It started quite inconspicuously. At a regular meeting of parliament’s Public Accounts Committee (PAC), the committee’s chair called for a probe into a unique facility that the State Bank of Pakistan (SBP) had provided back in 2020.

Within days the term TERF — which stands for Temporary Economic Relief Facility — was on everyone’s mind. Camps were set up, battle plans were readied, and lines were drawn.

On one side are the architects of the scheme like former State Bank Governor Raza Baqir and former finance minister Shaukat Tarin. They are joined by industrialists, large investors and others who feel the facility achieved many of the objectives it had been created for. On the other side are critics who feel the facility was dead on arrival and it ended up being just another scheme where industrialists got to enrich themselves with free money.

The reality is that the investigation initiated by the PAC was little more than a political witch hunt. The Noor Alam Khan led committee was more interested in sniffing around and trying to dig up some dirt on the financial team that was running the show during the Pakistan Tehreek i Insaaf government and the TERF scheme seemed to be a good place to start.

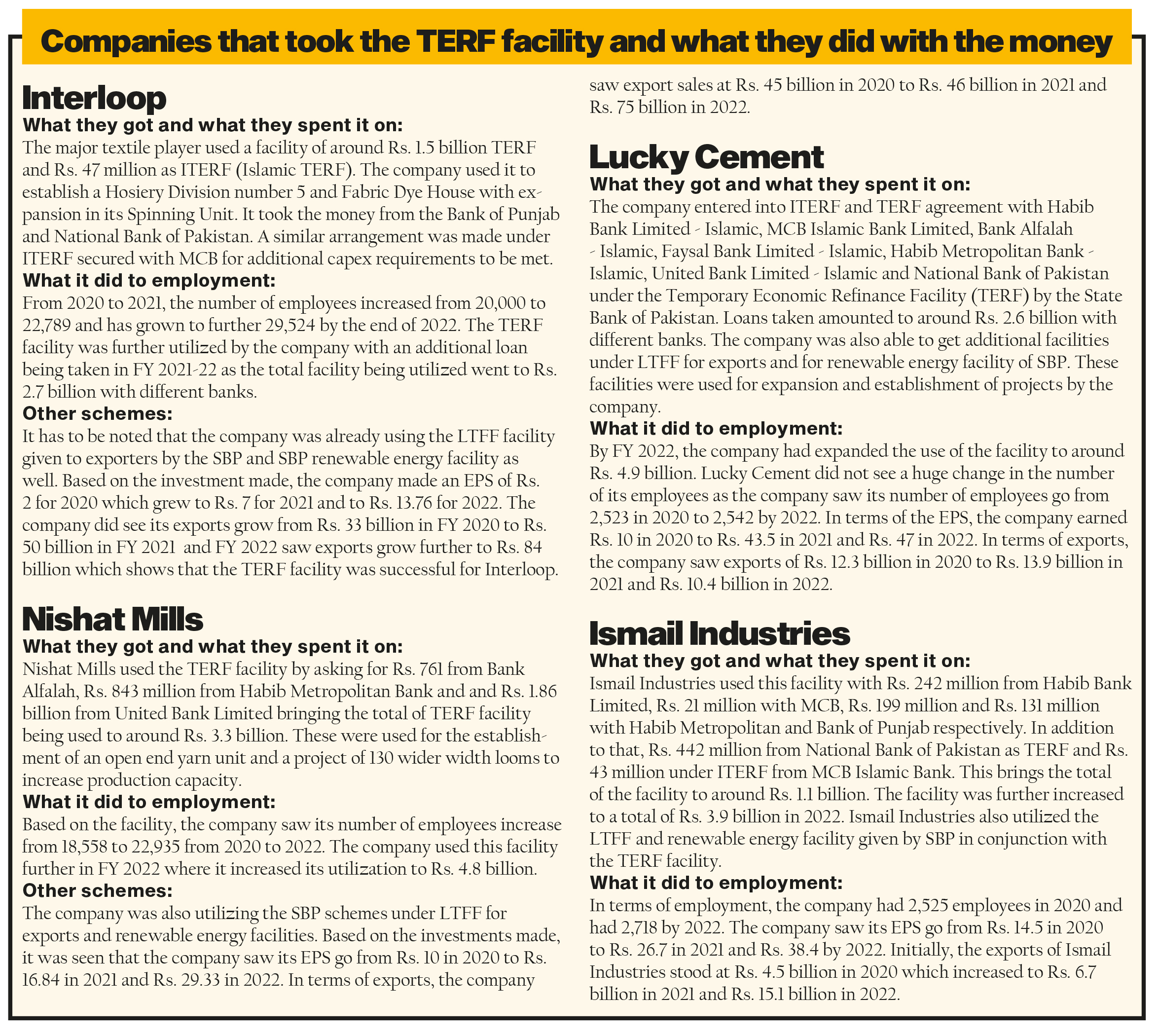

But to understand entirely what the entire fuss was about, it is important to understand what TERF was. Launched in 2020 during the Covid-19 pandemic, it was essentially a facility launched by the SBP with the help of the government that provided nearly interest free loans to businesses so they could keep the wheels turning and not lay off their employees. Over time, more than 600 businesses took advantage of this facility and the SBP lent over $3 billion for this purpose. Major businesses took them up on this offer, including giants such as Interloop, Nishat, the Lucky Group, Ismail Industries, and many others.

The question here is not whether there was something shady going on with TERF as the PAC has tried to claim (hint: there isn’t). The real question is that outside all the mud slinging and shrieking about corruption, how was the TERF scheme on merit as an attempt to keep businesses afloat and unemployment low?

Profit investigates.

TERF facility

