The budget was announced on the 12th of June 2024 and it would be an understatement to say that the Pakistan Stock Exchange was happy. The benchmark index saw an increase of 3,410 points from its previous day close and was able to cross the psychological thresholds of 73,000 to 76,000 points in a single day. At its highest moment, the market saw a high of 3,540 points where the index was touching the nose bleeding levels of 76,208 points. This sentiment has further been strengthened as the next session saw an increase of 1,100 points taking it past the 77,000 level.

Suffice it to say that the market has welcomed and approved the budget. The question then starts to be raised whether this is the highest the market has ever achieved and what was the reason behind the market reacting this way. Let’s break down both these questions and give a perspective on both of them separately.

Just how high is this times’ high?

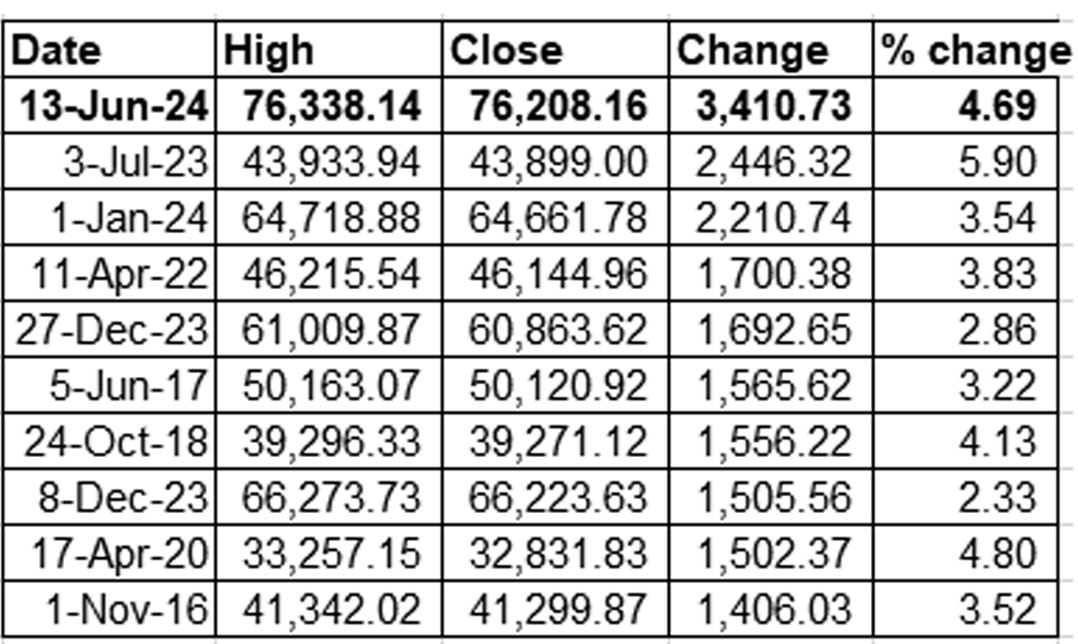

In regards to absolute terms, it can be seen that an increase of 3,410 is the most seen by the market. The previous highest point increase the market saw was around 2,446 points which were seen on 3rd of July 2023. There have actually only been three trading days where the index saw an increase of more than 2,000 points with 1st of January 2024 being the third such day. After this, the points increased between 1,700 points and 1,400 points which were seen at varied dates.

