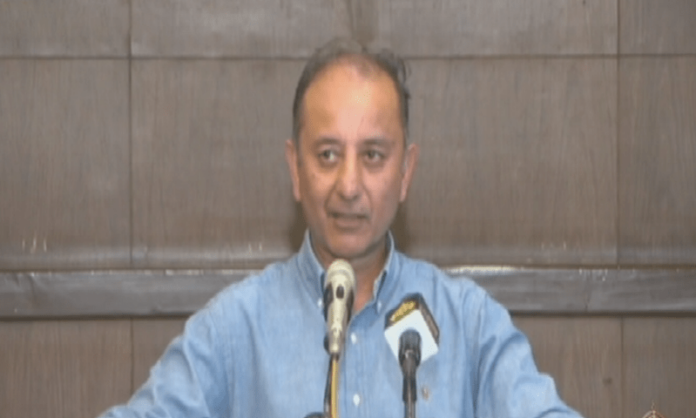

LAHORE: On Monday, Minister of State for Petroleum, Musadik Masood Malik, announced that the government plans to increase petrol prices by Rs100 for the wealthy and reduce them for low-income individuals in order to provide them with relief from fuel tariffs.

During a press conference, he stated that the extra cost incurred by the affluent would be used to subsidise petrol for those in the low-income segment. This statement was made a day after Prime Minister Shehbaz Sharif declared a relief package for the poor, which includes a subsidy of Rs50 for every litre of petrol.

The subsidy will only be provided to low-income consumers who own motorcycles, rickshaws, 800cc cars or other small cars. Malik further elaborated on the subsidy today, revealing that the PM had ordered an increase in the subsidy to Rs100, and stating that “the rich will be charged Rs100 more and the poor will be charged Rs100 less”.

The petroleum subsidy programme is expected to be implemented within the next six weeks without any provision of subsidies.

What is cross subsidisation?

A cross-subsidy refers to a scenario where a particular group of customers or clients is charged a higher price for a product or service to offset a lower price provided to another group.

Why is there a hesitance to call it a subsidy?

Malik has steered clear of using the word ‘subsidy’ particularly to disassociate the current scheme from the petrol subsidy provided by the previous government last year. The subsidy was additionally carried by the incumbent government, until it eventually came to an end in June.

The subsidy was a bone of contention between the previous Government, and the IMF. As the current government looks to negotiate a staff level agreement with the IMF, their reluctance to use the world subsidy is understandable. Whether the IMF seeks to scrap this ‘cross-subsidisation’ or not will be made evident in the days to come.

Will this work?

Profit sought to examine whether any situation existed where the government’s scheme would work. The answer we found was that, yes it would. However, it would do so only under the most specific of terms, and that too primarily due to the lack of data available surrounding the entire endeavour.

The Oil Companies Advisory Council (OCAC) reported that the transport sector consumed 654,110 metric tons or 654,110,000 litres of motor spirit (MS). At a weighted average price of Rs 218 for the month of January, a total of Rs 142.7 billion was generated in sales. The OCAC does not provide a breakdown of sales within the transport sector based on the type of vehicles. However, Profit was able to confirm with a senior source in the industry that total industry-wide consumption has a 35:65 between two and three wheelers, and four-wheelers respectively.

A Rs 100 fuel difference price would boil down to Rs 172 and Rs 372 at today’s petrol price based on the cross subsidy. Assuming any given month with these prices sees the exact same demand as January, then the cross subsidy would generate Rs 197.54 billion in total proceeds. This would be against the Rs 177 billion that would be generated with January demand levels, if the cross subsidy would not be in place. The cross-subsidy would in this case pay for itself. However, this is just one aspect of the story.

From July 1 to December 31 2022, total consumption in the transport sector fell to 3.83 billion litres against the 4.52 billion litres over the same period in the previous year. The difference is a result of the average weighted price of MS from July 1 to December 31 being Rs 229.14/litre against the Rs 129.37/litre seen across the same period, the year prior. The 77.13% led to a 15.12% reduction in sales. Similarly, utilising the 35:65 split, the weighted average price of petrol based on the cross subsidy would work out to be Rs 302/litre. A 9.93% increase in the price of MS would then theoretically lead to 1.95% dip in the sales of MS.

Factoring in the dip in sales, the cross subsidy would then generate Rs 197.5 billion. It would thus, still pay for itself. It is only under these circumstances that Profit found the subsidy to work, and if the government has utilised similar statistics then they are in for a rude awakening.

The error of assuming constant preferences

First, and foremost, Profit had utilised a split based on the assumptions of our source. Our source, though an expert on the matter, leaves room for error in the calculations because they state how an exercise such as this has simply never been done. Furthermore, our source also highlights that the consumption for two and three wheelers is likely to increase relative to their four wheel counterparts once the subsidy does kick in. Profit has assumed constant consumption patterns, a sizable shift in the ratio would most likely lead to the entire subsidy falling apart.

Furthermore, Profit has not factored in 800cc four wheelers and light four wheel commercial vehicles which are also beneficiaries of the subsidy. The 35:65 split does not account for the additional two categories because as much as the original exercise has never been conducted, this additional one has never crossed anyone’s mind. Until now that is.

More, and more cans of worms

Now Profit made all these calculations within the span of one hour. However, it was evident to us as well that we had made very fixed assumptions where we saw the subsidy being plausible. If the government has conducted a similar tertiary exercise then it is in for a rude awakening.

An effective execution of the subsidy requires an efficient delivery system baked with financial muscle to pull everything off. Does the government, and the energy sector have all of this in place? Read next week’s edition of Profit Magazine on March 27 to find out.

Instead of cross subsidizing why not ban gas guzzlers like Land Cruisers, Pajeros, BMWs, Mercedes, etc. Amazingly most of the govt officials / politicians/ army generals deem it below their self esteem to travel in any vehicle less than 2000 CC, although the petrol is paid from the taxes of the general public. It seems that the govt is running on hope and is reluctant to take the necessary steps to combat the real issues. Why not increase the petrol price in line with our neighbors ie India or even Bangladesh? They are financially much better off than Pakistan but do not provide any fuel subsidy to its population.

Thanks Daniyal for the write up.

First, it’s a good idea to do cross subsidy in this sector based on morality and efficiency.

Second, it does not need enforcement.

Third, slippage is something that Govt should not mind as long as it does not cost national exchequer.

Fourth, such a subsidy can easily be managed with a ring fenced endowment fund that can manage this with a lag of one to two months.

Real issue is inherent bias in all of us to discourage anything that can help the masses.

Best Regards

Forget the mechanism of this scheme. The biggest issue is one of basic incentives. People will commercialize this scheme by selling the petrol in the black market after filling up their motorcycles. A cross subsidy with such a huge differential is a serious arbitrage opportunity. Case in point being the white-red diesel fiasco in the UK which has shown us that even a government as strong as the UK’s is unable to administratively stop black market arbitrage.

It doesn’t take a Mankiw to realize how flawed this govt policy is.