In June 2023, Profit delved into U Microfinance Bank’s (Ubank) operational strategy, highlighting its remarkable financial performance. While numerous microfinance institutions floundered in the post-COVID environment, Ubank distinguished itself by not only tripling its balance sheet but also securing a profit of Rs 2.25 billion in 2022. In our story, we commended the bank for achieving a positive bottom line, which is a rare sight in the microfinance sector, especially for industry players that have adhered to conventional business model.

At the same time, the publication also lambasted the bank for achieving this feat by engaging in non-microfinance activities which essentially meant that the bank was operating similar to a leverage hedge fund, investing heavily in government securities. Little did we know that the bank would be at the centre of unexpected turbulence a few months down the line.

Read: Has UBank cracked the code to making a microfinance bank profitable?

By late 2023, dramatic shifts in leadership unfolded with the resignation of CEO Kabeer Naqvi and the delayed release of the bank’s mid-year financial statements. Subsequent revelations suggested these changes stemmed from allegations of artificial growth tactics, including questionable applications of IFRS-9 standards that painted an overly optimistic picture of Ubank’s financial health.

The turmoil reached a peak when rumours about the bank’s negative equity began circulating, sparking a rush among depositors to withdraw their funds. In response, PTCL Group, the parent company of Ubank, quickly intervened with a press release to quash these speculations. Ultimately, Ubank’s financial statements for the first nine months of 2023 were released, showing a downward adjustment in equity to Rs 5 billion, a significant drop from the previously reported figures. The adjustments were part of broader corrective measures mandated by the State Bank of Pakistan (SBP), including a capital injection by PTCL Group to address potential statutory shortfalls. As 2023 concluded, Ubank disclosed these adjustments in its annual financial statements, reflecting a more transparent and regulated approach to its fiscal management. As of March 2024, equity has further declined to Rs 3.5 billion.

Profit reviews the bank’s 2023 financial report to see what went down.

The growth strategy

Previously, we reported that UBank seemed to have discovered a method to inflate its balance sheets. In 2022, UBank’s balance sheet grew by threefold. How? The bank used its deposits to purchase money market mutual funds (MMFs) or government securities (T-bills). Then, it pledged those very government securities to the same banks or even a third-party bank, allowing UBank to borrow additional funds through repurchase agreements with a small margin.

With the borrowed money in hand, UBank repeated the process of purchasing more T-bills. This cycle continued, spinning a web of financial manoeuvring so much so that the size of assets increased from Rs 104 billion in 2021 to Rs 221 billion in 2022. At the same time, however, net assets declined from Rs 7.5 billion in 2021 to around Rs 7.09 billion in 2022, a decrease of Rs 0.4 billion (Rs 400 million or Rs 40 crore).

Moreover, UBank essentially sourced a major chunk of its deposits using a quid pro quo arrangement as most of the deposits were from banks and other financial institutions. These deposits were in a sort of give-and-take arrangement, where any funds received from a financial institution were funnelled right back into the same institution or its associated asset management company. Furthermore, these deposited funds were heavily concentrated, ranging from 25% to a staggering 77% of the fund’s assets.

