Agricultural economies are often confused with agrarian ones. The former include all kinds of agriculture, including livestock, while the latter specifically has to do with the cultivation of land. While Pakistan is definitely high on the agrarian agenda, it is an agricultural economy, and one dominated by the livestock sector.

According to the Economic Survey of Pakistan for fiscal year 2020, livestock contributes around 60% to the total agriculture sector, 11.7% to total Gross Domestic Product and 3.1% to Pakistan’s exports. Even though Pakistan is clearly a large meat producer, it only ranks 18th in world meat exports, and only serves 3% of the global market.

Hoping to improve those numbers and become a major player in the halal meat industry in the process is The Organic Meat Company (TOMC), one of the largest halal meat processors and exporters in Pakistan. Only last year, the company’s sales accounted for 7% of Pakistan’s meat exports.

With a growing Muslim population around the world, and more and more countries adopting halal meat generally, the currently $3.4 billion dollar industry is expected to grow by another 6% in 2020. Pakistan has generally faced stiff competition from meat exporters based in Australia and Brazil. However, TOMC will be looking to expand and get a significant slice of this growth in the market.

The company is well-placed since it has the largest export market access from Pakistan, and frequently exports to markets like the Gulf Cooperation Council (GCC) countries, Malaysia and parts of Europe and Central Asia.

To this end, the company made the year’s first initial public offering (IPO) in late June, and closed their book-building phase in early July, ending up with an oversubscribed IPO. The goal is to use the capital for the investment heavy industry, and to expand at the same time. But is it a good buy, and more importantly, what does it mean for Pakistan’s meat industry? Profit takes a look.

The impressive numbers

The company has been billed as a success story. The halal meat processor and exporter, was incorporated in 2010 and commenced operations in 2011. Initially, it only had two products, and a capacity of three tonnes per day for beef, and five tonnes per day for mutton. Currently the company has a daily production and chilling capacity of 75 tonnes per day.

With four product categories – frozen meat, vacuum-packed chilled meat, fresh chilled meat, and offal – the company owns a 9.8-acre slaughterhouse and a processing facility in Gadap, Karachi, with sufficient animal holding area for 2,000 goats and sheep and 2,000 cows. Its current slaughtering capacity stands at 60 heads per hour for beef and 120 heads per hour for mutton. The company has a daily production and chilling capacity of 75 tonnes per day and currently has the approval to supply products to 16 countries.

TOMC claims it is the only company which deals in white offal products and also the only company which is currently exporting to the Middle East region via sea. It is also the only company working outside of these traditional markets, and looking to export to Far East, China, Russia, and even former Soviet countries like Ukraine.

According to a recent report by Business Recorder, TOMC is already nearing the $20 million figure in annual exports, with a double-digit average annual growth rate over the past five years. This is compared to the rest of the industry, where gross value addition of livestock segment has grown from Rs1.3 trillion to Rs1.5 trillion at a 5-year average growth rate of 3.2%.

Why then did TOMC need to raise money? For starters, the nature of the meat industry is risky. The livestock is acquired through upfront cash payments, but the buyers of the meat expect to be extended credit that can run for several months at a time.

This means that historically TOMC has depended on short term borrowing from various banks for working capital requirements. Currently, TOMC has short term borrowings of Rs718.7 million. However, the currency devaluation forced the company to consider reducing its dependence on banks.

It can thus be expected that the company will use a good portion of its IPO collections towards working capital needs. In fact, of what the company was hoping to raise from the IPO, two-thirds are expected to be used for working capital. But as the Recorder report also points out, “if fully subscribed, TOMC may boast one of the most solid financials within the meat processing segment.”

IPO structure

In an IPO, a company offers shares to the public in return for capital it can use, usually for expansion or operational purposes. Book-building refers to a period when the IPO is open and bids are collected from investors at various prices, which are above or equal to the floor price. After this, an offer price is determined, that is used for shares to the general public.

