KARACHI: Fauji Foundation, owner of Askari bank wanted to buy Silkbank. Well, they do not want to anymore. In a notice to the PSX, Silkbank states that Fauji Foundation is no longer proceeding with the due diligence of Silkbank.

However, there is a new buyer on the block, Habib Bank Limited (HBL), which has requested Silkbank Limited to apply to the State Bank of Pakistan to proceed with the due diligence of the Consumer Portfolio of the bank comprising of credit cards, running finance, and personal installment loans.

The Board of Directors of Silkbank Limited have approved this on April 7, 2021.

Fauji Foundation says no to Silkbank

Previously, on January 28, Fauji Foundation expressed interest in acquiring the majority stake of Silkbank.

“Silkbank hereby notifies the Pakistan Stock Exchange that the Board of Directors of Silkbank Ltd in its meeting held on January 28, 2021, has subject to the approval of the State Bank of Pakistan, given its in-principle approval to allow Fauji Foundation to conduct the required due diligence,” the notice to the PSX read.

Had this gone through, it would be an indirect merger attempt considering that Fauji Foundation has a controlling stake in Askari Bank.

However, as per the recent notice to the PSX issued on April 8, 2021, “Fauji Foundation will not be proceeding with the due diligence process of Silkbank Limited in pursuance of its application in this regard.”

Does it make sense to buy Silkbank?

To keep it simple, Silkbank is an ailing bank.

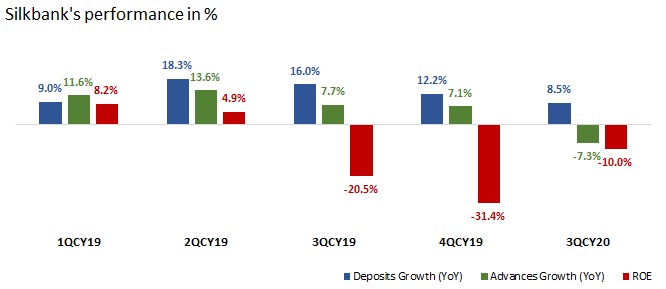

The bank’s market share has been low, hovering around 1pc of the total banking industry’s deposits for the last decade. Still, the bank ended up at Rs148 billion in 2019. The compounded annual growth rate (CAGR) for deposits for Silkbank for the period between 2014 and 2019 is 16.7pc, which is higher than the industry CAGR for the same period, at 11.9pc.

Silk bank witnessed significant stress in its lending assets during the pandemic year which jumped its infection to 32pc in 9MCY20. Recently, it announced that HBL is interested in acquiring its consumer portfolio which currently has assets up to Rs121bn, the sector alone contributed Rs1.09bn to the bank’s profitability in 9MCY20; its sale to HBL would enhance HBL overall consumer segment exposure and its profitability eventually.

“It’s interesting to notice that SILK’s management in 9MCY20 accounts shared its plan to dispose Other Real Estate Owned (OREO) assets and use the proceeds to further grow its consumer banking segment,” Aba Ali Habib Equity Analyst Zubair Jatoi said.

Another cause of concern for the bank is the return on equity numbers for the last decade. Usually, an ROE above 10pc is just about alright. But between 2009 and 2018, the ROE was only above 10pc in 2013 (at 13.3pc). For every other year, it was either below (in 2014, 2016, 2017, and 2018) or worse, the ratio somehow managed to be negative (in 2009, 2010, 2012, and 2015). This means that the net income was negative in those years.

“If the acquisition does go ahead, fundamentally I think it may be at a discount to its book value. The bank is in losses since the last few quarters,” says Faizan Khan, senior equity analyst at Arif Habib Limited.

Khan adds, “Silk’s Capital Adequacy ratio is also below the minimum required levels so the bank is not in very good health.”

Who owns Silkbank?

And who owns Silkbank? According to Silkbank’s latest annual report for the year ending December 2019, around 62.39pc of the bank’s shares are held by associated companies and related parties. This can be further categorised as: the Arif Habib Corporation holds 28.23pc, former finance minister Shaukat Tarin holds 11.5pc, the International Finance Corporation holds 7.74pc, Zulqurnain Nawaz Chattha (one of the owners of Gourmet Foods) holds 7.47pc, Nomura European Investment Ltd 3.93pc and Bank Muscat holds 3.48pc.

For most of the last decade, the bank was headed by Azmat Tarin, the younger brother of Shaukat Tarin (a key investor in the bank).

HBL buying silk bank is a great news. This will have great impact on silk bank customer care services and it’s a great opportunity for HBL as fauji foundation is not any more interested. Thanks for update.

Great news for Silk Bank customers.

An opportunity for both Bank to share the growth,equilly for the banifits of people of Pakistan, insha’Allah

HBL bank already third Class service & Bank.

i think hbl bank Sale to Bank Al Habib good service and banking.

I hate HBL & UBL both bank too Ghattia

Adi Grena Great ideas!. Another great post … thank you! Love these and the tutorial for the bows.1617986628

Its a great opportunity for the Silk Bank employees….!!

Why is HBL acquiring when they are closing and merging branches to consolidate themselves? Makes no sense. Just as they over paid for PICIC asset management and everything else. Meanwhile the “managers” of HBL continue to buy expensive houses and cars. Something is not right and more digging is required.