- Step 1: [This step is only applicable to Development Finance Institutions (DFIs) and other non-banking financial institutions (NBFIs) that can accept deposits,so move directly to step 2 if you are a normal business]

Get commercial banks and money market funds (mutual fund companies that invest most of their money in government bonds, but also keep some of it in cash) to either deposit their cash holdings or place money (Letter of Placement, Certificates of Deposits) with you.

- Step 2: Use the funds received in Step 1 (in case of NBFI/DFI) or any excess funds that are already available with the company (in case of a non-financial corporate) to purchase units of money market funds or short-term government securities i.e. T Bills. You could also buy long term government securities i.e., PIBs s. Just make sure that PIBs are floaters, i.e if interest rates increase, your return should also increase.

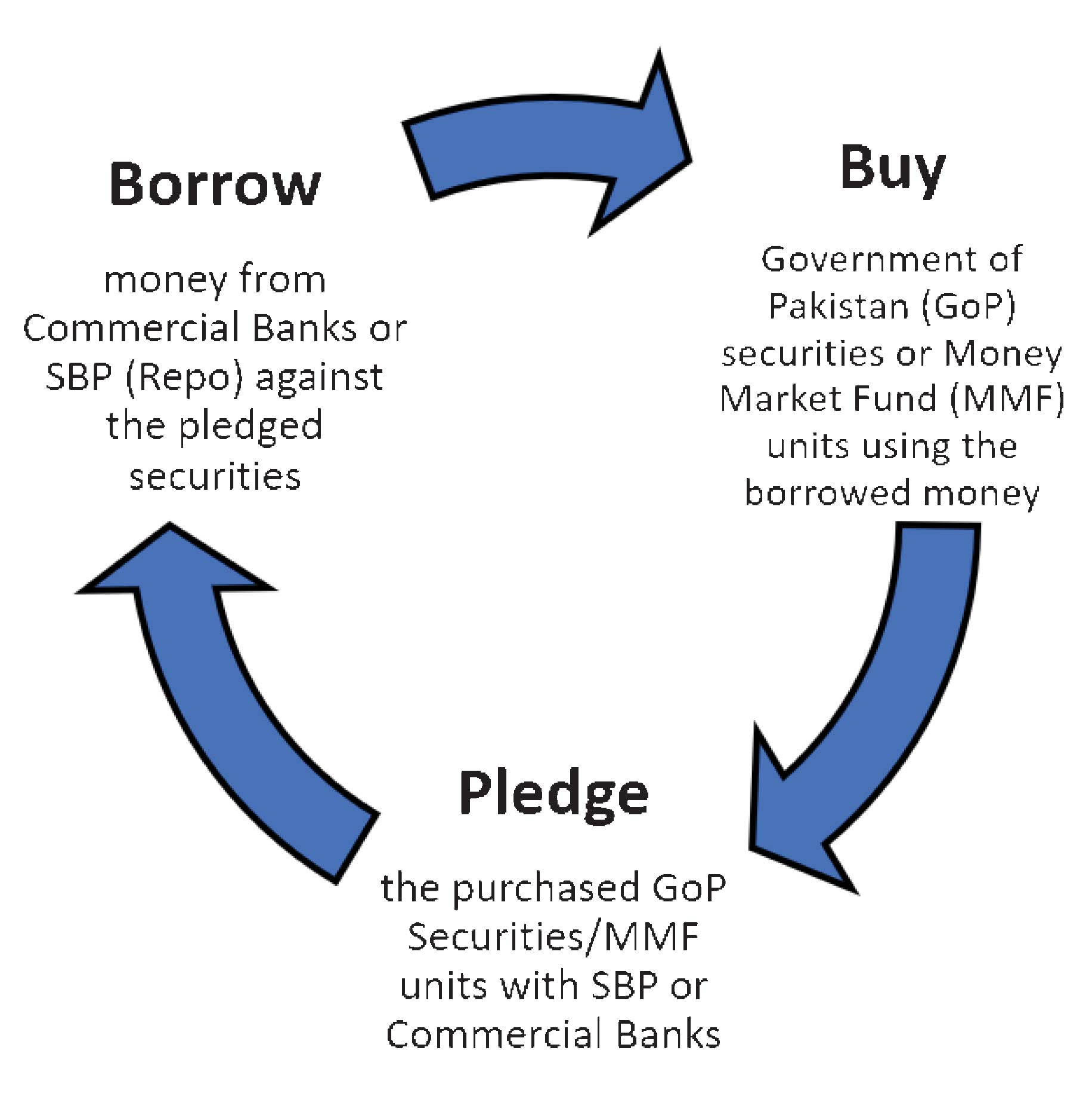

- Step 3: Now pledge your units of money market fund or the government securities with commercial banks to borrow money against these. Banks will happily lend you at very low rates as this lending is secured by the two of the most liquid collaterals in the country i.e.

