–This is the fifth rate cut since coronavirus pandemic hit the global economy, with total reduction being 625bps in the last 100 days

–SBP says decision taken in light of ‘improved inflation outlook’

KARACHI: The State Bank of Pakistan, in a meeting of the Monetary Policy Committee (MPC) on Thursday, slashed the country’s policy rate by 100 basis points from 8pc to 7pc.

The surprise move was taken in light of the SBP’s view that the inflation has improved further, but that domestic economic slowdown has continued, proving a risk to growth.

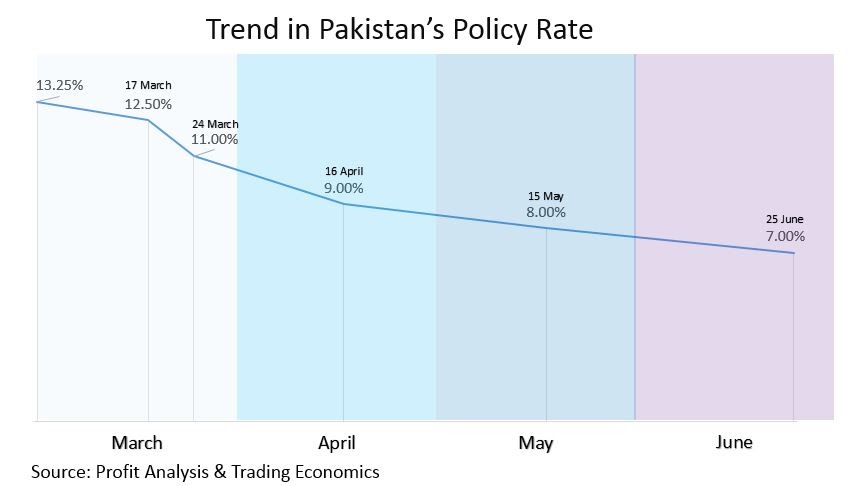

This is the fifth time in the space of four months in which the SBP has slashed the policy rate. In the space between March 17 and June 25, the SBP has now cut the policy rate by a whopping 625 basis points, from the relatively high 13.25pc to 7pc.

More specifically, it cut the policy rate by 75 basis points from 13.25pc to 12.5pc on March 17, by a further 150 basis points to 11pc on March 24, by 200 basis points to 9pc on April 16, and by 100 basis points to 8pc on May 15.

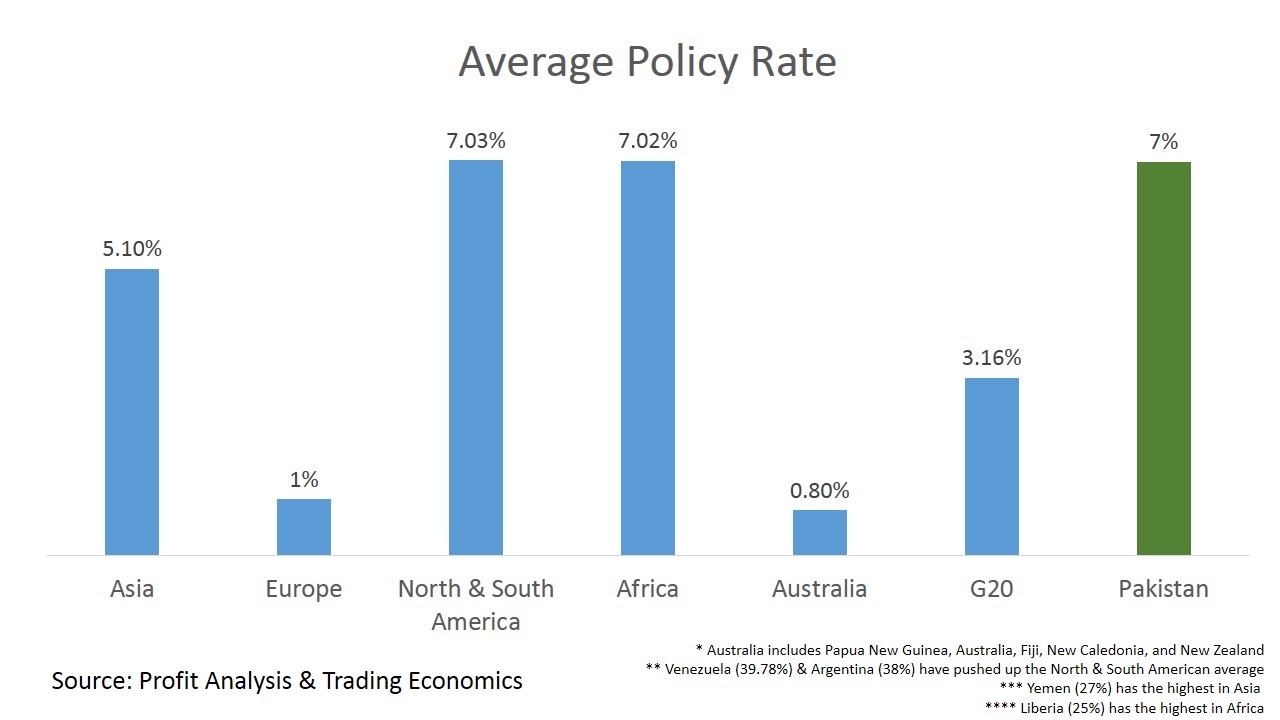

Central banks around the world have slashed interest rates, though perhaps none as aggressively as Pakistan’s SBP. According to a Bloomberg report in May, Pakistan has cut its interest rates the most this year, out of a survey of nine countries, including the US, Peru, South Africa, Turkey and Ukraine.

