On May 10, 2018, the Pakistan Telecommunication Authority (PTA) launched Device Identification, Registration and Blocking System (DIRBS) as per the guidelines of Telecom Policy 2015. In a few more months, the service became operational.

You might remember it from the time when PTA’s text message service of verification of mobile devices through 8484 became frequent. The second wave of importance for DIRBS came when PTA announced that mobile phones with non-compliant SIM or IMEI functionality will be blocked by January 15, 2019, and therefore all such phones should be registered through DIRBS to avoid blocking.

Reportedly, PTA started blocking unregistered phones from January 16, which sparked another debate about whether these phones could be unblocked in the black market. Profit covered that story in detail, showing that it was indeed possible to bypass PTA’s blocking and get non-compliant phones to become regularly operational again.

Then came the option of one imported phone per Pakistani coming to the country from abroad to be registered free of customs duty through DRIBS, putting this system back into the news, and then one final time when this offer was taken away by PTA.

DIRBS is the system that is used to make a phone PTA compliant through registration and paying the due custom duties and taxes as per the prices of handsets. However, there is more to the story, and not all of it is good.

Background of DIRBS

This system was pegged to have been launched as an effort to curb the risks associated with the use of illegal mobile handsets in the country. The system is intended to verify, detect and discourage illegal, non-compliant, non-tax paid handsets and devices. It works by authenticating currently active devices on cellular networks and ensuring continual monitoring as new devices are activated.

The reason that this sort authentication became necessary in the first place was the way mobile phones actually come to Pakistan before they can be displayed in a shop somewhere. There is the strictly legal route and the shadier methods where you buy phones without the original box and charger from a dingy shop for too good a price.

When a handset is imported through legal channels, the custom duty and any related taxes are already paid on the import and at the same time the International Mobile Equipment Identity (IMEI) number of the phone is registered with PTA.

Sometimes, the phones brought through regular channels as well do not have their IMEI numbers registered, but these phones come individually, for instance, an expatriate bringing one with them when they visit their families. So there is a small, yet persistent portion of mobile phones that are not smuggled but not registered with PTA either. However, any such phone can be made PTA-compliant and its IMEI numbers can be registered by paying the due taxes and uploading information on DIRBS.

On the other hand, the phones imported through grey channel are not registered, and often end up in the market without payment of duties and taxes. It makes them much cheaper for someone who buys them knowing that they are smuggled. At the same time, the fact that PTA has no record of them whatsoever, and the authority cannot trace their usage, such phones are also more likely to be used for criminal activities.

DIRBS was put in place to cater to this latter type of mobile phones by making it impossible for such phones to work in the country. The impact of the measures undertaken through this system, however, has been that unsuspecting phone users have found their devices blocked. Law abiding citizens thinking they are buying a legitimate phone have also discovered that their device was smuggled only after they get blocked.

So theoretically, you could be gifted a brand new iPhone from your brother in Dubai, replace his UAE sim with your local sim and have the device work perfectly for as long as two months before the PTA catches on and your phone literally turns into a very fancy, very shiny, very expensive brick.

What do you do when that happens? You go to the PTA, of course, who tell you that the registration price for the phone is Rs15,000. If you cannot afford it, then you are in trouble. Nobody is going to buy a blocked phone and your best bet is probably to buy a smaller, cheaper phone to make calls and send text messages, and use it as a data hotspot to use whatsapp and other features on your unregistered phone.

Another notable factor here is that the tax brackets applicable on imported phones are decided on their original sale value, and not depreciated prices. This means that if anyone buys a phone off the second hand market or is gifted one by a relative or friend, irrespective of how old the phone or the model, the payable tax amount would still be calculated on the original sales prices.

