The microfinance industry has been at the centre of some intense debate lately and have been labelled as “zombie banks.” They are different from commercial banks in terms of minimum liquidity adequacy requirements, collateral and the size of loans they can make. Their customer base is also very different from conventional banks and most, if not all, run a branchless operation. This and more, has made microfinance banking a very tough business in Pakistan. Barring a few, all microfinance banks are loss-making entities. However, it seems a new approach to microfinance banking may have worked, at least for the time being. An overly aggressive approach.

This is where U Microfinance Bank (UBank) comes in. Not only has UBank managed to achieve profitability, but it has also seen its balance sheet grow threefold in the year 2022. In the midst of the industry’s turmoil, UBank managed to navigate the challenges, and have thrived. But is it fair to call it a microfinance bank?

The microfinance banking industry’s rough ride:

The microfinance industry has been hitting some rough patches lately, and let’s just say that the picture looks….bad. Most of the microfinance banks are grappling with capital adequacy issue.

All commercial banks and microfinance banks, governed by the State Bank of Pakistan (SBP), are required to maintain a certain ratio between capital invested and risk exposure of different asset classes. This is called the Capital Adequacy Ratio (CAR). CAR for the Microfinance banks is 15% whereas for the commercial banks, it is 12.5%. The reason for having a higher CAR for microfinance banks is because microcredit has high risk. In other words, the customers of microfinance banks have a higher probability of defaulting on loans because they belong to a more disadvantaged socioeconomic group.

The State Bank of Pakistan has specified minimum capital levels (free of losses) for all banks and microfinance banks to keep their engines running depending on their scale of operations. A national-level microfinance bank is supposed to have a minimum capital of Rs 100 crore, provincial level microfinance bank is supposed to have a minimum capital of Rs 50 crore, regional-level microfinance bank is supposed to have at least Rs 40 crore as its capital, and finally, a district level microfinance bank is required to have at least Rs 30 crores as its capital.

Coming back to the microfinance banks, Apna microfinance bank reported negative capital of Rs 404.7 crores at the end of 2022. Despite capital injection of Rs 35 crore by sponsors, it still made a substantial loss of Rs 450 crore in 2022. To bring new capital, in early 2023, they announced consideration of a merger with FINCA Microfinance Bank (FINCA) which is also in the same boat, struggling with capital adequacy issues.

FINCA reported a net loss of Rs 150 crore in 2021, following which the auditors flagged out uncertainty over going concerns. FINCA does not have enough assets to pay off its liabilities. The latest period for which FINCA’s financial statements are available is for the first quarter of 2022 in which it reported a sparse profit of Rs 26 crores. The bank hasn’t released the subsequent period’s financial statements, which indicates the bank’s continued bleak capital adequacy issue. However, recently both microfinance banks have decided to not merge.

It doesn’t stop there. NRSP Microfinance Bank Ltd, the subsidiary of the National Rural Support Programme, reported a jaw-dropping loss of Rs. 400 crore in 2022. Advans Microfinance Bank? They’re not doing any better either, reporting losses of more than Rs 10 crore in the same year. Even the big players like Telenor Microfinance Bank and Khushhali Microfinance Bank took a hit, reporting a net loss of Rs 670 crore and around Rs 300 crore in 2022 respectively.

Now if we look at the microfinance banks that reported profits, these are handful namely U-Microfinance Bank, Sindh Microfinance Bank, LOLC Microfinance Bank (formerly known as Pak Oman Microfinance Bank), Mobilink Microfinance Bank and, lastly, HBL Microfinance Bank. UBank took the lead with the highest profit clocking in at a staggering Rs 220 crore followed by HBL Microfinance bank and Mobilink Microfinance Bank which reported a profit of Rs 120 crore and Rs 96 crores respectively. LOLC Microfinance Bank reported profit of Rs 11.5 crores while Sindh Microfinance Bank reported a meagre profit of Rs 4.1 crores.

When we add up all the losses, the industry as a whole reported a gut-wrenching loss of more than Rs 1800 crores in 2022. The profits reported during the same period only added up to Rs 450 crore. That’s a net loss of Rs 1350 crores! It is safe to say that the microfinance industry is in a pickle.

Who are the big boys of the microfinance industry?

Let’s take a closer look at the power players in the microfinance industry. Out of the 11-12 organisations in the mix, there are five that dominate the scene.

