Cement manufacturers in Pakistan’s northern region could be set to make a windfall in earnings as Afghanistan’s Ministry of Mines and Petroleum has announced a reduction in custom tariff by $15/tonne and royalty fees by $5/tonne on exported coal.

“The primary reason is that international coal prices have dropped, making it more viable for cement companies to import it than procure Afghan coal,” explains Fahad Rauf, Head of Research at Ismail Iqbal Securities. “The savings companies are set to make must be viewed in the context of the North and South regions. This is because Afghan coal is more economical for players in the North due to lower transportation costs compared to players in the South,” emphasises Mustafa Mustansir, Director of Research and Business Development at Taurus Securities.

Regional division of cement manufacturers

By producers in the northern region, we mean companies located in the northern region of Pakistan’s cement sector. The sector is composed of 16 companies divided into two regions: North and South. The North covers areas of Punjab, Khyber Pakhtunkhwa, and Azad Jammu and Kashmir whilst the South includes areas of Sindh and Balochistan.

Companies in the South are located near ports and bear significantly lower transportation costs compared to companies in the North. However, companies in the North have better access to exports to Afghanistan and India.

Why did Afghanistan slash the cost of its coal exports?

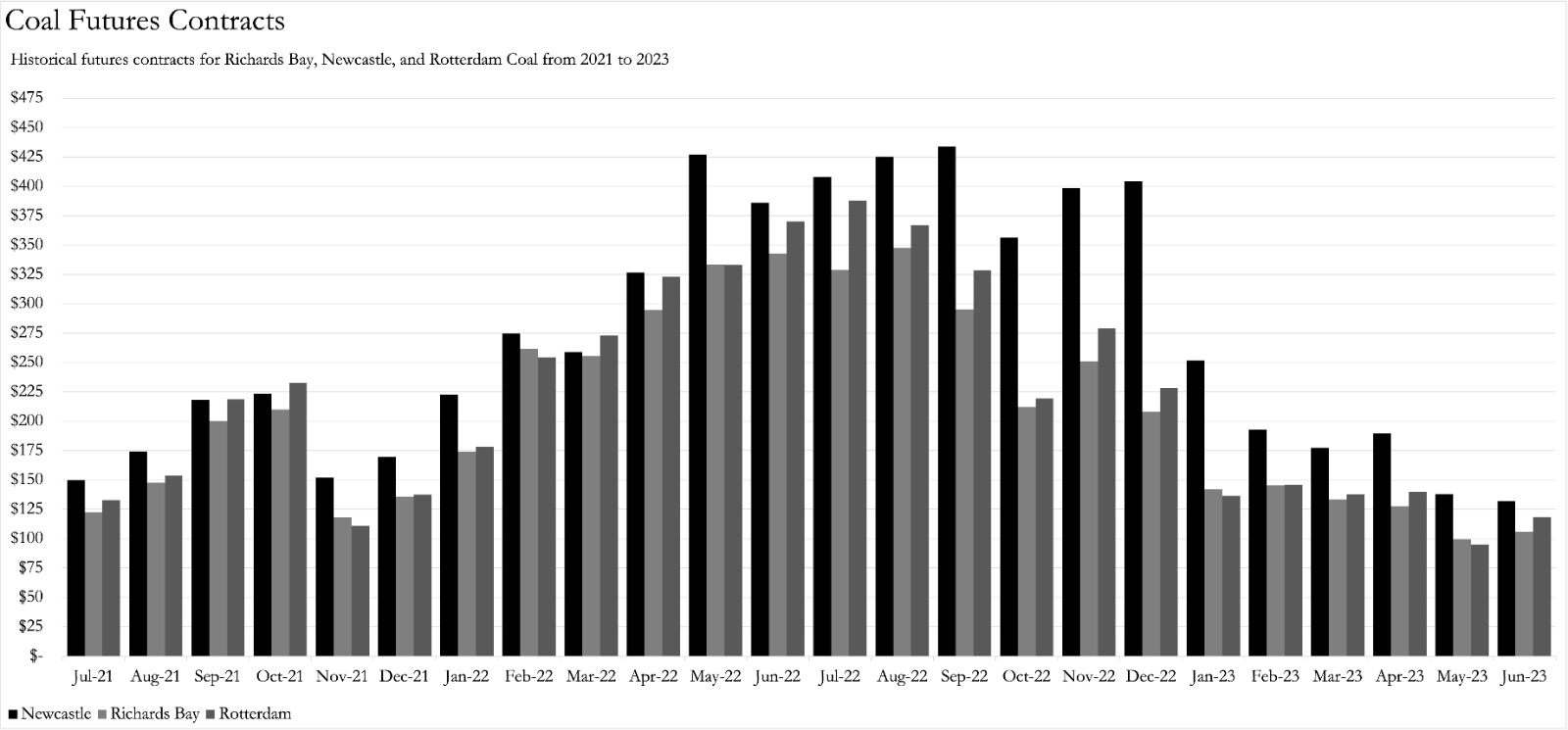

“After the tumultuous Russia-Ukraine war, the price of international coal futures contracts soared, compelling cement players in Pakistan to switch to Afghan coal due to their inability to import coal,” elucidates Fahad Rauf, Head of Research at Ismail Iqbal Securities.

A futures contract is a legal agreement to buy or sell a particular commodity or asset at a predetermined price at a specified time in the future. Futures contracts are the primary instruments of acquiring commodities in the international market. The Russo-Ukraine conflict exerted upward pressure in two distinct ways. Firstly, European countries frantically sought to diversify their coal supply chains away from Russia and consequently delved deeper into other international coal markets, driving up the price of futures contracts.

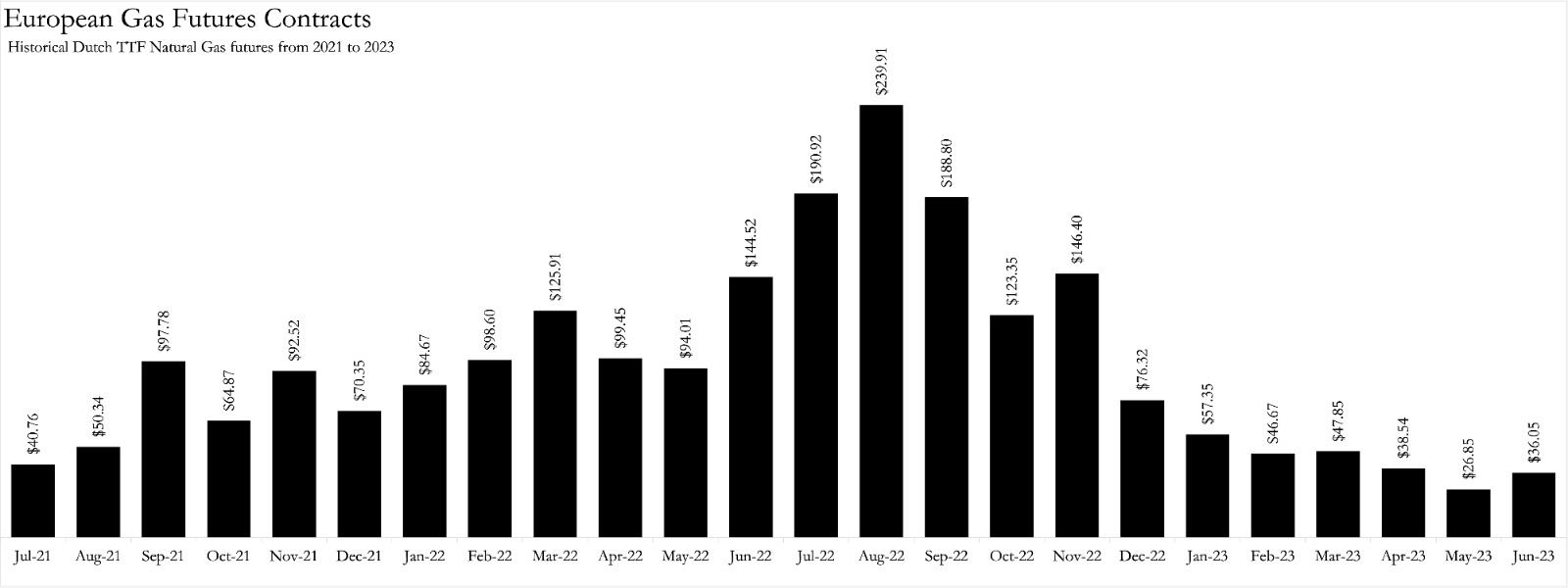

Moreover, as European gas futures prices skyrocketed due to the unavailability of Russian gas, European countries transitioned their power grids from gas to coal, thereby creating an even greater demand for non-Russian coal. All of this naturally also drove up the price of Richards Bay Coal from South Africa, which is the primary source of Pakistan’s coal imports.