- Highly marketable and credit risk free Tbills and PIBs issued by Government of Pakistan and

- Money Market Funds that mainly invest in aforementioned TBills and PIBs.

But if you have a DFI license, go to Step 3b as it offers even cheaper loans.

Step 3b: Use the Government of Pakistan securities to borrow from the SBP directly through a repo (recently made available to DFIs only). The rates offered by SBP for these loans are almost always lower than the rates charged by commercial banks. .

Plan such that the tenor of your borrowings (whether through commercial banks or SBP) is longer than the duration of your investments.

- Step 4: Now use this newly borrowed money to buy more government securities (or units of money market funds).

Step 5: Go back to Step 3

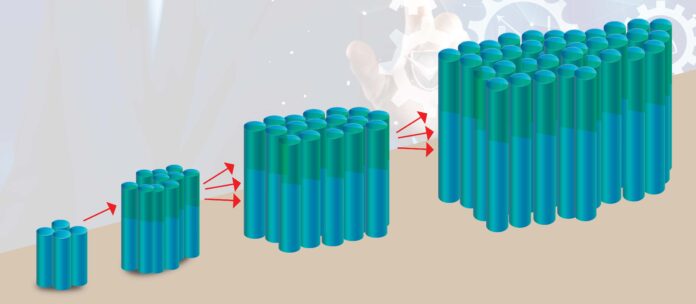

Step 1 and Step 2 are there just to kickstart the process. The exponential growth comes from continuously cycling through steps 3 to 5 i.e. buy-pledge-borrow. U Microfinance Bank (Ubank) has been able to double the size of its balance sheet in a year, and it has been successfully doing this for the last few years, while Pak Kuwait Investment Company (Pak-Kuwait), Pakistan’s largest DFI has been able to increase it by 6 fold in around 9 months by just cycling through steps 3 to 5.

On each position, you make a very very small profit. However, if you can build a very large position like UBank or Pak-Kuwait by repeatedly cycling through steps 3 to 5, the size of your profit may become meaningful.

FAQs

Question 1: In light of developments in the US banking sector wherein banks have been collapsing on account of mismatch between assets and liabilities, isn’t this a risky position?

Answer: The US banks took positions in long-dated fixed-rate mortgage securities which can become illiquid or accrue valuation losses in a rising interest rate environment. The strategy we followed in Pakistan involves investing in securities which aren’t affected much in a rising interest rate environment. As interest rates rise (as had been the case for sometime now) you would get higher interest income on your investments because your long term investments carry a floating rate and you can roll over your maturing short term securities into the higher yielding newly issued short term T bills. Thus, unlike the US banks, there is hardly any valuation loss on your asset side and your interest income has actually increased. While on the liability and expense side, your borrowing costs are fixed. Thus, in a rising interest rate environment, this strategy produces a positive return, albeit a very small one.

Question 2: This is a huge increase in balance sheet size. This strategy would have resulted in earth shattering income.

Answer: Unfortunately, that does not appear to be the case. It is hard to tease out the net impact of this strategy for UBank from its financial statement. We can, however, calculate the return to Pak-Kuwait of this strategy. Pak-Kuwait’s total investment in government securities increased from Rs.64 billion to Rs.679 billion from Dec 31, 2021 to Dec 31, 2022. During the same period, Pak-Kuwait was able to increase its net markup income by mere Rs.272 million which translates into a return on average assets of 0.07%. But hey, it is risk-free easy money.

Editor’s note: Both UBank and Pak-Kuwait recently released their first quarter financials for 2023. Based on extensive interviews, a deep dive into both UBank’s and Pak-Kuwait’s strategy and performance to follow in the following issues of Profit.

Question 3: Is there a limit to this strategy?

Answer: To date we have not seen a ceiling. Pak-Kuwait successfully grew its assets 6 fold purely based on the aforementioned strategy in 9 months (total assets grew from Rs 137 billion at the end of March 2022 to Rs 798 billion on Dec 31, 2022). UBank doubled its asset size from Rs 104 billion on Dec 31, 2021 to Rs 221 billion on Dec 31, 2022 and its leverage (total assets/net assets) from 15x to 30X in the same period.

Question 4: Is this strategy followed by DFIs and NBFIs in other parts of the world?

Answer: Such strategies are usually part of relative value “long short” strategies adopted by hedge funds wherein they fund their extremely large position in treasuries through repos, while at the same time selling corresponding future contracts and profiting from small differences between yield on cash treasuries and the corresponding futures. Since the cash yield and futures yield move together, the hedge funds can pocket the small yield difference regardless of which way the market moves. Such strategies are affectionately referred to as “picking up pennies in front of a steamroller” as hedge funds have a tendency to blow up when such strategies don’t work as advertised.

In the case of UBank and Pak-Kuwait, there is no corresponding futures contract or short position to hedge their long position. Both are earning pennies based on the yield difference between their borrowing/repo yield and government securities yield.