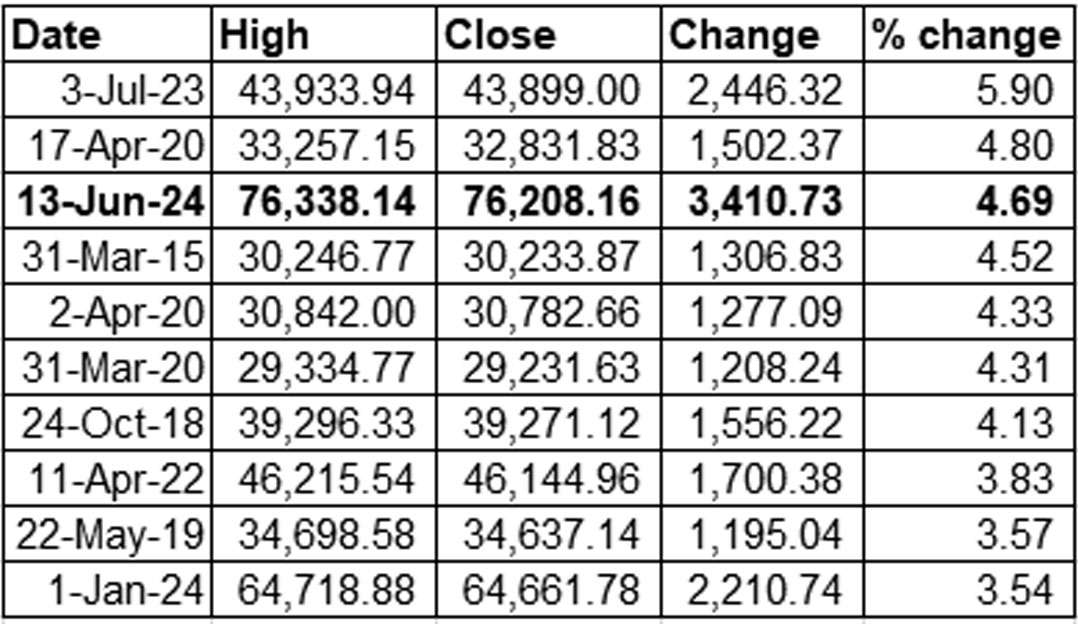

In terms of percentages, it can be seen that 13th was only the 3rd highest price increase which was seen. In terms of percentage, the 13th of June saw a percentage increase of 4.69%. There have been two days which saw a higher increase taking place on 3rd of July 2023 and 17 April 2020 which saw the index increasing by 5.9% and 4.8% respectively.

The fact still remains that this is no small achievement that has taken place. So now that we have explained the what, let’s consider the why and how of the increase taking place.

What’s in the budget?

In terms of the short term reaction, the budget can be seen as being business friendly. In the last few budgets presented, the corporate sector saw imposition of super tax, stringent taxing measures and steps taken to expand the tax bill on the corporations. The recent budget has shifted some of that focus. The finance ministry feels that most of the corporate sector is paying its fair share of taxation and so the new budget proposes tax measures which revolve more around personal income tax and sales tax.

One of the biggest victims of the new budget is the non-filer who is going to see his non-salaried income taxed up to 45%, capital gains tax from real estate and securities will be taxed up to 45% and they will be barred from traveling. Additional restrictions will see their mobile connection and utility connections being cut as well.

Some of the burden has also been shifted to the salaried class which will see their tax deduction rise with people earning up to Rs 200,000 seeing their tax expense rise by around 40%. Similar deduction will be seen for salaried class up to Rs 500,000 monthly salary which will see its tax expense rise by 25% as well. This adds on to the burden that this class already bears as the last paisa is squeezed out of them.

In addition to that, the general sales tax is going through a huge revision. Until the last budget, there were many industries which were exempt from sales tax or had reduced sales tax charges. Many of these exemptions have been taken away in this budget which would mean that industries will see a rise in their collection of sales tax. Why isn’t the corporate sector much concerned? Well it’s because of the fact that they can easily transfer this burden to the consumers and collect this sales tax from them. They increase the price of their product and make sure that they do not have to pay any tax from their pocket.

So it is clear that this budget will hurt the companies less than the consumers who have to pay additional taxes in the form of income tax and sales tax. The stock exchange is reflecting much of the same sentiment. The stock exchange is a collection of views and future outlook of people in relation to their expectation relating to the future performance of the company. The reaction by the market investors shows that they feel the budget is friendly for the corporate sector in general. The major weight is actually carried by the investors who are investing in the market who are seeing their purchasing power and ability to invest shrink as a result of the budget.

That is not to say that certain sectors are not being impacted. One of the industries which is seeing higher taxes being levied on them is the cigarette manufacturers. Federal Excise Duty (FED) is being levied on acetate tow, nicotine pouches, e-liquids and filter rods which will see a rise in their cost and tax burden. FED is also being charged on cement bags which will raise the cost burden on the cement manufacturers. FED is also being charged when sugar is supplied to manufacturers which will raise the raw material cost for food industry related companies. One of the biggest changes being made is to take away the special status of exporting companies as they will be brought under the same corporate regime of 29% corporate tax and additional super tax in terms of revenues generated by them. Even when the index is improving, companies like Interloop are seeing their share price plummet as they are hit by this provision.

To say that the budget is the only contributing factor for the increase would be a stretch. The market is impacted by thousands of factors on a daily basis and naming one factor would be unfair to all the remaining factors. There are other factors that are also playing their role in this increase and they need to be seen as well.

Still, it can be seen that the general perspective of the investors is that the state of the corporate sector is healthy and the market will see further improvement in the coming months. What’s the reason behind this optimism?

