It started pretty much as a non-event. On the 20th of September the Pakistan Stock Exchange (PSX), as part of its mundane routine, asked Pakistan Hotels Developers Limited (PHDL) what was going on with their stock price. The question was asked since PHDL, a publicly listed company that owns the Regent Plaza Hotel in Karachi, had been experiencing a surprising surge in its share price since the past two weeks.

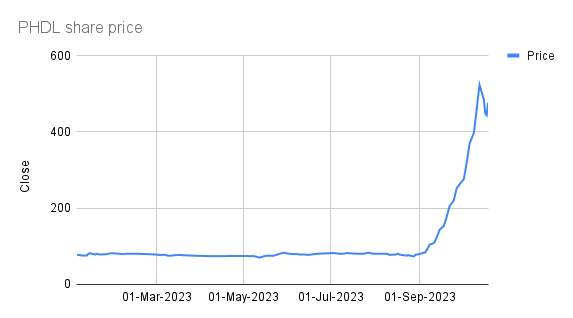

The price had more than doubled from Rs 83 on the 6th of September to Rs 177 on the 20th of September. Any time there is a rise of this nature without any apparent reason, the PSX is supposed to ask the company if they know what is going on, and if there is any price-sensitive information that they have failed to release to the public. Companies almost always say that they have no clue why their share price is increasing, and usually that is the end of that.

Price-sensitive information is any information that, if disclosed, would most likely have an impact on the company’s share price. For example, in the case of the PHDL, if their crown jewel, the Regent Plaza, was to go up for sale, the company would need to disclose this immediately, through a notification on the stock exchange.

There is wisdom to this. If, for example, company A comes in and wants to buy company B and pump money into it one would expect company B’s stock price to go up. Now, this is information relevant to investors and as such company B must disclose it publicly via a notice to the stock exchange. This is because if they do not disclose it, the individuals that are in the loop regarding the deal will be able to buy shares in company B beforehand. When the information is finally disclosed the share price will most likely go up, and these individuals would benefit, but at the expense of those shareholders who sold their shares at lower prices being unaware of this price-sensitive information. This, of course, is what is called illegal insider trading.

And that is exactly why the PSX followed procedures and inquired about the rise in share price from PHDL. The suspicion was that there might be some positive development that had led to an unusual increased interest in the shares of the company by some insiders.

But, as expected, on the morning of 22nd of September the company replied with an official sounding “idk”.

However, despite the company stating that it had no price sensitive information to disclose, the share price continued its upward trajectory, going up by another 7.5% that day, the maximum allowed increase in a single day. Perhaps this was because, the company in the very same response also mentioned, in a very by-the-way manner, that there were parties that would off and on approach the company for buying their crown jewel, the Regent Plaza. However, it stated that no firm offer, that was also acceptable to the company, had been received so far, which is why they had not made any disclosures.

This was the first time the company had, albeit casually, informed the PSX that it was open to selling the Regent Plaza Hotel. Let that sink in. Any price-sensitive information is supposed to be intimated to the stock exchange. PHDL never told the exchange they had plans to sell, and yet through this notification informed them that they had at the very least received parties that were interested in buying the hotel.

And it did not end there.

The very next working day, on Monday the 25th of September, PHDL announced that the Sindh Institute of Urology and Transplantation (SIUT) had approached them over the weekend with an offer to buy the Regent Plaza, and that the potential buyer was interested in conducting a due-diligence of the property. Even more incredible? The notification claimed that SIUT had approached them a mere one day after PHDL claimed they had never been approached by a serious buyer up until that point.

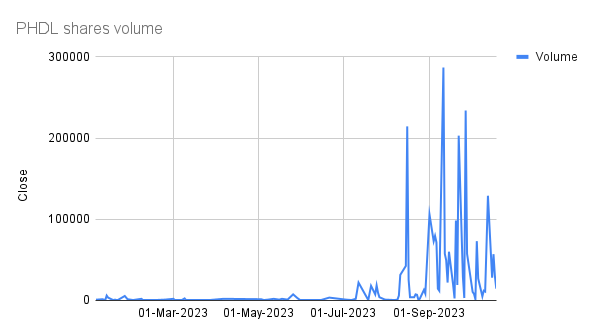

Following the official announcement that SIUT was indeed making an offer, for the next three weeks, the share price continued to increase by the maximum allowed 7.5%, every single day. When markets closed on Friday the 13th this month, the share price stood at a whopping Rs 523.1. This would mean that if someone would have started accumulating shares in PHDL between the 6th of September and the 25th of September, when the material information was publicly disclosed, they would have made a profit of over 500% in a month’s time.

And from the increased buying activity that took place during this period, one thing becomes clear: Someone had to be doing exactly that. A coincidence? Highly unlikely.

The more plausible answer is insider trading. As highlighted above, this occurs when any person that had prior knowledge of the deal starts buying shares at a time when the information is not available to the public. To understand if this was in fact a case of illegal insider trading, one must first answer a few questions:

- Why would a company’s share price go up if it is about to sell its main asset, which is akin to closing down the main business of the company? Should the share price not go down instead?