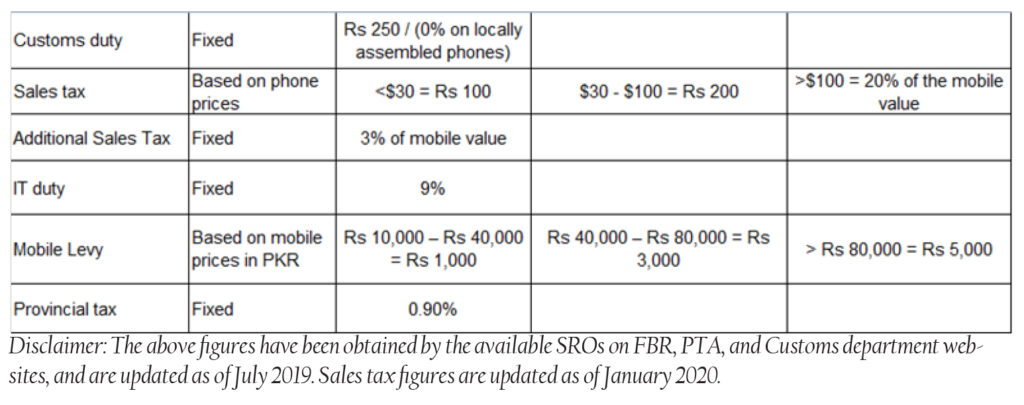

The tax amounts and custom duties on mobile phones have also undergone much fluctuation in the past one year, with three different policies coming in on March 12, July 10, and September 15 during last year. As per the latest updates, the taxes and duties payable are as follows:

Even with these fluctuating rates, there are still more areas under impact from DIRBS. The debate on whether DIRBS has actually been effective to control smuggling or black channels of mobile phone imports is another debate. We will discuss that in the next section.

Why has DIRBS failed in most of its intended aims?

One of the key aims for DIRBS was to control the illegal trade of mobile phones, both in the form of grey channel imports as well as the snatching and stealing of mobile phones ending up in the second hand mobile market. On both these fronts, the market realities seem to point towards DRIBS failing.

An earlier story Profit covered had narrated how the IMEI numbers blocked by PTA were being unblocked in the black market. Now, with tighter controls, the methods to bypass regulations have become more notorious.

“The most expensive phones come with more than one SIM slot, and sometimes even with one for an e-SIM specifically such as iPhones. So lets say a dealer will take three IMEIs for two or three different phones – one SIM from each phone – and get them registered as one phone,” says Director SmartLink Technologies, Muhammad Ahmed Butt speaking with Profit. “Since most people use one SIM anyways, or they have to pay a lower price so they choose to be okay with one functioning SIM only, so they go along with it.”

The PTA is aware and keeping abreast with these developments, however. In response to this they have declared registration by putting different IMEI of the same model an illegal activity. “PTA is actively carrying out audits and all such identified devices are being addressed. Such cases are being handed over to law enforcement agencies for legal actions. Furthermore, such devices shall be blocked as per procedure” they said in a statement. “PTA has also been informing through print, electronic media & SMS to all consumers to ensure that at the time of purchase, they should check all IMEIs programmed in the device and confirm status by sending SMS to 8484, through PTA website or via Android App.”

“Once a user sends IMEI of the device through the above mentioned mechanisms, the system will provide status of IMEI along with the model and make to which such IMEI belongs. The added information of model enables users to verify if the device is genuine or tampered i.e. an IMEI of a different model is copied on the actual device.”

An official from a telecom operating company, speaking on the condition of anonymity, also explained that phones being stolen and sold on the market was still very much happening. “The only difference is that instead of being resold in the local market, they are now smuggled somewhere abroad. The only place those stolen phones are not going to work is Pakistan. They are fully functioning everywhere else” they said.

However, when it comes to tax collection, from the perspective of PTA, DIRBS is doing an excellent job. As per reports, PTA has said on record that more than 10 million mobile phone handsets were imported during fiscal year 2018-19 and around Rs 28.8 billion were collected in taxes as a result of DIRBS. Likewise, between January and April 2019 approximately 7.6 million phones were imported and the government collected a record Rs 15.1 billion under the head of duties and taxes, indicating that increased in legal imports of mobile devices.

