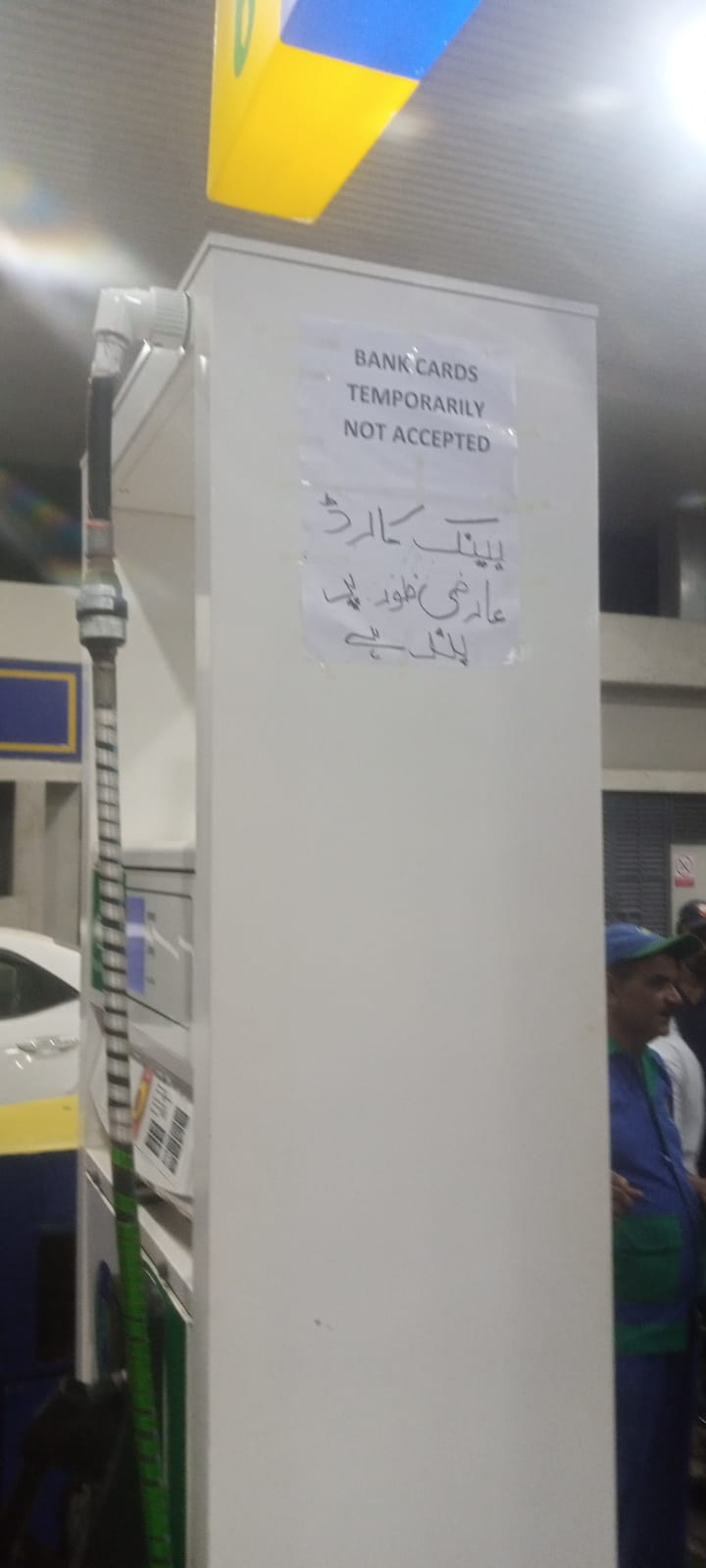

A crisis is brewing in the petroleum industry, and it may result in you being unable to pay for fuel using a credit or debit card at petrol stations. Oil marketing companies (OMCs) have already started stifling card payments at petrol stations, dealing a blow to digital payments which had only recently started kicking off.

But why are petrol stations not accepting card payments, and what does it matter to OMCs how end-consumers pay for fuel? Because there is a cost associated with selling fuel on card payments, and it is a burden that has put OMCs under a stress test. That is why they have been stifling card payments all together, and are making a quick buck while they do it.

While this has all been brewing in the background, it came to a head officially in a letter sent by the Oil Companies Advisory Council (OCAC) to the State Bank, asking its governor to decrease the charges paid by OMCs on card transactions.

The problem is for the entire industry but PSO only has so far been the one to tell its dealers that it will no longer be able to foot its share of the MDR bill. Dealers can either continue accepting card payments at their own expense or discontinue accepting cards completely. Dealers on the other hand have been ingenious: they have either stopped accepting card payments, or have started passing it onto consumers.