- What exactly does the law say about disclosing price-sensitive information? Is there any confusion in law and amongst market participants about what constitutes price-sensitive information and at what time it has to be disclosed?

- If such a case appears where there is such a discrepancy, what tools do the regulators have to establish if this was a case of insider trading or not? And if it was, what could have been the modus operandi to execute and hide the crime? And can the regulators find proof and narrow down who the suspects are?

Busting white-collar crime is a tough gig. In Pakistan it seems the authorities have had a particularly hard time of it. In the case of Regent Plaza’s sale to SIUT, let us start at the very beginning.

A bit about PHDL

Let’s take a step back for a second. PHDL is a listed company that owns the Regent Plaza Hotel located on Shahrah-e-Faisal, Karachi. For years it has been in the hotel business and hasn’t been doing particularly well. It made profits in some years but nothing compared to the assets on their balance sheet.

This is because PHDL has one very big and very fixed asset. The Regent Plaza Hotel accounts for a total of 97.7% of all assets that the company owns. In all companies, real estate is an asset that is regularly evaluated to reflect the real value of the asset in the financial statements.

For example, the fixed assets (basically The Regent Plaza Hotel) were worth Rs 2.4 billion in 2010 and in 2023 stand at close to Rs 10 billion due to it being revalued at market prices. Based on this increase in assets, the book value of PHDL’s share should have gone from Rs 125 per share in 2010 to Rs. 542 per share in 2023.

The only problem is that since these assets are rising because of increasing property value, investors are not particularly interested. The value of the property is rising, but that does not mean profits are rising. Just look at the past few years. In the year 2020-21, the company recorded losses worth Rs 4.64 crore. In 2022-23 they made a profit of Rs 5.88 crores. While they did make a profit last year, remember this is a company with assets worth tens of billions of rupees. So even if PHDL made a profit of Rs 5 crore every year it would be a meagre utilisation of the value of the assets they own.

Investors are only interested in how well a company is doing, not the big fancy toys they own. Unless, of course, they are planning on selling those toys. If you are an investor in a company like PHDL, then shutting shop and selling the business is good news because you will make money. This is especially good if the company over the years had not been making any significant money off their assets.

And since PHDL never expressed any interest in selling its properties, the value of the share remained low and steady. The share price has been trading between Rs. 20 and Rs. 160 from 2010 till August of 2023. The share price has been range bound between these two numbers and, regardless of performance, the share price has never broken past the Rs.160 mark.

That is until now.

As we’ve mentioned above, the price was Rs. 83.5 when the market closed on 5th September 2023. Since then, the share price has rocketed to above Rs 500 after hitting upper lock on a nearly daily basis. This was strange. The company did not disclose any intention to sell, they did not announce that they were looking for buyers, or that anyone was interested in buying it. The stock price had remained steady for more than 13 years. And then in a matter of weeks it had ballooned. The only reasonable explanation for this can be that the company was planning on selling its real estate.

The problem is that there had been absolutely no indication as to such a sale. And since this is considered ‘price-sensitive information’ which is relevant to investors the PSX ended up asking PHDL. They in turn said they knew nothing about what was going on, with the caveat that they had on occasion been approached by potential buyers.

After the reply was sent to PSX, the company sent out an announcement to PSX on 25th September 2023 that a potential buyer namely Sindh Institute of Urology and Transplantation (SIUT) Trust had approached the company through a letter dated September 23, 2023 and had shown interest in buying the hotel from the company. On 27th September, PHDL held its board of directors meeting and decided to provide hotel property documents to SIUT Trust to carry out their due diligence. On October 11th, the company disseminated the information that an offer for the property had been received and that an amount of Rs. 14.5 billion was being offered.

The impact of such an offer is going to be massive. As we have already seen, the hotel was valued at around Rs 10 billion by the company. Based on the Rs 10 billion number, the book value per share came to Rs. 542 per share. With an offer being made of Rs. 14.5 billion by the purchaser, the book value will further increase by 45% bringing the book value per share to around Rs. 786. As the book value of the shares would increase, the market value of the shares should settle around that point as well, assuming the sale goes through.

The share price reaching Rs. 786 would mean that there is a further upside potential of the price to increase by approx Rs. 300 or another 55-60%. If the initial price of Rs. 83 is taken, the total price increase would be 9.46 times or 946%.

Where was the regulator?

These are the moments that stock exchanges live for. There is nothing that should make a stock exchange suspicious like unusual activity. The PSX has a rule that in case there is any material information that has not been disclosed by the company, they should do so to explain, from their view, the sudden increase in price of the shares. The safeguards are in place specifically to prevent insider trading.

The law is pretty clear on these matters. Any and all information that is price-sensitive needs to be disclosed. That means if a company like the PHDL gets even a whiff of a sales offer, they need to disclose it immediately. Remember, when it comes to insider trading everyone is at risk. The insider could be an employee of either SIUT or PHDL that had knowledge about the deal being negotiated, it could have been a lawyer writing out the contracts, it could have been members on either one of the companies’ boards, it could have been a secretary that was booking the conference room in which the two sides were meeting.