Let us start at the beginning. In 2020 the economy was tanking. The Covid-19 pandemic had hit Pakistan and the rest of the world and halted most businesses. According to a report, “Special Survey for Evaluating Socioeconomic Impact of COVID-19 on Wellbeing of People”, the labour market of Pakistan dropped by 13 percent in the April–June quarter of 2020.

According to the Economic Survey 2020-21, prior to Covid-19, the working population was 55.7 million. During the pandemic, this number declined to 35.04 million which indicates that 20.71 million people either lost their jobs or were not able to work.

With falling demand some businesses found themselves reeling worse than others. Retailers were closed down, malls barred their doors, and demand was in the dumps. The government was facing an unprecedented crisis in which people were losing out on jobs as well as on business. This is where TERF was introduced. This was a facility provided by SBP in order to promote investment and expansion of industrial capacity of the country.

The time this facility was introduced, the pandemic was ravaging the world with lockdowns being announced on a daily basis. It was feared that the pandemic would slow down economic growth and a facility was provided by the SBP to SMEs and industries to borrow at low interest rates. In a time where economic uncertainty was high, no one would be willing to invest and the scheme was a way to incentivize investment.

So what exactly did the SBP do?

The mechanism which had been used by the SBP was to allow banks and DFIs to carry out financing across all sectors. The banks had the ability to carry out their own due diligence and scrutinise the companies themselves before granting a loan under this facility. The facility was to be used to either purchase imported or locally manufactured plants in order to complement existing projects or set up new projects from scratch. Later the scope of the loan was also expanded to include Balancing, Monitoring and Replacement (BMR) to be carried out.

These funds could be used to finance all Letter of Credit that had been established after the announcement of the scheme from March 17 till March 31, 2021. Banks were allowed to give a loan of Rs. 5 billion per project and the rate that would be charged was 7% a year which was later reduced to 5%. The SBP charged a refinance rate of 1% while the remaining 4% was charged by the banks as the spread above the refinancing rate. The period of the loan was set to be 10 years with a grace period of two years.

