Besides physical cash, bank accounts, gold, and real estate, the one investment vehicle that most middle class Pakistanis have at least heard of, if not used themselves, is National Savings, the government department that sells a variety of government bonds directly to individual investors through a network of 376 branches spread throughout the country.

All told, Pakistanis have invested Rs3.4 trillion in National Savings. To put that into context, that is the same amount of money as the total deposits in Habib Bank, the largest bank, and Allied Bank, the fifth largest bank, combined.

And no wonder it is so widely trusted: National Savings first came into existence under the British Raj in 1873 as the Government Savings Bank and served as a means of the British government raising funds for its needs, including the expenses of fighting both World War I and World War II. It was renamed the National Savings Bureau in 1943, from where the National Savings name comes from and has stuck since, even after the tumult of Partition.

When you invest in National Savings, your money is backed by the full faith and credit of the Government of Pakistan. Our government may not have an investment grade credit rating globally, but domestically, we know that it has the ability to print the Pakistani rupee, which means there is a guarantee of being paid back if you lend money in Pakistani rupees to the Government of Pakistan. So it is understandable that people like parking their money in National Savings.

But is it the best option? As we will explore in this article, in some circumstances, it makes sense to put your money in certificates issued by National Savings, but for many other people, there are other options that they should consider. We will lay out when National Savings is right for you, which certificates to choose from (there are three main options), and when to put your money somewhere else.

Who should invest in National Savings?

Anyone looking to park their money in a fixed income instrument that yields steady, monthly interest payments should at least consider National Savings as an investment option. That is usually people who are retired, or people who can no longer earn (possibly because of a disability or illness), or else people were dependent on an earning partner who is no longer with them, either because they passed away (widows/widowers), or because of divorce.

What all of these people have in common is that they have a fixed sum of money that is usually a large amount when seen in isolation, but it is all they have, meaning they need to put it in an investment that will safely provide them with an income every month. They have few, if any, other means of earning an income.

For people like that, regardless of how much they have in assets and what economic strata they belong to, National Savings is almost always something that should be at least part of their portfolio. And for some, it may even make sense to put the majority of their money into National Savings. Which certificate? We will explain shortly.

But for people who invest in fixed income instruments as a means of parking their short-term cash reserves and want to get a better yield than the meagre returns offered by savings accounts, we have some news: you are probably better off leaving your money elsewhere under most circumstances (though there may be some cases in which it may make sense to use National Savings).

If we had to distill the rule as to who should invest in National Savings and who should not: in general, people who need their savings to give them a steady current income should consider National Savings, and those who are saving for any other reason should generally avoid it.

What are the alternatives?

As we stated before, National Savings are effectively retail government bonds, backed by the full faith and credit of the Government of Pakistan and thus effectively risk-free investments. (Caveat: nothing is ever completely risk-free, including government bonds, but at least there is no repayment risk with rupee-denominated bonds issued by the government that also prints rupees.)

As a result, we examine only investment that offer those same risk-free returns, and the category that we have come up with are fixed income mutual funds that invest exclusively in government bonds. Our comparison with National Savings, therefore, is then like-for-like: we are comparing investments with the same risk-free profile.

Across both conventional and Islamic funds, there are a total of 10 fixed income funds that invest only in government bonds, two of which are Islamic and the remaining eight are conventional. In order to provide a long-term analysis, we restricted our comparison pool to the five funds (two Islamic, and three conventional) that have a track record of at least 10 years as of June 30, 2020. All yields for mutual funds were examined net of fees.

The three conventional funds we examined are the MCB Pakistan Sovereign Fund, the HBL Government Securities Fund, and the NIT Government Bond Fund. The two Islamic funds (and the only two Islamic options available to Shariah-conscious investors) are United Bank’s Al Ameen Islamic Sovereign Fund and the Meezan Sovereign Fund. NIT’s fund is the only one not managed by a bank-owned asset management company.

