There has been a lot of talk that the latest industrial package offered by the government under Income Tax (Amendment) Ordinance 2022 will lead to an inflow of dollars.

This article explains why this might not be the case.

The Benefit of Investing

Tax credit for foreign investment for industrial promotion. The company [set up under the package] shall be entitled to a one-time tax credit equal to 100% of the amount remitted and credited in rupees in the bank account of such company against the tax liability for the tax year in which commercial production commences.

Who is eligible?

A non-resident Pakistani (NRP) citizen having continued non-residential status for more than five years; or a resident individual having foreign assets declared in terms of section 116 or 116A by the 31st December, 2021, (meaning it is not an amnesty for undeclared assets).

What are the conditions?

Investment is required in equity of a company incorporated on or after the 1st March 2022. The company shall be an industrial undertaking in Pakistan. Equity shall be at least Rs 50 million with funds remitted into Pakistan through proper banking channels as per the procedure to be prescribed by the State Bank of Pakistan, at any time up to the 31st December 2022. Commercial production should commence by the 30th June 2024.

Where no tax is payable by the taxpayer in respect of the tax year in which the commercial production has commenced or where the tax payable is less than the amount of credit, the amount of the credit, or so much of it as is in excess thereof, shall be carried forward and deducted from the tax payable by the taxpayer in respect of the following tax year and so on, but no such amount shall be carried forward for more than five tax years.

To summarize, the package allows the investor to earn income tax-free from the industry set up by her under the package equal to the money remitted from abroad as rupees into the company’s bank account. The money should be remitted by December 31, 2022 and commercial production should start by June 30, 2024. The equivalent tax-free income should be earned within five years.

The risks facing an industrial undertaking

The purpose of limiting the tax credit to investment in industrial undertaking is to discourage the setting up of trading businesses or service-oriented businesses under this incentive scheme. The intention is to sow the seeds for industrial growth in Pakistan.

Industries are long-term investments. It takes 12-36 months to set up before production can take place and the recovery of investment can take up to a decade unless the industrialist over invoices. Investments are made if the projected rate of return on the investment is higher than the hurdle rate. The higher the risk of the return, the higher the hurdle rate.

Some of the factors that an investor will consider for calculating her hurdle rate are; Opposition’s long march, the no-confidence motion on the horizon, and political instability, Elections due in a year, Inflation, Devaluation (the dollars will be converted into rupees at the rates prevailing between now and Dec 31, 2022. The tax credit ceiling will be based on this amount. Taking an extreme scenario, if the rupee devalues by 25% by the time the company starts making a profit, the tax credit has reduced by 20% in foreign exchange terms), Interest rate risk, Budget deficit, Current Account deficit, Bureaucratic red tape for getting the tax credit, Law and order situation, Readily available infrastructure and Project completion risk as the project has to start commercial production by June 30, 2024, to qualify for a tax credit.

The aforementioned isn’t a comprehensive list or a mutually exclusive list. One may rightly point out that investors in real estate plots also face the same risk, but they couldn’t care less about the factors listed above.

An industrial undertaking isn’t like an investment in a plot. Setting up an industrial unit requires dealing with the bureaucracy of FBR or all other bureaucratic headaches of permits, licenses, bank account openings, utility connections, or the challenges of hiring employees, firing them, training them, dealing with buyers, suppliers and whatnot that come up when someone sets up an industry.

Deriving a hurdle rate

Finance textbooks provide a methodology of calculating a hurdle rate by starting with a weighted average cost of capital (WACC) and then adding a risk premium to it. In real life, investors usually go by rule-of-thumb or arbitrary numbers such as the projects should have a minimum IRR of 12%.

The other method is to use a rate on a sovereign instrument (a proxy for risk-free rate) and add to it an arbitrary risk premium of 2% – 5% based on the risks the project faces (some of which were listed in the previous section).