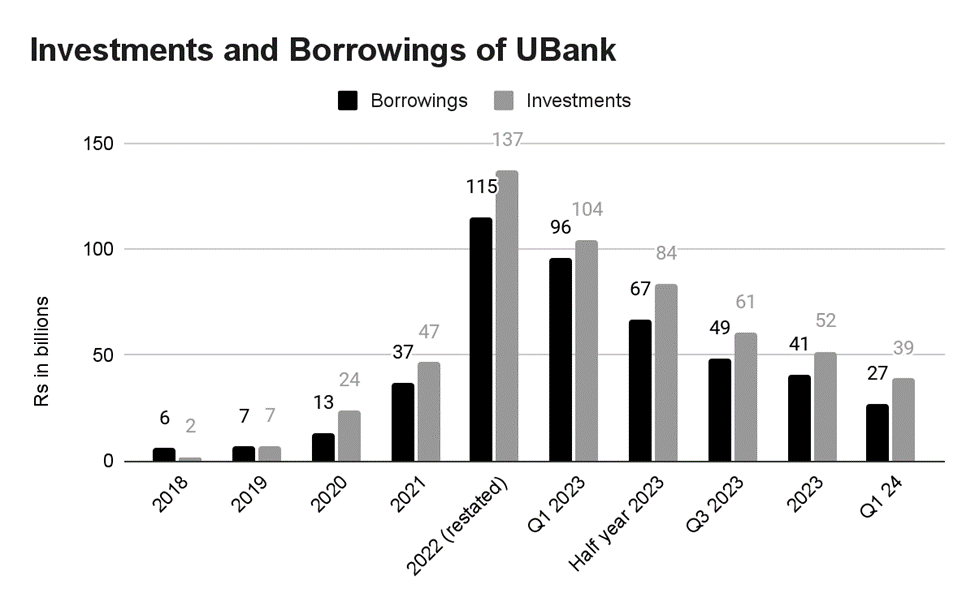

This growth in assets was majorly from a surge in investments from Rs 47 billion in 2021 to Rs 137 billion in 2022, which was financed through leverage (borrowings increased from Rs 37 billion in 2021 to Rs 115 billion in 2022).

Essentially, UBank was playing a high risk game. In other words, it became a highly leveraged bank, as it had accumulated a lot of government securities. In case of a change in interest rates, the bank could have incurred significant mark-to-market losses.

However, in 2023, UBank made a u-turn from this aggressive growth strategy as both borrowings and investments declined by 64% and 62% respectively.

Naqvi, who was the CEO of UBank then, clarified UBank’s investment approach, emphasising the utilisation of shorter-term instruments to capitalise on increasing interest rates. By borrowing at a fixed rate for a longer duration and investing in shorter-tenor instruments, the bank aimed to leverage interest rate fluctuations to their advantage.

UBank’s method, while aggressive and unique in the microfinance banking sector, aimed to mitigate advance book risks by borrowing heavily from banks and actively managing their necessary investments.

And even if the bank made some loss on treasury operations due to unforeseen economic circumstances, for example, the logic was that his board and shareholders should still be happy as he was successfully securing the bank against a liquidity crisis.

However, 2023 saw a significant change in UBank’s strategy. The bank seemingly reversed its highly leveraged approach, experiencing a substantial decline in both investments and borrowings. The growth engine (leveraged investment portfolio) was unwound at a fast pace. Investments have more than halved from Rs 137 billion in 2022 to around Rs 52 billion in 2023