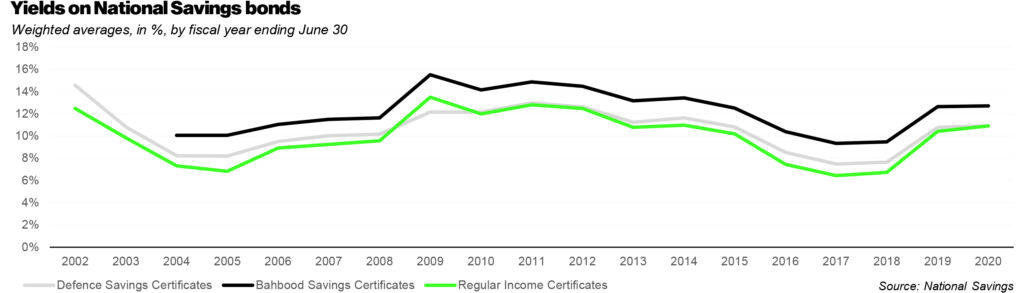

On the National Savings side, we compared primarily the two main income certificates: Behbood Savings Certificates and the Regular Income Certificates (RIC). We excluded the Defence Savings Certificates from our analysis because the DSCs are effectively zero-coupon bonds that are meant to be a savings instrument rather than yielding regular income. We examine what these instruments are appropriate for later in this story.

The yield champion: Behbood from National Savings

Here are our findings: there is absolutely no government bond fund (or frankly any fixed income fund of any kind) in Pakistan that compares favourably to the Behbood Savings Certificates. If you want a regular income, Behbood is the champion in terms of yield, despite the fact that it is lower risk than some of the bond funds that invest in higher-risk corporate bonds as well.

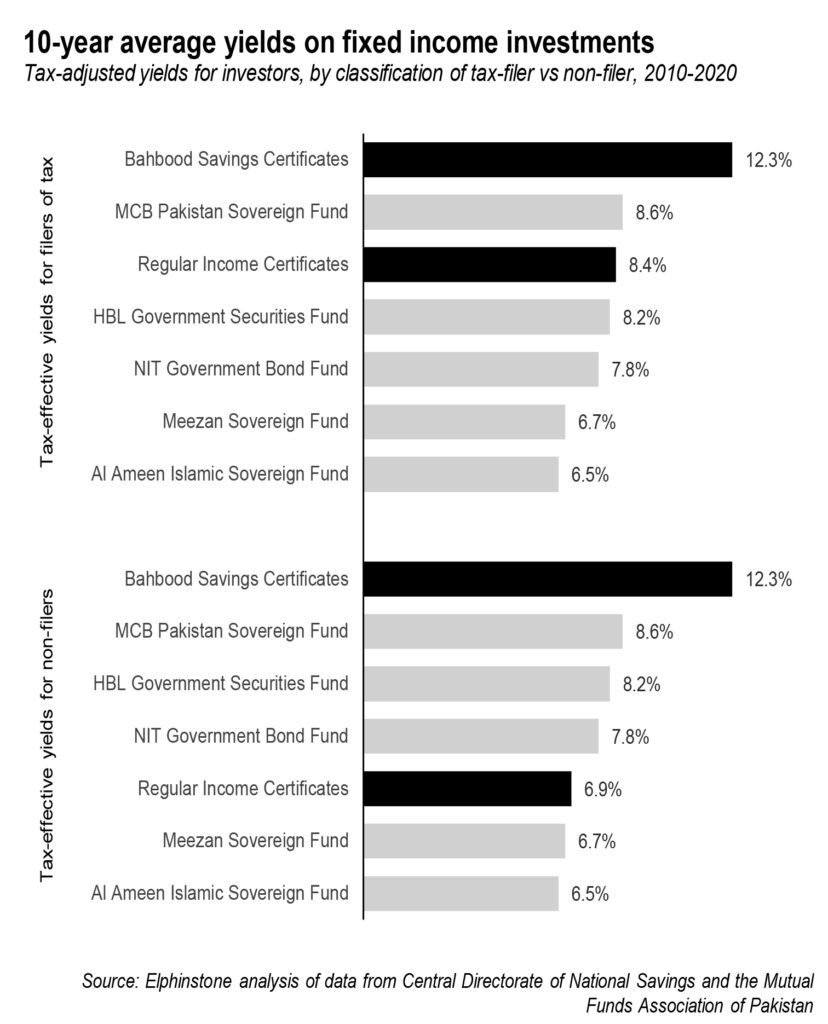

Over the 10 years ending June 30, 2020, Behbood Savings Certificates yielded 12.3% per year on average, compared to 10.2% average yield per year for the next best alternative: the MCB Pakistan Sovereign Fund. Coming in third were the Regular Income Certificates, followed by all of the remaining mutual funds. The two Islamic funds, as expected, rank dead last in terms of average yields over the past decade.

