In a recent press conference criticizing the state of the economy, former Finance Minister and PML-N stalwart Miftah Ismail faced a question from a reporter that was a little off beat. It was a bit polemic in nature, but it was fair enough. If the economy is really as bad as you claim, the reporter questioned, how come Ismail Industries (of which Miftah is executive director) doubled its profits?

This was a bit of an awkward moment for Miftah. At the press conference, he had been railing against the state of the economy and what he saw as the mismanagement of the PTI government. And here the financial results of his own company were being used to disprove his pint. During the PML-N’s administration, in which Miftah was the Finance Minister, Ismail Industries was able to make Rs 350 million profit during PMLNs government. Since then, the journalist claimed, that profit had doubled.

While he may not have been there as a representative of Ismail Industries, Miftah was well equipped to answer the question. He could have given a number of responses here. The former minister could have told a heartwarming tale about how he could not give attention to Ismail Industries because he was so busy as Finance Minister, or how the company since his return had actually performed well against the odds. Instead, he went for a simpler, less evocative explanation, saying flatly that the company’s profit had nothing to do with the economy of the country.

But the question of Ismail Industries has been on everyone’s minds for a while. Mostly because of one product: Cocomo. It is one of those staple snacks that have defined the childhood of many Pakistanis, and which evokes not just nostalgia but a strong sense of ownership and protection. So when the amount of cocomos per packet started to visibly decline (at one point there regularly only being a paltry 3 cocomos in a single small packet), the public was in uproar. It was at this point that in an interview to The Current, Miftah Ismail responded to the controversy by saying the number of cocomos per pack had decreased because with the arrival of this new government, wheat, sugar, and other primary products that are used in making cocomos have all risen sharply in price.

Yet the company has been growing, and perhaps because Ismail Industries is much larger than just cocomo. Yes, Candyland is a big part of the group’’s appeal and business, but it is much more than that and Miftah and his brothers run a tight ship. One explanation for this increase has been that the government has improved economic conditions, which as we will show, is not the case. The other explanation is that by reducing the amount of product in their packaging, through shrinkflation, Ismail Industries have been able to turn a profit. But most importantly, it has been the increased focus on exports and growth in the plasti segment that has managed to mitigate the impact of a less vibrant local market.

Fact check: Have profits really grown?

