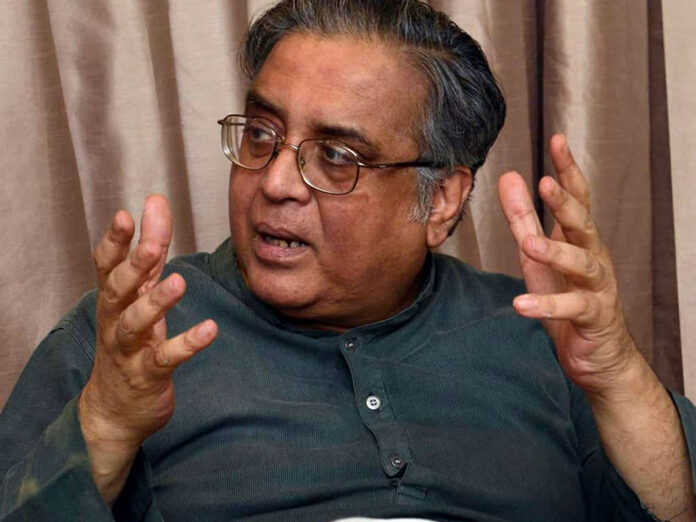

Former finance minister Hafeez Pasha on Monday said that the government has added an additional cost of Rs1,800 billion in the Budget for FY21 by locking itself into long term debts while interest rates in the country were on a decreasing trend.

Speaking to Pakistan Today Editor Arif Nizami on Channel 92’s programme ‘Ho Kya Raha Hai?’, the economist explained that it is a known fact in debt management policy that when interest rates are high, loans of a short term duration are preferred.

He claimed that the Pakistan Tehreek-e-Insaf (PTI) government followed a completely opposite approach and floated long term national saving schemes and Pakistan Investment Bonds at a time when interest rates were at a high of 13.25 per cent.

“This is what is called a lock in effect. The government is now bound to pay a higher interest rate for the next few years despite the decrease in domestic interest rates,” he said.

The former finance minister suggested that the PTI government should have floated short term treasury bills, if it had foreseen a decrease in interest rates.

He further added that despite the reduction in domestic interest rates, Pakistan’s debt repayment and interest payments have increased by more than 11 per cent.

“In the last two years there has been more than a 100 per cent increase in Pakistan’s long term debt while short term debt has decreased,” he explained.

“Currently 74 per cent of Pakistan’s domestic debt is long term. It was earlier estimated that the government will gain Rs700 billion to Rs800 billion due to decrease in interest rates, however that has not happened.”