Of these five, three are subsidiaries of telecom giants. We’re talking about Telenor Microfinance Bank, Mobilink Microfinance Bank, and U-Microfinance Bank. Telenor Microfinance Bank is jointly owned by Telenor Group and ANT Group. Mobilink Microfinance Bank is a subsidiary of VEON, a global digital operator that provides mobile connectivity and services and sister company of Jazz. Finally, U-Microfinance Bank is a wholly owned subsidiary of Pakistan Telecommunication Company Limited (PTCL) – Etisalat Company.

Other two include Khushhali Microfinance Bank and HBL Microfinance Bank which are subsidiaries of commercial banks, with United Bank Limited (UBL) holding a 30% stake in Khushhali and Habib Bank Limited (HBL) holding over 70% in HBL Microfinance Bank.

How is UBank different from other Telecom-based Microfinance banks?

Conventional approach

If we look at the strategies and approaches of two telecom-based key players in the microfinance industry namely Mobilink MFB, and Telenor MFB, both of these organisations have set their sights on branchless banking. By the end of 2022, Telenor MFB and Mobilink MFB had 61 and 109 branches respectively. Mobilink MFB has its digital platform called Jazzcash, while Telenor MFB has Easypaisa. These platforms have allowed them to bring banking services directly to the fingertips of their customers, making transactions and financial management more convenient and accessible than ever before.

According to the annual report of 2022, Easypaisa had 14 million monthly active users. The mobile wallet recorded around 1.4 billion transactions whereas Jazzcash reported 16.4 million monthly active users and recorded 2.1 billion transactions in the same period.

Telenor MFB decided to steer towards branchless banking when it unearthed massive employee fraud back in 2019. This incident prompted them to reassess their approach and move away from bullet lending in the agriculture sector. Instead, they decided to pivot towards a digital-first strategy, integrating their microfinance banking and branchless banking businesses into one cohesive unit. Mudassir Aqil, speaking to Profit, explained, “We made the entire bank on a digital-first strategy.”

In contrast, UBank opted for a distinct approach, adopting a conventional, brick-and-mortar strategy. Kabir Naqvi, CEO of U Bank, told Profit, “We did not try to turn it into a telecom company. We said that this is a bank, and its mission is microfinance. Just like a bank, its balance sheet will grow. It will have liquidity, strong cash reserves, a treasury function, Islamic banking, digital banking, and even conventional microfinance. It will also have an urban unit responsible for deposit mobilisation. If all these elements are in place, (only then) will this institution thrive and last for the next hundred years”.

“Credit also goes to our shareholders, who understood our perspective and had faith in us. Simultaneously, we will continue pursuing our agenda in branchless banking,” he added.

Naqvi further elaborated that they have been cautious about engaging in loss-making activities. They have prioritized profitability and sustainability. “If making an interbank fund transfer (IBFT) transaction is generating a monthly loss of Rs 400 million, I did not let that happen at UBank,” he explained.

Secured Loan book

In the microfinance industry, the practice of bullet lending to the agriculture sector has proven to be a double-edged sword. Telenor MFB, recognizing the pitfalls of this approach, made the strategic decision to exit this type of lending after experiencing significant write-offs. The move was prompted by the realisation that such loans were not yielding the desired results for the bank. Similarly, most of the microfinance banks that report losses and have been writing off massive non-performing loans reference these loans.

Interestingly, UBank has also engaged in bullet lending, but with remarkably different outcomes. UBank has managed to navigate the treacherous terrain of bad loans and write-offs. How? Unlike other microfinance banks, UBank has chosen to secure around 60% of its loan portfolio with gold.

Note: The cap on collateralizing loan portfolio against gold is 35% as per regulator. We were unable to get a response from U bank in time explaining how it has managed to take this up to 60%, as indicated by them in our initial reporting.

This means that UBank issues most of its loans against gold collateral which serves as security against risk of defaulting on loans.

While this decision provided a safeguard against potential defaults and minimised the risk associated with unsecured lending, it restricted the size of UBank’s loan book compared to other microfinance banks like Khushhali MFB and HBL MFB, who chose not to secure their loans. “Theirs may be around Rs 8000 crore while mine is Rs 6000 crore. (Though) in relative terms, UBank’s loan book is bigger as they (Khushhali bank and HBL microfinance bank) have been around for 23 years, whereas UBank has been in operation for 7 years”, said Naqvi.