The figures for 2019-2020 fiscal year are not yet available, but the general consensus among mobile phone vendors as well as regulatory authorities is that tax collection has definitely improved as a result of this system, so this is one area where DIRBS deserves the applause it gets from the government. According to PTA’s statement to Profit, “Since the launch of system, the legal import via formal channels has seen an increase from previous years. In 2019, a total of 28.02 million mobile devices (16.28 million complete units & 11.74 million locally assembled) were imported. Whereas, in 2018 a total of 17.26 million devices (12.06 million complete units & 5.2 million locally assembled) were imported.

Furthermore, 4G devices connected to mobile operator networks increased from 16% in January 2018 to 31% as of Dec 2019. Whereas, 3G devices connected to mobile operator network has decreased from 19% in January 2018 to 13% as of Dec 2019. This reflects that users are preferring to migrate/utilize 4G based devices over 3G.”

Problems

When DIRBS was launched, PTA put an ‘amnesty’ policy in place that all those phones that were operating in Pakistan before January 15 would continue to function, but those that have not been registered (or those with invalid IMEIs) will be paired with the SIM card – and therefore the users’ details – being used in that phone. While there was the option of getting such an IMEI registered with up to five different SIM cards, due to complete absence of any awareness campaign carried out at that time, most users did not get their phones registered for more than one number that was already being used.

Fast forward to when these invalid IMEIs were blocked. Now if any of those users, whose phones were paired with their SIM card, were to change their number or sell the smartphone in second hand market, now that phone will not work. Such IMEIs will now only work with that one SIM card which was operational at the time of DIRBS implementation.

Another direct impact of this system has been on the affordability of mobile phones. There is an argument here, that before such a policy the sellers or importers of mobile phones who used to import phones through black channels also used to sell those on lower amounts. However, those mobile phone dealers and distributors who have always been dealing through legal channels believe DIRBS to be a blessing.

Corona virus has been more of a problem for importers who deal with Chinese mobile phones. Director SmartLink Technologies, Muhammad Ahmed Butt, who is also an official distributor, wholesaler and retailer of mobile phones operating out of Hafeez Center in Lahore said that the government reducing taxes had initilly been a big plus point. “When the government reduced taxes, my initial investment that I had planned now fetched me a higher number of mobile phones because now my costs were less. Likewise, when I can afford it at a lower price, I can also afford aggressive marketing so in a way this actually helps business” he said.

Another mobile vendor named Ishtiaq operating out of Blue Area Islamabad said that his business had actually gone up. “ Some customers were obviously those who had to replace their phones because they either did not know when this system was being put in place or they simply deemed the tax amounts to be high enough to rather just buy a new registered phone altogether.” Concurring with Ahmed’s statement he said, “The newer lower taxes also allowed us to do more trading, and not just on the phones on which taxes are reduced. The fact that our costs are lower means that we can now afford to sell even more expensive phones with a lower margin and still make profit. So the market is doing well for us at least.”

Customers, however, have a unanimous opinion on this taxation and registration policy, and that is that it has made mobile phones more expensive. Profit spoke to shop vendors, students, ride hailing captains, businessmen and marketing professionals, who all seemed to express dissatisfaction with the policies brought by DIRBS although some labeled them as necessary hardships for the betterment of the country.

One project manager at MOL Pakistan said, “I cannot survive without an updated phone, nor can I afford to have my phone simply go off, so I need to buy a good phone irrespective of its price and now definitely it is more expensive. I don’t mind however because there needs to be some rules put in place for our nation to get into the habit of paying taxes.”

A tobacconist who owns a shop in G-9 sector Islamabad told Profit, “Phones are now a necessity and not just for making calls. This uncertainty in taxes and when PTA is going to block our phones for whatever reasons is simply a headache. A person spends so much on a phone and then one day it just goes off. PTA only knows how to block phones, when there is a sit-in or a religious holiday or when they feel they can squeeze more money out of people like us. They don’t bother even telling people or conducting some sort of an awareness session to at least tell people on what scheme they have thought now to make our lives difficult.”

