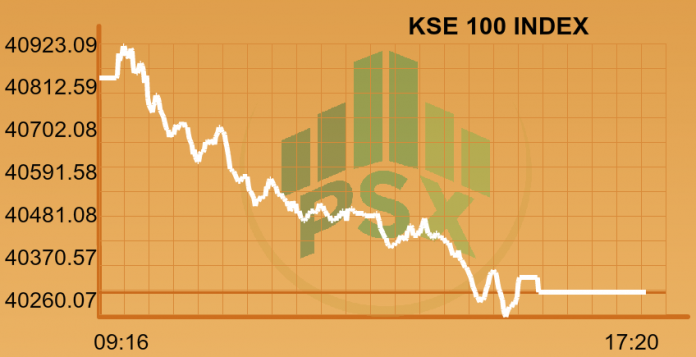

LAHORE: Pakistani equities after a promising start during the day remained in red throughout the day. The market steadily lost ground as selling pressure exacerbated on account of sizable position in future contracts of Rs 9.4 billion requiring settlement by end of this week. Today, investors even did not pay heed to the $ 1.29 rise in WTI oil price to touch $ 56.6 a barrel.

As a result, the market closed lower at 40,316 down (527 points / 1.3 per cent). The KSE 100 index depleted by another 584.35 points intraday to day’s low of 40,260.05. It ended lower by 527.47 points at 40,316.93. The KMI 30 index rolled lower by 1,008.29 points and the KSE All Share Index declined by 291.38 points. The advancers to decliners ratio stood at 76 to 237. Traded volumes day on day basis were down 19 per cent while value was down 21 per cent.

Investors were also concerned about government failure to achieve a breakthrough in negotiations with sit-in protesters. Many fearing further continuation in a deadlock between both the parties might turn the situation volatile. The confidence of investors who have already been reluctant to trade, indicated by low volumes, has taken another blow after the confusion regarding finance minister’s office. The Finance Minister has been getting treatment abroad and the finance ministry portfolio has fallen under the prime minister’s control, as per cabinet rules.

Top index point performers were PAKT (+5 per cent), PMPK (+5 per cent), CPPL (+3 per cent), SNBL (+1.9 per cent) & THALL (+0.5 per cent) contributing 32 points while PSO (-3.2 per cent), NESTLE (-5 per cent), ENGRO (-1.5 per cent), MARI (-2.8 per cent) & POL (-1.4 per cent) withholding 125 points.

On the sector front; OMC took away 82 points, while E&P further eroded 65 points and commercial banks withheld 63 points while on the flip side Tobacco added 25 points.

The market volumes depreciated to 93.96 million from 115.57 million of the last session. TRG Pakistan Limited (TRG -4.21 per cent) stroked the top of the volume charts with 13.03 million shares exchanged.

Dost Steel Limited (DSL +0.90 per cent) followed with 8.13 million shares traded as they notified the exchange regarding the possible commencement of commercial operations. The company announced the start of operations by the second fortnight of December 2017, barring any unforeseen circumstances.

The food and personal care products sector was the top loser with 4.27 per cent cut off from its cumulative market capitalization. Nestle Pakistan Limited (NESTLE -5.00 per cent) hit the floor and Clover Pakistan Limited (CLOV) was down 4.98 per cent while Treet Corporation Limited (TREET) lost 4.54 per cent.

Sazgar Engineering Works Limited (SAZEW +5.00 per cent) jumped to its upper circuit breaker taking its 1-year return to over 58 per cent. The company informed the exchange of signing a Vehicle Assembly Corporation Agreement with Chinese Automobile Manufacturer for manufacture, assembly, sales and after-sales service of passenger and off-road vehicles.

On the other hand, current account deficit (CAD) during Oct 2017 was reported at $ 1.3 billion vs $ 1.1 billion in Sep 2017 (up 20 per cent). Exports were up 14 per cent to $ 2.0 billion while imports also increased 12 per cent to $ 4.4 billion compared to Sep 2017. The deficit on income and services increased to $ 857 million up 45 per cent over Sep 2017’s $ 587 million. Remittances posted strong growth of 28 per cent over previous month to $ 1.6 billion. Even though the above CAD is higher than the previous month, it broadly remains in line with our estimated CAD for FY18 of around $ 16 billion (5.2 per cent of GDP) compared to $ 12.2 billion (4.0 per cent of GDP) last year.