Read: UBank’s strategy makes a sharp U-turn

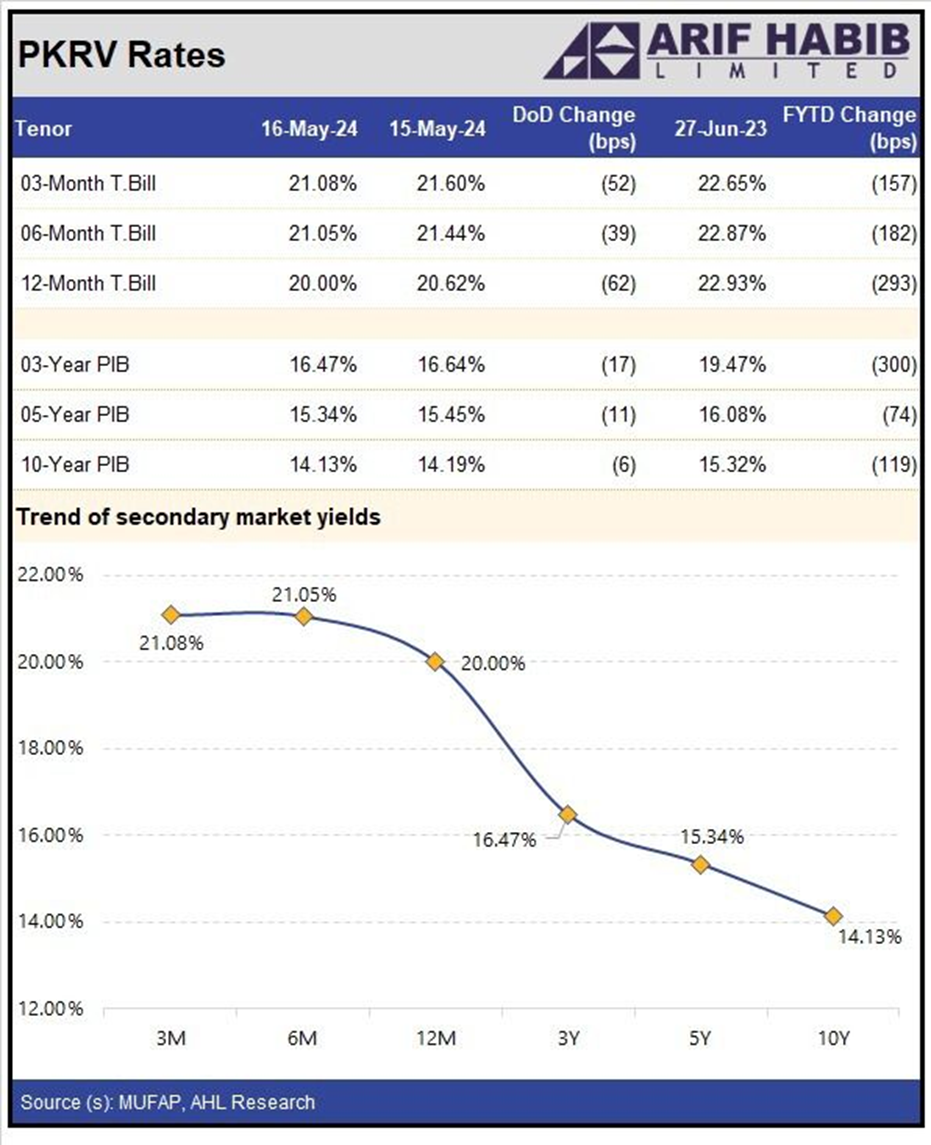

It is only logical for UBank to make this U-turn given that borrowings to invest in government securities is becoming a costly endeavour for the overall banking sector. Yield on investments have declined while cost to finance these assets, i.e. the rate on deposits and borrowings has remained constant.

The cost of borrowing and the interest paid on deposits held with banks are linked to the policy rate. On the other hand, returns on banking assets; investments and advances, are influenced by secondary market sentiments, as demonstrated by the Karachi Interbank Offered Rate (KIBOR) and the secondary market yields on T-bills and PIBs. Although government treasuries are also significantly impacted by the policy rate, they are also influenced by sentiments in the secondary market. Yields in the secondary market have been below the policy rate since November 2023 as market anticipation of rate cut increased as macroeconomic indicators improved.

While yields for shorter-tenor securities have inched up. However, the market has factored in rate cut for longer tenured instruments.

Hence, it was only logical that UBank reduced its portfolio of government securities along with borrowings to improve profitability and reduce risk.