In all of this Pakistan found itself compelled to look towards Afghanistan for coal imports. In a shrewd move, Afghanistan seized the opportunity to increase the export duties it levied on coal exports, capitalising on the supply shortage. Coal imports from Afghanistan are estimated to have doubled since the Taliban took over, netting Afghanistan a staggering $160 million despite their increased duties.

However, in 2023, the tides turned as European gas contract prices plummeted, prompting European countries to revert back to gas and subsequently causing the price of coal futures contracts to collapse. Afghan coal was not immune to this international downward pressure.

“The crux of the matter is that coal futures contracts skyrocketed from a mere $50 during Covid-19 to a staggering $350 during the conflict. The Europeans voraciously bought all the gas and coal they could get their hands on and overdid it. Then Afghan coal production surged when prices rallied, and they imposed an export duty to generate revenue,” Yousuf Farooq, ex-Director of Research at Topline Securities and independent analyst, articulates succinctly.

“Afghan coal prices had already commenced their downward trajectory for the last month,” states Mohammad Aitazaz Farooqui, Head of Research at Providus Capital. “Some manufacturers had already ordered Richards Bay coal which is now more economical than Afghan coal. However, due to letter of credit restrictions, limited quantities are being imported. Afghan suppliers had been capitalising on the situation and charging a premium,” Farooqui adds.

“Now, as things have eased up a bit on the letters of credit front, companies would opt for imported coal, which makes more economic sense,” adds Rauf. “Letters of credit have started opening so ships are arriving at Pakistan International Bulk Terminal Limited. The Afghans are unable to sell because of the duty. So they reduced the export taxes to match imports from Richards Bay,” adds Farooq.

What sort of savings are cement manufacturers looking at?

“Cement players in Pakistan could see a significant drop which would increase margins for cement companies substantially,” came as an alert to informed investors from Chase Securities. The notification, however, did not highlight the exact savings companies might be making. The exact saving is indeed elusive. However, Profit has taken the initiative to delve into various scenarios, or at least had our sources do the intricate maths for us.

According to Farooq’s astute calculations, “Cement margins are poised to expand significantly because of this. Cement players use an average of 130 kgs of coal per tonne. So cement margins will increase by around Rs. 750/tonne. Cement profit before tax in 3QFY23 was between Rs. 2,000-3,000/tonne. So this impact would be significant. Coal prices during 3QFY23 were around Rs. 56,000 per tonne and are currently hovering around Rs. 48-50,000 (Afghan coal). So the combined impact of the price drop in coal and the duty reduction will be colossal.”

Farooqui elucidates his calculations: “In effect, it would translate into a Rs. 20-30/bag cost reduction for cement producers depending on the mix of coal used by each producer.” Whilst Rauf states, “Should they choose to retain the extra margin, roughly, it is equivalent to saving Rs. 35 per bag of cement, which means billions in savings for cement sector companies.”

Is there anything for Southern manufacturers?

“No. They don’t have a high proportion of Afghan coal because of the distance. They were relying on imports from different destinations,” Farooqui articulates simply. “Mainly northern producers have been using Afghani coal due to their proximity to Afghanistan,” he adds. There is no additional cost advantage that Profit has been able to identify as of yet.

“Realistically, everyone stands to benefit. Richards Bay landed today at Rs. 38,000/tonne. So with transport to central Punjab, it’s roughly Rs. 44,000. Afghan coal after this $20 drop will be close to Rs. 44,000,” explains Farooq.

If anything, it’s just the Afghan government trying to ward off competition from South Africa. Northern Cement manufacturers being able to profit from this is just an unexpected windfall.