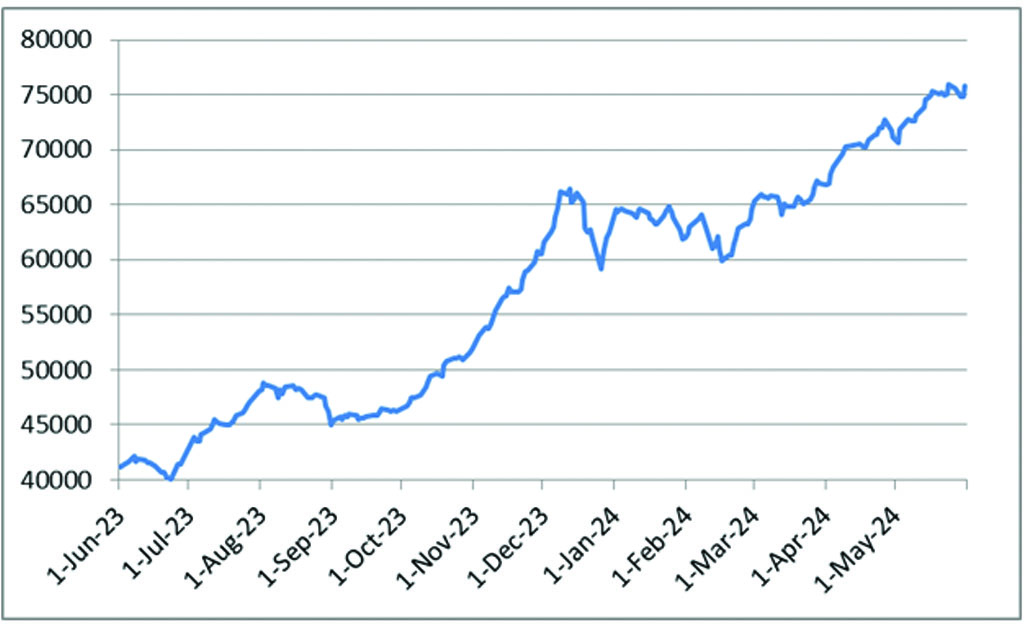

The last year in the market

In order to see into the future, there is a need to gain some insights by looking into the past. The previous budget was given by Ishaq Dar on 9th of June 2023. At that point in time, the KSE-100 index was trading at 41,904. The interest rates were hovering at 21% and they would be increased to historic high levels of 22% in less than a month. The government was negotiating with the IMF as the second installment of the Standby Agreement (SBA) was being worked on.

Considering the corporate landscape of the country, companies were making record profits. The last time the index had hit an all time high was back in May of 2017 when the index touched 52,876. The company earnings around this time were lower and the market was trading in an overweight territory. The picture had completely changed in June of 2023 when it was felt that the corporate sector was making historic profits. Companies were beating the market expectations around their earnings on a constant basis.

The market was ripe for a rally which was not coming due to the political uncertainty prevailing in the country. The market started to rise from 40,065 on 23rd June and the interest rate increase was announced on 26th of June. Even though it dampened the mood for the day, it seemed like the idea of a market rally had come and could not be denied. From June 2023 to May of 2024, the index had gained 35,726 points which meant a return of almost 90% in a span of 11 months. The rally that was seen after the budget has some of its roots leading back to the momentum that was seen in the market already.

The budget uncertainty and Kamran Khan factor

It seemed like the party for the index was over at the start of June. Rumors were already spreading around that the budget was going to be tax heavy and that all segments of the economy were going to be impacted. With an already spooked market, the tweets by two journalists made this into a full blown panic. First, Kamran Khan tweeted on 5th of June that there were rumors that the government had decided to substantially increase taxation on stock dividends and capital gains tax. He sourced his information to the State Minister for Finance and Revenue, Ali Pervez Malik. He also stated that there was massive selling going on based on this rumor by a Lahore based stock broker.

More rumours started filtering in about how the capital gains and dividend were going to be equalized to standard personal income and that people earning more than Rs 500,000 per month could see a marginal tax rate of 45%.

The panic reached fever pitch weh Kamran again tweeted on the 7th of June that rumors of enhanced taxes on capital gains tax and dividends would end the stock market. He backed it up by showing that the market had already lost 4,000 points in a span of a week caused by these rumors. This was tweeted at 10:28AM. The Friday session saw the index tumble by 2,080 after the tweet was made. In today’s era, this tweet was shared multiple times on Watsapp groups which became a self fulfilling prophecy. The market had started to become afraid of its own shadow by now.

The panic finally subsided when only 3 and a half hours later Khan tweeted that he had talked to the Finance Minister who had poo pooed the whole idea and quashed this rumor. The market gained back 2,000 points it had lost as the chaos finally ended.

Coming back to the point.

After the second tweet was made, the market was still truly spooked so much so that even an interest rate cut of 150 basis points was not able to bring it out of its hole. The market was expecting a rate cut of only 100 basis points, however, the State Bank of Pakistan beat these expectations. Still, the market had all of its focus on the budget.

From 3rd June to 12th June, the market had lost more than 3,000 points. After the market closed and the budget was announced, the market showed its positive response and the market saw the rally that it did.

So what can be the contributing factors?

Part of this can be linked to the fact that the budget jitters had finally ended which brought the market to the levels it was trading at before the budget expectations creeped in. Some of the response can be down to the fact that the worst fears of the market had finally been allayed and that the budget was not as bad as it was expected. Well, at least for the corporate sector. Salaried people still have a case for the way they have been treated.

Part of the optimism can even be down to the fact that the budget has been made while keeping in mind that the IMF will give the next facility based on this budget. Once a budget this tax heavy is passed, the road will be paved for the next facility being granted. There are also positive sentiments in regards to the interest rates that will be seen going forward. The recent cut in interest rates and the inflation tapering off does show that there are chances that the interest rate will come down further which is being factored into the index as well. Falling interest rates bode well for the private sector and their financing cost going down in the future which will have a positive impact on their profitability.

With the index currently trading at 77,197 mark and the market seeing a point increase of almost another 1,000 points, it can be said that the party at the PSX is not going to end any time soon.