LAHORE: Toyota and Chery have introduced price hikes for their entire lineups.

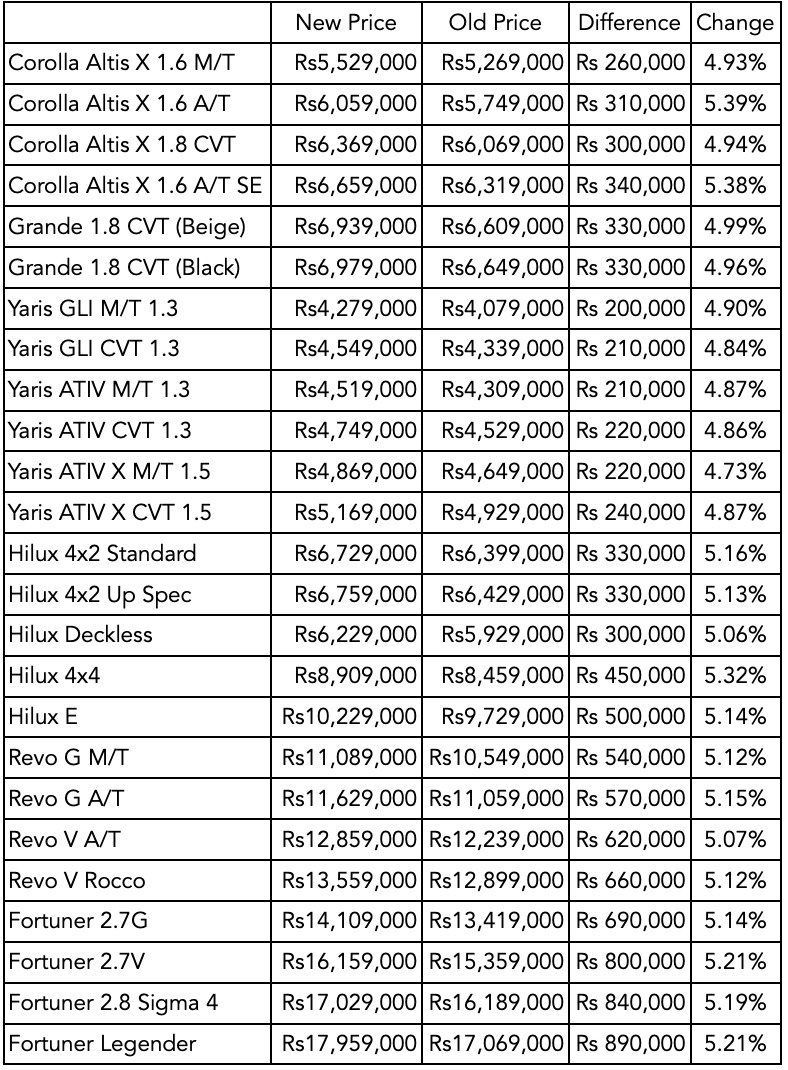

The new prices for Toyota are as follows:

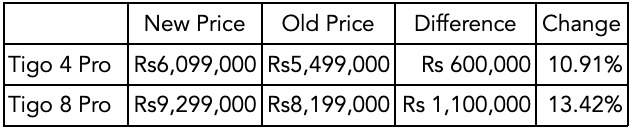

The new prices for Chery are as follows:

The most likely explanation for the price increases are the increases in the cost of production due to the Rupee’s depreciation, the global commodity supercycle, and the general rise in the domestic cost of production. These new prices are likely, and hopefully, also reflective of the companies factoring in further dips by the Rupee, and potential increases in taxes levied on vehicles. The latter is potentially a consequence of the rumours across industries of new rounds of taxation across industries due to negotiations with the IMF.

The most likely explanation for the price increases are the increases in the cost of production due to the Rupee’s depreciation, the global commodity supercycle, and the general rise in the domestic cost of production. These new prices are likely, and hopefully, also reflective of the companies factoring in further dips by the Rupee, and potential increases in taxes levied on vehicles. The latter is potentially a consequence of the rumours across industries of new rounds of taxation across industries due to negotiations with the IMF.

Playing Devil’s Advocate: Toyota

This price increase amounts to Toyota’s third price increase within the span of a month.Toyota’s rationale is clear. It has made operating losses for two consecutive quarters. It recorded an operating loss of Rs 3.3 billion in Q1FY23, and Rs 1.483 billion in Q2FY23 taking its HFY23 operating loss to Rs 4.78 billion. Its HFY23 loss is a 150% Year-on-Year contraction, for a staggering reduction of Rs 15 billion.

Furthermore, Toyota has been unable to meet demand due to inventory shortfalls. This has led to it announcing non-production days from February 1 to February 14, and its intent to shift to a single shift work day from February 15 until stated otherwise. Toyota seems to be so crippled by these shortfalls that it reintroduced its refund policy, from July, last month.

Thus, Toyota’s decision comes down to a confluence of two things: It can only produce a limited number of vehicles, and it needs to increase the profit margins for its vehicles. The price increases, therefore, are a means for Toyota to achieve this. There is no doubt that Toyota’s sales volume has fallen as a result of these. Its 7MFY23 sales volume stands at 21,877 units. This is a 51% contraction from the 44,869 units it sold over the same period last year. However, there seems to be a method to the madness.