Question 5: UBank maintains deposits of retail accounts. Pak-Kuwait is using SBP repos which are usually short tenor (around 7 days or less). Isn’t the SBP as a regulator worried about UBank and Pak-Kuwait behaving like hedge funds?

Answer: SBP’s mandate is the financial stability of the system. I cannot claim to understand what SBP is thinking other than what has already been explained in Question 1 above, however, I can assume that despite the fact that leverage of UBank has increased from 15x to 30x based purely on the above strategy, SBP does not deem it to be a systemic risk to the financial system. Pak-Kuwait does not have retail deposit accounts and all its borrowing is against “risk free” government securities which are pledged with SBP. Also Pak-Kuwait, for now, is using longer-term repos to borrow from SBP, that range from 63-70 days.

Question 6: Don’t the auditors or the board of directors or board risk committees find this approach risky?

Answer: The auditors have not highlighted any risk from the aforementioned strategy in the annual accounts. If the board or the risk committee had any concerns, they have been allayed by the management. Otherwise how could UBank have increased its leverage to 30x in a year and Pak-Kuwait increased its asset size by 6 fold in 9 months. The board of directors and risk committees would be fully on board with this strategy.

Question 7: DFIs are allowed to participate in open market operations under SBP DMMD circular 11 of 2022 which allows DFIs to participate in OMOs for liquidity management. Pak-Kuwait is using OMOs to take highly leveraged and speculative positions in Government securities. This isn’t the objective of the circular. Is SBP not aware of it?

Answer: SBP should be fully aware of it. Over the years, repo balances on the SBP balance sheet have been increasing and have become a permanent source of indirect financing, via commercial banks, to the Government of Pakistan. Since the late 2021 and throughout 2022, SBP conducted 63, 70 and 77 day OMOs, not necessarily to inject liquidity in the system, though that is the official line, but to provide cheaper source of money to commercial banks to nudge them to participate in the auction of government securities which otherwise the banks are reluctant to do so fearing rising interest rates. All this to say that SBP should be fully cognizant that participation by Pak-Kuwait in OMO isn’t for liquidity reasons but to be a leverage buyer of government securities, similar to the commercial banks.

Question 8: Why do banks lend against pledged Money Market Fund (MMF) units?

Answer: The banks own the Asset Management Companies (AMC’s) that manage the MMFs. By lending against the MMF units, banks help their AMCs increase their Asset Under Management (AUM). This enables AMCs to earn higher income as AMCs charge management fees based on AUMs. From a risk perspective, the MMFs invest in government securities so banks are essentially lending against government securities thus taking minimal risk.

Question 9: For this to make sense for NBFIs and DFIs, banks should be lending at a slightly lower rate than the yield on government securities. Why are banks leaving money on the table and not investing directly in government securities?

Answer: In September 2021, the government decided to impose an incremental tax on banks whose advances-to-deposit ratio (ADR) would fall below particular benchmarks apparently to encourage the banks to lend to the private sector. However, the banks it seems found a way out of this conundrum i.e., window dress their investments by lending to NBFIs etc., which then purchase government securities with this money and pledge those securities to the same banks. The banks may be leaving a few bps (one bps is 1/100 of 1%) on the table but saving a few percentage points on the tax. It is funny how egregious some of the banks have been in this i.e., first lending/depositing money to/with the borrower to invest in MMFs, and then lending more money to the borrower against the very MMFs to buy government securities, and so on. In the bank and SBP reporting, this appears as advances/lending whereas effectively it is indirect investment in government securities.

Editor’s Note: Two big banks, namely UBL and ABL, were specifically asked to explain their intentions behind lending to NBFI’s instead of investing directly in government securities. No response was received till the filing of this report. You can read a more detailed story on this aspect of the article below:

Question 10: If a new corporate/NBFI/DFI wants to take part in this strategy, which are the main institutions to approach?

Answer: For a DFI, doing repo with SBP is the easiest and most straightforward strategy using government securities as collateral. As of Dec 31, 2022, Pak-Kuwait had 97% of its government securities pledged as collateral.

For others (NBFIs/Corporates), we have seen banks accept Faysal Asset Management and ABL Asset Management MMFs as eligible collateral.

On the bilateral lending side and repos, UBL, ABL, MCB, Askari Bank and Bank of Punjab appear to be big players. There may be others, but we haven’t been able to establish them. This is not to imply that all of the above mentioned banks were involved in window dressing.

Thanks for the detailed plan! This will help our finance team structure funds placement in these difficult times

Very nice blog post. I certainly appreciate this site.

The writer, specifically highlighted Pak Kuwait only. While he fails to mention that all other DFIs do the same as their equity is limited, they resort to borrow from different avenues. Writer need to analyse Balance sheet of Pak Oman and Pak Brunei as well.

Thanks for the detailed information. I appreciate this content.

Floaters are also subject to duration losses, they are not fully protected in case of rising rates.