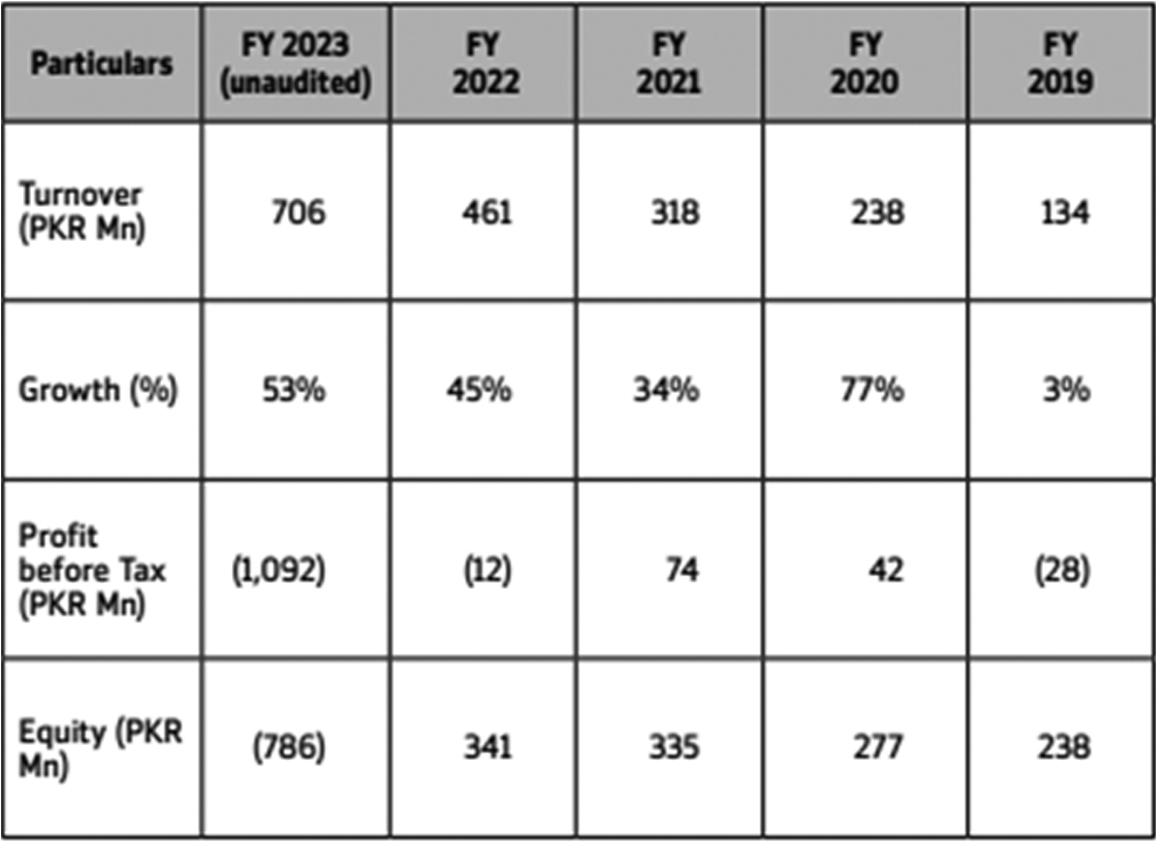

Something strange is happening over at Bank Alfalah’s brokerage house. Just put their financial results into context and it becomes clear.

In 2021, the brokerage house made a profit of Rs 7.4 crores. By all indications, this was a company that was healthy and making money. Then came 2022. This was the year when the economy started overheating, inflation was through the roof, political instability was at its peak, a deal with the IMF was falling through, and a new government had come to power in controversial circumstances. Naturally, the stock market dipped. As a result, Alfalah’s brokerage house posted a loss of Rs 1.2 crores. By the standards and circumstances, this was a crisis avoided.