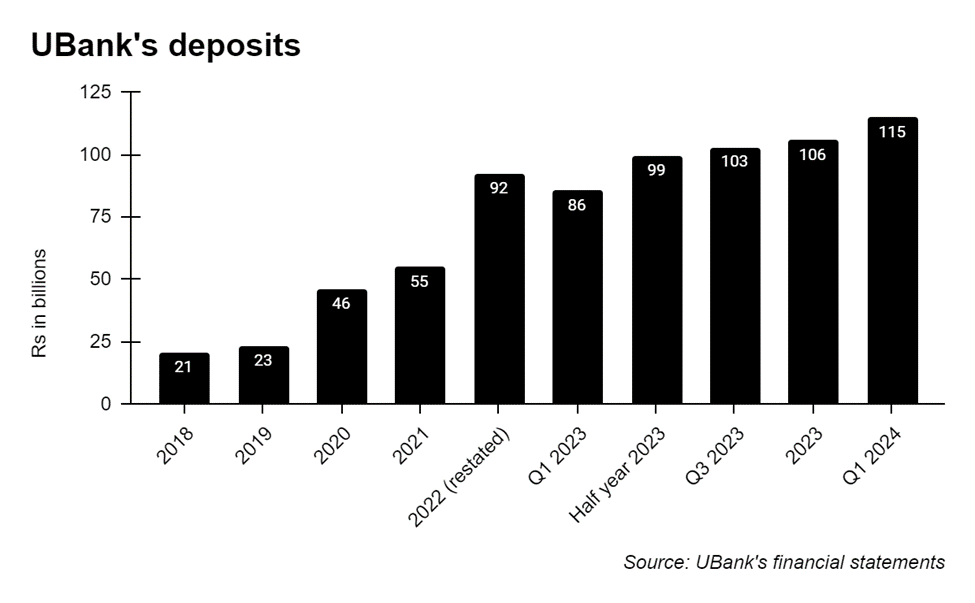

Deposits

For any bank, deposits serve as an important source of funding. Low-cost deposits from individuals are a holy grail especially in the current high interest environment. Microfinance banks are no different. To mobilise and attract low-cost deposits, Ubank had been growing its branch network to urban cities. The bank had added around 100 branches in 2022. This expansion spree continued in 2023, as UBank’s branch network increased by 90 branches.

This in contrast with other big telecom-based microfinance banks (Telenor Microfinance Bank and Mobilink Microfinance Bank) that had set their sights on branchless banking and were moving towards digital.

In a previous interview with Profit in June 2023, Naqvi said, “We did not try to turn it into a telecom company. We said that this is a bank, and its mission is microfinance. Just like a bank, its balance sheet will grow. It will have liquidity, strong cash reserves, a treasury function, Islamic banking, digital banking, and even conventional microfinance. It will also have an urban unit responsible for deposit mobilisation. If all these elements are in place, (only then) will this institution thrive and last for the next hundred years.” These new branches were essentially to bring in low-cost deposits.

However, despite the expansion efforts, most of the deposits were from other institutions, with the top five depositors contributing a whopping 38% of the total deposits, and the top 10 accounting for nearly half.

Such deposits are not sticky retail deposits but are hot money. These deposits were in a sort of give-and-take arrangement, where any funds received from a financial institution were funnelled right back into the same institution or its associated asset management company.

In our previous story, we predicted that deposits of UBank could decrease significantly owing to the bank’s equity concerns or the PTCL Group will restore confidence in UBank, and any deposits that left the bank would return.

Read: A sneak peek into the deposit growth of U Microfinance Bank

In 2023, UBank’s deposit continued to grow. Deposits grew by 15% from Rs 92 billion in 2022 to around Rs 106 billion in 2023.

What’s even more remarkable is that the increase in deposits is mainly from individual depositors which shows that expansion efforts are paying off. Besides, institutional deposits have decreased by 37%, almost the same as we predicted earlier.

Advances

In the revised financial statements of 2022, there is a notable decrease in net advances (loans) by Rs 4.3 billion, dropping from Rs 59.3 billion to Rs 55 billion. In 2023, net advances increased by around 50% to Rs 82 billion.

This was primarily due to the revised implementation of IFRS-9 under which certain loans were reassessed on the basis of their probability of default.