Sovereign risk-free rate

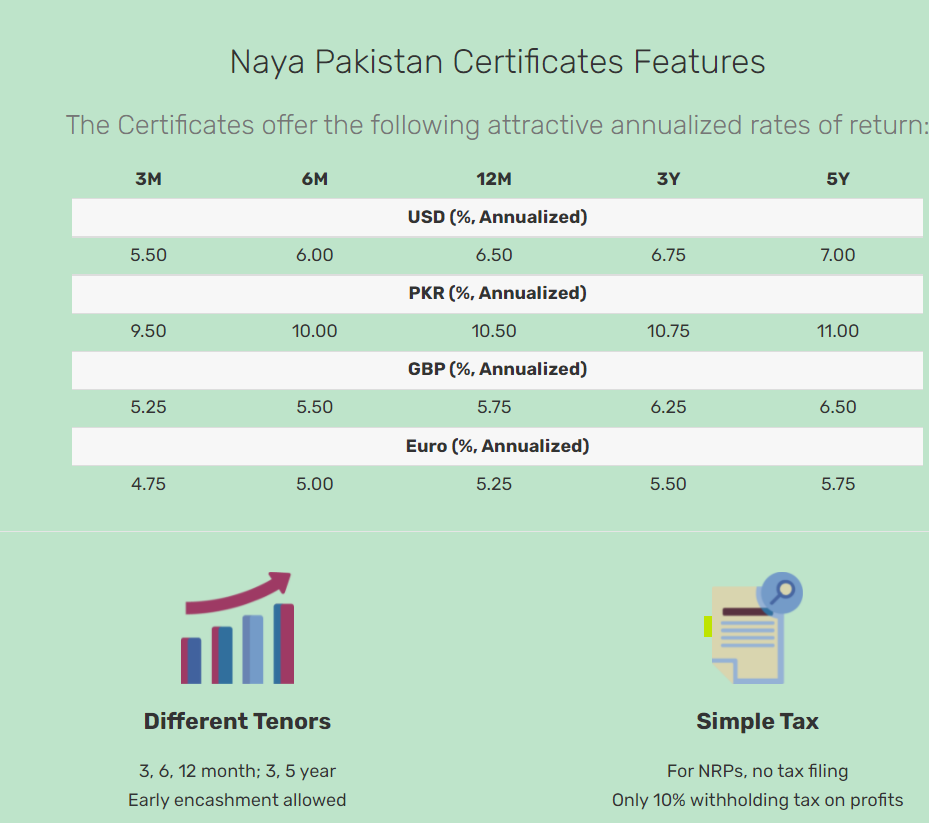

For a non-resident Pakistani (NRP), the closest thing to invest in a risk-free instrument is Reza Baqir’s Naya Pakistan Certificate (NPC). The advantage of NPC is that if one invests in a foreign exchange denominated instrument, it eliminates the foreign exchange/devaluation risk. The below table lists the profit offered on dollar NPCs as per the SBP website.

It should take at least 5 years from investment to earn enough income to benefit from the tax credits, thus the 5-year rate provides a good comparable.