And then comes 2023. In June last year, Pakistan successfully concluded talks with the IMF and the stock market surged off the back of the news that default had been averted. Trading floors heated up and daily trade volumes reached as high as 818 million trades. The markets had gained much-awaited momentum, and brokerage houses were set to clean house. Leading brokerage houses like AKD Securities, Arif Habib and Sherman Securities posted profits of Rs 90.3 crores, Rs 97.5 crores and Rs 57.3 crores respectively.

But somehow Bank Alfalah CLSA failed to cash in on the year that was 2023. Not only did they not post a profit, they ended up making a massive loss of more than Rs 1 billion. A loss so huge that its equity went from being Rs 34.1 crores to negative equity of Rs 78.5 crores. The brokerage house could not sustain the losses and needed additional liquidity to be injected in order to make its equity positive again. In the middle of all this, the company’s CEO Atif Khan also left quietly after a hush-hush resignation.

In the wake of the massive loss, Bank Alfalah, the parent company of the brokerage house, had to scramble to put out the fire. Bank Alfalah CLSA was well in the red and the bank had to pump in a further Rs 1.2 billion in the company. Before this, Bank Alfalah’s share in the brokerage house was 62.5% and now it has gone up to 90.6%. The injection of capital was a simple instrument to save the brokerage house. But how were the losses posted? Sources have told Profit some of the brokerage’s senior management made some bad calls and then tried to hide some of the bigger losses they made. The possibilities within this are two-fold. The first is that the senior management trusted the wrong clients. The other is that they knowingly shifted things around, and the company is now having to regroup.

To understand what could have happened at Bank Alfalah CLSA for it to bleed over a billion rupees in a year, it is necessary to understand how brokerage house’s work.

How it all works

There are a few ways a brokerage house can make money. The most basic source of revenue is commissions that a brokerage charges on trades and the different services they provide such as consults and underwriting.

This is why brokerage houses with large clientele like AKD Securities, Arif Habib and JS Global Capital can earn operating revenue of more than Rs 50 crores. But there are additional sources of income to this as well.

A brokerage house is able to buy and sell shares for themselves as well. This is called proprietary trading and allows the brokerage house to keep shares as a part of their own portfolio. This is not the primary function of a house but they can still buy shares with their own funds. Lastly there are “other incomes”, which are incomes derived from sources that are not directly related to the key function of a brokerage house. This includes dividend income on the shares that the house has and markup earned on bank deposits are incomes that the house will not consider as part of its main services and would categorise them as other incomes. When all these incomes are put together, the brokerage house is able to tally up its total income.

From these incomes, it subtracts, like any other service business, operational costs like salaries, rent, electricity, etc. These are the expenses that have to be paid and borne in order to operate the brokerage house.

The reason behind AKD Securities making a profit of Rs 90.3 crores was due to the fact that they made operating revenues of Rs 59.3 crores and a realised gain of Rs 41.1 crores. Similarly, Arif Habib earned operating revenues of Rs 69.7 crores and unrealised gain of Rs 76.3 crores which led to the house making a profit of Rs Rs 97.5 crores.

Signs of distress

The first indications of distress came from Bank Alfalah itself. On 27th February 2024, the bank announced it was going to hold its Annual General Meeting on the 20th of March 2024. Among the other agenda items, one item was a special resolution where the bank was looking to invest Rs 1.2 billion into Alfalah CLSA in exchange for its shares. This was pretty standard up until now.

It was the attachments that were given by the bank which were cause for alarm. The bank disclosed to the stock exchange that Alfalah CLSA, in its unaudited accounts, had seen a loss per share of 28.34 for 2023 and the value of its equity had turned negative Rs 19.64 per share.

In absolute terms, the loss amounted to around Rs 1.1 billion.

Before the year, the company had an equity of Rs 34.1 crores. After considering the loss, it went down to Rs 78.5 crores in the red. Negative equity means that the company is not viable for operations anymore. Its assets have fallen in value compared to its liabilities. Even if all the assets are liquidated today, the liabilities will not be met. In other terms, as creditors cannot be paid, either the company declares insolvency or sees an injection of new equity.