The effect has been enormous. From numbers obtained by Profit, card transactions at PSO declined from 145 million transactions on August 31 to 60 million on September 1. That is at PSO alone. Shell has also said that they have received reports of Shell dealers either not accepting cards or charging customers on top, while Shell has not given its dealers any clear guideline to do so. No numbers were shared by them of volumes or value of card-based transactions.

This has put OMCs in a disarray: While card payments form a good chunk of overall sales especially in the urban centres like Karachi, Lahore and Islamabad, OMC’s inability to foot the bill means they will see a drop in volumes on card sales because it constricts their margins.

The problem is double-barrelled, however. The central bank has for long been gunning to push digital payments and in January last year adjusted the merchant discount rate (MDR) to make POS acquiring a worthwhile business. OMCs now want that MDR revised for the petroleum industry and be fixed at 0.3%, according to the OCAC letter to the central bank. This is not only going to pull down volumes of digital payments, the bottleneck here is that if the SBP revises the MDR to that much, it would impact acquiring business as well as PSO/PSPs and payment schemes.

The situation is a confusing one where dealers are not willing to accept card payments, killing card payments at pumps, unless MDR charges are reduced. And if card charges are reduced, those in the payments business would be unwilling to push card payments, killing digital payments again. The eventual casualty is digital payments which the State Bank has long been gunning to push.

How does the MDR work and how does it affect earnings of OMCs and their dealers? It all lies in margins.

Earnings by a whisker

In July this year, the Pakistan Petroleum Dealer Association (PPDA) went on a nationwide strike to demand that the government increase the commission of dealers . The association wanted this commission to be increased from 3.5% to 6% as promised earlier by the government.

There are various components that help determine the price of fuel in the country. Dealership margins are the margins a dealer (a pump owner in this case) gets. These used to be in the form of percentages but have now been fixed per litre.

Back in November, the dealers went on a strike asking for revised margins.

Petrol pumps would earn PKR 3.91 per litre on petrol and PKR 3.30 per litre on diesel. Profit made by petrol pumps per litre was 2.75% which the PPDA had demanded be increased to 6%. If this demand was met, the profit made by pumps on petrol would be PKR 8.75 per litre and PKR 8.5 on diesel.

Instead, the government negotiated with the dealers and they would now charge PKR 4.90 per litre of petrol. Essentially, an enhancement of 99 paisa in the existing margin of petrol and 83 paisa in the existing margin of high-speed diesel.

In 2016, the Economic Coordination Committee (ECC) decided that margins will be revised annually by the amount of average Consumer Price Index (CPI). The period for this average changed in 2019, but the rule remained the same. Despite that, over the past five years, the margin was only revised four times for petrol and three times for diesel. There have been threats of strikes every time.

Before November 2022, a revision in margins took place in April 2021 which was after a delay of nine months for petrol. The government, over the past few months, has been delaying the revision stating that the PIDE study would be used as a gauge to revise margins. The study, however, is completed yet the government was still not keen to revise rates.

In addition, if you link this to the fuel shortage of June 2020, the government’s relationship with fuel pumps isn’t that great to begin with. While inflation remains a concern and with fuel prices rising internationally, the government feels compelled to make fuel pump owners wait.

Petrol pumps can be company-owned, for instance by PSO, Shell, Byco or Total, or these OMCs could have dealerships to run it. Dealer-owned petrol pumps are where an individual buys a “franchise” of a petrol pump, follows all legal procedures, and sells fuel on behalf of an OMC. They earn through the dealership margin, which was revised after the strike by the association.

On the other hand, OMC margins are fixed flat at Rs3.68 per litre.

The bulk of the transactions on fuel stations are cash-based. But because the volume of sales of petroleum products, high speed diesel and petrol is so high, even a small percentage of card payments would translate into billions of rupees worth of transactions paid through payment cards. There is no uniform number of how much of fuel sales are paid through card but we will try to give readers a sense of proportion of card based payments against cash payments through some estimates received by Profit.

According to an official at an OMC, the overall card transactions for fueling transactions would be around 15% of the overall sales. According to one of Profit’s sources, PSO last year made sales worth Rs18 billion on payment cards, which is estimated to be about 30% of its total sales on retail fuel stations. In its response to Profit, PSO said that less than 2% of their transactions pertain to bank cards.

While the estimates of 15% sales on cards is a number overall for the country, this number is significantly higher in urban centres such as Karachi, Lahore and Islamabad where the demographic is relatively affluent and own bank accounts and linked payment cards such as debit and credit cards. The proportion of sales on cards could be as high as 30%, with some days touching 50%, according to a PSO dealer operating a fuel station near Lahore’s Ganga Ram Hospital.

According to some conservative estimates provided by another petroleum industry official, about Rs92 billion worth of sales are made on debit and credit cards yearly at fuel stations across the country. From what OMCs earn from the Rs92 billion worth of transactions, MDR charges eat away most of it.

