What has Pakistan Cables been up to? In the midst of one of the worst years for construction (2020) and the best years for construction (2021), the company has been quietly sluggin away at its expansion plan – that it had prepped for all the way back in 2018. In a notice sent to the Pakistan Stock Exchange on August 17, the company laid out its quarterly progress report on the utilization of its right share funds.

To recall, in April 2018, the company had offered 25% right shares for the purpose of acquiring machinery for its manufacturing expansion project, by offering 7,115,594 shares to existing shareholders at a price of Rs160 per share (including a share premium of Rs150 per share). As per the notification, the right shares were fully subscribed by the shareholders and the proceeds from the issue were credited in the company’s bank account at end of July 2018.

Today, the full proceeds of around Rs1,138 million have been spent by the company on construction and civil works, as of June 30, 2021. The company had purchased a 42-acre plot of land in Nooriabad-SITE in 2018 for a new manufacturing base, with most of the work intended to be completed by end 2021. After the site is done, manufacturing operations will be split between the new Nooriabad factory and the current S.I.T.E factory.

Not bad for a company that essentially has perfectly timed its expansion plans to coincide with the biggest boom. Pakistan Cables has been one of the strongest performing companies on the exchange, even during its rough years. And the latest 2021 financial results only point to that.

Here’s how it got here: the company is the brainchild of Amir Sultan Chinoy, an industrialist born in British India in 1921. He migrated to Pakistan and almost immediately had a massive impact on the industrialisation of the nascent country, incorporating International Industries (it initially dealt in electronic instruments). Chinoy initially named the company Sir Sultan Chinoy & Co. Ltd., after his father. In 1953, Chinoy sponsored the establishment of Pakistan Cables Ltd, as a joint venture with British Insulated Callender’s Cables (BICC).

The company was the pioneering company in Pakistan’s cable industry, producing conductors, cables, and wires for the new country. In 1984, the company started extrusion of anodized aluminium profile sections for architectural applications. In 1996, the company set up a state of the art plant to manufacture High Conductivity Oxygen Free (HCOF) Copper Rod. In 2008, the company set up a PVC Compounding Plant to manufacture high quality electric cable grade PVC compound. The company also set up a 2-MW gas fired trigeneration Power Plant, allowing it to be mostly self- sufficient for its electricity needs. Between 2010 and 2017, the company was affiliated with General Cable, a Fortune 500 company headquartered in the United States

Today, the company can boast a fair bit of ‘onlys’: it is still the only wires and cable manufacturer in Pakistan listed on the Pakistan Stock Exchange; the only cable company in Pakistan to have a fire testing laboratory for flame propagation testing; and the only manufacturer to launch an an e-store on September 2019 (conveniently months before the pandemic). That store is now present in 50 cities in Pakistan (the overall trade network extends to 190 towns and cities).