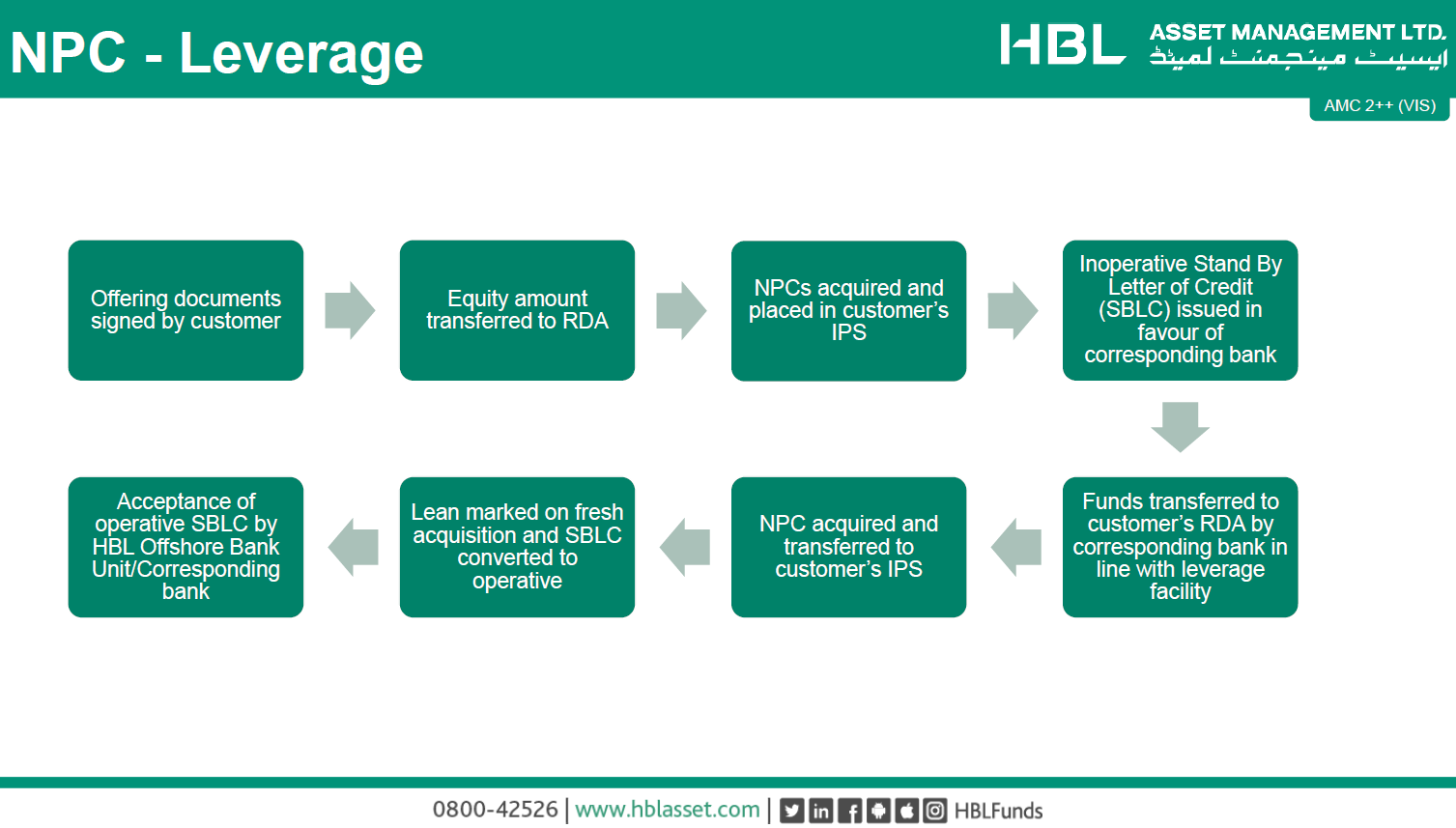

Leveraging it up

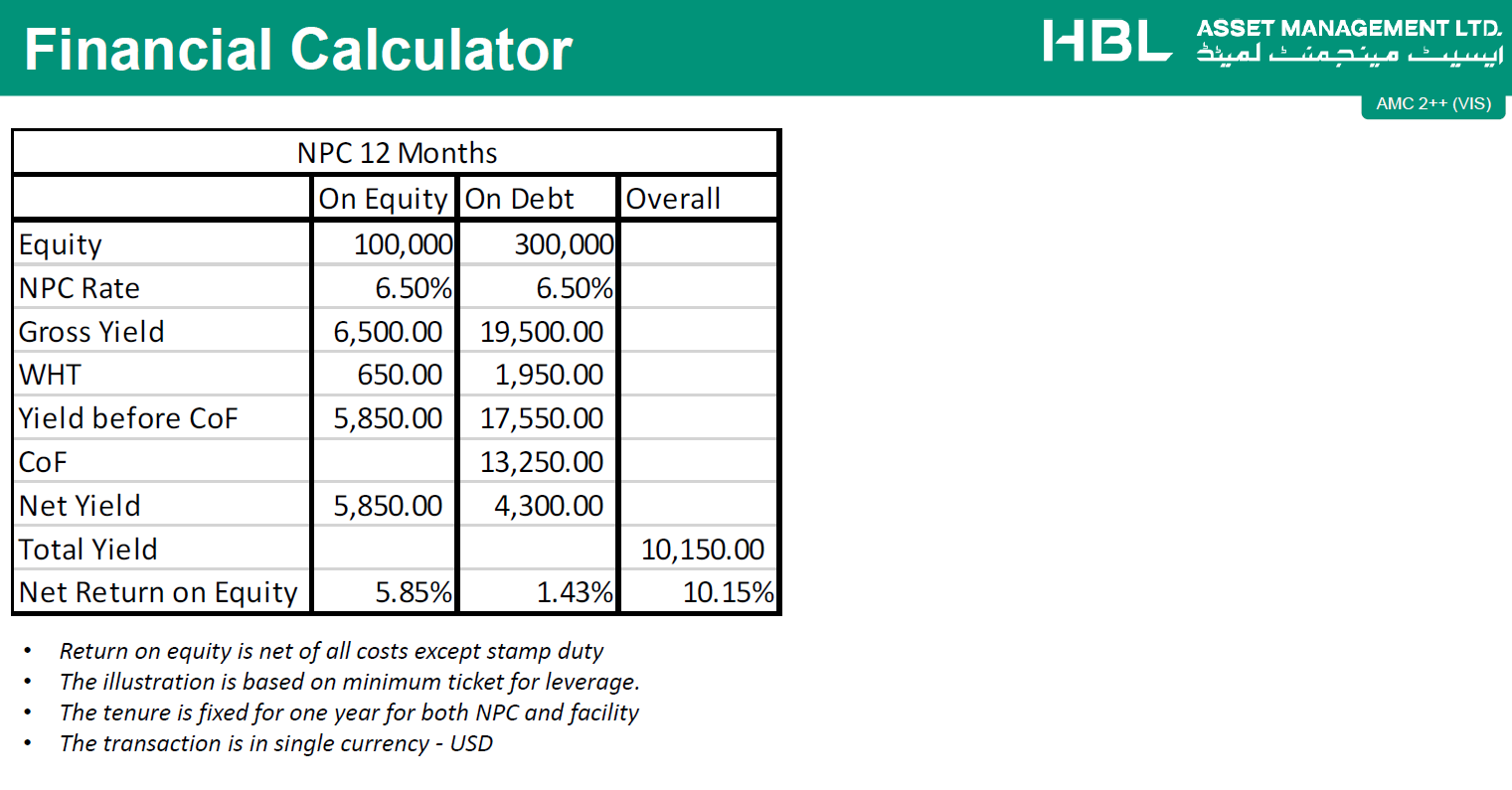

Let’s start with dollars. The 5-year dollar profit rate is 7%. HBL and UBL are offering 3x leverage on this investment.

By leveraging it up with HBL/UBL, the NRP is getting a 10.1% on a 1-year NPC instrument. It is reasonable to assume that a leveraged return on a 5-year instrument should be at least 11%.

