DUBAI: Abraaj, the Middle East’s largest private equity house, is in violation of conditions relating to a portion of its debt, said six banking sources, adding to the pressure on a group locked in a dispute with investors.

Banks are still keen to support Abraaj but are worried about the outcome of an investigation into the firm’s alleged misuse of investor money and any related regulatory action, including possible fines, some of the sources said.

Abraaj has denied any wrongdoing.

The sources said Abraaj was in technical breach of certain financial covenants relating to bilateral debt owed to some United Arab Emirates-based banks.

Three of the sources said Mashreq was one of the banks involved.

Mashreq was not immediately available to comment. Dubai-based Abraaj declined to comment.

The sources said although creditors were primarily concerned about the company’s adherence with the conditions of the loans, ultimately questions could arise about its ability to repay its debt.

The firm is facing an investigation by four investors, including the Bill & Melinda Gates Foundation and International Finance Corp, a member of the World Bank Group, over use of some of their money in a $1bn healthcare fund.

Bankers said the expected sale of a stake in its fund management unit and its Pakistan utility K-Electric would help ease cashflow pressures, therefore banks are unlikely to make provisions against the debt in technical breach.

Abraaj agreed in October 2016 to sell its 66.4 per cent shareholding in K-Electric to the Shanghai Electric Power Company but the deal has been held up.

Separate sources say the main reason for the delay is because K-Electric is pushing for a higher electricity tariff compared to the lower-than-expected tariff approved by the National Electric Power Regulatory Authority (Nepra).

Two to three potential buyers are in talks to bid for Abraaj Investment, including Los Angeles-based Colony Northstar, Reuters reported on Friday. Colony Northstar and Abraaj have declined comment.

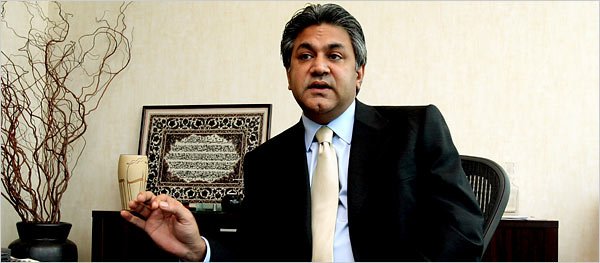

The potential sale comes amid calls from investors for founder Arif Naqvi to further scale back his involvement in the group.

Our Reporter adds: The news of problems with its creditors comes two days after Bloomberg, citing unnamed sources with knowledge of the matter, reported that two audits underway at fund have found “potential irregularities in its $1 billion health-care fund as well as its other vehicles.”

In a late development, the Financial Times also reported that two large American investors have stepped forward to acquire Abraaj’s investment arm. That report too, cited unnamed sources with knowledge of the offers.

“Cerberus Capital Management and Colony Capital are in advanced talks to buy the emerging-markets specialist fund that has been rocked by claims it misused money entrusted to it by investors. Abraaj is confident of closing a deal that could be worth up to $600m in coming weeks, the people said.”