Naqvi also shared the criticism that he and UBank received when they started gold-backed loans. Critics initially raised concerns that UBank’s gold-backed loans deviated from the spirit of microfinance. However, Naqvi strongly defends this approach, highlighting the win-win situation it offers. “If someone has a dead asset lying in their home which can be monetised and can also help leverage our capital adequacy. And (in return) they are receiving locker services and getting a better interest rate, isn’t it a win-win situation? Why should we not do it?”, retorted Naqvi

Naqvi further emphasizes that gold-backed loans have an added advantage. “Gold carries sentimental value, which reduces the likelihood of defaults whether the price of gold goes up or down,” he added. However, better sense has prevailed as other microfinance banks have also recognized the benefits of gold-backed loans and have started issuing gold-backed loans.

Handling gold

It is an odd proposition, the handing over of your gold to your banker to raise finance, but it is the only way MFBs can collateralise their lending. SBP has issued detailed guidelines on how MFBs are supposed to handle and store the physical gold. This ranges from the valuation and authentication process to the storage, return or auctioning of the gold.

One industry expert, who wished to remain anonymous, put the concerns surrounding gold-based lending in two categories. The theoretical and the practical. Theoretically, microfinance banks are supposed to provide de-collateralized credit and therefore taking gold as collateral to lend goes against the spirit of microfinance banking.

From a more practical perspective, there is the argument that it disempowers women.

“The type of gold in question here is biscuits or raw gold, it is mostly processed, jewellery and all. And this is mostly owned by women who inherit it or receive it at their wedding for example. The lending that is being done is mostly, if not only, to men and in many circumstances the women might not want their only asset ‘the gold’ to be put at risk for a project they most likely will have nothing to do with or benefit from”, he added.

Apart from these valid concerns, there is the problem of security i.e. physically securing and handling the gold. Not only does it add to the administrative expenses but there is the added risk of pilferage and theft. Some instances of missing gold from the possession of banks have been reported.

“This is why UBank charges close to 43% for gold-backed lending. Because their cost is so high, close to 22%”, commented a senior MFB executive on condition of anonymity.

Naqvi however disagrees and believes this is the only way to do business and is investing heavily in this side of his business: lending against gold.

“We have spent a lot of time and money on security and administrative measures to make sure that the gold entrusted to us is safe”, Naqvi explains.

U Microfinance Bank or U Commercial Bank?

Microfinance banks can now lend up to Rs 30 lakhs which is a significant increase from the previous limit of Rs 5 lakh. Moreover, 35% of the loan book can also be consumer finance like low-cost housing loans which are loans of up to 20 years. Microfinance banks have also expanded into the MSE (micro small entrepreneur) segment that offer commercial vehicle loans which include tractor financing and are extended for up to 5 years. Essentially, UBank is mirroring the services provided by commercial banks to their SME customers as Naqvi proudly declares, “I think calling us a Microfinance bank is a misnomer. These are retail challenger banks if you ask me.”

“The microfinance industry is going through a metamorphosis and it is one of the reasons why UBank is experiencing growth,” claimed Naqvi.

UBank undertook a strategic overview of its balance sheet and business model two years ago. “We used business model canvas to break down our business into different verticals. The first canvas is of microfinance core. We named it ‘Rural Retail’. The lending in this vertical accounts for most of the Rs 5900 crores of advances you see in our financial statements.The next vertical we recently created, an in-progress initiative, is ‘Urban Retail’. Under this vertical, we are opening new branches in Karachi, Lahore, and Islamabad urban cities and hiring commercial bankers to run these banks. This vertical is to mobilise deposits and increase the deposit base”, Naqvi told Profit. Other business units include Islamic Banking, Digital Banking, Corporate Banking, and Corporate Finance & Investment Banking.

Will UBank be able to mobilise low-cost deposits?

As mentioned earlier, instead of going digital, UBank has prioritised brick-and-mortar format and have been expanding their branch network. Number of branches in 2021 was 207, which increased to 303 by the end of 2022. UBank plans on adding another 100 branches to reach 400 branches by the end of 2023. That’s an increase of approximately 100 branches per year. Assuming that there are 260 working days, UBank has opened a new branch every 2.6 days!

So why is UBank opening so many branches? Usually it is to enhance proximity to its customers. The closer the microfinance banks are to their borrowers, the easier it will be for the borrowers to approach it for borrowing more money and timely servicing their loans.