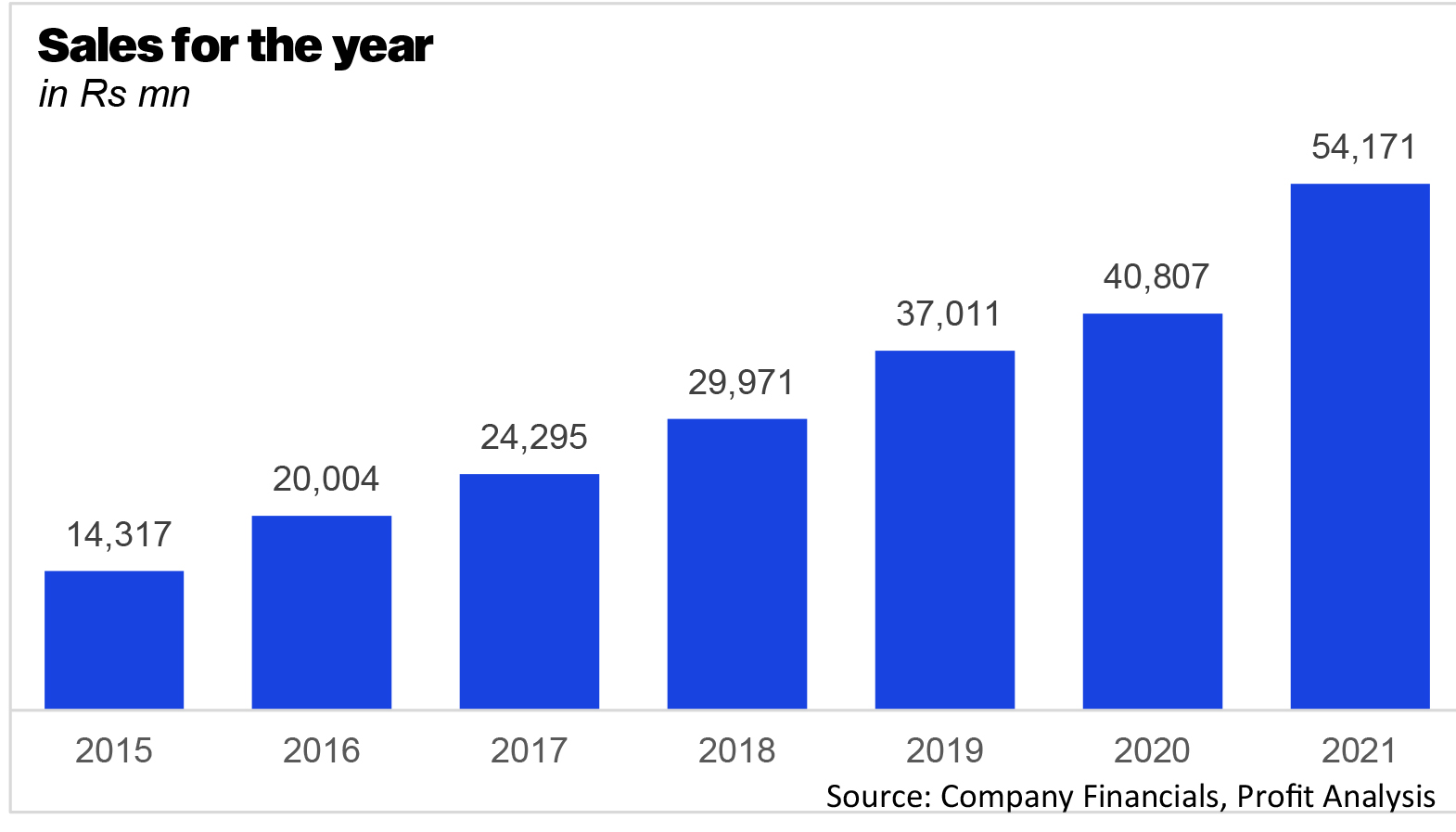

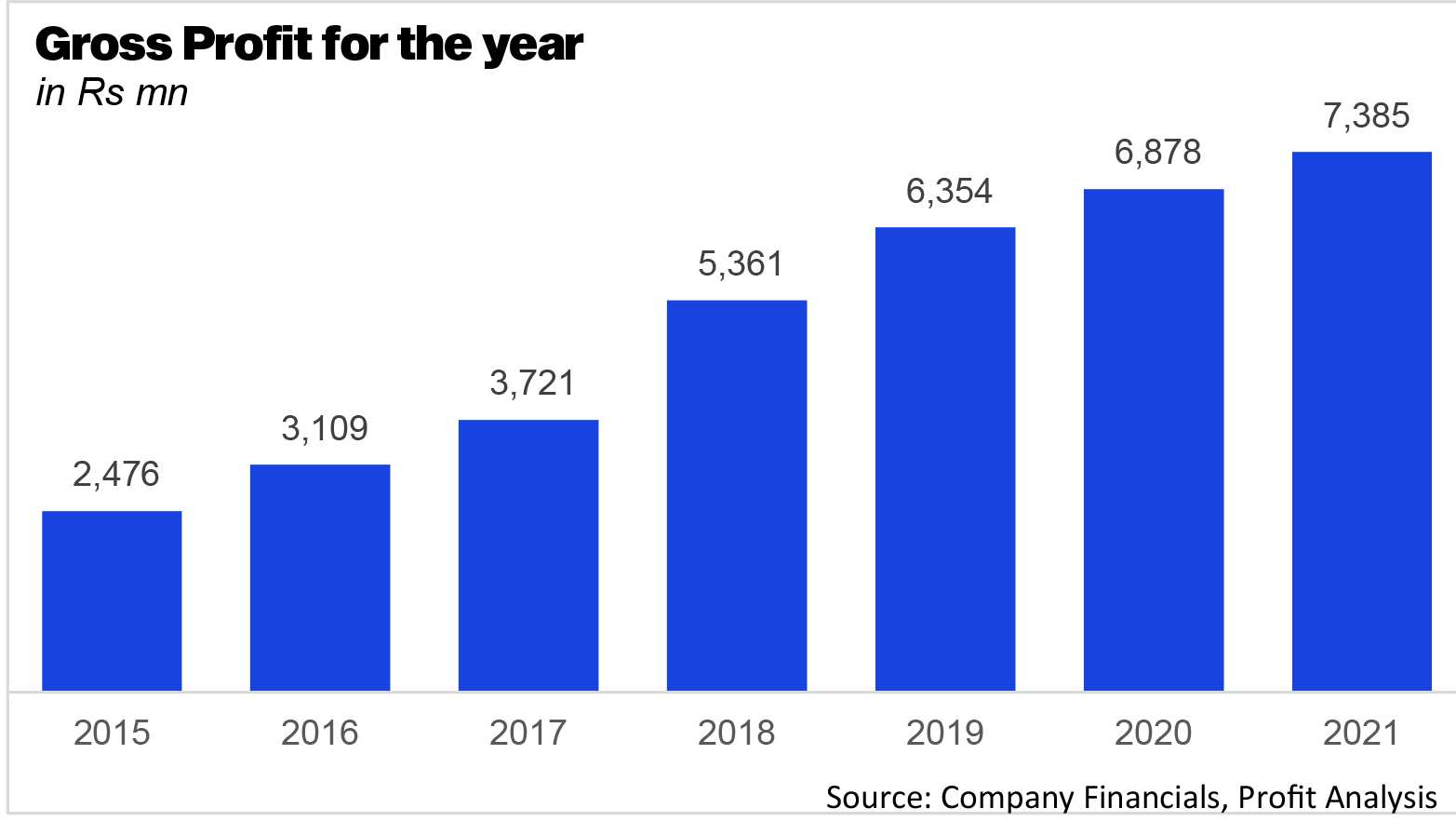

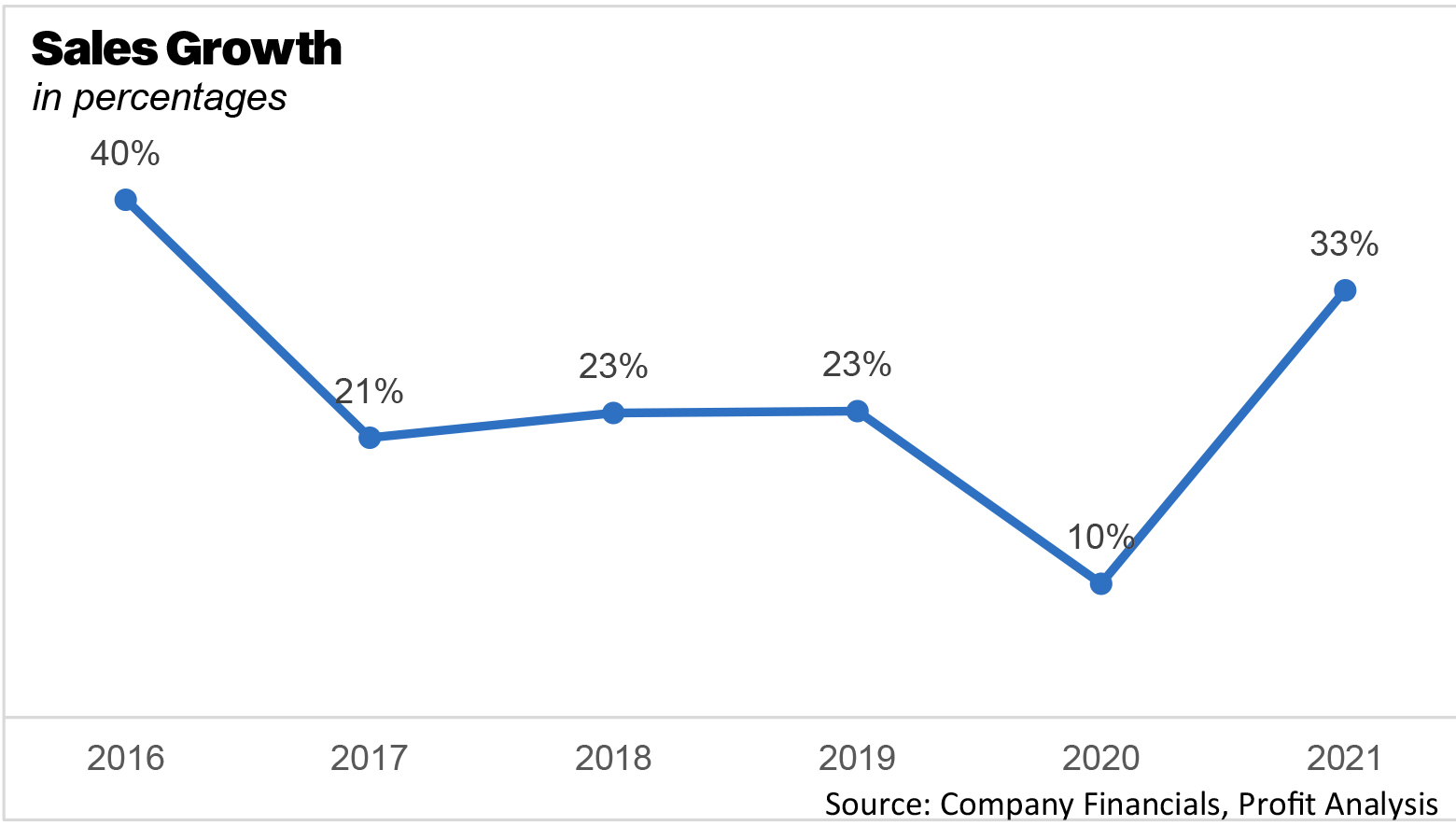

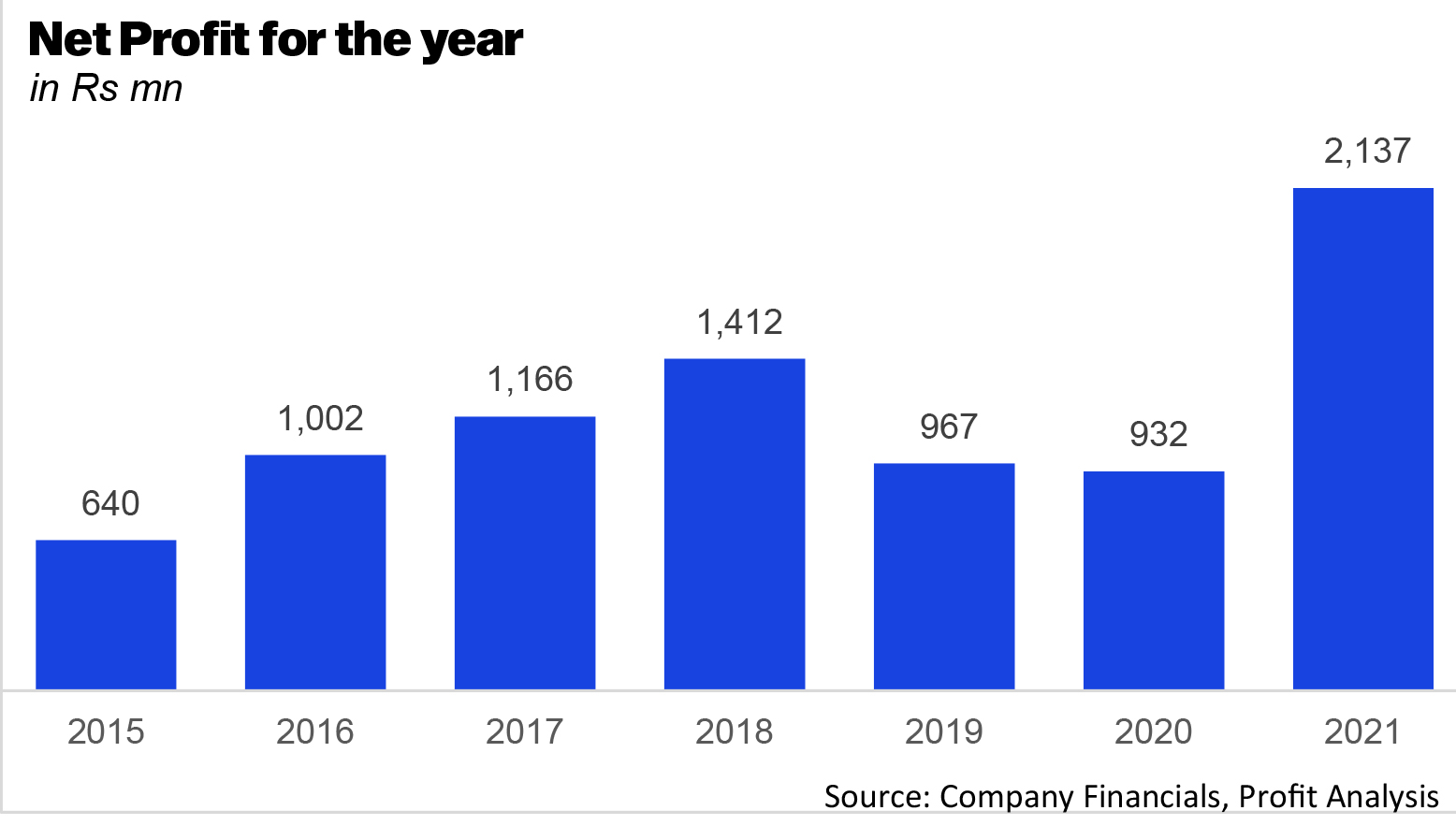