That is why it is so important to disclose this information. If it is anyone high ranking from PHDL or SIUT involved then it is a clear case of malicious intent to withhold information. In the case that it is some distant party using the information to make profits, PHDL sat and watched as the share price skyrocketed very quietly. They only responded when asked and even then made the very suspicious move of disclosing an offer to sell a day after denying any such offer existed.

The PSX makes a particular point of this. In fact, in July 2023 the stock exchange issued Guidance Notes to listed companies on continuous disclosure obligations under the PSX Regulations. The document was 18 pages of bullet points that can very easily be boiled down to one sentence: When in doubt, give more information than you think necessary. In short, to cover their tracks and be compliant, companies need to be proactive in giving out information.

So was this a case of insider trading and what can be done about it?

“An increase in share price does not automatically imply that there has been insider trading or other market manipulation, however, the sharp increase in share price immediately before the announcement of a takeover bid raises red flags that need to be further investigated,” says Haroon Baryalay, Managing Partner at FGE Ebrahim Hosain. “Whether any insider trading has occurred or other market manipulation took place is something that will need to be determined based on the facts, which can only be decided after an investigation has been carried out.”

There must have been a moment where the company’s board made a decision that they intended to sell their hotel. This decision must have gone through a process of making the decision within the company before the intent was broadcasted outside. The question that needs to be asked of PHDL are around this.

The question is, will the PSX confront them on this now? And what tools do they have at their disposal?

“Please be informed that the PSX has already taken cognizance of the unusual price movement in the share of PHDL. Any adverse findings as a result of the assessment shall be dealt with in accordance with the relevant provisions of the applicable laws. Rest assured, PSX is fully cognizant of its duty to ensure fair dealings and always takes measures to enhance transparency in the interest of investing public and market at large,” a representative of the stock exchange said in response to Profit’s query.

So what can be done?

The PSX actually has a number of options at its disposal. The stock exchange is just the frontline regulator of these matters. That means they are the ones that pick up on unusual activity and make inquiries into it. If they find that the answers from a company are not satisfactory, they have the option to go to the Securities and Exchange Commission of Pakistan (SECP) which is the apex regulator of all matters that have to deal with financial crimes.

The SECP is actually empowered to deal with these situations. All listed companies do provide details of the people they employ, board members are all known, and a lot can be done. The SECP initially makes inquiries. The commission has an “ACCESS TO INSIDE INFORMATION REGULATIONS, 2016” which requires each listed company to appoint a senior manager to maintain a register with names of persons that have access to insider information. It should be possible to determine if the persons listed as insiders therein have been involved in any transactions in the weeks prior to the announcement of the acquisition. If so, this would be evidence of insider trading.

If an investigation is launched, they can approach the Federal Investigation Agency (FIA) to take charge. The FIA then can swoop in with some commando action. This means raids, seizing phones, pulling company records and doing a thorough forensic investigation into the matter. This is ideally how white collar crime should be dealt with.

A complete audit needs to consider the accounts that were buying and selling the shares around these dates and see who the beneficial owners of these accounts are. It is important to carry out such an audit as it will show if the deal or even the knowledge of informal talks was leaked out beforehand. As the information was credible, people acted on it and made quick money once the deal would be made public. The PSX will do itself a favour by getting to the bottom of these trades and see if shareholders of the market were disadvantaged in any way.

During these dates, two Negotiated Deal Market (NDM) trades were also carried out with Arif Habib Limited (TREC Holder Code 050) where 20,000 shares and 25,000 shares were bought outside of the regular market. Just based on current market price, these two trades made Rs. 13 million on just two trades as well. All these trades are suspect as they were carried out before the deal was announced formally.

The only problem is that Pakistan has generally had a hard time busting white collar crimes. Most crimes come out when it is too late. The SECP is empowered to investigate insider trading and were once actually quite active in issuing press releases when they busted someone. The problem is that the last time such a press release came out was way back in 2017. In fact back then two high profile cases had come out where high ranking officials of UBL and The Bank of Punjab had been caught being involved in insider trading. In the case of UBL, it had actually been their head of Investments.

The past six years have not seen any such action being taken, and there is a general understanding that insider trading can be undertaken relatively safely because the regulators have been a bit lax. But the very stark and obvious actions of PHDL make it seem like another press release from the SECP may be on the cards.

very accurate research allah apko apny hifzoo aman me rakhy itny sachai k 7th yeah news channel challa rahy hain

Thanks for sharing very informative article.

What justice you demanding to case fwd to FIA?

Are you not living in Well prepared country?

This is PSX world record that no insider trading initiated for perpetually 7th year..

One simple solution is fwd case to SECP to label five years ban on selling any of property of PHDL & donate banned 5 years income to SIUT Trust

SIUT is obviously involved as no one bids for a property 14 B whose declared value is 10 B. SIUT has bo reason to take five start hotel , there are othe rproperties for sale in the region that can be converted into a great hospital in far less amount than this.