With such high volumes on cards in urban centres, OMCs are worried that the MDR being charged right now is eating away at their margins, especially because their own margins are regulated by the government and the increase in fuel prices hasn’t really increased their margins. On the other hand, dealers negotiated their margins with the government but contend they are not enough, and that the MDR they pay on card transactions is eating away their margins.

How is that exactly happening? If you go to a Shell fuel station today and buy one litre of petrol priced at Rs234, only Rs3.68 go to the OMCs. That’s a margin of 1.5% that OMCs earn per litre of petrol. On the other hand, dealers get Rs7 per litre out of the total price, which is a 2.99% margin for the dealers.

Now take the case of Shell, which on average is charged 1-1.2% MDR depending on the bank or fintech company it uses the POS machines of, for acceptance of card payments. OMCs run retail fuel stations on their own as well through dealers. At the stations that are company-operated, the OMC bears all the MDR charges itself but at dealer-operated stations, the oil marketing company shares the MDR charges with the dealers at pre-negotiated rates.

The arrangement can vary for each OMC with its dealers. For the sake of understanding, let’s say that Shell bears 50% of the MDR and its dealers bear the remaining 50%. So if it is 1.2% MDR charged to Shell per litre, that is Rs2.80 on a debit card.

(Note: MDR on credit cards is higher than debit cards. But since credit cards are very small in number as compared to debit cards in Pakistan, this analysis is restricted to debit cards only)

In a 50/50 arrangement, Shell pays Rs1.4 per litre extra for accepting payments on a debit card of a certain bank. Its earnings per litre come down from Rs3.68 per litre to Rs2.28, or a margin of 0.97% per litre. A Shell dealer’s margins on the other hand falls from Rs7 to Rs5.6 or 2.3% before FED charges.

To understand the scale of the problem, lets broaden it to the total estimates for the sales on bank cards. According to our source in the industry, Rs92 billion worth of sales are on payment cards. At 1.5% margin for OMCs, only Rs1.38 billion can be earned as margin for OMCs. Assuming a 1% average MDR, though MDR can be even higher than this, Rs920 million goes in MDR charges and OMCs only get Rs460 million.

In their response to Profit, in their case, PSO said that approximately 1.5% MDR plus taxes and FED charges are added to the sale price of petrol and high-speed diesel. This amount adds up to eventually become Rs4 for petrol and Rs4.18 for high-speed diesel, higher than the margins PSO has for these products, turning them losses on card payments.

The petroleum industry operates on thin margins and slightest additions of costs make the margins razor thin. The industry is already facing a meteoric fall in demand while costs of operating a fuel station have increased.

Consequently, the OMCs have had it rough on digital payments and decided to do something about it. On August 22, the Oil Companies Advisory Council (OCAC), the official body representing the oil industry stakeholders such as refineries and OMCs, wrote a letter to the State Bank governor apprising him that the petroleum industry was bearing the brunt of being regulated by the government.

The OCAC pleaded its case that because of being regulated, OMCs and dealers worked on fixed margins set by the government and any costs incurred in their operations could not be passed on to the consumers like they can be in other sectors. In the letter, the OCAC apprised the governor that the MDR being charged by banks was eating away the gross profits of OMCs as well as their dealers.

The OCAC official communication requested the State Bank to fix the MDR at 0.3% for the petroleum industry.

The State Bank of Pakistan is the de-facto regulator of everything banking and financial technology, and as a regulator wants to see digital payments thrive. In the current macroeconomic scenario, however, OCAC’s stance is that in the current arrangement, digital payments at retail fuel stations are going to suffer if the MDR is not fixed. And instead of each OMC going individually to banks to negotiate MDR which the banks would most likely refuse because it reduces their business from payments, it is perhaps more convenient that the SBP itself tells the banks to fix the merchant discount rate, otherwise digital payments will suffer.

What was not officially communicated, however, and it would have perhaps eventually going to come to this, and in our case it came only a week later that the OMCs would not be willing to continue bearing charges on card payments while their own margins were regulated by the government. Consequently, the biggest OMC in the industry, the state-run Pakistan State Oil (PSO), informed its dealer-run fuel stations that it had exhausted its funds and could not make further allocation towards MDR charges it shares with the dealers.

Killing digital payments (and making a quick buck while you do it!)

OMCs’ case against the MDR that they pay right now is very well-grounded. The volumetric sales of petrol and high speed diesel have remained steady over the course of the past 12 months. However increases or decreases in the regulated pricing of these products has affected the overall sales of the industry.

An interesting insight that can be derived from the OCAC data on sales of these products is that sales of both petrol and diesel spiked immediately following the onset of the Russia-Ukraine war. Even though globally oil prices had spiked, the government of Pakistan at the time announced a blanket subsidy by fixing fuel prices well below the market rates.