Here is where things get even better for Behbood: it is completely tax free. Every other investment you can make in a fixed income instrument of any kind is taxable, and the tax is usually deducted at source by the financial institution that manages it. But Behbood incurs no tax liability whatsoever.

So why is it not a slam dunk for Behbood? Why should one even consider any other investment? Because not everyone is allowed to invest in Behbood, and there are restrictions on how much you can invest even among people who are allowed to invest in it.

Behbood was originally launched as an instrument for just widows without an earning partner or disabled persons, though in 2004, that was expanded to senior citizens over the age of 60. That is the limit on who can invest. And even among that population, they can only invest up to Rs5 million for an individual, or Rs10 million for a couple, both of whom have to be eligible investors.

That means that, at an average yield of 12.3% per year, a couple who invests Rs10 million (1 crore) in Behbood can get a maximum of Rs102,500 per month on average from Behbood. That is effectively a middle-to-lower-middle class income in most cities in Pakistan, though it could be a comfortable income in some smaller cities or rural areas.

Behbood, in other words, is a product that the government designed to deliberately provide higher-than-market-average returns to people who need them the most: the needy, or the elderly who do not have much else by way of income sources. It serves its purpose to do just that, and is explicitly designed to exclude anyone else. Everyone else must get the market rates.

The effect of filing your tax returns

Aside from that group of people, and even for people eligible for Behbood who have more in savings than the legal limit for Behbood, you need other options. And that is where the comparison between the Regular Income Certificates and the mutual funds comes in. And which one is best for your needs depends on whether or not you file your tax returns.

Let us examine the case of non-filers first because, let us be honest: if even if you pay income taxes honestly, the odds are very high that you do not actually file your tax returns. And the law does not distinguish between people who pay their taxes but do not file their returns and people who do not pay their taxes and also do not file any tax returns.

For non-filers of both kinds, it is not even a contest: all three conventional mutual funds are better than the Regular Income Certificate, as is evident from the chart. Here is why: mutual fund dividends are taxed at 15%, regardless of whether one files their tax returns or not. But income payments from National Savings certificates, on the other hand, are taxed at 30% for those who do not file their tax returns, and 15% for those who do file their tax returns.

The tax rates are lower for people who can demonstrate that their income from fixed income investments in a given year was less than Rs500,000. In that case, for non-filers, the tax rate goes down to 20%, and for tax filers, it goes down to just 10% of interest income.

Taking into account those tax rates, the tax-effective yield on the RIC goes down to 6.9% per year on average over the past decade, compared to the MCB Pakistan Sovereign Fund, which sees its tax-effective yield – impacted by just a 15% tax – go down to an average of 8.6% per year. One Rs1 crore of investment, the RIC will yield Rs57,500 per month, while the MCB fund would yield Rs71,667 per month.

If you file your tax returns, however, the difference between the two fund narrows: the tax-effective average yield stays at 8.6% still for the MCB fund, but goes up to 8.4% for the RIC. Crucially, unlike in the case for non-filers, among non-filers, the MCB fund is the only fund that outperforms the RIC. The HBL and NIT funds both underperform the RIC.

In short, you are probably better off investing in the MCB fund than you are in the RIC if you want an income over and above the amounts allowed by Behbood.

Why mutual funds outperform, and why exclude DSCs

Two quick technical notes before we go: how do mutual funds, which have management fees that National Savings does not, outperform the RIC? Simple: the RIC is a variable rate bond, whereas the mutual fund companies invest in fixed-rate Pakistan Investment Bonds (PIBs), which can vary in price based on movements in interest rates.

