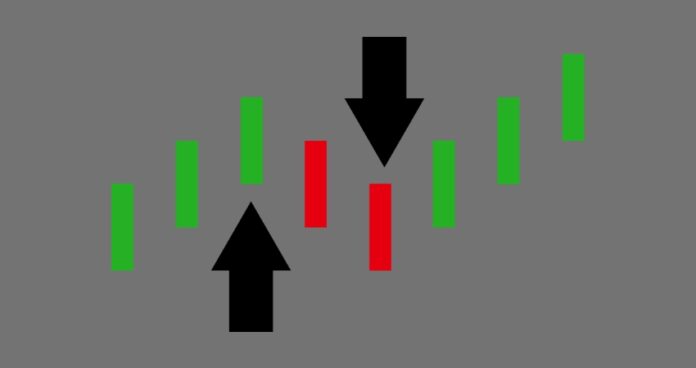

Pakistan’s stock market witnessed a lackluster week as trading volumes dropped by 25% and the benchmark KSE-100 Index lost 1.27% of its value.

According to a note by AKD Research, average trading volumes remained down by 24.7% week-on-week, clocking in at 312.8 million shares, compared to 415.8 million shares traded in the past week.

The market was mainly influenced by news events in the energy sector, such as the hike in fuel prices and the conflict in the Middle East.

Investors also awaited the outcome of the monetary policy committee (MPC) meeting and the inflation data for January. The MPC decided to keep the policy rate unchanged at 22%, citing the possibility of future easing as real interest rates are expected to stay positive for the next 12 months.

The inflation rate for January came in at 28.34%, slightly lower than AKD Research’s forecast of 28.63%, but still very high compared to the regional and global averages.

The inflation was driven by the increase in energy and food prices, which offset the impact of the appreciation of the Pakistani rupee against the US dollar. The rupee ended the week at Rs 279.41 against the US dollar, up 0.07% from the previous week.

The country’s foreign exchange reserves declined by $55 million to $8.22 billion, as Pakistan requested China for a $2 billion debt rollover to ease its external financing pressures.

The International Monetary Fund (IMF) also lowered its GDP growth projection for Pakistan to 2% for the current fiscal year, citing the challenges of inflation and fiscal consolidation.

The Karachi interbank offered rate (Kibor) increased to 22%, reflecting the tight liquidity conditions in the banking system.

Among the sectors, exchange traded funds and transport were the top performers, gaining 5.7% and 3.2% respectively, while automobile parts & accessories, chemical and oil marketing companies were the worst performers, losing 7.4%, 6.9% and 5% respectively.

The major net sellers in the market were foreigners, who offloaded $9.7 million worth of shares, while the major net buyers were insurance companies, who purchased $7.0 million worth of shares.

The top performing companies in the KSE-100 Index were Millat Tractors, Oil and Gas Development Company, Unity Foods, MCB Bank and Askari Bank, while the top losing companies were Younus Brothers, Pakistan Tobacco Company, Colgate-Palmolive, K-Electric and Punjab Oil Mills.

The brokerage firm forecasted that the next week is uncertain, as the market will be overshadowed by the upcoming elections, which are expected to reduce the participation and activity of the investors.

However, after the elections, the market may regain some momentum, especially if the government manages to implement the circular debt settlement plan and the industrial tariff rationalisation plan, which are pending the approval of the IMF.

AKD Research maintained a bullish outlook on the banks, exploration and production, and oil marketing companies, as they offer potential for earnings growth and attractive dividend yields.