The federal cabinet has approved exemptions for the Petroleum Division, allowing it to bypass Public Procurement Regulatory Authority (PPRA) rules to meet the deadline for selling stakes of the Reko Diq project to Saudi Arabia by December 25, 2023.

The News reported, quoting sources, that the Ministry of Energy (Petroleum Division) secured cabinet approval through a circulated summary which permits the Petroleum Division to hire financial advisors to offer Reko Diq shares to potential investors.

The shares must be diluted in a manner that maintains an equal distribution between the existing shareholders including the Government of Pakistan, the Government of Balochistan, and Barrick Gold.

Following this, the Petroleum Division will propose a negotiation committee to commence discussions with Saudi Arabia.

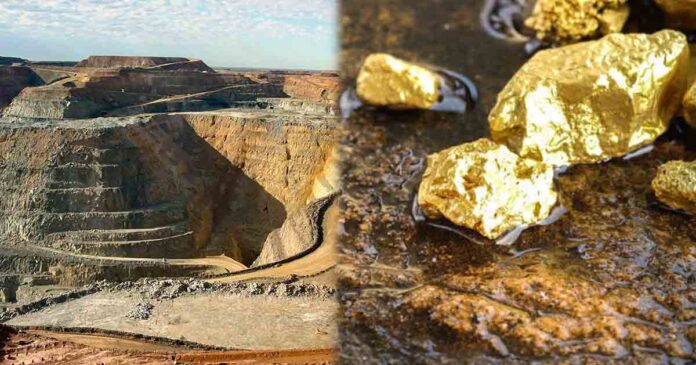

Pakistan Minerals Private Limited (PMPL) will consider divesting its shares in the Reko Diq Project. PMPL will engage advisors for due diligence, resource valuation, asset assessment, finalizing commercial terms, and completing documentation and structure.

The transaction agreements are expected to be concluded by December 25, 2023. All relevant departments will provide support to the Petroleum Division and negotiation committee during due diligence and negotiations.

To meet the December 25, 2023 deadline set by the Special Investment Facilitation Council (SIFC), the government sought the services of specialist advisor RB&A Partners (UAE), an independent consulting firm, as an additional financial advisor for the project and cabinet’s approval was obtained for this pupose as per the agreed terms and conditions between PMPL and the recommendations of the SIFC.

The Kingdom of Saudi Arabia’s interest in acquiring stakes in the Reko-Diq Project through Manara Minerals, a joint venture of Saudi Mining Company Ma’aden and the Public Investment Fund, has been discussed in various SIFC meetings.