Skilled fund managers can see those interest rate movements coming and can trade in and out of various PIBs to take advantage not just of the cash yield of those bonds, but also of price movements resulting in capital gains. As a result, well-managed mutual funds investing in government bonds can outperform direct investments into government bonds, even after paying the management fees of the mutual funds.

And why exclude DSCs, which outperform all of the mutual funds? Because the DSC is not an income instrument. It is a zero-coupon bond, which means it yields nothing in the period that you hold it and pays out the entirety of its profits when you encash it. That does not make it a comparable investment to the others, which all have a monthly income payment option.

A zero-coupon bond is good for a relatively limited set of circumstances, but that is the subject of another story for another day.

(Disclosure: The author is a founder of Elphinstone, a fintech startup that is working to create a free tool called SmartRupee that will allow users to set up automatic deposits into curated, diversified investment portfolios, based on their financial goals.)

Interested in learning more about fixed income investments? Have another question about personal finance? E-mail your questions to farooq.tirmizi@pakistantoday.com.pk. Your identifying information will be kept completely confidential.

Wonderful article for middle age people who are thinking seriously where to park their surplus cash.

My only concern why you have not discussed about AL MEEZAN oldest and largest mutual fund ?

Please also do some comparison on mutual funds pension funds for private sector emoloyees .

What are %return on this certificate?

Dear all please do remember two things one the interest rate is very low nowadays on saving schemes secondly it is against the teachings of Islam as Riba interest is prohibited in Islam and its better for you to invest in some sort of small business you can contact me for that consultation

Pls. Tell where can we invest rather than national saving. And we give the money to govt. Of Islamic jamhoria Pakistan not to any person

Advise what business is possible

Aslamo alikum.. how and what you will advise me.. as i am looking to start a small business of my own. And with a capital of not more then 5 to 7 lakhs. Thank you very much. Waiting your replay.

your whatsup

Money is a product or asset like any other asset suppose house, furniture, vehicle etc and when somebody utilises someone else money and earn many times, he is bound to pay rent for utilising it and thereby earning on it many more times. Further with every increase in general price levels of various products, money loses its value or purchasing power and to maintain its worth with other products, interest or profits are applied to maintain its worth or value vis-a-vis other products and not making holders of money poorer with loss of its value/worth with every increase in prices of other products. .

Hence profit on it in Saving Schemes or in Saving Bank account in banks do not come under the definition of Riba.

Agree with your explanation.

For Good Investment opportunities you can contact me on whatsapp I have better options for you to start business with low investment my contact number is 0312-0444414 on WhatsApp

Advise

Giving your hard earned money to some individual is as good as throwing it in the river. So it’s not wise to give your money to any individual person.

For investment in nbp income funds better rate then national savings watsapp at 03332606869

What is NBP intrust rate?

please do not forget to mention National Investment Trust limited.

Good

Would you be kind enough to send me whole article by email.

Regards

Dear brother ‘ Same full article is required by me as well. If you can favour me please. I will be grateful.

Its better to invest in Property sector there we have a good profit margin

We work with Gulberg Green Islamabad & Bahria Town

For information

Please contact me

Rashid Hassan Qazi

03009029172

Leads Consultant

Gulberg Greens Islamabad

PBA and senior citizens profit may be revised especially for those who retired before 2005. Meagre pension, suffering from financial hardship.

I think in islamabad property is best option to purchase specially in g-14 cda sector and behria enclave islamabad where cda approval under process.This is good time to purchase as prices will likely to to grow within one year which gives better rate of return and its trading and halal.

Regards

Land estate reality( investment adviser)

0310-1053333

All saving scheme are appreciable.on should save some money for his family needs as well as for his old age. I shall suggest to invest in state life insurance policy which is guaranteed by Government of pakistan.These policies fully protects financial requirements whether a person is alive or (Allah forbid) Died.For detail 03330943457

NIT funds are best and oldest in Pakistan.

Especially NIUT

Bhai ya kiya sistam ha bita sakty hn

Koi bhai dtayl my bitay ga k ya kiya join kr saqty han

Please share the full article, thank you.