Taking things further than just public opinion, this impact on affordability of smartphones might have more grave consequences than just angry populace. The Prime Minister’s view of Digital Pakistan is also under threat. Smartphones and IoT devices play an essential role in that regard but if people are not able to afford smartphones or use them properly then how will they use digital services?

Blocking of smartphones has eventually led to a slowdown in data/internet/digital adoption amongst mobile customers across industry. While smartphone vendors might have seen a small boom in their business, it is still lower than the speed with which Pakistan started adopting technology.

Data collected through independent resources as well as data taken from the PTA website reveals that the market in the country is still growing but in 2018, the growth rate fell by 0.8% and in 2019 the slowdown in this growth was calculated at 4.5%. With the current economic slowdown overall coupled with higher taxes on mobile phones, it is not difficult to see which way this growth would go in the near future.

Another nugget of data shows that a total of 68 million handsets have been included in the industry blacklisted handsets. Amongst these are 11.5 million handsets that were blacklisted as of 15 January 2019. Since January 16, 2020 another 56.5 million handsets have been blocked or blacklisted. Out of these, 20.5 million (36%) have invalid IMEIs, while 34 million (60%) are handsets with valid IMEIs but tax has not been paid on these within the 60 days stipulated time period and 2.3 million (4%) handsets blocked have been reported stolen IMEIs.

So what is the way out?

Profit sat with officials from telecom operators, mobile phone operators and an economist who requested anonymity to come up with potential solutions that do not affect tax collection, promote data security, and also makes the registration and digitization process easier for the Pakistani Diaspora. Here are the suggestions:

Resolve issues with policies instead of discounting the policies:

One of the biggest reasons why ‘one custom duties free imported phone’ policy was discontinued was that it led to massive data theft from NADRA and travel agents for illegal registrations. Instead of strengthening laws and implementation of stricter controls on data, PTA conveniently chose to stop offering the policy altogether.

Despite the fact that every attending member of the Senate Standing Committee on IT and Telecom, as well as all members of National Assembly Standing Committee on Finance recommended the continuation of the policy, the regulating authority decided that it was easier to stop the privilege than it was to stop its misuse.

The lack of effort from PTA can still be seen from the fact that even though it has been reported and confirmed to and from PTA that certain biometric machines given to SIM card vendors have been causing data leakage, only 36,000, out of approximately 174,000 machines, have been recalled.

For the rest, the PTA has given the telecoms time till September. This simply means that until September 2020, the data of those who buy SIM cards can be leaked and misused, without any authority taking quick and necessary actions.

Awareness sessions is PTA’s responsibility and they should regularly follow it

From changes in taxation, to changes in smart phone registration policies, to allowing telecoms the time period of 180 days to reissue dormant SIMs, PTA has an unbroken record of not bothering to hold any awareness sessions, not even for the digitally literate.

Time and time again, it has been reported, not just by Profit but also by other publications, that mobile phone and telecom customers have found themselves to be in trouble because of lack of communication from the regulator to the general public.

Here too, PTA’s response was of complete denial, as their statement to Profit said, “PTA not only runs awareness campaigns on all important issues pertaining to consumers but also direct operators from time to time to run such campaigns. Since the launching of DIRBS number of awareness campaign cycles were run to educate consumers about the new system. PTA is effectively using social media platforms to aware consumers on telecom related issues.”

No details of any such campaigns were given, and Profit’s own research did not find any evidence of any awareness campaign except periodic tweets or text messages telling customers about the services of finding out the number of registered numbers on their ID cards.

The taxation amounts should be adjusted to depreciated values of smartphones

The mobile phone industry is highly volatile, and smartphones are one of few products that lose their value immensely once they are out of their box packaged by the original assemblers. There is also a very active second-hand mobile phone market in Pakistan, which is large enough to be a concern for the government. Many expatriate Pakistanis bring mobile phones, both new and used, as gifts for their families back home.