Here is the catch: UBank has been opening new branches in urban cities like Karachi, Lahore and Islamabad. So why is UBank adamant on adding these many branches in cities who are not the primary customers? “These branches will mobilise our deposits”, responded Naqvi.

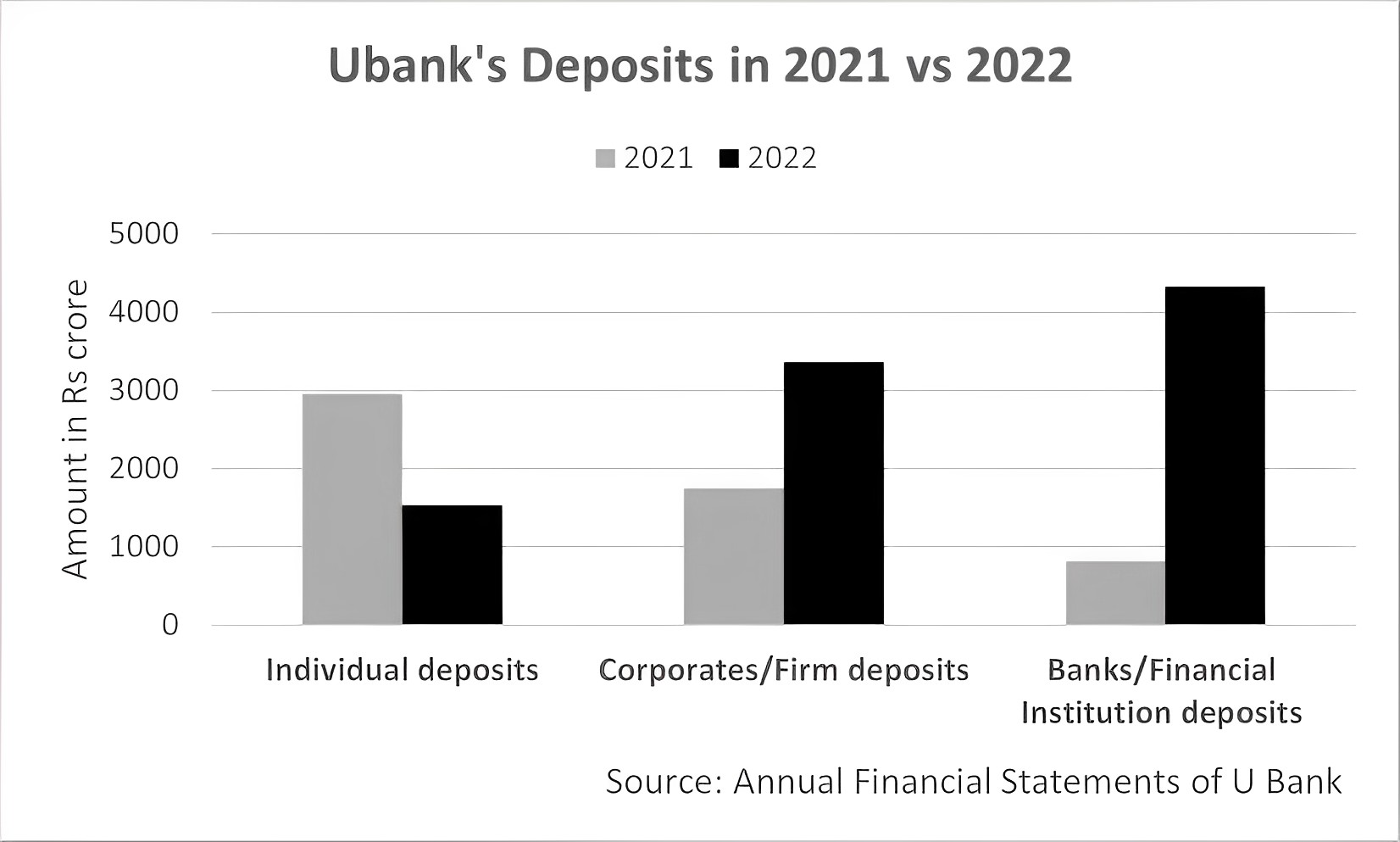

Did the deposits increase? Overall, deposits increased by 1.7 times in 2022 as compared to 2021, clocking in at Rs 9,200 crores. However, the increase is not coming from individual depositors but rather from banks and financial institutions.