In the case of TOMC, their bid for IPO will be both for operational and expansion purposes. During this period, they auctioned 40 million shares in the book building process from July 3 to July 7, 2020. This was Pakistan’s first IPO after 15 months, and has finally closed its book building process. They were offering 35.8% of post-IPO paid up capital of 112 million shares at a floor price of Rs18 per share to raise Rs720 million.

Despite the coronavirus-led economic contraction, investors’ response was far better than expectations. Bids of Rs1.4 billion received in the first phase of offering to qualified investors. About 68.1 million shares bid was received for 40 million shares, which means it was not just fully subscribed, but oversubscribed by 1.7 times, with retail offering set to happen this week.

“There is always demand for quality businesses run by experience management,” said Muhammad Sohail, who was a consultant to this deal. “Despite the economic contraction and lockdown, we saw good participation by local and foreign investors, which bodes well for future IPOs at Pakistan Stock Exchange (PSX).”

What’s TOMC going to do with the money?

Part of the Rs720 million goal was to be used for two specific facilities. The first is an offal processing facility in Korangi to process locally collected offal, costing about Rs167 million. The second is an offal production facility at Karachi Export Processing Zone (KEPZ) for exports to China and Vietnam, costing around Rs104.4 million. The remaining funds will be used to increase TOMC’s product portfolio.

Offal is the viscera and entrails of a butchered animal. Essentially the products made from the innards and remains of livestock that are not from the traditional, clean, ‘meat’ cuts. More significantly, TOMC proudly says that it is the only company that deals in white offal, which includes the harder to process but more in demand parts such as the brain, spine, bone marrow, etc.

The company also has another offal processing unit in Korangi with investment of Rs167.2 million to process locally procured offal. The remaining proceeds will be utilized for working capital purposes and further enhancement of TOMC’s product portfolio.

The principal purpose of the issue is to increase offal processing capacity by setting up 2 new facilities it will take up the offal processing capacity from 5TPD to 25TPD.

The company has mentioned one of the main purposes of the IPO is to generate funds to finance TOMC’s expansion plans. The company intends to enhance its processing capacity in the ‘high-margin’ offal category. Post expansion the offal processing category is expected to rise by 5 times to 25 metric tons.

Industry overview

Despite having immense potential, Pakistan’s meat industry has not shown significant growth in recent years due to FMD (Foot to Mouth) disease, lack of traceability (farm to fork), and lower yield (usable meat obtained from carcass). Lack of traceability mechanism makes it difficult for local exporters to penetrate the European Union as a market.

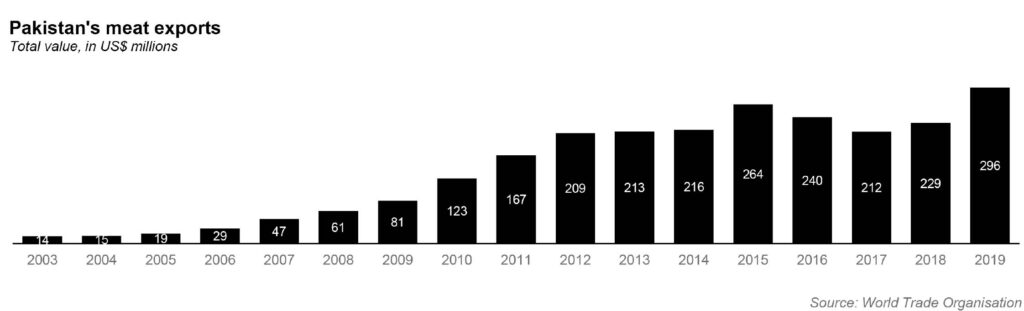

Pakistan’s meat and edible meat offal segment exports stood at $242 million in fiscal year 2019 as compared to $211 million in the previous year, an increase of 15%.