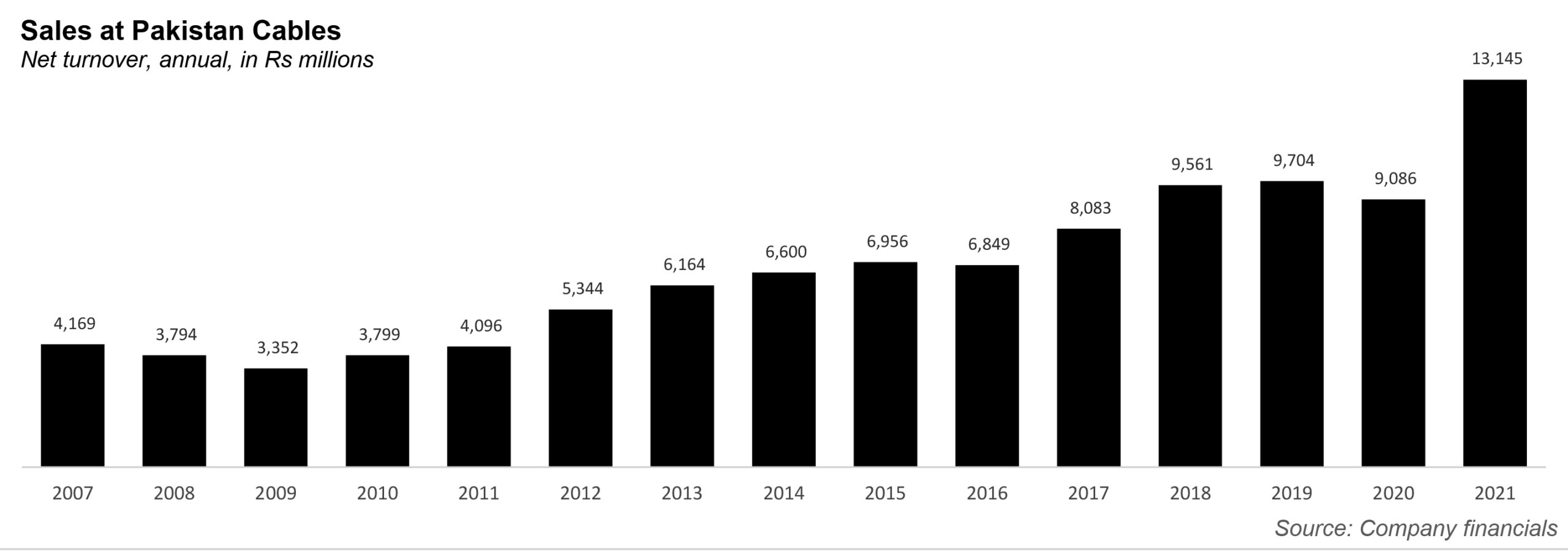

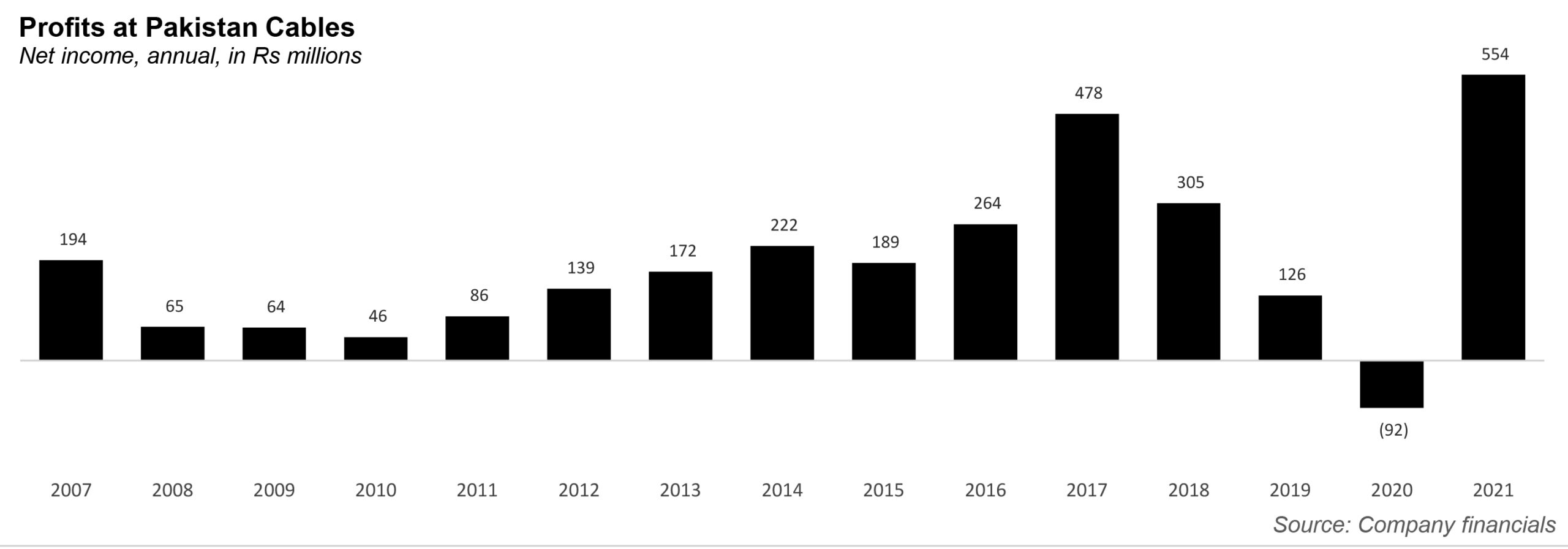

The company’s revenue grew steadily between the years 2009 and 2015, from Rs3.3 billion to Rs6.9 billion. After faltering somewhat in 2016, revenue jumped to the Rs9 billion range in the 2017-2020 years. However, steady profits have been more elusive. The company had some good years between 2013 and 2016, in around the Rs200 million range, and then a very good year in 2017, with profits of Rs478 million. But profits actually declined in the years after that – and the company even posted a loss of Rs92 million in 2020.

What happened? According to that year’s annual report, it was not actually the pandemic that affected the company – after all, sales only dipped 6%, because of government lockdowns. Rather, it was the devaluation of rupee against the dollar which increased the cost of the company’s inputs. The exchange rate loss on borrowings in US dollars and high interest rates also made the company’s finance cost jump.

The company is also vulnerable: the prices of cables, copper rod, conductors and aluminium extrusions are closely linked to the global markets for copper and aluminium. Both base metals are traded on the London Metal Exchange (LME), the world’s premier non-ferrous metals market. The price of both these metals is therefore determined at the LME and any fluctuations in copper or aluminium prices have a direct effect on pricing.

Still, the company was optimistic. As it oted in is report, it was “confident, that fundamentally there is a

strong need for infrastructure development and construction in Pakistan, particularly with lower

borrowing rates and the recent construction / real estate packages announced by the government. This is expected to drive the demand for wire and cable in the medium to long term.”

That is exactly what happened: not just with new government policies, but also the State Bank of Pakistan mandated the banking sector to increase lending towards construction and real estate to equal 5% of their total private sector lending. And the results speak for themselves: the company’s 2021 revenue stood at Rs13.1 billion, the highest it has ever been. It also recorded its best profit, at Rs554 million. And with its new plant, there is bound to be more growth.

seasoning of timber