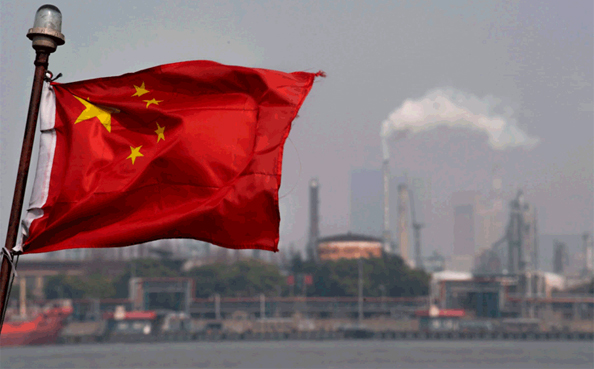

Global investors are increasingly choosing to bypass China’s markets in favour of other emerging countries that are either gaining from the geopolitical and growth risks stalking the world’s second-biggest economy or are far removed from them.

Reuters analysis shows a massive jump in the assets of emerging market (EM) mutual funds and exchange traded funds (ETFs) that exclude China as U.S. and European investors turn more wary of being exposed to the Asian giant.

Some of the money is being diverted into markets directly benefiting from China’s economic pain, such as Mexico, India, Vietnam and other locations that are replacing it across global manufacturing supply chains. Other investors are simply moving to markets with better growth prospects, such as Brazil.

The scale of change needed in global supply chains could drive such capital flows for the next decade, he said.

Refinitiv data shows China-focused mutual funds suffered a net outflow of $674 million in the second quarter of this year, while, in contrast, nearly $1 billion went into EM ex-China mutual funds.

With China comprising nearly a third of the EM MSCI index, such ETFs and funds also offer alternatives to tracking that index.

“China is the one major country that investors are most concerned about in EM,” said John Lau, portfolio manager for Asia Pacific and emerging market equities at SEI.

The favourable growth and valuations in Latin American markets, the tech-driven tailwinds for companies in South Korea and Taiwan, and the supply chain changes were offering investors better opportunities than China, he said.

Data from Goldman Sachs showed that as of mid-July, foreign buying of emerging market Asia ex-China equities amounted to $39 billion over 12 months, the first time since 2017 that this buying exceeded inflows into mainland Chinese equities via the Stock Connect scheme.

NO TAKERS FOR CHINA

The size of the top 10 China-focused mutual funds tracked by Morningstar has slumped over 40% from its peak in 2021.

The well-known UBS China Opportunity Equity Fund saw assets shrink to $4.5 billion by the end of June, a fourth of levels in January 2021.

Singapore sovereign wealth fund GIC’s [RIC:RIC:GIC.UL] CIO Jeffrey Jaensubhakij said it has “incrementally” moved its capital to sectors and countries benefiting from shifts in the global supply chain and most of it “has been basically out of China into countries such as Mexico, India, Indonesia and Vietnam.”

Fund managers and advisers are struggling to attract investment into China-focused products.

“In the last six to 12 months, there have been almost no queries for a China-focused mandate,” said Benjamin Low, a senior investment director at Boston-based advisory firm Cambridge Associates.

Some of his clients are instead looking at ex-China exposures within Asia, such as Japan, he said.

China’s CSI 300 index (.CSI300) is flat for the year, whereas Japan’s Nikkei index (.N225) is up 25% and the S&P 500 (.SPX) nearly 19%.

Investors who had turned shy since the Donald Trump administration barred U.S. investments into Chinese military companies have become more so after President Joe Biden’s government expanded the banned list to include sectors such as chips and quantum computing.

While many of those restrictions apply to exports and venture capital, portfolio investors are wary of running afoul of investment limits or being caught in sanctions.

“The situation is even worse than last year when investors still had something (i.e. reopening) to look forward to,” said a business development manager at a Hong Kong-based hedge fund, who is not authorized to talk to media.

The fund has managed to make profits in a challenging market in the first half, and yet has been struggling to raise new money from foreign investors in the past few months, he said.

China’s pledge this week to step up stimulus measures to shore up the economy provides some hope for investors, but it’s too early to say what impact it could have on foreign money inflows.

REPUTATION AND COMPLIANCE

Besides the financial risks, western institutional investors are worried about mounting reputational risks. Portfolio managers say it is increasingly difficult to justify China investments even to internal compliance departments and management.

For example, Canada held a parliamentary hearing in May to check on several domestic pensions about their relationship with China. The Biden administration is also working on an executive order to restrict outbound U.S. investments to China.

“U.S., Canadian, and some European investors are exiting China due to political pressure. On the face of it, the U.S. seems to have started an investment war, following a trade war, and a tech war,” said Wong Kok Hoi, chief investment officer of APS Asset Management.

GET RICH WITH BLANK ATM CARD, Whatsapp: +1 (502) 509-4485

I want to testify about Dark Web blank atm cards, which can withdraw money from any ATM worldwide. I was poor and had no job. I saw so many testimonies about how Dark Web Cyber hackers send them the atm blank card and use it to collect money in any ATM and become rich {[email protected]}. I emailed them also, and they sent me the blank atm card. I have used it to get 500,000 dollars. Withdraw a maximum of 5,000 USD daily. The dark Web is giving out cards to help people experiencing poverty. Hack and take money directly from any ATM vault using an atm programmed card that runs automatically.

You can also contact them for the service below.

* Western Union/MoneyGram Transfer

* Bank Transfer

* PayPal / Skrill Transfer

* Crypto Mining

* CashApp Transfer

* Bitcoin Loans

* Recover Stolen/Missing Crypto/Funds/Assets

Email: {[email protected]}

Text & Call or WhatsApp::: +1 (502) 509-4485

GET RICH WITH BLANK ATM CARD, Whatsapp: +1 (502) 509-4485

I want to testify about Dark Web blank atm cards, which can withdraw money from any ATM worldwide. I was poor and had no job. I saw so many testimonies about how Dark Web Cyber hackers send them the atm blank card and use it to collect money in any ATM and become rich {[email protected]}. I emailed them also, and they sent me the blank atm card. I have used it to get 500,000 dollars. Withdraw a maximum of 5,000 USD daily. The dark Web is giving out cards to help people experiencing poverty. Hack and take money directly from any ATM vault using an atm programmed card that runs automatically.

You can also contact them for the service below.

* Western Union/MoneyGram Transfer

* Bank Transfer

* PayPal / Skrill Transfer

* Crypto Mining

* CashApp Transfer

* Bitcoin Loans

* Recover Stolen/Missing Crypto/Funds/Assets

Email: {[email protected]}

Text & Call or WhatsApp::: +1 (502) 509-4485