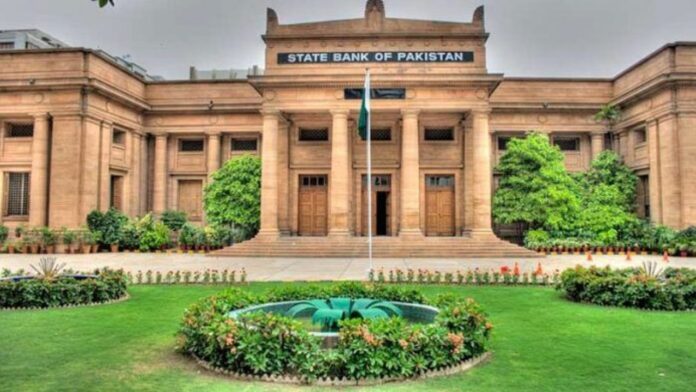

WASHINGTON D.C: Continuing with its accommodative stance, the State Bank of Pakistan (SBP) decided to keep the policy rate unchanged at 15 per cent during Monday’s Monetary Policy Committee (MPC) meeting.

The MPC justified the status quo decision based on the continued deceleration of economic activity, declining headline inflation, and the current account deficit (CAD) since the last meeting. The floods also played a role in altering the country’s macroeconomic outlook. The Monetary Policy Statement (MPS) stated that the MPC thinks growth will further slow down in the “aftermath of the floods”. The committee noted that earlier tightening actions had started showing signs of working. As a result of which tightening will need to be carefully calibrated going forward.

Taking September’s inflation rate of 23.2 per cent, the real interest rate at present is 23.2 per cent minus 15 per cent. That comes to a negative interest rate of 8.2 per cent which means that despite the previous tightening cycles and the high-interest rate, Pakistan’s central bank is still accommodative.

“The SBP’s accommodative stance is primarily because of the expectations regarding lower CAD on the back of a lower trade deficit and additional inflows in the wake of floods. Lower commodity prices and freight costs will also help bring down inflation,” says Sami Tariq, Head of Research at Pak Kuwait Investment Company.

To illustrate how high 15 per cent is in a global context, Argentina with 75 per cent, Zimbabwe with 60 per cent, war struck Ukraine with 25 per cent, Angola with 20 per cent, Ghana and Uzbekistan with 17 per cent are the only countries in the world that have a higher interest rate than Pakistan. In fact, only 22 countries around the world have double-digit interest rates.

Can Pakistan afford to be unreal now?

The SBP states that the in wake of the floods, Pakistan has received additional external flows commitments from Asian Development Bank worth USD 1.5 billion by the end of October 2022, the United Nations (UN) of slightly under USD 1 billion, and AIIB worth USD 0.5 billion.

The World Bank (WB) has committed USD 1billion expected between October-December 2022. This, however, is subject to the competition of a few conditionalities.

During its analyst meeting, the central also stated that the IMF programme is on track and that it has fully complied with the assigned September 2022. It stated that the bank is hopeful of a positive outcome with a reconsideration of conditions post-flood in the next review.

While the floods will bring some relaxation in the conditions and inflows which Pakistan needs; it is important to note that the accommodative stance by the Fund or by friendly countries and organizations is because the floods will leave a negative impact on the economy. For starters, the floods will have an impact on the output of cotton, rice as well as the livestock sector this year. In order to avoid food inflation, Pakistan will need to turn to imports; which is why the support for the reserves is coming in.

As per AHL Research, “As witnessed after previous natural disasters, international aid and assistance could cushion the current account, which should remain in the vicinity of previously forecast 3 per cent of GDP whereas securing external financing and additional commitments in the wake of the floods could improve the FX reserves.”

The reliance on the help, however, does not really show a structured long-term plan. Forward guidance, which had been a regular practice, has however been missing from this statement. The primary focus is tempering expectations in inflation and flood assistance. Sources believe the forward guidance proved to be counterproductive in the past and may create more havoc in uncertain and volatile times like the present.

You’re correct in saying that the inflows coming from multilateral institutions will be used to offset CAD losses from floods therefore it should have no bearing on monetary policy. However, I agree with SBP’s wait-and-see stance simply because the true ramifications of the flood as well as import restrictions will only be observed months down the line. High interest rate has already cooled down the red-hot auto market, equity markets as well as the construction/real estate sector so a negative wealth effect is very much going to dampen consumption as well and thus domestic demand.

Also, interest rates are already quite high to the point where possibility of corporate default becomes a reality especially in the steel sector, so SBP has to take into account as well.

Creating product labels are good for the branding but if you add some extra gravy in it by packing it in the boxes or plastic bags this can make your brand known and for this I can suggest you to connect with these

Hi there, just became alert to your blog through Google,

and found that it’s truly informative. I’m going to watch out for brussels.

I’ll appreciate if you continue this in future.

Lots of people will be benefited from your writing. Cheers!

That is really interesting, You’re an overly professional blogger.

I’ve joined your rss feed and look forward to searching for extra of your

great post. Additionally, I have shared your site in my social networks

What’s up it’s me, I am also visiting this website daily, this website

is genuinely nice and the visitors are in fact sharing fastidious thoughts.

I’d like to find out more? I’d like to find out some additional information.

Hello,

As per AHL Research, “As witnessed after previous natural disasters, international aid and assistance could cushion the current account, which should remain in the vicinity of previously forecast 3 per cent of GDP whereas securing external financing and additional commitments in the wake of the floods could improve the FX reserves.”

Not sure what to make of AHL research. The fiscal deficit is “Gigantic”- there is no way flood relief would even make any impact- a slightly relief would be to keep up with EuroBond payments that are coming up. i.e. One coupon matures in December 2022. 1Billion USD. On top the usual inward worker remittances are down by 10%- that is probably not equated anywhere.

15% is not a high interest rate considering the state of economy and SBP reserves. Find me a single country with Central Bank Reserves of around 7.2 Billion USD-almost 100% of which is borrowed money from friendly countries.

United Kingdom for instance is running double digit inflation- and you can research on their GDP and size of USD reserves.

We feel, If SBP can maintain rates at 15% and DAR manages to reschedule bilateral debts allowing atleast 6 month worth of room to breath for SBP reserve , we will come out of the Red zone into a Yellow one-probably more manageable.

J.K

In a country where the black economy is bigger in size than the documented economy, MPC’s policy rates are increasingly becoming irrelevant. The auto industry’s challenges have more to do with FCY rates and SBP restrictions than the higher interest rates. Once imports open and USD rate becomes stable, ‘Own’ money on auto cars will again increase. It is not the higher interest rate but the lack of stability in the economy, with fluctuations in USD rate which are creating these challenges / problems. Similar is the case with other industries as well. The first structural reform government has to take is to tax the real estate sector in line with the market value and FBR needs to ask the buyer the source of their wealth. This will stop the flow of black & white money to the real estate sector and maybe more investment will be made in increasing production capacity and to new sectors.

Thetradebuzz is a leading B2B marketplace where you can interact with global manufacturers, suppliers, buyers, and importers to conduct business online.

The Business Witness gives latest updates and articles about business and marketing, technology, sports and games, as well as travel and tourism guides.

The Inforinn is one of the greatest blog websites that provide updated and useful information for blog readers and here you can Write For Us for all topics

Thanks for your information . i am read your article i am very impressive.

Thanks for sharing.I found a lot of interesting information here. A really very thankful and hopeful that you will write many more posts like this one.