If nothing else, the past few years have seen a definite recognition of the importance that financial inclusion holds for the future of banking in Pakistan. It is a pretty simple equation. Women make up for nearly half of the population and their access to financial institutions is vital to ensuring sustainable development.

The numbers reflect this too. Just look at Mobilink Bank, which recently announced 38% growth in its women’s loan portfolio during 2023. This would indicate an encouraging upward trend in financial inclusion and access to finance for Pakistani women.

It was, as the Bank’s COO and Interim CEO Haaris Mahmood expressed, proof of the growth potential of Pakistan’s microfinance sector and the financial inclusion of all the citizens. But what exactly does it indicate to us?

The importance of financial inclusion

Financial inclusion has been a stated mission for the state of Pakistan for some years. In the National Financial Inclusion Strategy (NFIS) 2015, the goal was to achieve universal financial inclusion by 2020 by bringing 50% of the adult population into the fold of financial inclusion. However, it missed the target by miles. According to the World Bank’s Global Findex, only 21% of adults in Pakistan were financially included by 2021, compared to a global average of 69%, with a persistently wide gender gap.

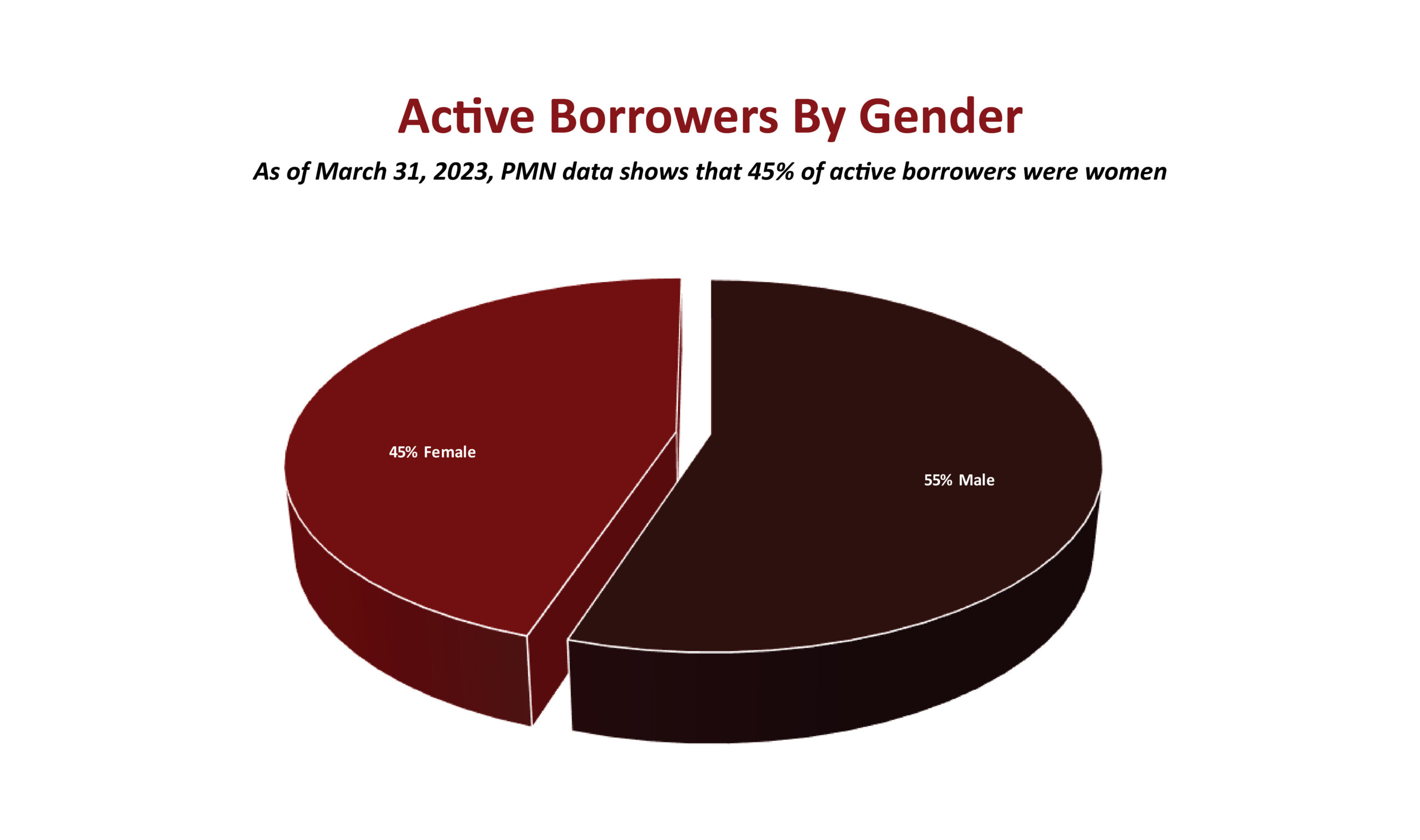

As per the Asian Development Bank (ADB), Pakistan’s gender finance gap currently stands at 34 percent, which indicates the distance the country still has to cover. Reassuringly, Pakistan’s microfinance sector has been working to deliver on the government’s vision, mainly by employing digital and financial solutions like mobile money and digital wallets that are accessible to anyone with a smartphone and internet connection. Microfinance institutions have found immense acceptance amongst small-scale borrowers and enterprises looking to expand and enhance their incomes.