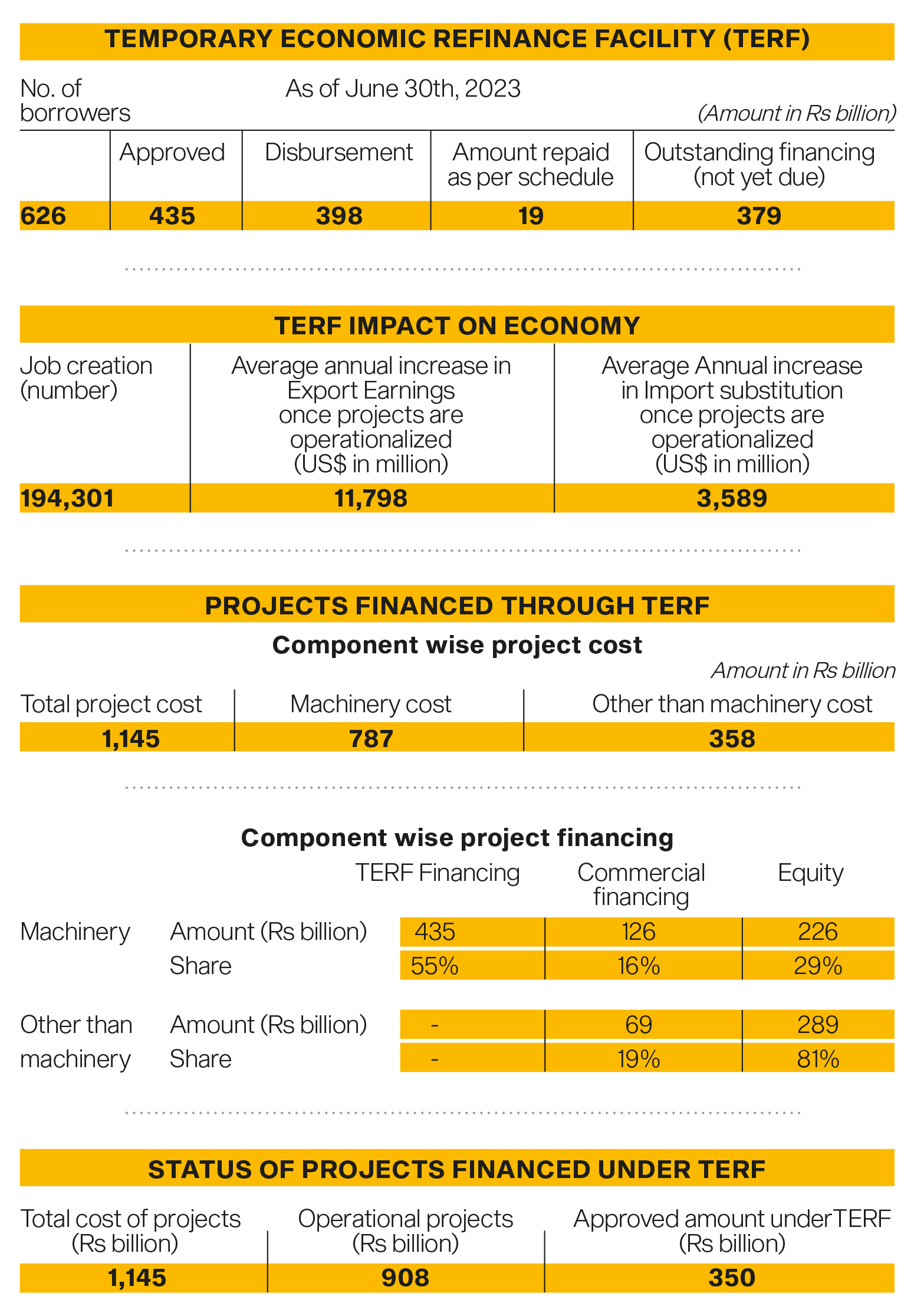

According to SBP’s own record, it can be seen that the bank has a record of 626 borrowers still left in its books with Rs. 398 billion disbursed and Rs. 19 billion already repaid. The program has seen an increase in employment by nearly 200,000 workers directly and it is expected that the program will see export potential increase by $12 billion and import substitution by $3.5 billion.

Demystifying the headline figure of $3 billion

One of the pertinent questions that needs to be asked at this stage is where does the $3 billion come in. The loans that had been given out to the investors were worth Rs. 436 billion according to the records of SBP at the end of Mar 2021 when the facility was supposed to expire. Mr. Chairman Noor Alam Khan seems to be considering the dollar against Pak Rupee as it stood at March end 2021 which would make this figure true to a certain extent that loans of $3 billion were granted.

The problem with the figure is that it is being presented as an amount that has been given away by the government. The $3 billion amount has been portrayed and amplified as being the loss that the government made while the industrialists were able to use this facility to get away with these funds. That is not true. These are loans and these loans have to be paid back by the companies when they mature in 2032 or even before that. Once these loans are paid back, the $3 billion would be returned and interest of 1% would be earned back by the SBP.

Granted the State Bank will be making a loss compared to earning a higher interest rate and that criticism has its merit but the goal of these loans was to boost investment. To state that these funds have been wasted or handed out is a blatant lie. The goal of the statement was to parade around the $3 billion figure as a loss to the country and create a ripple in the political discourse of the country which it has sadly done.The PAC was going to go on vacation in mid July and the government would be ending its tenure in mid August which would have made this probe futile in itself. This all was known well in advance and the PAC was able to create a political storm in a teacup.

Who is actually paying the cost?

This issue might have a political motive behind it but the question still needs to be asked who is actually paying the cost and what the cost is. The scheme was introduced in March of 2020 and interest rates had fallen from 12.5% to 7% within 3 months by June of 2020. The government had initially given these loans at 7% but seeing the base interest rates fall, the rates were revised to 5%. As the refinance rate was 1%, banks that had given the loans were able to earn a spread of 4% with these loans.

The initial model seemed sound enough as the interest rates remained steady for more than a year when they were increased by 25 basis points in September 2021. The rates have significantly ramped up since then and stand at 22% in June 2023. There are borrowers who were able to use the facility and are paying a measly 5% interest on these loans while the rest are borrowing at 22% and higher. The banks are still earning their spread on a principal that they did not have to put up and it is free money for them as well.