After the latest cut, Pakistan’s interest rate is now the same as countries such as Azerbaijan, Ethiopia, Kenya, Maldives, Tanzania, and Uganda.

TIMING OF CUT

In explaining its rationale for cutting the policy rate, the SBP said that from a risk management point of view, a prompt response to downside risks to growth was called for given the improved inflation outlook.

The timing of this surprise announcement was also partially explained: the SBP explicitly pointed out that approximately Rs3.3 trillion worth of loans were due to be repriced by early July 2020.

“This was an opportune moment to take action from a monetary policy transmission perspective. In this way, the benefits of interest rate reductions would be passed on in a timely manner to households and businesses,” the statement read.

Additionally, the SBP said that despite SBP reserves declining to $9.96 billion as of June 19, since then, the SBP has received fresh disbursements from multilateral agencies.

This includes around $725 million from the World Bank and $500 million from ADB, while another $500 million is expected shortly from the Asian Infrastructure Investment Bank (AIIB).

It could be argued that the SBP waited in order to make sure it had some reserves before cutting the interest rate again. That way, the extra reserves could act as a buffer to offset any outflows due to the reduced policy rate.

INFLATION EXPECTATIONS

According to the SBP, average inflation could fall below the previously announced range of 7-9pc for next fiscal year, given the absence of demand-side pressures.

In January 2020, the inflation rate had hit a record 14.56pc, according to data released by the Pakistan Bureau of Statistics (PBS). However, it has been declining since, slowing to 12.4pc in February, 10.24pc in March, 8.5pc in April and finally 8.2pc in May.

According to the SBP, headline inflation has decreased on the back of a recent cut in diesel and petrol prices. Recent SPI data has also shown continued moderation in overall price pressures in June, despite price increases in some food items like wheat.

Inflation is also likely to remain neutral in the upcoming fiscal year “as the freeze on government salaries, absence of new taxes, and lower production cost from reduced import duties should offset the decline in subsidies in some sectors”

As part of the International Monetary Fund’s (IMF) loan agreement, Pakistan has been given strict instructions to maintain positive real interest rates (nominal interest rate minus inflation rate).

The rapidly decreasing inflation rate has given the SBP wiggle room to decrease the policy rate, something which the MPC acknowledged in today’s statement.

“The MPC felt that real rates on a forward-looking basis would be kept close to zero, which is appropriate under the current circumstances,” according to the statement.

PAKISTAN OUTLOOK

The MPC was somewhat concerned about Pakistan’s economic and fiscal future, in light of the Covid-19 pandemic, but did say that the outlook for the external sector remains stable.

As the statement pointed out, the IMF yesterday downgraded its 2020 global growth forecast further to -4.9pc, 1.9 percentage points lower than in April, and projected a more gradual recovery than previously anticipated.

Though Pakistan’s economy is expected to recover gradually in FY21, the SBP said there are several risks, and that recovery will depend critically on the evolution of the pandemic both in Pakistan and abroad.

Large-scale manufacturing had declined by 41.9pc year-on-year in April, while cement dispatches, automobile sales, food and textile exports have also contracted in May.

However, on the bright side, the SBP noted that the current account recorded a surplus in May on the back of a reduction in the trade deficit, and a pick-up in remittances compared to the previous month.

Additionally, portfolio outflows slowed considerably compared to the previous two months and FDI has been resilient, nearly doubling to $2.4 billion so far in fiscal year 220 compared to the same period last year.

The MPC also noted that “the flexible exchange rate has played its valuable shock absorber role, helping cushion the economy from the tightening of financial conditions associated with capital outflows from emerging markets and deteriorating global sentiment.”

The MPC also noted that the depreciation in the rupee has been lower than in many other emerging markets, reflecting the increased reserve buffers accumulated over the last year.

ANALYSTS’ REACTIONS

After the previous interest rate cuts of April and May were announced, many analysts felt that SBP would reduce the policy cut even further in light of the global pandemic, and falling inflation. Many called the move surprising, but also welcome.

According to Saad Hashmi, Executive Director at BMA Capital, such a cut was expected in the July monetary announcement, but has happened earlier than expected. “This step should bode well for the country’s growth prospects and stock market sentiments,” he said.

Syed Noman Ahmed, Deputy Head Research at Insight Securities, also called the decision ‘totally unexpected’.

“The key objective of 100bps reductions in interest rate is to pass-on the impact on loan borrowers. Approximately Rs3.3 trillion worth of loans due to be repriced by early July 2020,” he noted, echoing the SBP statement.

“We had highlighted this in our report published on Tuesday that inflation trajectory for next 6 months provides a cushion for a further interest rate cut,” noted Sateesh Balani, Director of Research at Ismail Iqbal Securities.

This view was also supported by Yasin Muhammad Hanif, Analyst at Darson Securities, who said the rate cut is needed to provide immediate liquidity to homes and business so to avoid defaults and contain unemployment

“SBP moving in the right direction as govt focus was to revive the economy along with consumer demand,” said Tahir Abbas, head of Research at Arif Habib. “Also, the decision will also support local businesses in terms of lower financial charges.”

A