KARACHI: Around Rs598 billion was paid on account of domestic debt servicing by the government during first five of financial year 2017-18, according to State Bank of Pakistan (SBP).

As per SBP’s latest monetary policy statement, the central bank stated fiscal deficit for first half of the year is expected to be 2.5 percent, like corresponding period of 2016, reported an English Daily.

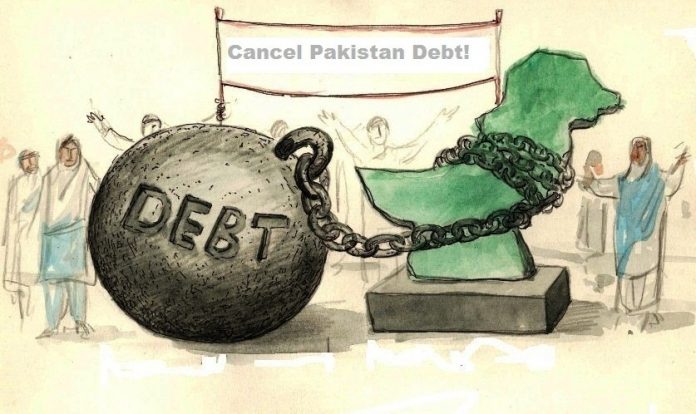

The rise in debt servicing could contribute to widening of fiscal deficit and indicates govt is depending heavily on borrowing for development expenditure and budgetary support.

According to SBP’s report, debt servicing stood at 30.4 percent of tax revenue during last financial year. And five-month debt servicing stands at around 60 percent of development expenditure, whose estimate for FY 2017-18 is a touch over Rs1 trillion.

SBP’s report revealed domestic debt during first five months of FY 2017-18 rose by Rs917 billion against Rs652 billion in same period of FY 2016-17. Total debt stocks grew to Rs15.76 trillion by end-November.

Domestic debt servicing incurs a rise due to increased borrowing by govt from commercial banks and the SBP. During FY 2016-17, the government paid Rs1.2 trillion in domestic debt servicing, which was more than combined expenditures of development and defence.

The five-month data available from SBP indicates debt servicing for FY 2017-18 will reach around Rs1.4 trillion, which means the government may miss its forecast annual fiscal deficit.