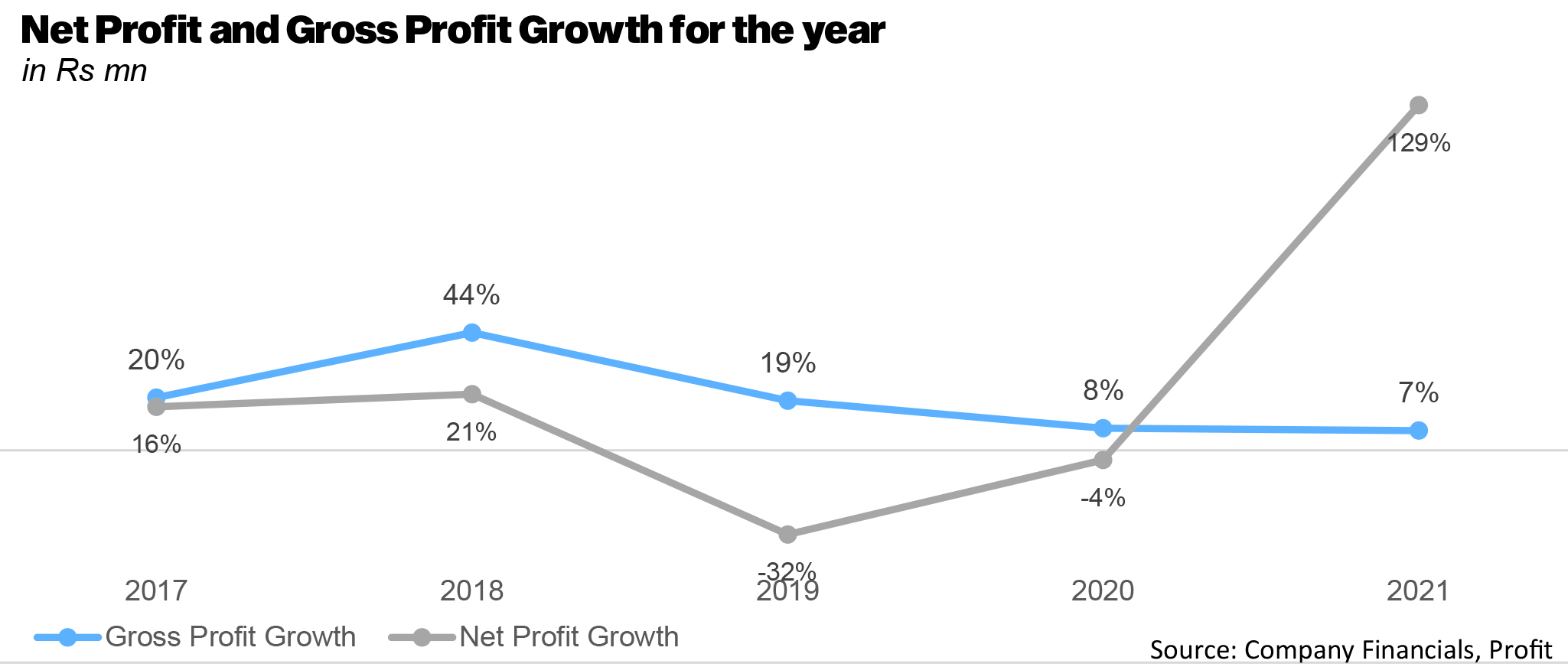

Based on the available annual reports, a fact check shows that profits have not doubled in 2020. In fact, they have fallen by 35 million within the span of a year. In fact, Ismail Industries attained it’s highest ever profit in 2018, and the current profit levels are lower than what was witnessed in 2016 and 2018. Gross profit, however, has managed to grow steadily over the years and so have sales. A quick glance at the charts show that Ismail Industries has not had it’s best years since 2018.

