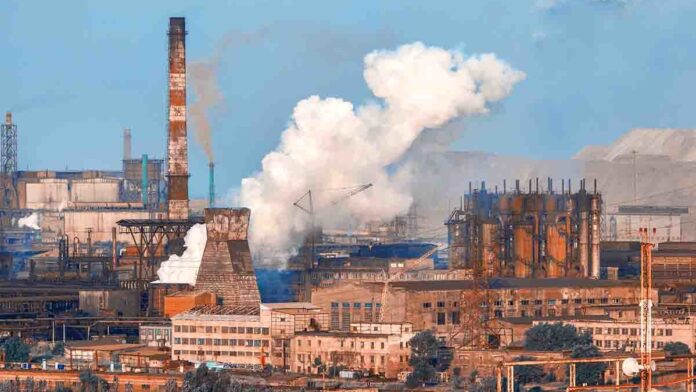

ISLAMABAD: In a sobering revelation, the Pakistan Bureau of Statistics (PBS) on Tuesday has reported a decline of 10.26 % in the output of the Large Scale Manufacturing Industry (LSMI) during the fiscal year 2022-23 (FY23), compared to the previous fiscal year (FY22). This marks a significant setback for the country’s industrial sector.

According to the provisional Quantum Index numbers of the Large Scale Manufacturing Industries (QIM), the LSMI output exhibited a sharp decrease of 14.96 %for June 2023 when compared with the corresponding period in 2022. However, there was a minor glimmer of hope as the output increased by 0.98% when compared to May 2023.

What is the Quantum Index for Large Scale Manufacturing?

The Quantum Index of Manufacturing (QIM) measures the changes in production of Large Scale Manufacturing Industries (LSMI) overtime, on a monthly as well as cumulative basis. The weights presently used for the QIM were derived from the Census of Manufacturing Industries (CMI) 2005-2006.

The provisional quantum indices of Large Scale Manufacturing Industries (LSMI) for June 2023, based on the 2015-16 base year, are derived from data provided by various source agencies including OCAC, Ministry of Industries & Production, Ministry of Commerce, and Provincial Bureaus of Statistics (BoS).

An overview of Financial Year 2022-23

A closer look at the factors influencing this downturn reveals that several key sectors bore the brunt of the decline. Notable contributors to the -10.26% drop include the food industry (-1.14), tobacco (-0.65), textile (-3.65), garments (2.79), petroleum products (-0.89), chemicals (-0.52), pharmaceuticals (-1.85), cement (-0.86), iron & steel products (-0.24), electrical equipment (-0.54), and automobiles (-2.21).

Interestingly, while the production of wearing apparel, furniture, and other manufacturing sectors such as football increased in FY23 compared to FY22, a decrease was observed in the production of food, tobacco, textile, coke & petroleum products, pharmaceuticals, chemicals, non-metallic mineral products, machinery and equipment, automobiles, and other transport equipment.

In June 2023 there was a substantial year-on-year production decrease of 14.96% in Pakistan’s LSMI, with the index dropping to 112.21 from 131.95 in June 2022. On a month-on-month basis, there was a slight recovery, with the LSMI output increasing by 0.98% compared to May 2023.

The cumulative data for FY23 as a whole paints a grim picture, with the LSMI output experiencing a 10.26% YoY decrease, reaching 114.83 compared to 127.96 in FY22.

Numerous factors contributed to this downturn, including restrictions on imports, weak macroeconomic indicators, monetary tightening, supply chain disruptions, and an increase in energy costs. The country’s political instability has also played a role in constraining output growth.

The decline in LSMI output is undoubtedly a formidable challenge for Pakistan’s economy. This downturn emphasizes the critical need for sustained investment and support to resuscitate and fortify the country’s industrial sector.