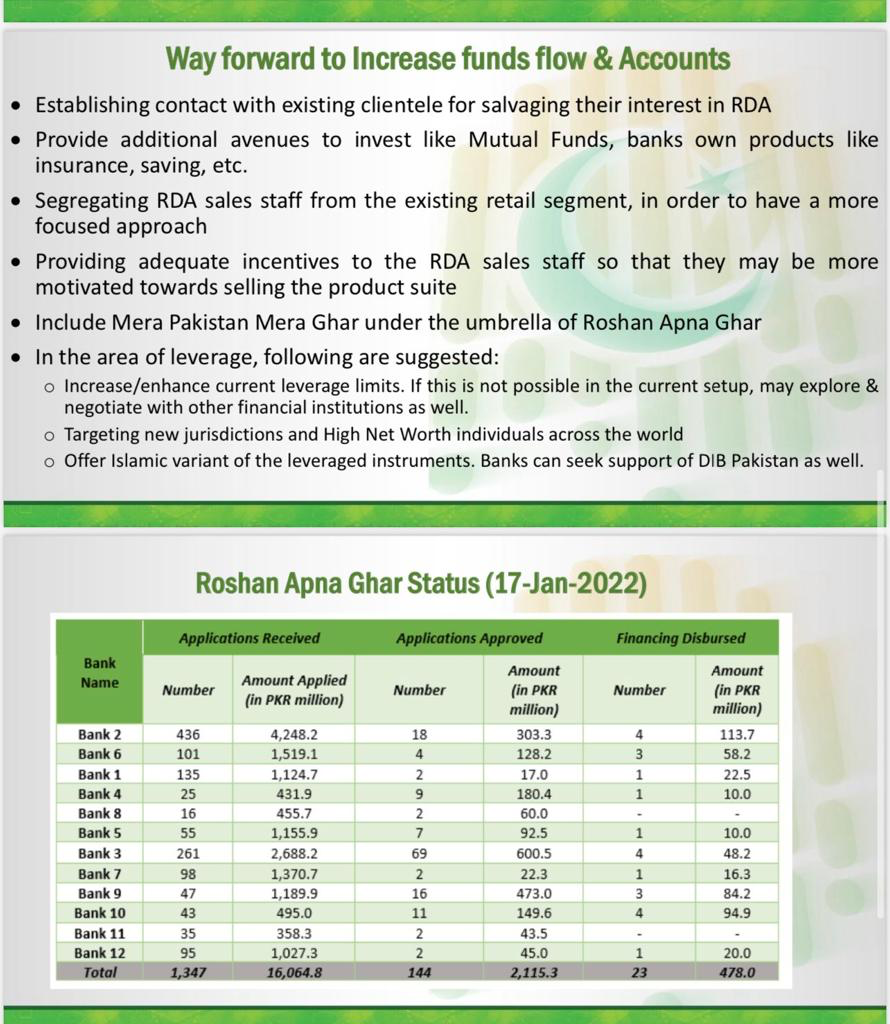

SBP encouraging more leverage

Below is a slide from SBP’s presentation at a meeting held with Bank CEOs on January 19, 2022. SBP is imploring the banks to increase the leverage offered on NPCs.

If the leverage is increased to 4 times of that in the HBL Excel sheet presented earlier, the return on a 12-month instrument comes to around 16%. The leveraged return on a 5-year instrument would not be less than 17%.

Based on the risks highlighted in an earlier section, we can add 2% arbitrarily as a risk premium. However, as the profit on the industrial unit is not repatriable, we will ignore this assumption for now.

Summary

The closest thing to a sovereign risk-free instrument for an NRP contemplating investment in Pakistan is the NPC.

Even with the 3x leverage that HBL and UBL are offering, the risk doesn’t increase as the return is guaranteed by the Government of Pakistan. Thus, an NRP can earn at least 11% per annum. in dollar terms by investing NPC through HBL and UBL. The profit, as well as the principal amount, is 100% repatriable in foreign exchange guaranteed by the government of Pakistan.

We are ignoring the 4x leverage as, despite the fact that SBP is encouraging it, we don’t have any evidence if HBL/UBL is offering it. If HBL/UBL starts offering 4x leverage, all NRPs might as well beg, borrow or (steal) to invest in the short-term NPCs at 4x leverage.

Alternative Investment

You may say that using NPCs as a proxy is not fair. The comparison between investments isn’t apples to apples. NPCs don’t have the same risk characteristics as industrial units. Fair enough. Whereas it is hard to come up with a perfect hurdle rate, we can try to find an investment whose characteristics closely match that of the industrial investment.

Let’s consider the favorite investment of Pakistanis (overseas and underseas) i.e., real estate. Not just any real estate, rather a project where Reza Baqir is providing additional benefits to NRPs. Yes, you guessed it right. Real estate investments through Roshan Digital Account or Roshan Apna Ghar scheme.

Source: Meezan Bank

Earlier, DHA allowed investment in its plots through Roshan Digital Accounts with the same terms, i.e., full repatriation of sales proceeds.

Under the income tax laws of Pakistan, no capital gains tax is payable if a property is held for 4 years. Thus, an NRP can invest in a commercial property, a residential property, or a residential plot through Roshan Digital Account and repatriate the entire proceeds tax-free if he holds on to the property for four years.

Bottom line

The NRP has to decide between three options:

Invest in Reza Baqir’s Naya Pakistan Certificate and earn 11% in dollar terms after withholding tax, hassle-free and guaranteed by the government of Pakistan and fully repatriable. As close as you can get to risk-free.

Buy real estate under Reza Baqir’s Roshan Digital Account, sit on the real estate whether a home or a plot for at least 4 years, and then repatriate all the sale proceeds tax-free. It has political risk and foreign exchange risk.

Invest in setting up an industrial unit under PM Imran Khan’s Foreign Investment for Industrial Promotion Package for a tax credit equal to the equity investment, wherein the tax credit will be calculated at the exchange rate prevalent when the equity investment is made and not when the company incurs the tax liability. There is no repatriation guarantee and setting up an industrial unit requires exposing the investment to operational risk in addition to political and Foreign exchange risk.

A rational choice for NRP with surplus liquidity, would be option 1 or option 2. To use the term that economists love, investment in Reza Baqir’s hot money packages will crowd out PM Imran Khan’s Industrial Promotion package.

Very informative article and best information collected by Author with the title industrial package compete with roshen digital account in attracting dollor, best information collected in fugures

Superb information.

Where I might get more information or assistance for the leverage accounts.

Also I from UBL.

Sounds to good to be true.