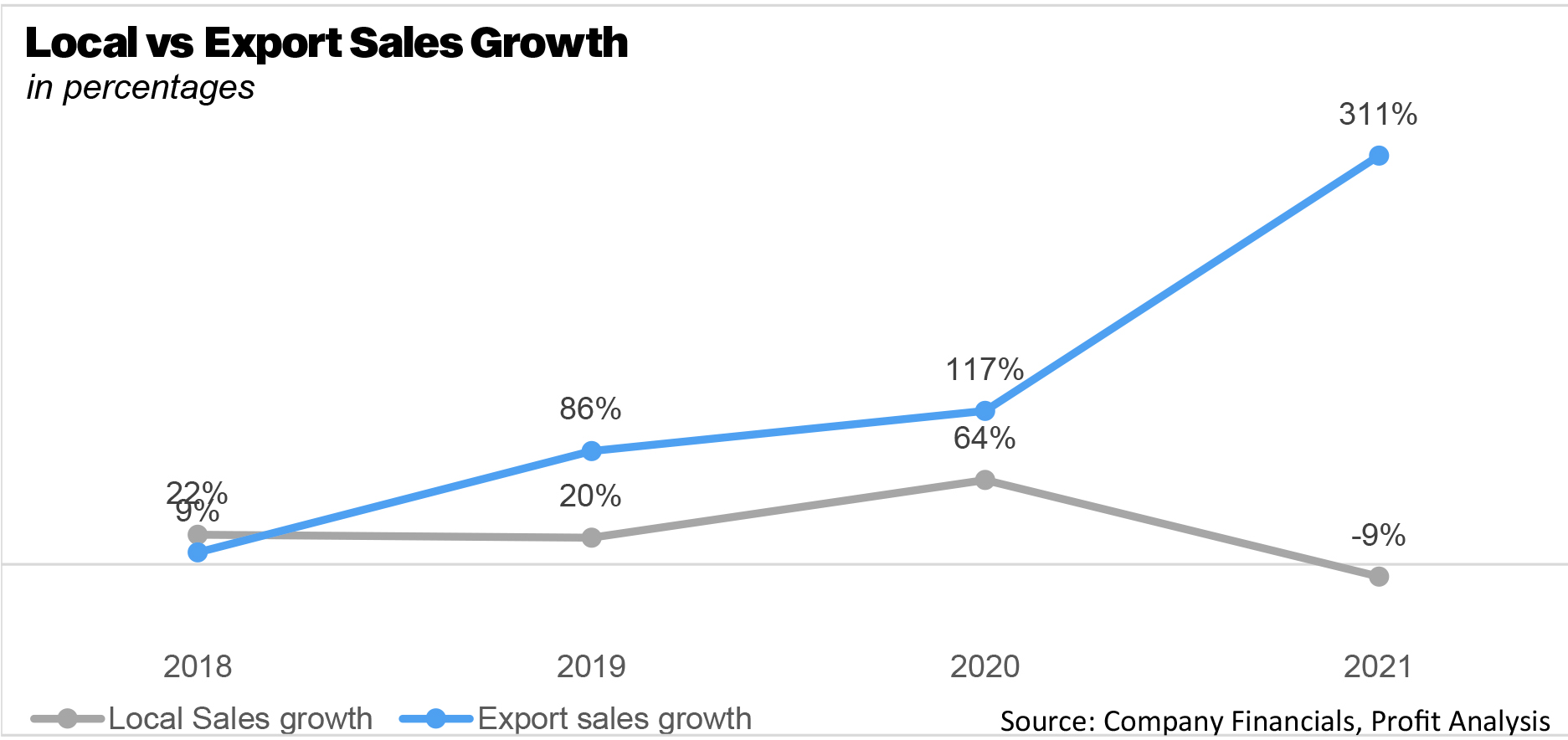

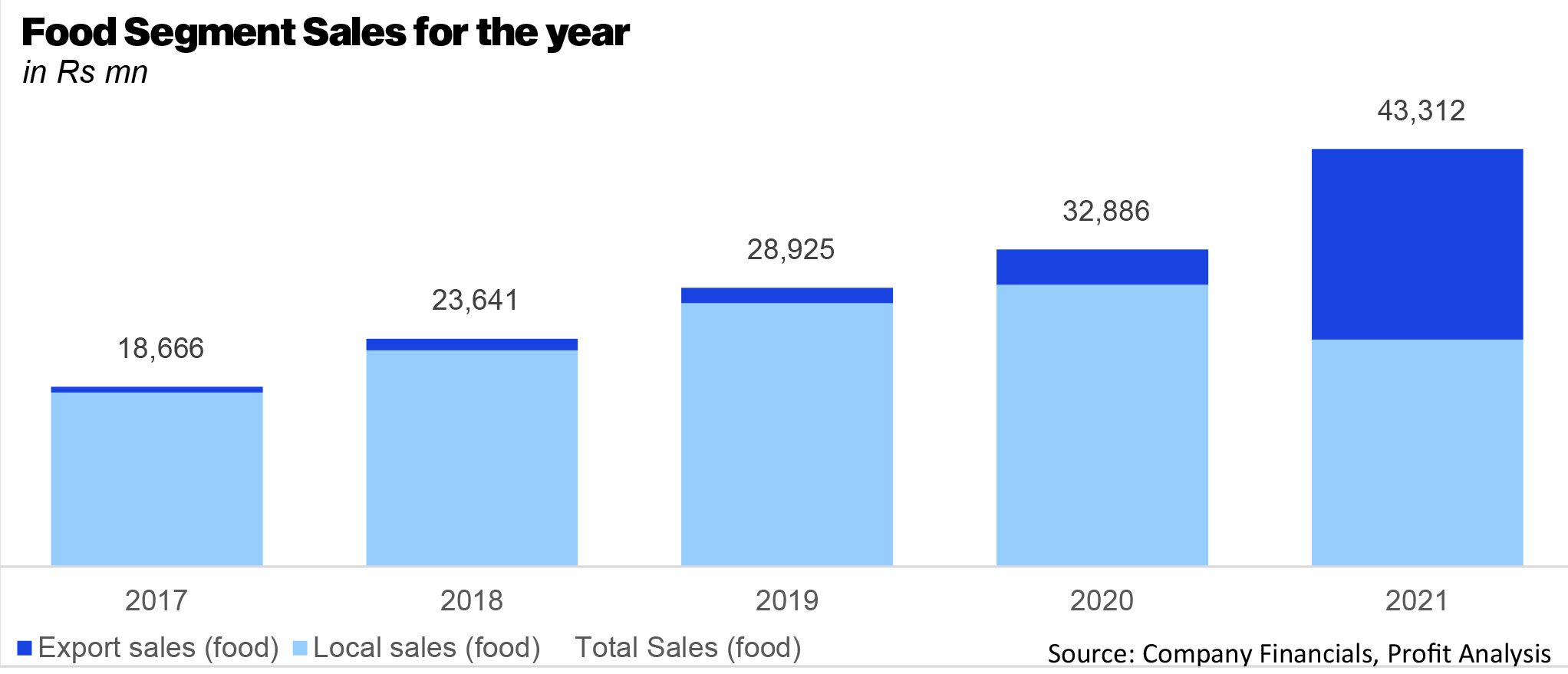

Considering 2021’s financial statements are not out, Profit has annualized key indicators using the data available for the last three quarters ending March 2021 to make a comparison. Based on those numbers, Ismail Industries has witnessed a 33% growth in sales. This is largely driven by export sales rising 311% in 2021, whereas local sales decreased by 9%. Moreover, the share of export sales in the food segment has rapidly increased and has taken over local sales by increasing its share to 39%.

Gross Profit remains largely flat, however, net profit has increased drastically by 129% after shrinking by 4% in 2020 and 32% in 2019.This suggests that the company has managed to reduce its costs such as a 42% reduction in finance costs as a result of lower interest rates, in addition to cutting costs through shrinkflation. Based on annualized numbers, the company has made it’s largest profit in 2021, which is approximately 50% higher than the profits made in 2018.