Collectively, Banks and Financial Institutions have placed Rs 4,300 crores with UBank in 135 accounts. It is all the more impressive considering that the balances kept by banks and financial institutions with UBank were just Rs 800 crores in 2021. That is a five-fold increase in deposits in one year. In other words, banks and financial institutions have placed an average of Rs 35 crore per account. On the other hand, the amount deposited by individual deposits have actually gone down from around Rs 2950 crore in 2021 to around Rs 1530 crore.

There is one more catch to these big-ticket deposits by banks and financial institutions: these are high-cost deposits. As one senior investment banker told Profit, big-ticket deposits earn higher interest rates. If these deposits are in microfinance banks, then the interest rate can go up to 21% i.e. interest rate set by the State Bank of Pakistan. Microfinance banks can offer a higher rate because their lending portfolio is also priced very high as interest rates on loans range between 31% to 40%. Besides, unlike retail deposits which can be sticky, these institutional deposits are like hot money which can suddenly flow out when circumstances change as we have seen recently in Silicon Valley Bank (SVB).

This is not the case with other telecom based microfinance banks who have been able to attract low-cost deposits (low to no interest deposits). Mobilink MFB’s deposit pool of Rs 65 billion is predominantly fueled by individual depositors, who contribute a whopping Rs 50 billion, making up a staggering 78% of the total deposits. Similarly, Telenor MFB had about Rs 47 billion of deposits in fiscal year of 2022 of which Rs 42 billion were fueled by individual depositors. That’s almost 90% of the deposits.

So on one hand Naqvi criticises the approach of other microfinance banks that they are indulged in loss-making activities and on the other hand it itself is plagued with high-cost deposits.

It is a no brainer that UBank would want to attract low-cost deposits and it is also fair to say that increase in branches has not yielded much result as not only has UBank failed to attract individual deposits but the deposits have actually decreased. Naqvi attributes this phenomenon to the relative novelty of the bank’s branches, which were established in the last two quarters of 2022. However, he is confident that the results of these branches will become apparent soon. “Our branches are fairly new right now. These were opened in the last two quarters of 2022. You will see the result in the next year or two.”

However, deposit mobilisation in major cities such as Karachi, Lahore, and Islamabad is going to be no easy feat. These cities already have a multitude of well-established commercial banks with stronger presence and reputation. Considering the tarnished image of microfinance banks in general, will UBank entice customers by offering higher profit/interest rates? Moreover, will individuals be inclined to open deposit accounts with UBank when alternative options exist?