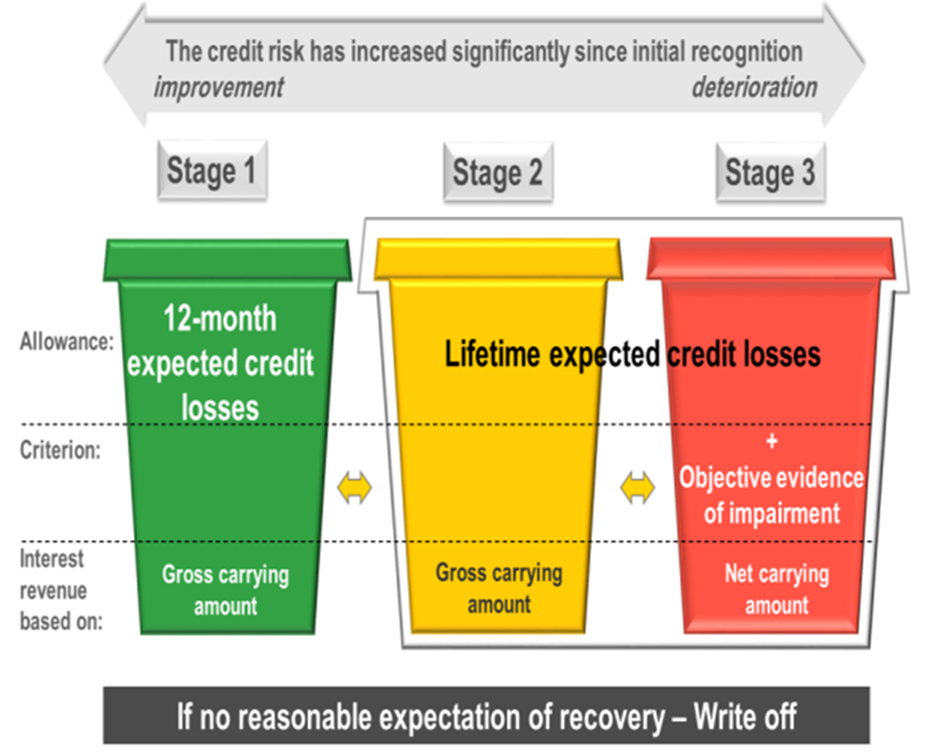

Before delving deeper, it is important to understand a few financial jargons. First is the application of International Financial Reporting Standards (IFRS). These, as the name suggests, are global standards that set the rules for drafting financial statements. The standards are adopted by many countries including Pakistan, to ensure the uniformity of financial reporting to allow for comparability of financial statements and investor reliance.

Now the specific standard under question is the IFRS-9. The standard essentially governs the treatment of financial instruments including assets and liabilities.

For the purpose of this story, we will be explaining a certain section of that standard which is the Expected Credit Loss (ECL) Model and its impact on the loan portfolio. The standard, under the ECL Model, requires that the outstanding loan portfolio should be assessed periodically, and an expectation must be developed of its recoverability. If a portion of it is deemed unrecoverable, an appropriate provision should be recorded or in simple terms a loss should be booked.The quantum of the loss depends on the stage of the assessed credit risk. So, initially the loans are placed under stage 1 which doesn’t imply a significant risk of default. However, if there is a significant increase in credit risk like amounts being rescheduled or categorised as NPL, the loans are moved to stage two and three, and additional amounts are provided for.

Now for Ubank, as detailed in the financial statement notes, it reduced its gross advances (loans) in stage 1 from Rs 54.9 billion to Rs 47 billion, marking a difference of approximately Rs 7.9 billion. Simultaneously, there’s been a Rs 7.3 billion increase in gross advances in stage 2. Additionally, gross advances in stage 3 have declined by around 40% from Rs 1.95 billion to Rs 1.18 billion.

Moreover, UBank has made adjustments to its credit loss allowance for stages 1 and 2: the allowance for stage 1 has surged significantly, tripling from around Rs 254 million to Rs 819 million, while for stage 2, it has nearly doubled from Rs 2.5 billion to Rs 5.3 billion. However, the credit loss allowance for stage 3 has decreased by 46%, moving from Rs 943 million to Rs 511 million.

Profitability

Finally, in our previous analysis based on the 2022 annual financial statements, UBank was one of the few profitable microfinance banks.