These loans are being refinanced by the SBP and the central bank was able to fund these loans through money supply. The central bank has the power to print money and using this ability, they have been able to make these loans. Based on this, it is evident that SBP and ultimately the people of the country are the ones bearing the cost of TERF. At the time when funds were being allocated to create such a loan, SBP had little concern for inflation and printed the money to stimulate the economy.

Due to the act of printing money, the economy would have gone through inflationary pressures which have cost the people in the end. One of the contributing factors for the interest rates to be at 22% was the fact that large scale borrowing was carried out at low rates and there should have been some foresight by the SBP to make sure that the inflation that once inflation started to become a concern, there were measures in place to counteract it. The real cost of this program resulted in inflation in the economy and that cost has mainly been ignored in the debate that has been carried out around this issue.

The supporters of the scheme

The people who support the scheme state that the goal of the facility was to allow businesses to carry out their investment plans without any delays. Raza Baqir, the Governor of SBP during the pandemic, has stated that the SBP was under pressure from the business community to lower the interest rates and TERF was seen as a welcome relief to the worrying industrialists. “Ultimately, the institution won the hearts of many industrialists and businesses,” he said.

The loans were initially for green field and expansion related projects which were later tweaked for BMR projects as well. Proponents of the scheme state that the project was a success as the country was able to expand exports and create new job opportunities which might have seen unemployment and loss in economic output if the facility was not present.

Overall, the scheme is seen as being positive for the country and a much needed boost to the investment. It led to generation of tax revenue which would not have been possible without the program. The design of the scheme was to give the banks the authority to carry out the due diligence and assess the creditworthiness of the businesses which meant that SBP was not involved making the process fair and equitable to every business.

The SBP made sure the loans were to be provided to SMEs and businesses alike as the program was supposed to be sector agnostic. It was felt at that time that carrying out extensive imports of machinery would have put undue burden on the import bill of the country but once the economy rebounds, it was felt that it will be on the back of these TERF funded investments which will enhance the long term growth of the country. They defend the fact that most of the borrowing was carried out by the textile sector as the industry forms the backbone of the country and would carry out export-led growth for the country in the long run.

The textile industry benefited most from the program as they were able to expand and upgrade their plants and export to new markets. Supporters of the program do admit that there were inefficiencies in terms of placing and monitoring limits on the borrowing and keeping them sector relevant.

Detractors of the scheme

The detractors of the scheme feel that the program was lopsided and that it primarily failed to achieve the goals it had set out itself. They highlight the fact that most of the loans that were provided under this facility were given to industrialists at the expense of SMEs. This was an inherent flaw in the design of the facility that was provided by the SBP they claim.

The decision making ability to provide the loans was given to the banks themselves after their due diligence was satisfied which meant that the banks would favour established and running businesses over SMEs who had little track record or collateral against the loan they were able to get. The industries which attained most of the funds were textile, sugar, chemical and automobile sector just to name a few which shows that these loans were extended to established industries. The goal of this program was to benefit businesses of all shapes, sizes and industries, however, banks are always going to prioritise loans to bigger established companies. This flaw became apparent as banks were not mandated to follow any sector or size related financing and were given free reign for the decision making process.

Only 7% of the facility was utilised by non-manufacturing industries which amount to around Rs. 10 billion while 45% of the funding went to some form of textile related industry. There are also concerns raised over the fact that SBP had the final right of approval of all the loans granted by the banks and that SBP could have been more vigilant when approving these loans which they failed to do. There are also claims of preference in regards to certain business groups which benefited the most from these loans and SBP could have made sure that this did not happen where business groups were able to crowd out most of the funding for themselves.

The SBP also mandated that these companies did not carry out any downsizing or firing of staff after they took these loans which was not followed through either which shows that the state bank was not looking to implement the rules it had set out itself. There could also have been a system where these business groups or companies could have been taxed higher in later years in order to offset some of the benefits they would have gotten due to the lower rates of interest that was levied on them which was not put into place either.

Long term financing through TERF

Another aspect that has been criticised is the fact that many companies looked to finance their long term projects with these low rates loans and the benefits of which will accrue years into the future.The goal of the facility was to allow for industries and small enterprises to carry out investments without any delay and these projects had to be executed in the short term. The SBP did not place any temporal limitations which meant companies could carry out large scale investment in projects which would take years to complete before providing any economic benefit. As these loans were at low rates and rates were not going to be revised upwards, they could bear the miniscule costs these projects were worth and could take advantage of output in the future.