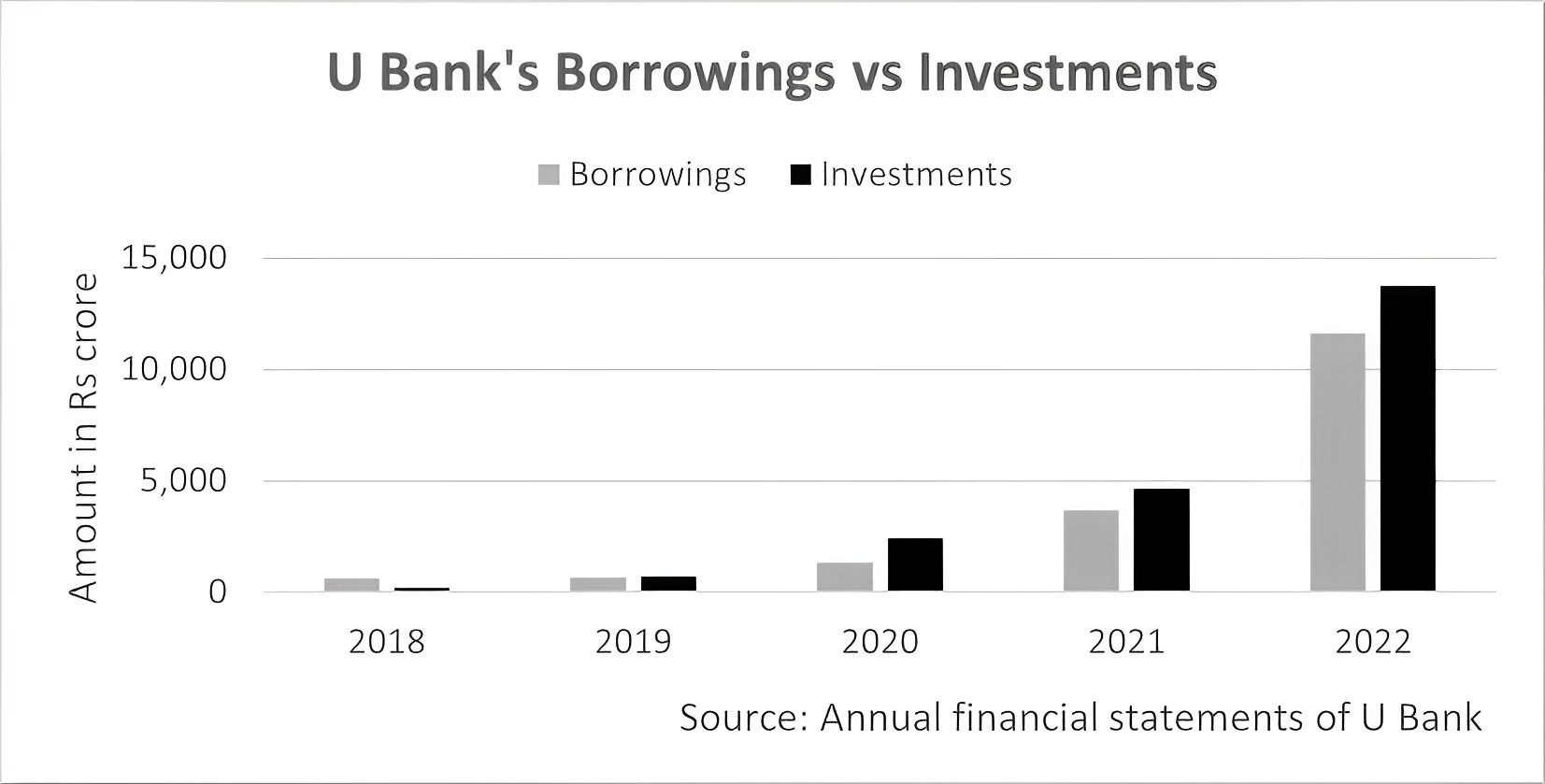

Tripling borrowings and investments

Remember UBank’s deposits increased to clock at Rs 9,200 crores (a whopping increase of Rs 3700 crore)? One would assume that advances (loans) would have increased by almost the same amount because that’s what banks are supposed to do. However, UBank’s lending grew by only Rs 2500 crore. So where did the incremental deposits go?

If we look at the other significant movements on the asset side of the balance sheet to see what the increased deposits are financing, we see a major increase in investments. The deposits were more than the advances by Rs 1200 crore. So the difference should have been used to make investments. But the increase in investments is Rs. 9100 crore between 2022 and 2021. And this investment is not being financed by equity as net assets have actually decreased. Rather, the increase in investment is being financed by increased borrowings. Both investments and borrowings increased three-fold over the last year. The investments increased by Rs 9700 crores to Rs 13,700 crores which was financed by an increase in borrowings of Rs 7900 crores which amounted to Rs 11,600 crores.

So what has happened here? UBank used its deposits to purchase money market mutual funds (MMFs) or government securities (T-bills/PIBs). Then, it pledged those very PIBs to the same banks or even a third-party bank, allowing UBank to borrow additional funds through repos with a small margin. With the borrowed money in hand, UBank repeated the process of purchasing more Tbills/PIBs. This cycle continued, spinning a web of financial manoeuvring so much so that while the size of assets increased from Rs 10,458 crore in 2021 to Rs 22,130 crore in 2022, net assets have declined from Rs 749 crore in 2021 to around Rs 709 crore in 2022, a decrease of Rs 40 crore.

Naqvi explains this increase with its newly added treasury and corporate finance vertical. Through this vertical, UBank aims to be the first microfinance bank with an active treasury just like commercial banks. “It will provide UBank with arbitrage opportunities,” Naqvi said. The bank has formed beneficial alliances with multiple banks. The borrowing activities of UBank encompass syndicated loans, bilateral loans, and bonds, he calls it a “beautiful bouquet”. Initial borrowing was secured against the loan book, while subsequent borrowing was supported by pledged investments, fostering stronger relationships with banks.

“On the investment side, government securities consist mostly of floating PIBs which account for Rs 5600 crore of the total investments. These securities are repriced every two weeks. We have taken short exposure of 2 weeks to 1 month because we can endure this much exposure only”, Naqvi further added.