A loss of Rs 1.1 billion is already too large. But consider the fact that by September end, the company only had losses of Rs 1. crore. This means that an additional loss of Rs 1.09 billion was made in 3 months. The company lost Rs 1.09 billion in 90 days. That is Rs 1.2 crores a day or Rs 5 lakhs per hour. It is difficult to consider a loss of 5 lakhs being made in an hour.

In the Annual General Meeting held, Bank Alfalah shareholders voted to save the brokerage house and resolved to inject the extra investment into the company. The specific reasons behind the loss will become clearer once the annual accounts are done being audited. As such, little can be said with any concrete evidence.

As the annual accounts are still under audit, there is little that can be said with any concrete evidence. The company is expected to release its accounts in the first half of April according to regulations and it can be expected that they will come in the week after Eid. When the management at Alfalah CLSA was asked for the accounts, they stated that they will be published once they are finalised.

But sources close to the company have painted a picture of financial misdemeanour and irregularities on the part of the brokerage house’s top management including its erstwhile CEO.

They have alleged that senior management was carrying out wrongful practices in order to inflate the value of the stocks and then using that to maintain their books. Once the game of musical chairs stopped, they had no option but to accept the reality of the situation sooner rather than later.

The alleged reason for the losses

The goal of the stock market is to allow investors to buy their shares, pay money for the shares they have bought and get to own them. This is the normal course of business and allows for smooth functioning to take place. A common practice that is used in the Pakistani market is that a client will call up a brokerage house and ask them to buy a share for them. In normal circumstances, the client is supposed to put up the money for this purchase.

As he is a big client, the brokerage house buys the shares on behalf of the client without the client having to put up the money. Once the share price increases, the client sells those shares, squares his position and makes a profit. The brokerage house makes commission and everyone lives happily ever after.

But what if the shares actually lose value? When the shares lose value, the client is left with keeping the shares until they actually earn a profit. In older days, this would be easy to do. Not in today’s stock exchange where the stock exchange itself and the regulator have a keen eye on what is going on in the market. In order to regulate the brokers, both Pakistan Stock Exchange and Securities and Exchange Commission of Pakistan require the brokers to file accounts and returns at quarterly intervals. Any sort of mismanagement would be identified early and brokers can be asked to explain any discrepancies.

Unless they are a step ahead of the game.

In the case of a company like Alfalah CLSA, a lot of what matters is the personal connection a broker has with his clients. In this case, for example, a client of Alfalah CLSA could call up the brokerage house’s CEO and ask them to buy certain shares for them. If the CEO or any other person managing affairs was partial to it, they might order that the sale go ahead. As such, the brokerage house would buy the shares on their own account on behalf of the client.

The brokerage house on behalf of this big client would then buy, say, 1,000,000 shares of ABC for Rs. 10. The total value of the trade was going to be Rs 1 crore. Now near the end of the quarter, the share price falls to Rs. 8. Rather than showing a loss of Rs 2 crores in its accounts, the brokerage house could sell the shares to another house or any of its clients for Rs. 11. Once the quarter end date passed, the brokerage house would buy the shares back at Rs. 11 and things would go back to normal.

Essentially by selling their position in the market to someone else and they would evade having to disclose the loss that should have actually been realised.

In regular circumstances, the loss made would be recorded and a debit balance would be shown in the accounts in order to show that even though the shares have fallen in value, another asset receivable from the client is still there so the loss is not actually made by the brokerage house.

Buying on behalf of a non paying client is a big no-no and having a debit balance in a client’s ledger is carefully scrutinised by PSX and SECP. In order to avoid this, the management would most likely be selling and buying the shares back to avoid this situation from taking place. And while this kept them away from prying eyes for a while, it was a system that would eventually come crashing down.