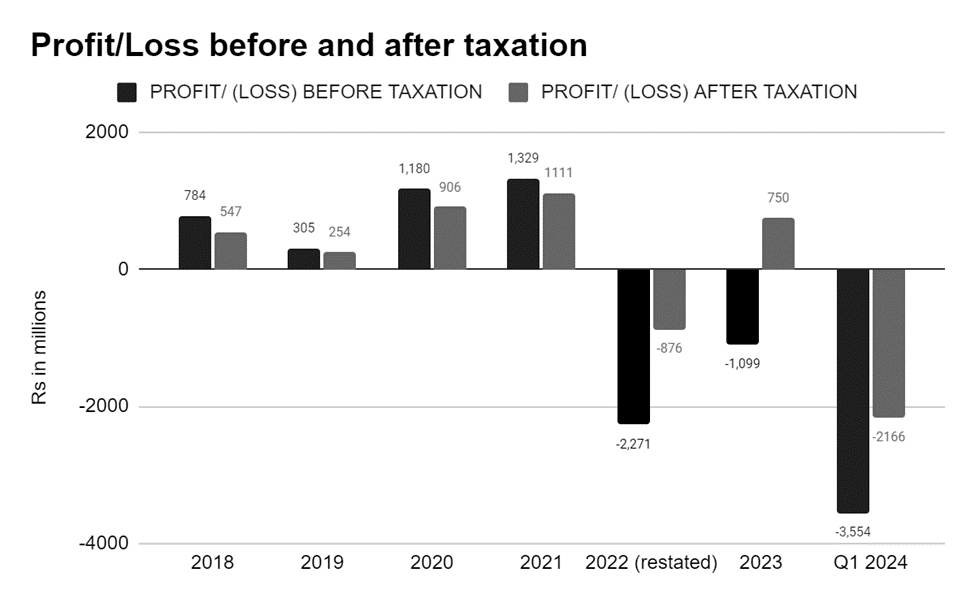

However, recent reports reveal that this was not the case. UBank reported a loss of Rs 2.3 billion before taxation in 2022. With tax reversals, the loss amounted to Rs 876 million. The bank’s losses continued in 2023 as UBank recorded a loss before taxation of Rs 1.1 billion, and a profit after tax of Rs 750 million following tax reversals. This number is a far cry from the figures released by the bank in the nine monthly financial statement where the bank recorded a profit of Rs 1.7 billion. The bank’s accumulated losses amount to around Rs 1.9 billion which shows that UBank, which was touted as one of the profitable microfinance banks, is in the same league as other undercapitalised microfinance banks.

Resultantly, the Bank’s capital adequacy ratio fell below the regulatory threshold of 15% to 13.86% at the end of 2023. Interestingly, as per the subsequent financial statement released for Q1 2024, the ratio fell further to 9.4%. This isn’t the first time this has transpired in the microfinance industry and there are remedies in place.

And Ubank is exactly moving towards that.

The Board of Directors of PTCL convened on April 18, 2024, and agreed to support the bank’s capital structure through the following measures:

- a) Conversion of PTCL preference shares into ordinary share capital of Rs. 1,000 million.

- b) Conversion of PTCL subordinated debt of Rs. 1,200 million into ordinary share capital.

- c) Additional cash equity injection of Rs. 1,200 million.

These capital enhancements would have increased the bank’s total capital adequacy ratio to 15.4% as of March 31, 2024, and to 16.6% as of December 31, 2023.

Amid the significant buzz Ubank has generated in recent years about its performance and its ambition to evolve into a commercial bank-like microfinance institution, it appears to have encountered significant challenges similar to those faced by its peers in the post-COVID landscape.

The future trajectory of Ubank remains uncertain. However, there’s potential for a strategic pivot, particularly towards digital banking, mirroring the path taken by other telco-backed microfinance banks.

A potential area for strategic consolidation following PTCL’s acquisition of Telenor could involve considering the acquisition of Telenor Microfinance Bank and its digital assets like Easypaisa. Given that the bank was previously available for sale a few years ago, exploring this opportunity might be a plausible next step for Ubank to consider.