For the past few weeks, the gold market’s usually bustling and lively atmosphere has been replaced with uncertainty and fear. Jewellers say business has declined drastically and their shops wear a deserted look. But a glimmer of hope was seen today (Tuesday) after the All Pakistan Gems and Jewellers Association (APGJA) released the ‘official’ gold rate, which had been suspended since Sep 13.

The APGJA typically shares the gold rate every evening. However, the association suddenly stopped sharing them mid-September. Various reports emerged regarding the reason before APGJA Chairman Haji Haroon Rasheed Chand shared a voice note with the media on Sep 15, stating that a crackdown had been launched and discussions with the authorities were ongoing.

But what necessitated the crackdown?

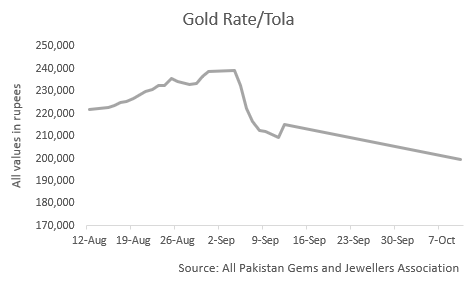

Gold has always been an attractive investment – its value rises in times of economic and political uncertainty, and it can act as a hedge against inflation and rupee devaluation. As the country’s situation worsened earlier this year with the crackdown on the PTI and the arrest of its chairman, and concerns about a potential default were voiced loudly, the per tola gold rate rose to a record high of Rs 240,000 on May 10, 2023. While the price later fell as the situation improved – reaching Rs 204,000 per tola on July 12 – it started rising again eventually.

Authorities turn their focus to the gold market

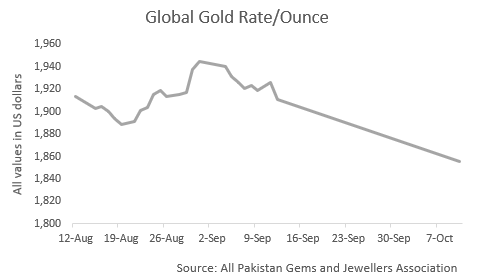

Since the domestic gold rate is pegged to the international bullion price, it continued to rise despite a decrease in the latter as the rupee depreciated sharply. And when the authorities launched a crackdown on dollar smuggling and illegal foreign currency dealings, there were concerns that these elements would move to the gold market. (Profit has done two separate stories on the currency market developments: ‘Dollar Danda: How the currency market was tamed and why it won’t work’ and ‘Big banks are all set to run the open market. What does it solve and what it doesn’t’)

But the crackdown wasn’t only because of the concerns that black money would flow into the gold market; authorities also wanted an end to rate manipulation and smuggling. On Sep 12, the last day the rates were issued, the global price of gold declined by $15 per ounce, but the domestic price went up by Rs 5,600 per tola. (one tola is equal to 11.6 ounces). And this happened while the rupee was appreciating.

Shortly after, a task force of officials from law enforcement and intelligence agencies was formed to take action against “gold smugglers and mafia”. According to APP, the task force had prepared lists of those involved in illegal gold trade.

In a voice note shared with the media on Sep 15 (a day after the state-run APP published news of the task force), APGJA Chairman Chand said association members were being summoned by agencies, and five jewellers had already been detained. The purpose of the crackdown, according to Chand, was to bring the gold rate down and end speculative trading (more on how this is done later).

Since the crackdown was launched, the APGJA did not share gold rates, and its chairman did not specify when they would be released again. In his Sep 15 voice note, Chand said the authorities wanted the bullion market to remain shut for three months.

He added, however, that he had assured them that all gold trade henceforth would be legal and documented, and he would uncover the mafia involved in illegal gold trade. He also advised jewellers to direct any people who came to them with dollars or other foreign currencies to moneychangers.

Chand also said the gold trade would be computerised, and weekly, speculative trading would end. A jeweller who spoke to Profit on the condition of anonymity explained that this type of trading is done only on paper. It is a sort of futures trading where one person agrees to buy gold at a specified rate at the end of the week from the jeweller. However, all this trading is done on paper only and cannot be regulated. In his assurances to the authorities, Chand said that henceforth, only physical gold would be sold at the spot rate which would be in line with the daily updates announced by the APGJA.

In another voice note shared with the media on Sep 19, Chand blamed the situation on the ‘gold mafia’ and those doing illegal trade. He revealed that certain jewellers in Lahore and Peshawar were quoting rates as high as Rs 222,000 and Rs 230,200 per tola, respectively. “When bullion is closed, which mafia is selling gold at those rates? If official rates are not being released and they are still selling, then anyone can sell at any rate, and the industry will be destroyed. I urge you to straighten yourselves out,” Chand said in the voice note.

