What is one of Pakistan’s largest and oldest sugar mills doing entering the paper business? For Mirpurkhas Sugar Mill the numbers speak for themselves. In their latest quarterly report the sugar mill reported that its newly formed Paper Division had made profits before taxation of just over Rs 14 crores and 70 lakhs — that too in just under 50 days of the paper plant being operational.

To put the number in context, the sugar division of the company made profits before taxation of just over Rs 26 crores and 70 lakhs for the last quarter and that too for a full 90 day period. The entry into the paper division is a part of the continued expansion of Mirpurkhas Sugar Mills and its parent company the Ghulam Faruque Group. The same month as its paper facility started operations (May 12th 2023), Mirpurkhas Sugar Mills also announced that it was acquiring the entire assets of Popular Sugar Mills.

Company background

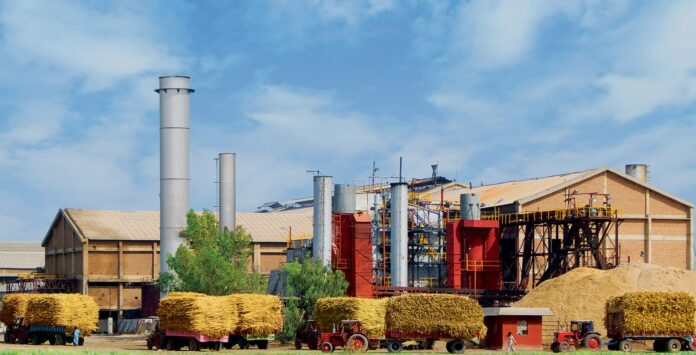

One of the oldest sugar mills in the country, Mirpurkhas was listed on the stock exchange in 1964 and started sugar production with a cane crushing capacity of 1500 tonnes in 1966. At the time the sugar mill was operated by the Pakistan Industrial Development Corporation (PIDC). At the time the corporation’s chairman was Ghulam Faruque who took personal control of a lot of PIDC assets in the 1960s including the Mirpurkhas Sugar Mill.

Since then the mill has been operating as a subsidiary of the Ghulam Faruque Group (GFC). The group has a wide range of interests including Cherat Packaging, Cherat Cement Company, Madian Hydropower, Zensoft, Greaves Pakistan, Unicol, and Unienergy, among others. Mirpurkhas is very much a family owned company and its chairman and CEO are Aslam Faruque and Arif Faruque — Ghulam Faruque’s sons.

Over time, the sugar mill continued to increase its cane crushing capacity as the demand for locally crushed and processed sugar increased in Pakistan due to expensive sugar imports.

By 2006, the plant’s cane crushing capacity had steadily risen to 500 tonnes which is when the sugar mill entered into a joint venture with Unicol to start distilling ethanol using the by-products of cane crushing. By 2012 the company had started corporate farming to provide its own sugarcane. The combination of the ethanol production and corporate farming meant that the mill was expanding but did not have many new opportunities within the sugar industry.

There was a ban on establishing new sugar mills as well as a cap on the crushing capacity of existing mills and by 2018 Mirpurkhas had already hit that capacity at 12,500 tonnes. As a result, in 2021, the company decided it would set up a paper plant. One of the main by-products of sugarcane crushing is bagasse which is the pomace from squeezed sugarcane. Its rough texture makes it a good raw material for pulping and papermaking.

The paper that is created as a result is not quite the best for printing but can be very useful for making the kind of paper used for paper bags and the like. The Ghulam Faruque group already had experience and contacts within the packaging industry. Cherat Packaging was founded under the group in 1992 and focused on making paper sacks. In 1992, it started off with one tuber, and one bottomer, which could produce 50 million paper sacks a year. In 1998 it added its second bottomer, and in 2003 it added its second tuber, its third tuber and bottomer in 2006, and in fourth tuber and bottomer in 2009.

Having rapidly expanded its paper sack production to 265 million sacks, the company turned its sight on to polypropylene bags, installing the first such line in 2012. It installed a second line in 2014, and a third line in 2016, with a total production capacity of 195 million bags. Cherat then entered the Flexible Packaging segment (used for food items) in 2017, expanding the capacity to 12.6 million kgs in 2019.

Profitable paper

The immediate rise of the company’s paper division points towards flaws in Pakistan’s sugar industry and the benefits of the paper industry. In its latest quarterly report for the months April to June (the sugar industry operates on a different financial calendar starting in September due to the crop’s harvesting season) the company mentioned how output was lower this year.

During the crushing season 2022/23 that started on November 29, 2022, the plant operated for 87 days compared to 124 days the previous year due to delay in harvesting and less availability of sugarcane. This resulted in the factory being able to crush 562,641 metric tons of sugarcane to produce 59,325 metric tons of sugar as compared to 649,557 metric tons of sugarcane to produce 70,460 metric tons of sugar during the corresponding period last year. The plant operated efficiently throughout the crushing season.

The Company also produced 28,772 metric tons of molasses during the period compared to 33,080 metric tons produced during the corresponding period last year — which will have affected ethanol production as well.

Overall, during the period under review, the company sold 43,755 metric tons of sugar compared to 44,972 metric tons during the corresponding period last year

And this is where paper enters. The company’s paper plant began operations on the 12th of May 2023. Since financial data is available only up until the 30th of June and not for the current month, we only know how well the plant’s product did for its first 48 days. According to the quarterly financials, the paper division made sales worth just over Rs 1 billion. In comparison, the sugar division performed better with more time but not significantly making sales worth just over Rs 1.6 billion.

The cost of sale for the sugar business seems to have been significantly higher at over Rs 1.3 billion compared to the paper business where the cost of sale was around the Rs 77 crore mark. However, the cost of sugarcane distribution was low at around Rs 1.9 crore compared to the distribution cost of paper which was hovering around the Rs 6 crore mark.

Overall, the sugar division of the company made a profit before taxation of Rs 26 crores and 70 lakhs compared to the very new paper division which already clocked in Rs 14 crores and 70 lakhs. These figures are of course for the last quarter financing costs were higher as well at over Rs 40 crores. The director’s report explains that finance costs increased by 159%, primarily due to significantly higher discount rates coupled with higher costs of sugarcane and other raw materials. A better picture is presented by the overall results of the past nine months for Mirpurkhas Sugar Mills.

According to these, in the nine month period from September 2022 to June 2023 the company made an overall profit of Rs 62 crore compared to Rs 35 crores in the same period last year. Of this profit, over Rs 13 crore is allocated to the newly founded paper division accounting for just over one fifth of profits within the first 50 days of being operational.

According to the company’s quarterly report, the paper plant produced 12,421 tons of paper (including the trial production) to date. “The plant is operating efficiently and achieved all the operational parameters required under the purchase agreement. Due to high inflation and poor economic conditions, consumer spending is on a downward trend. This is directly impacting all FMCGs, including snacks and confectionery businesses, leading to a reduced demand of packaging and corrugated products as well,” reads the directors’ report.

Good to learn about success story of Mirpurkhas Sugar mills and its allied Divisions. Best of luck.