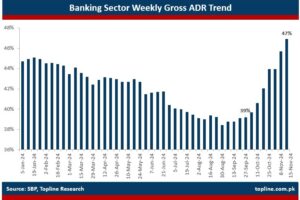

The Banking Sector’s Gross Advances-to-Deposits Ratio (ADR) has climbed to 47% as of November 15, 2024, reflecting a significant increase from 39% reported on September 27, 2024, according to data released by the State Bank of Pakistan (SBP).

This rise in ADR is primarily driven by a 19% increase in gross advances, which now stand at Rs14.4 trillion. In contrast, deposit growth has stagnated, with total deposits remaining flat at Rs30.7 trillion during the same period.

Banks reported a 16% year-on-year increase in advances in October. According to the State Bank, in October alone, the total bank advances grew by 15.8% to Rs 13.8 trillion , compared to Rs 11.9 trillion in the same month of the previous year.

The ADR is a key metric in banking, indicating the proportion of a bank’s deposits that are disbursed as loans. Advance is the amount of money a bank loans to the private sector while deposit is the money that is deposited in the bank.

A higher ADR suggests that banks are utilising more of their available deposits to extend credit, which can be a sign of increased lending activity and higher economic demand.

After the finance bill 2023, banks are penalised on low ADR in the form of taxes. An effective tax benefit of 10% to 15% is reaped by a bank whose ADR is upwards of 50%.

Due to high interest rates, advances were low throughout 2024, however with an expansionary forward outlook on the monetary policy and changes in Minimum Discount Rate (MDR) regulations by the State Bank of Pakistan (SBP), things have started to look up for the banks.

According to a poll conducted by Topline Securities, 71% of the market participants expect that the central bank will announce a minimum rate cut of 200bps on its next Monetary Policy Committee (MPC) session.