The custom duties applicable on mobile phones should reflect their market value and not their original sales price. To avoid corruption in the sense that everyone might try to show their phones as used before getting them registered, the taxation model should be updated according to the release date of phone models as opposed to the time of sale on the receipts.

Installation of invoicing systems on mobile shops

With problems like IMEI duplication or clubbing of different IMEIs from different handsets, there is a risk and also some complaints where more than one person had either the same IMEI or had a phone with an IMEI registered to someone else. For registration purposes, they have to establish proof that which of those multiple people actually brought the registered phone with a valid IMEI and which one had one with duplicated or stolen IMEI number. The original buying receipt is the only trustworthy proof in such a case, which in Pakistan’s context not many people keep the receipt safe for long periods.

A solution to this problem can be digitally printed and recorded receipts with the mobile phone sellers. In turn, this policy will also pave the way for the PTA and the government to keep a better record of the number of mobile phones sold and purchased and taxes and custom duties paid on those phones.

When PTA was asked why isn’t there such a policy already in place, they said that it does not fall under their responsibility. “Introduction of invoicing is not related to PTA. However, for the convenience of buyers and sellers PTA has introduced 3 mechanisms to register mobile devices; Through USSD short code *8484#, PTA website portal, and through all mobile operators franchise/custom service centers.”

Involve stakeholders in the decision making process

This should be a no-brainer when it comes to policy making. Consumers, telecom operators, importers and traders of mobile phones, regulatory authorities, and ministry of telecom as well as ministry of science and technology are all key stakeholders in the policies related to mobile phone usage.

By simply including representatives from all key stakeholders, PTA can avoid the problems following the sudden policies and keep the channel of change smooth, not just for the government but also for the general public. While the telecom operators, mobile phone vendors and general public all denied any effort or invitation from PTA before formulation of policies, the authority claims to have included all relevant stakeholders.

“PTA has involved all stakeholders prior to implementation of DIRBS which includes mobile operators, GoP, manufacturers and other relevant stakeholders. After due consultation, all regulations/SOPs were developed accordingly.”

just goes to show how a simple change has led to so many problems. they didn’t think it through! you can’t fix corruption with more regulations. that only encourages people to work around the barriers you put up and actually increases corruption.

they should remove taxes on mobile imports and satisfy themselves with the taxes on telecoms services. tax revenue on telecoms services will increase if mobile imports are freed up. it’s also easier to tax the 3-4 telecoms companies than enforce your writ on our borders.

Ok so there were phones coming the light grey channel and used by criminals so let’s just put the non-grey phones who people have bought themselves from white money in the same category as grey market ones.

Pta

Kamichanna

as an overseas Pakistani returning to Pakistan I am not only confused but also feel that paying such high duty for a phone I purchased abroad and have been using for sometime is unfair or exorbitant. it makes more sense for me to simply sell my old phones.

Excellent article having an indepth insight into a potentially important matter. The solutions are well worth as well. We need Journalism of this quality in quantity to improve shortcomings ranging from policy making to the evils within the society. I think taxation is quite reasonable in sense that its not much on sets that can meet basic needs. Its only significant when it comes to luxury. We do need shift in taxes from basic necessities towards luxuries.

Typical example of regulations in a third world country.

Such laws not only makes Pakistan look stupid and a beggar country, but also stops people from progressing rapidly and adapting new technologies.

I honestly believe successful societies are those who value freedom including freedom of money, with extremely low taxes.

Pakistan is what it is only due to high taxes. and Dubai is what it is today only due to 0% taxes.

When Pakistan could have reduced taxes, and pulled in all the regional wealth, they were happy following the Brits, and increasing taxes, to support the poor, poor who are only poor in the first place due to such high taxes in the country.

hi sir my name is shahzad ali and i live in rawalpindi my question is that i pay my mobile tex 7865 but my mobile dose not work on sim 2 sim 1 is working when my sim 2 worked plz answer in my email id thanx

Comments are closed.