Muhammad Shahroz, research analyst at Insight Securities, a brokerage firm estimates that Pakistan’s meat exports are expected to grow by 25% in fiscal year 2020 in US dollar terms. The domestic meat sector is dominated by different players mainly Al Shaheer Corporation, Fauji Meat, PK Livestock, Al Tazij Meat, Anis Associate etc. Al-Shaheer Corporation and Fauji Meat are both also publicly listed companies.

Of these, TOMC’s major competitors is Al Shaheer Corporation (ASC) which has a presence in the export as well as domestic market, through its Meat One and Khaas brands. Analysts at BIPL Securities, a brokerage firm, state that ASC’s presence in the local space has translated into higher gross margin for ASC compared to its export-only competitors.

Despite this, TOMC has a better net profit margin than ASC. For the nine months ending March 31, 2020, TOMC’s net margin was 8% compared to 5% for ASC. Furthermore, with the addition of offal processing plants the net margin is expected to expand further.

Shahroz says that Pakistan’s major export destination is in the Middle East region. In terms of share in total export UAE, Saudi Arabia and Kuwait are top three destinations with 37.5%, 17.7% and 13.9% share respectively in 2019. He maintains that China and Japan are the biggest importers of meat, having shares of 14% and 8% respectively.

“We believe export to these countries will be a real game changer for the local meat industry and TOMC is eyeing for the Chinese market,” says Shahroz.

Key Strengths for TOMC

According to KASB Securities, a brokerage firm, the management of TOMC is one of the most experienced within the industry, spanning decades spread over several countries. It is the crown jewel in a fourth generation livestock processing merchant family. Faisal Hussain is the company’s CEO and the primary sponsor of TOMC with a stake of 71% in the company. He possesses over 21 years of experience within the offal processing industry and more than a decade of experience in the meat processing industry.

Hussain has pioneered several concepts within Pakistan’s meat processing industry including the introduction of vacuum packaging, which enhances the product’s shelf-life and enables exporting meat to longer distances.

As mentioned, the bulk of TOMC’s revenues originated from export receipts during fiscal 2019 (93%) with expectations of even higher inclination towards export receipts during fiscal 2020 (98%). The company has kept an export-oriented focus enabling improved margins. The export receipts also offer a hedge against the weakening rupee, allowing the company to further improve margins if the domestic currency depreciates.

The analysts at KASB also noted that a domestic footprint is generally a costly venture with heavy competition from the informal meat market. In Pakistan, the organised meat retail outlets generally price their products around 80%-100% premium over their informal counterparts to cover their expensive overheads. This pricing discrepancy generally compels the bulk of the domestic market to stick to the informal sector, resulting in underperforming sales.

Notable risks

Needless to say, no business venture is without its risks, and TOMC is no different. Analysts identify four key risks: the pandemic induced lockdown and their impact on supply and demand, the working capital constraints structurally built into the business model, rising domestic livestock prices, and the possibility of dilution for equity stakeholders as the sponsors convert their interest-free loans to the company into equity.

The coronavirus pandemic likely to subdue demand and constrict margins:

According to KASB Securities, the coronavirus pandemic has generated notable hurdles for the meat processing industry. The outbreak and the resultant lockdowns have greatly disrupted supply chains across the globe including sharply limiting port activities.

These factors are expected to come into play for the export-oriented company. The limited sales outlook may likely compel the company to offer discounts to ensure adequate plant operations during fiscal 2021 and onwards.

Moreover, the pandemic is also expected to increase the hygiene and quality criteria for most meat export processing units including TOMC. This fact is likely to enhance the exporting costs for the industry and may limit access to certain markets.

Furthermore, the Covid-19 led restrictions have greatly hampered the demand of processed meat from key purchasers, including restaurants and hotels, a scenario that significantly limits the commodity’s growth till the pandemic situation normalises.

A constrained cash-flow cycle:

The company largely procures its cattle from the informal market, which generally deals in cash. The company, however, receives around 30% of its export receipts at the time of sale/booking while the remaining 70% is received upon the issuance of bill of lading.