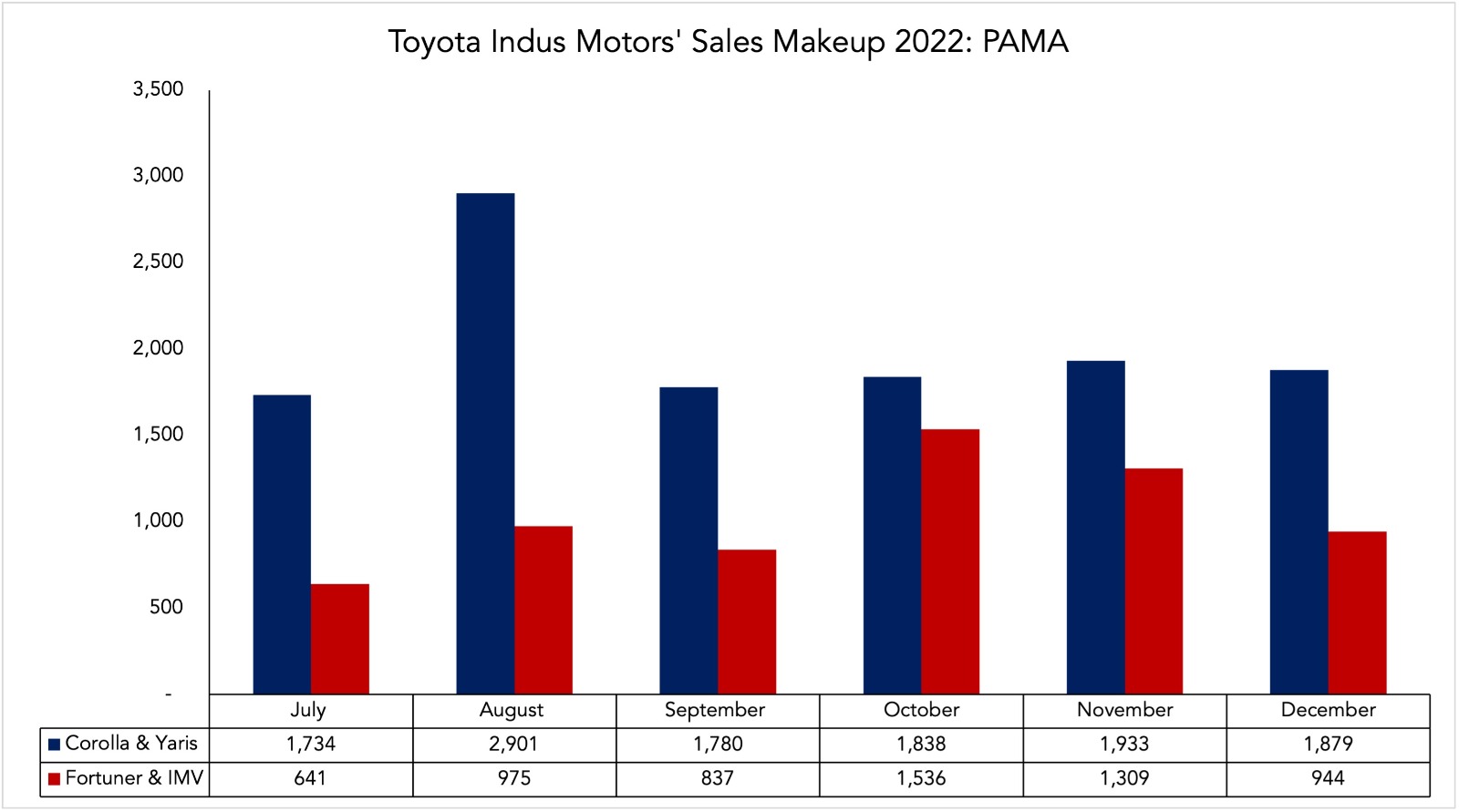

Toyota gross profit, and gross profit margin both improved Quarter-on-Quarter from Q1FY23 to Q2FY23. This was despite Toyota selling fewer vehicles within that time span. This is likely in part due to the change in the composition of vehicles Toyota sold over the period. Q1FY23 saw the Toyota Yaris and Corolla constitute 72% of total sales, with the remainder being attributed to the Toyota Fortuner and its IMV line of vehicles. Q2FY23, in contrast, saw the Yaris and Corolla’s share dip to 60% with the shares of the Fortuner and the IMV line of vehicles rising to 40%.

Based on past precedent, the higher prices are likely to dissuade customers from the more affordable options across Toyota’s portfolio, whilst encouraging sales across Toyota’s more expensive lineup. Such a dynamic would therefore lead to Toyota only producing those cars which it has higher profit margins for. This is the most likely explanation for why Toyota has also reduced its shift; it is expecting demand to fall, and therefore aims to reduce its fixed costs whilst bolstering its margins.

Playing Devil’s Advocate Part Deux: Chery

Chery cannot be faulted for its price increase. The company has withheld its prices from September till now, and its decision is a likely consequence of the aforementioned macroeconomic reasons plaguing the entire industry. Ghandhara Nissan introduced the Chery Tiggo 8 Pro and 4 Pro almost a year ago, however, the reception has not been lacklustre to say the least.

Ghandhara Nissan started Q1FY23 with a Rs 78 million loss. Now, the company did not provide disaggregated segment wise data to extrapolate which of its automotive brands was failing. However, the fact that it made a loss overall, is indicative of Chery also struggling. This is despite the fact that Chery International outlined its eagerness and plans to expand across the Pakistani market in 2023, earlier this year. Chery’s Tiggo Pro 4 might serendipitously be a beneficiary of Toyota’s price increase as Chery’s SUV enjoys an even more considerable price advantage compared to Toyota’s sedans. The Tiggo Pro 8, however, now operates in a very competitive price market with the majority of the newer entrants who entered the market having their premium offerings either within that price range or on the boundaries of it.