Dwindling business and an environment of fear

It became clear that the APGJA chairman’s appeals were not being heard by everyone in his sector. And with the impasse, the association continued to dilly-dally about sharing the ‘official’ gold rate. Two jewellers that Profit reached out to quoted rates between Rs 200,000 and Rs 202,000 per tola on Monday (Oct 9).

How has this crackdown, and the parallel crackdown on the open market that led to the rupee’s appreciation, affected the gold trade?

The first jeweller that Profit spoke to and who owns a large shop on Karachi’s Tariq Road said that his business had already been declining amid high inflation. “There has been an extreme slowdown,” he rued.

When asked about sellers, he said people were choosing to hold off on it as the gold rate was falling and they did not want to suffer losses in case it later went back up.

The second jeweller, who is based in Karachi’s Saddar, said his business had declined by 80-90% since the crackdown started. “People are not buying or selling because they expect the rate to fall further. There are also reports that the FBR (Federal Board of Revenue) will impose a tax on gold trade, which is keeping people away.”

“There is a sense of fear. There were reports that the authorities have asked associations to provide a list of all jewellers so transactions can be monitored and the data of every person purchasing or selling gold can be shared with the FBR,” he added.

The second jeweller said that prior to the crackdown, a lot of people were coming to his shop looking for gold bars. Since gold is not a regulated sector, this meant people would not have to provide documentation to purchase gold and gold bars would be a “safe” asset to park their money in.

“Gold provides the best profit margins,” he commented. According to a research report by Topline Securities, gold was the highest-performing asset in 2022, with a return of 41%.

When asked how trade was being conducted given the absence of the ‘official’ gold rate shared by the APGJA, he said every shop owner was quoting his own rate but keeping a margin of a few thousand rupees so they wouldn’t face any losses.

Another layer to the complexity

While the sharing of the ‘official’ rate remained suspended amid a lack of progress on fixing the issues that necessitated the crackdown, the Ministry of Industry and Production formed a committee comprising jewellers from different cities to resolve the problem. However, this led to further complexity as APGJA Chairman Chand, who is also known as Baba-e-Gold (father of gold), was not included.

In a voice note shared with the media on Oct 6, an angry Chand claimed that those included in the committee were the ones who had “looted wealth and destroyed the trade”. He appealed to the army chief and the intelligence chief to discuss matters related to the bullion market with the APGJA, and announced that he would hold a meeting with other jewellers to discuss the issue.

Profit also reached out to Pakistan Gems Jewellery Traders and Exporters Association Chairman Akhtar Khan Tessori, who is reportedly heading the committee, multiple times but he was unavailable to comment.

Why the suspension was lifted

A day earlier, Profit asked Chand when the APGJA would resume sharing the ‘official’ rate, and whether the situation in the gold markets would improve any time soon.He evaded the answer and said only that they [presumably, the gold mafia he spoke of] were not listening and that discussions with the authorities were ongoing.

Why then did the APGJA suddenly decide to start sharing the official rate again? Speaking to Profit, Chand said the prevailing uncertainty in the market convinced the association.

“Everyone was quoting rates based on their whims. [Some] jewellers were buying gold at Rs 5,000 per tola less than that rate and selling it at Rs 5,000 per tola more. The global rates are being released anyway and we cannot prevent that. We wanted to end the uncertainty so trade could be conducted on an official level.”

Does this mean the crackdown has also come to an end? The APGJA chairman said it hadn’t, and the operation against “speculators and gold mafia” is still going on. He noted that the latest gold rate was down Rs 15,500 per tola compared to the Sep 12 rate, and said it would be brought further down.

“The rupee has appreciated,” he pointed out, adding however, that the Israel-Hamas conflict would cause the global gold rate to surge as people would seek to buy the “safe-haven metal”.

When asked what had improved since negotiations with the authorities started, Chand said large jewellery stores had been brought into the tax net and all trade was documented.

Commenting on the latest development, the second jeweller Profit spoke to earlier said the move would be welcomed by the gold markets. “Business will likely resume as normal and customers may be less hesitant to come to shops because the official rate is now available,” he added.

Hoarding dollars is against our economy.

Hoarding Gold means you are supporting the economy because gold is actually a final currency.

Our government may not buy gold now a days but people are able to buy at their capacity,this support our country indirectly.

Good to hear that the suspension was lifted.

All the turmoils around the world (Ukraine, Israel, earthquakes, floods…) could push the price of gold to $3000 or even higher.

plz share knowledge about bisp Tehsil Office in Pakistan complete list

What about stocks updates

Thank you for taking the time to research and write about topic.