Capex and no opex

Critics have said that the SBP allowed companies to carry out capital expenditures at low rates, however, operating expenditure financing that is needed by the companies has to be funded by higher rates prevailing in the economy. They state that once the production capacity was increased, there was a need for similar financing to operate the business and use this capacity which was not provided for. This claim can be shot down by the fact that the central bank did mandate the PFIs to “ensure that the working capital facilities in respect of the new project are adequately secured/agreed to, preferably by a financing PFI or one of the member of the consortium, prior to the approval of financing under the facility, so that project does not suffer due to lack of working capital facilities in future.”

The central bank did put into place certain checks which would have meant that operating expenditure of the future could also be met once the capital expenditure had been carried out. Again, mandating PFIs to make sure this financing was available and was carried out at a long term low rate could have been put into place and made sure TERF was successful in the long run. The fact remained that the interest rates grew to 22% which was not foreseen by anyone and once the rates did get so high, there was a lack of liquidity of funds. This led to an increase in capacity of the business which could not be utilised properly. Rather than something that could have been a feather in the cap of SBP, this ended up being a burden with financing being crowded out and the potential benefits of the scheme not being realised fully. However, the SBP did put in measures to make sure operating expenditure was provided for.

Takeaways for TERF

One of the biggest plus points of a scheme like TERF was the fact that it was a long term loan which does not exist in a country like Pakistan. From the government to the private sector, there is little to no scope of a medium term debt or borrowing market where borrowers can borrow for a substantially long time without risk or revision or changes. From the T-Bill market to the unmatured bond and sukuk market, no bank or institution is willing to commit funds for a long term of time. TERF changed this scenario. It was the first time that a loan was being given for a period of 10 years with a grace period of 2 years. This was a game changer for a country like Pakistan where stability is scarce and needed in order to bring some modicum of certainty in the business environment of the country. This was a good aspect that needs to be kept in mind when future facilities or programs are designed.

One huge criticism of the program was the fact that big industrialists and groups had taken over the scheme by procuring most of the loans. This is something that needs to be looked into and SBP needs to develop sector and business related restrictions to make sure that certain elements of the business community do not end up taking advantage of the facility. Banks supplied TERF related financing to the same companies multiple times which benefited only a few groups. The SBP was responsible for refinancing the loans and should have done more in order to make sure the spirit of the facility was honoured. Banks, when given a choice to lend to an established business and SME, will always lend to an established business and SBP should have enforced its own rules and regulations in a better manner to make sure the facility was open to a larger group of people and businesses. The SBP could have asked the banks to apportion a certain amount of loans to SMEs in order to balance the risk of lending to industrialists and that could have been implemented more stringently which did not take place.

Another tweak that could have been made would have been to peg the interest rates of the TERF program to the interest rates prevailing in the market. They could have been set at KIBOR minus a certain percentage which would have meant that once the interest rates would have increased, the interest on these loans would have changed as well which would have lessened the losses on the central bank. SBP provided liquidity in the market by handing out these loans at lower rates and printed money. This ultimately means that the cost of the project could be seen in terms of inflation that was suffered by the country and that cost needs to be weighed when the benefits of the program are counted out. By pegging the interest rates, the bank could have recouped some of its cost and would have been acceptable by industries as well.

The purview of the SBP

The SBP has the power and the authority to investigate the abuses that are being highlighted by the critics and it would have retained the secrecy of the clients with the matter staying between the banks, the central bank and the borrower. Any misuse of the funds can also be recouped from the banks accordingly even if the borrower does not release the funds and this is something that should be looked into to quell the feeling of unfairness that exists in the minds of the critics of TERF. An institution like the SBP should look to investigate claims of abuse and misuse and carry out investigations of these claims in order to alleviate the sense of unfairness that exists around these loans. This is an opportunity for the SBP to save some face for itself and look to investigate the blatant abuses of funds that have been carried out. This would help alleviate the feeling of gouging and helplessness that the people feel and will bring some perception of fairness and shed light on the success of the program itself. The businesses and industries which took money from the government need to be held accountable and even punished.

Revealing the complexities of evaluating the impact and intentions behind such initiatives.

Bringing to light the difficulties of gauging the results of and motivations for such endeavors.

Addressing discrimination and advocating for the rights of transgender individuals, including access to healthcare, legal recognition, and protection from discrimination.

Very informative! It’s what I was looking for

Grab opportunity to elevate your lifestyle by choosing one of our meticulously designed residences

I thoroughly loved the essays on this topic.

Keep sharing more articles like this

Thank you for sharing this excellent information. You have a pretty great website. It’s amazing how much detail you have on your website.