflation has risen from 2.1 per cent in 1st half 2015-16 to 3.9 per cent as in H1-2016-17 which reflects a higher domestic demand and an increase in global commodity prices. However, it highlights that on a year-on-year basis, the CPI inflation has fluctuated in a narrow range during this period.

Finally, the report perceives the growth to maintain the upward trajectory, while inflation is to remain below the target during 2016-17.