Ironically, while UBank criticises other microfinance banks for straying from the microfinance realm and becoming telecom companies, it appears to be following a similar path. It is engaging in practices that commercial banks have been criticised for, such as investing in government securities to earn risk-free interest income instead of actively lending to the private sector. In essence, UBank has enhanced its profitability not by increasing lending, which is expected of a microfinance bank, but by capitalizing on income generated from government securities. “Income from lending is taxed at 32% while income from investment securities is taxed at 15% which has improved our net income”, Naqvi highlights this advantageous tax treatment as a contributing factor to their improved financial performance and higher profit.

Method in the madness

UBank is essentially managing risk. We will have to look at three main heads to understand what exactly they are doing: deposits, borrowing and investments.

Of their total deposits amounting to Rs 92.2 billion, only Rs 15.2 billion is attributed to individual depositors, the remaining Rs 77 billion is from institutional depositors i.e. banks and corporates. These deposits are not sticky meaning any bank; say ABL or a corporate like Engro can take this money elsewhere at any time.

According to its 2022 financials, UBank’s deposits increased by Rs 37 billion year-on-year, which is more than the increase in advances for the same period, Rs 25 billion. UBank therefore more than covered the increase in advances, which would conventionally mean it had no need to borrow. But it cannot rely on non-sticky institutional depositors money to remain parked with the bank, it therefore had to borrow to cover the risk of any liquidity problems.

UBank’s total borrowing from banks amounted to Rs 116.1 billion in 2022, which more than covers its advances book. This is fully-secured borrowing – why else would commercial banks lend so easily to a microfinance bank? What this means is that UBank has to buy government-backed securities with the borrowing it is doing from banks and pledge those securities to the bank. And this brings us to the investment side of the equation.

UBank’s investments stood at Rs 137 billion for the year ended 2022, reflective of the terms of borrowing from commercial banks. But wait. Isn’t this a bad deal? Commercial banks won’t lend at a loss, so they will charge interest, at KIBOR plus-X. T-bills and PIBs don’t pay more than that as they are closer to the discount rate. So what is UBank doing? Booking a loss? Not quite

“We borrow at 6M KIBOR+1 and most of my investments are of a lesser tenor than that, one to three months. So I lock my interest rate for 6 months and in an economy where the interest rate is increasing, I actually turn a profit because the earning on my shorter term investments (T-bills and PIBs) will be higher” Naqvi explained.

To simplify, if one borrows at 6-month KIBOR + 1, that rate is locked for all interest payments to be made for the next six months. If the discount rate increases within these six months, it will not impact those interest payments. On the investment side however, the same party has invested in a shorter tenor instrument, a 1-month T-bill perhaps. It will therefore be able to take advantage of the interest rate hike as it will immediately be reflected in the market price of the T-bill.

It is widely expected that interest rates will start to fall in the coming months as inflation recedes. In an economic environment where interest rates are falling, UBank will do what any other commercial bank treasury will do, start borrowing shorter term and invest in longer tenors.

What UBank under Naqvi is doing is building and managing a money market book. “All banks have treasuries. There is no restriction on microfinance banks to run a treasury. So that is what we have done”, he added.

There is nothing wrong with what is being done at UBank. It’s just an aggressive approach to microfinance banking that no one else is taking. To mitigate his advances book risk, Naqvi has borrowed heavily from banks and by actively managing the necessary investments his bank has to make to borrow, he is also earning on the interest.

And even if he does make some loss on his treasury operations due to unforeseen economic circumstances for example, his board and shareholders should still be happy as he has successfully secured the bank against a liquidity crisis.

“I am building relationships with banks. And overtime, they will start lending to me against my advances rather than government-backed securities. One or two banks are already comfortable enough with us to start doing this”, Naqvi added.

While on the surface UBank has managed to steer itself away from losses, it has also been steering away from the realm of microfinance banks. In other words, the primary business of a microfinance bank was extending advances (microlending) to people who otherwise did not have access to financial services because commercial banks did not want to cater to this audience. But instead of increasing proximity with its target audience, UBank has been steering in the direction of a commercial bank and doing exactly what commercial banks are criticised for.

But there is no restriction to what it is doing. It is all within the confines of the allowances its microfinancing banking licence makes. It is just unconventional, but if it is working, which it apparently is as per its P/L, then it is perhaps something its competitors should be looking at. However, there are some significant risks being that only time will mitigate and whether or not UBank makes it to that stage in its journey as an ‘industry defining’ bank, relatively unscathed, remains to be seen.