Mobilink Bank’s role

What is more important than anything else is consistent effort from financial institutes in ensuring financial inclusion. Just take a look at Mobilink Bank. According to the bank’s yearly financial results, its total loan portfolio stands at nearly PKR 59 billion, a majority of which goes to the country’s agriculture sector. A significant lot of women borrowers also belong to the agro-sector and essentially to the rural economy. In 2023, the Bank disbursed 22 percent of loans to the agriculture sector, of which 16 percent of borrowers were women or women-led agro-businesses.

“Mobilink Bank’s steadfast commitment lies in empowering the backbone of Pakistan’s economy: women, farmers, and SMEs,” explains Haaris Chaudhary. “We are overjoyed by the resounding success of our initiatives, witnessing a 38 percent surge in our women’s loan portfolio in 2023 alone. Notably, the proportion of female borrowers has escalated to 25 percent, a figure we’re determined to elevate to a minimum of 50 percent within the next three years.”

“The robust growth in our women’s loan portfolio is the fruition of years of hard work to empower women entrepreneurs,” Haaris M. Chaudhary explains, “Our women empowerment program, ‘Women Inspirational Network (WIN)’ has been instrumental in fostering their economic participation and banking nationwide. The program imparts valuable digital and financial skills and knowledge to thousands of women entrepreneurs and borrowers nationwide to help them invest their loans prudently and drive their businesses toward sustainability and resilience,” he stated, further adding that the loans disbursed to women are remarkably high-performing and have impressive return track record.

The Bank witnessed 41% growth in SME portfolio in 2023. Despite its immense growth potential, Pakistan’s SME sector is mired by the country’s macroeconomic situation, which fails to present any encouraging prospects for new investment and entrepreneurship. However, experts believe the sector can enhance its growth significantly by adopting digitalization and operating sustainably.

“Sustainability is key to business resilience. Otherwise, new enterprises will crumble in the face of challenges,” says Haaris. “Businesses can foster sustainability and agility through digitalization, saving costs and enhancing operational efficiency and profits. For instance, agro enterprises can expand their customers, reduce time to market, and eliminate middlemen by going digital.”

Mobilink Bank also facilitates conversion to clean energy to promote financial and environmental sustainability of small and medium enterprises. A significant portion of the bank’s loan portfolio is dedicated to funding solar-powered energy solutions for SMEs. The Bank’s current solar financing portfolio stands at more than 1.7 billion rupees and is poised to grow exponentially over the years. Affordable solar energy solutions can be a game changer for Pakistan. The country has been grappling with chronic power shortages, gravely affecting both enterprise and domestic users, not to mention the adverse effects of fossil fuels that erode the country’s safeguards against climate change.

Hence, there is pressing need for effective and timely facilitation from the government and relevant authorities to speed up the country’s conversion to clean and green energy solutions, as sustainable energy will enhance the resilience of small-scale businesses, especially across disaster-prone regions, to protect the livelihoods of low-income and vulnerable segments. Experts also highlight the need to enhance digital infrastructure to connect remote regions that lack a physical banking footprint. Individuals and small-scale businesses across remote rural regions rely on mobile money and digital wallets alone to fulfill their financial needs.

The significance of these fintech solutions can be gauged from the fact that Mobilink Bank’s mobile money platform, JazzCash alone, operates with a nationwide network of nearly 250,000 agents and serves more than 44 million account holders, of which nearly 30 percent are women. Women also hold 15 percent of the share in its overall deposit base, which stands at PKR 64.6 billion in total. In the first quarter of 2024, JazzCash facilitated more than 560 million transactions valued at more than PKR 2.4 Trillion at a daily rate of 6 million, with an average transaction valued at PKR 4,288.

“With enhanced democratization of digital technology, affordable smartphones, and internet, we can swiftly close the existing gaps in financial inclusion,” Haaris states, “Digital wallets can bring the entire bank to your mobile phone. It doesn’t matter if you are based in Khunjerab or Karachi as long as you have a smartphone and an active internet connection. It benefits individual users and small and medium enterprises looking to make necessary transactions like sending or receiving payments, paying utility bills, or recharging their mobile phones,” he said.

Digital financial services are particularly useful for Pakistani women, a majority of whom have limited mobility for cultural considerations, and giving them access to smartphones and the internet will open up a plethora of growth opportunities.

“Women in Pakistan are an underserved yet highly influential segment with immense growth potential. They await their moment, which probably awaits a digital conduit to be delivered,” Haaris concludes. “It is up to the government, stakeholders, and digital and financial players to help marry the talent with the opportunity to transform the future of this country.”