This scenario creates a potential for a cash-crunch and enhances the company’s working capital requirements. Case in point, based on the company’s FY19 financials, its trade debt stood at Rs 823 million while loan advances stood at Rs293 million.

For this reason, 62% of the projected IPO proceeds (Rs448 million) will be utilised for TOMC’s working capital.

Rising domestic meat prices to further augment procurement costs:

According to KASB Securities’ analysis, domestic beef and mutton prices have a very high correlation with inflation. While the rupee depreciation supports the company’s revenue receipts, it also augments the country’s inflationary outlook, reflecting in domestic mutton and beef prices. Consequently, meat prices have grown at a 5-year average growth rate of 9%. Higher meat prices generally result in higher procurement costs and restricts margins growth.

Interest-free loans from sponsors may potentially get converted:

Based on the available financials, the company has Rs159 million in interest-free loans from the sponsors on its books. These loans have the potential to become interest-bearing or have an equity conversion option after the IPO.

KASB predicts that conversion to an interest-bearing loan may enhance finance costs by Rs13 million while an equity conversion option may increase the company’s outstanding shares by 9 million (8% of post-IPO shares) if converted at the floor price.

Is it a good buy?

Arsalan Hanif, an investment analyst at Arif Habib Ltd (AHL) says the management believes volumes to grow by an average of 20% in the next five years as the company is currently seeking approvals to export to China, Russia and Thailand because demand of meat related products is high in these countries and they are untapped markets. For him, TOMC, being an export-based company, conducts business in foreign currency (USD) which is providing a natural hedge against rupee devaluation.

However, when asked, some analysts say the floor price for TOMC is too high, and it should have been between Rs12 and Rs15. TOMC’s CEO Faisal Hussain says: “TOMC had an EPS of Rs3.04 last year, and this year we are expecting much improved earnings, in fact we expect the earnings to continue to improve and this is the reason why we believe that if the market basis price on fundamentals, TOMC will become a choice investment for many very soon but at a much higher rate. To be honest, I really don’t understand that our floor price is based at a PE of 4.56X and any performing food sector entity should be valued much higher,” Hussain said.

When asked about any additional expansion plans apart from the one listed in the prospectus. He says, currently, they are focused on the plan at hand, which is to successfully commission the two plants. “Once consistent numbers are driven, of course the next step would be to expand organically within our current operational areas. There is still much room for growth in these areas,” he says.

Despite Covid-19, Hussain is confident, and says that right now, household usage exports have massively increased, and the company wants to take a hold of this market until the hospitality sector gets back on its feet.

“We are getting some good responses from good prospective investors despite the pandemic situation. The business has grown, and it seems the investment community is seeing the strong fundamentals of the business, so no, we don’t believe that TOMC’s IPO was impacted.”

The international competition

Of course, as an export-oriented company, TOMC is competing on a larger level where halal meat processors from around the world are also trying to get a slice of the market. Hussain says that who the competition is becomes a very relative question, based on which product we are talking about. “For fresh chilled meat, there is no international competition for Pakistan’s meat for destinations like the Middle East. For the frozen meat segment, our meat competes with South American suppliers as our meat qualities are comparable,” he says.

“We are also halfway through having government to government protocols established with China, we reckon that in another year or so, the exports should start for mainland China. This will be a big market for us.”

“We have tried to keep ourselves ahead of the curve through close monitoring of the international meat sector dynamics and learning from what products and processes are being followed in the developed world countries,” he says.

TOMC and a few other companies has made a good breakthrough in the development of so far untapped agri-oriented industrial / export initiative, which if taken up on scientific lines may even surpass textile sector at exports end. In this context, scientists /experts on the university as well as bureaucracy level need to come up to increase yield and quality in the export as well as local market where sky is the limit, resulting prosperity to the Pakistani es.