The economy and the snack business

The confectionary, cookies, and snack industry is tied to the economy much like any other industry would be. Considering the fact that such products are not essential, they are generally price elastic and income elastic. The extent of this varies from product to product and consumer to consumer based on preferences, habits, and, of course, how big of a dent it is in one’s consumption.

What this means is that when a country is faced with inflation or economic uncertainty whereby their purchasing power falls, households are faced with less disposable income. As a result, they change consumption patterns. To make it even simpler, if the economy is down and money is worth less, you have less money to spend. It is then up to you to decide how important cocomos are to you, and all other products. It becomes an analysis of weighing the costs against the benefits.

For instance, if a household finds itself with lower disposable income, it is likely that they would substitute buying junk food in favor of staple food items. The ticket size of the item also needs to be taken into account. A household may not give much thought to a five rupee biscuit packet, but it might hesitate while buying an entire carton or a large box of that item.

The company also talks about the impact of disposable incomes on its performance. In the third quarter financial statement ending march 2021, Munsarim Saifullah comments about the future outlook, “The management acknowledges the uncertainty emanating from Covid 19 and its impact on economy, high inflation is taking its toll on the disposable incomes and consumer spending is expected to remain in check during the periods ahead.”

So yes, the question that was asked of Miftah Ismail made sense. People would need to have more disposable income for a confectionary company like Ismail Industries to have such a significant boost in profits.If the economy was performing badly as Miftah had been claiming, his company should have too. And as Miftah Ismail has explained previously, because of the country’s economic conditions, his companies have had to cut costs, and products have become a victim of what is known as shrinkflation.

Shrinkflation or should we say Cocomo: Mujhe bhi aur do

We have discussed the outrage over there being fewer cocomos per packet. But is it possible that by such a minor adjustment it is possible to double profits? Think about it, gone are the days you could open up a small pack of cocomo and share with your friends. Why? Because now you’ll find four chocolate filled bite sized cookies in a pack, and if you’re having an unlucky day, you might find three.

Have you noticed that the size of your loved snacks have shrunk over the years? Think about it, we now have fewer cocomo in every packet, and they contain less chocolate filling inside. And it isn’t just the cocomos. Popsicles have gotten smaller, so have biscuits, and even rotis.

This phenomenon is called shrinkflation. Shrinkflation is basically when the sticker price/ menu price for a product remains the same but the product quantity and or size shrinks. While the price of the product has not increased, customers find themselves paying more per gram or piece. This is most common in the food and beverage industry. This is done to raise profit margins. These changes are often negligible and not as apparent.

Shrinkflation is a type of inflation but is not apparent from the consumer price index of a country. If we take shrinkflation into account, the inflation witnessed locally would most likely be much higher. In some countries, such as the UK, the Office for National Statistics keeps track of products that have decreased or increased their sizes. This helps keep a tab on shrinkflation.

Whilst buying snacks, food, or beverages people often do not take the quantity or weight of the product into account. For instance, if your favorite burger joint reduced the size of its meat patty as opposed to raising the price, you would probably not notice. Even if you did, you might right it off to a trick of the mind. This kind of gradual decrease will then continue to keep happening. Had the business increased the price of the product, consumers may have been deterred from buying the product, but despite the shrink, they may continue buying it.

Another advantage of shrinkflation is greater consumption. For instance, people are now inclined to eat more than one pack of cocomo to satisfy their cravings or get the family pack instead. This also drives up sales. And while these are all reasonable assumptions, it would be fair to say that the government would be responsible for Ismail Industries doing better, even if that is by increasing inflation rather than performing well. The only problem is that very intuitively, even without the unavailability of data to this point, it seems unlikely that shrinkflation over such a short period of time would double the profits of Ismail Industries.

The shrinkflation explanation makes much more sense when you consider that a lot of these new profits that are coming in are thanks to the increased focus on exports that Ismail Industries have taken over. In fact, locally, the increase in profit in local sales for the food division increased by a meager 6.91%, plastic segment decreased by 9.27%, and cumulatively rose by 3.29% for the group. This is a paltry number, and both the increase and decrease are a routine affair. It could be due to shrinkflation, but it is not such a significant jump that it would make Miftah Ismail sing for joy. What has changed, however, is the group’s newfound focus on exports and the success they have found in this way.