Kindly tell me the return rate for 10000 saving certificate and other liabilities/restraints.

Regards.

How much investment required to invest in G-14 or bahria enclave?

how can do itsend me detail my whats app 03083464208

It’s all Haram..

Staff of national savings are the worst people on the face of earth.

Yes NSC Sialkot Staff are also famous for their dishonesty they also ditch people by providing wrong information in case of customer death to their legal heir.

In Pakistan it is totally uncertain condition of investment. However mostly trained people fraud with innocent citizens. After all it’s a very difficult to give money for investment and to take back.

Hi,

While comparing yield on investment in income mutual funds and RIC, you forgot the factor of tax credit for tax filers. A 20 percent tax credit in mutual fund, if added to the interest makes the mutual funds yield a much better.

Thanks

Shafique

Here is brief explanation for naive investors. Suppose investor earns an annual salary of 1200000/-. He invests 20% of this salary which Rs. 240000/- into income mutual fund. His tax bracket of 5% income tax renders him to pay Rs. 60000/- in taxes. Investing Rs. 240000/- in mutual fund enables individual to get 20% tax credit of his total tax liability. So his income tax reduces to Rs. 48000/- (saving of Rs. 12000/-). This is not possible by investing in RIC at national saving center. If for example income fund offered only 7% profit on Rs. 240000/-. Investors take home interest after deducting 10% tax is 15,120. This along with tax credit of Rs. 12000/- added to Rs. 15120/- takes total profit in first year to Rs. 27120/- (a huge profit of 11.3%).

One point to note here is that to avail tax credit, invest needs to stay invested for just 2 years and in addition income mutual funds also can provide a growth opportunity thus even reducing tax on capital gain on 4yrs of investment.

I hope I made my point clear.

Thanks

Shafique

I am in Islamic Economy, Finance and Banking since last 39 years after graduating in the subject from mist prestigious university in 1982.. Had a research on National Saving status and macanism and I can only say I prefer to keep my saving with Bahabood Saving rather with banking Islamic and Banking. Perhaps NIT and NS are the two saving investment offers which are clean, transparent, without guaranteed and without compounding. All funds are use in government scheme. Thus article is perfect and I just add my research. I am available for any discussion on this topic.

sir your whatsup

What % on this certificate

Plz details if I invest 100000/then how much return me in which years

Where we gain shart turm certificat and what is its policykash

Good article, but it misses out on inflation proofing, which an average retiree struggles with. If one takes the example of Rs. 102,500 per month from Behbood on one crore, and the retirees spends this money every month, while assuming inflation is 8% per annum and remains at that level, then five years down the road the retirees will have buying power of approximately Rs.70,000, i.e., the retiree couple will have to cut down on some of their spending each year. This is the case with Behbood, all other options will leave the retirees with a bigger predicament. The other point to note is our system of giving subsidies, Behbood offers a subsidy of over Rs. 16,500 per month in interest rate and and an additional 2,500 in tax exemption, a total of Rs. 19,000 per month versus, a BISP recipient family, which has nothing and gets around 2,000 per month. I don’t grudge the retirees, but we need to give more to the bottom of the pyramid, those who could not get jobs and have no savings. We need to end the silos (Debt office giving the extra interest rate, the FBR giving a tax relief and BISP giving pittance when you compare).

I have not accounted for the cross subsidies in the utility rates or the subsidies on food shopping through the Utility Stores.

WhatsApp +923008235689

Interested Investors,

You may contact on below for potential investment proposals.

CTC # 03365666742

Regards,

Spot on.

It seems people do not understand the difference betweenconventional banking and Islamic banking. If you are a Muslim then you need to understand that all conventional banking is haram. Any product or scheme dealing with interest is strictly prohibited. For halal investments/products, you have to go for Islamic banking. There are many that turn a blind eye to this fact as investors are naturally drawn towards more profitable schemes. Although this is the investors choice but in Islam this is haram. All evidence and proof is out there should anyone want find out for themselves. Alternatively you can email me to discuss further.