As each quarter end would be nearing, this same tactic was allegedly being used to make sure losses and debit balances are not reported in the accounts. This merry go round can keep going for an infinite amount of time. Just like a ponzi scheme can be made to continue for a long period of time, this can be done to build a house of cards. But the problem with that is that it is nonetheless a house of cards. One day it will all come crashing down. Which it did.

Alfalah CLSA had no option but to set their affairs in order, bring a change in leadership, and realise these losses. It was a responsible response to irresponsible behaviour from their management. There are reports that even March 2024 end accounts will show a loss as the real magnitude of these losses have not been fully realised till now.

Profit reached out to Alfalah CLSA but the company did not respond. This correspondent also reached out to the former CEO of the company, Atif Khan, who also did not respond to Profit’s request for comment.

After the publication of this story, Bank Alfalah Limited issued a statement saying that it is committed to the long-term success and financial stability of its subsidiary, Alfalah CLSA Securities.

“We understand the challenges that the company has faced recently, and we want to assure all stakeholders that, as the parent organisation, we stand firmly with it,” it said.

Alfalah CLSA’s financial challenges are being addressed, and we are providing comprehensive financial support to ensure that it continues to operate effectively and fulfil all its obligations to all parties involved, read the statement.

“We believe in the firm’s strength and resilience and are resolute in our commitment to Alfalah CLSA Securities,” it further added.

very strange that they lost in spite of the market favours in the last 2 years.Something other must be there?

those numbers are complete crap, a thousand times that much would make sense

In 2008 Bank Alfalah performance on account of consumer financing was matter of concern. They do aggressive banking on credit cards and car financing. A lot of confiscated cars were parked at various plots owned/ taken on rent by Bank. There must be reason for such huge loss.

I am sure very soon, we would be hearing similar news for Al Flalah Islamic……

Atif khan is the worst-case choice of the Alfalah Management and Ali Malik and Atif Khan togather cheat the Bank, i know both of them from 25 yrs, Alfalah have to register a criminal case against both of them ….

I am very happy that this happened to Bank Alflah because they were very rude to me almost lost my money because of them not once in my three Accounts I left them in 2021 choose another Pakistani bank for my remittance from EU and UK .

This is all bcuz now clowns hv entered the palace. in Pakistan there no check n control tupe of thing. hotel management graduate can become a foreign minister, finance minister can bcome foreign minister. As if there is no talent in pakistan. PIA collapsed, steel mill collapsed. Ruling elite are more than corrupt. what else u expect.

اسلام و علیکم۔

بعد سلام عرض ھے۔ کہ جہاں بھی کسی کے حقوق کی خلاف ورزی کی جائے اور ضورت کے وقت اپنے کسٹمر کے حقوق ادا نہ کیا جائے تو اللہ تعالیٰ اس ادارے کی بنیاد سے ختم کرتا ہے استفی بے معنی ہے ۔

شکریہ

@cristy They can Sell mother’s Coffin to Earn Charity income so it can be laundered to Usa to buy Estate for sisters.They can steal and Sell State gifts.

Can Hire Gogi to collect Bribes from Officials.

@cristy @Ahsan-IQBAL i am american and we don’t want your corrupt politicians or their money here either 💀

How did Alfalah Securities move securities from its prop account to another account? Like its not like a physical transaction, CDC has records of all such transactions as almost all shares in the capital market are in demat form. Did they sell it to another party under a sale agreement or did they just place the shares in another account? And if the transfer was done on above market price how did they get away with it? Please make another post on all this to shed light on this aspect.

Once the best bank of Pakistan

Once top bank of Pakistan

everything is going down in Pakistan

good bank in pakistan

Best bank of Pakistan

HBL and Faysal is looking good banks in Pakistan

How did Alfalah Securities move securities from its prop account to another account? Like its not like a physical transaction, CDC has records of all such transactions as almost all shares in the capital market are in demat form. Did they sell it to another party under a sale agreement or did they just place the shares in another account? And if the transfer was done on above market price how did they get away with it? Please make another post on all this to shed light on this aspect.

HBL is best in every manner