Exports help Ismail Industries grow

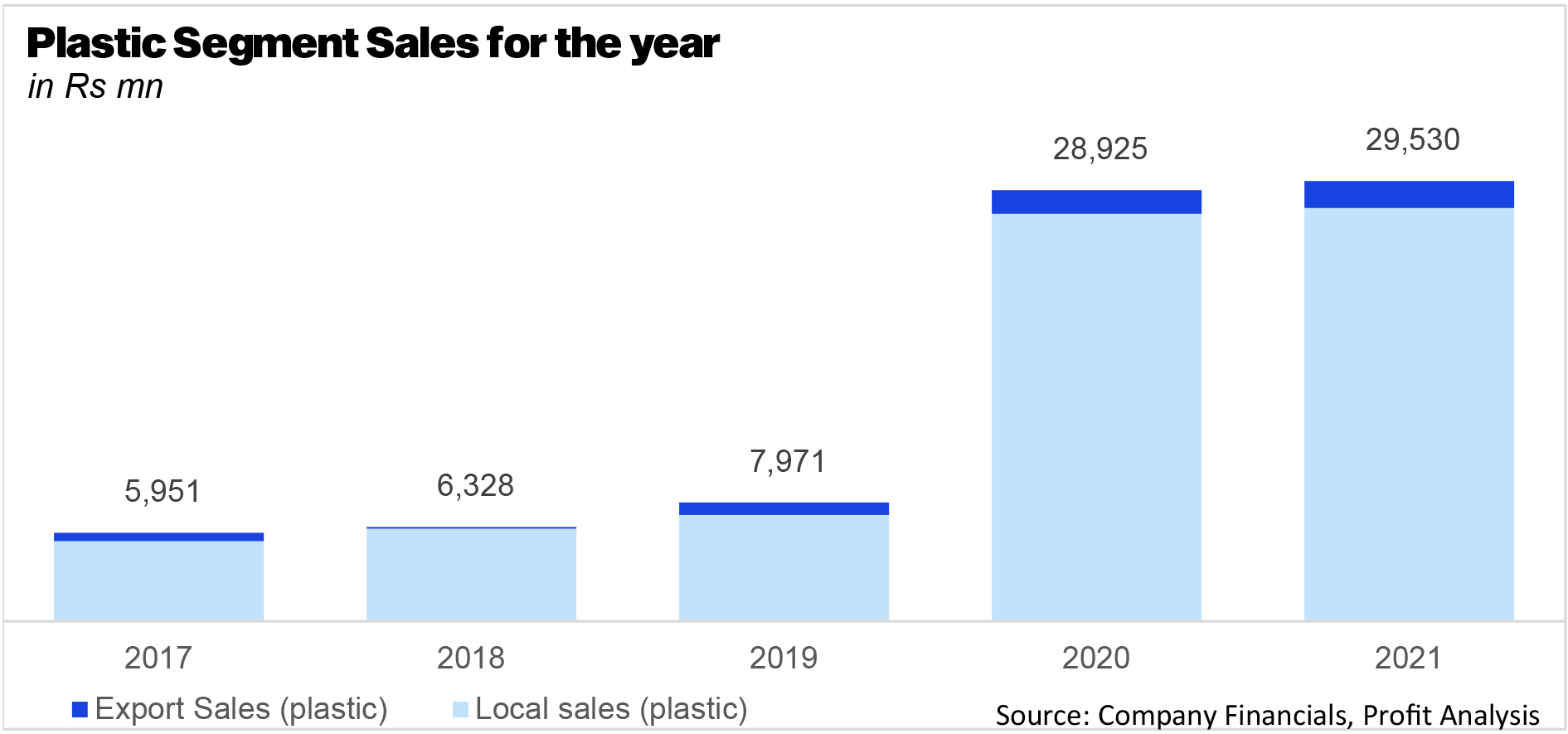

As per the annual statement for 2020, “Ismail Industries has achieved nearly triple growth in export business volumes as compared to the previous fiscal year, despite the challenges faced due to the pandemic.” The company has managed to increase its export sales by 130.46% from 1,589 million in 2019 to 3,662 million in 2020 for its food segment, and 90% from 836 million to 1589 million for the plastic segment. Cumulatively, this means a 117.65% increase from 2,425 million in 2019 to 5,251 million in 2020.

What has become very clear is that Ismail Industries has both focused on and succeeded in increasing the export of their products to grow their business, a technique they will most likely want to stick to now that it has proven so successful for them, and also growing its plastic segment.

And this has been a deliberate strategy. As we mentioned earlier, there have been audible complaints about the quality of cocomos and the number of them found in any given packet from people in Pakistan, something we have argued may have contributed to significant shrinkflation. However, it has been reported that the cocomo packets that are being exported from Pakistan, mostly to countries with large expat populations, are of a better quality, are packaged better, and have more cocomos in each packet as well. This is a clear sign that Ismail Industries has found a more profitable segment in expat communities compared to local customers. And while it is ironic that Miftah Ismail’s company is treating the expat community with the same favouritism that the incumbent federal government does, it also explains why the company was able to increase its footprint in other countries.

The business’s improved performance can be attributed to thegrowth in export sales which are not impacted by local economic conditions. And while local sales had increased, the growth was not impressive enough to draw the conclusion that the economy was not suffering at the hands of inflation.

not a thorough article. Few things does not make sense especially where you are relating local sale and local economy, and local package & export quality package.

Hi 🙂 Thank you for the auspicious writeup. It if truth be told was a enjoyment account it. Glance complicated to far introduced agreeable from you! However, how could we keep in touch?