This caused the sales to rapidly increase at the expense of the national exchequer. Since then, however, the Pakistan Tehreek-e-Insaf (PTI) government relinquished reigns to a coalition government which, to acquire the much needed IMF loan, started increasing fuel prices in May this year. Following this increase in prices, the volumetric sales of the industry have dipped to their lowest point over the past year.

The average monthly sales volume for high speed diesel and petrol for the past year amounted to 998 trillion and 1,024 trillion litres respectively. Whereas looking at the latest data, monthly sales currently stand at 618 trillion and 829 trillion litres respectively for high speed diesel and petrol. The dip is a significant one, which would put anyone in the business on the backfoot. There is a significant shift in demand which can likely turn chaotic because of the recent flooding. There is also no guarantee that the government will not increase fuel prices in the future.

What’s certain is that the petroleum industry is bearing the brunt of an economic downturn and wants to cut costs wherever possible. The effects could be magnanimous, however.

You see an OMC, like PSO, has a tiny margin to begin with. Rs3.68 per litre or 1.5% in the case of petrol currently priced at Rs234. So it has a good reason to not pay that. But if OMCs back out from paying their share of MDR, dealer margins, though better than OMCs, shrink by the percentage OMCs refuse paying. This arrangement seems unacceptable to dealers. They have already went on a strike against the margins initially allowed to them and they would not bat an eye at taking steps necessary to secure their margins.

It has only been two days that PSO has communicated that it will not pay its share of MDR and the PSO dealers have either stopped accepting cards completely or have started charging an extra amount on card payments – in some cases even more than the share of banks towards the MDR, and are making a quick buck while they do it by passing their costs on to consumers.

Our own PSO dealer in Lahore’s Queen Road plans to charge 2% extra on card transactions, while the bank share of MDR would be less than 1%.

In only two days, card transactions on PSO stations have fallen from 145 million on August 30 to only 60 million on September 1. PSO right now is the only one that has pulled itself out of the arrangement with its dealers.

“Currently, owing to the significant high impact of the cost of bank card transaction on company’s margin, many OMCs including PSO have temporarily discontinued centralized arrangement with the bank cards acquiring services provider,” a representative from PSO told Profit.

While PSO is the only one right now, it is also the biggest. More OMCs can follow suit.

At least Shell Petroleum told Profit that they do not plan to withdraw from paying their share of MDR to dealers, but communicated their frustration of paying an MDR while the government had capped their margins. More than anything, the state of disarray in the petroleum industry has more than one casualty. If dealers start creating deterrence in acceptance of card payments, one obvious casualty is the goal of spurring digital payments, followed by payment schemes that earn an interchange on these payments, the PSO/PSPs providing systems for acceptance of these payments, the acquirers and the issuers.

You see the petroleum industry is being given merchant discount rates that are already below the floor set by the State Bank of Pakistan. In its famous circular issued in January 2020, the SBP allowed the MDR to be charged within a range of 1.5-2.5% from an earlier fixed percentage of 1.5%. The SBP had also increased the percentage acquirers, the banks or fintech companies that acquire merchants and deploy POS machines for acceptance of payment cards, could get out of this arrangement.

The entire premise then was that for card payments to thrive, acquirers need to be incentivised so that they can cover the costs of deploying POS machines which run in hundreds of dollars and make a profit on top. Banks, however, have already given lower MDR rates to OMCs because of the nuances in this sector which is regulated.

“Digital financial services industry needs to be conscious about sectoral pricing,” says Omer Bin Ahsan, Regulatory Lead at Pakistan Fintech Association. “Importantly, acquirer margins need to be protected because they undertake the bulk of the effort in the digitisation of fuel retail merchant,” he says.

So on the one hand, dealers are shirking on paying MDR that is already low and killing acceptance of cards, and on the other, the OMCs are asking for MDR to be lowered which is going to disincentive almost every payments player in this arrangement and would kill digital payments. In the meanwhile, people like you and me are going to scramble through our wallets, ask for the nearest ATM in embarrassment as our cards are declined – quite literally.

An earlier version of this article was published without comments from PSO. While they were willing to respond with comments, they couldn’t do so until the publishing of this report. The article has now been updated with comments from PSO.

Additional reporting by Asad Ullah Kamran

Headline is misleading.

What these Oil marketing companies doing for checking the meters of the petrol pumps where some are playing foul!

Saleem bhai, valid point 👍

Me 7(8-):-\(TT):-\:^):-!:-$

Price Calculator SEO tool calculates the price of the link. Check the estimated market value of any link 100% free: view, the price estimate for a link using this Link Price Calculator by BlueSeotool.com. The link price calculator is easy to use; just copy the Domain name and paste it into the link price calculator search box and click the submit button.

I am very many poors deaf disability new fuel card. Thanks.

A detailed and well written article.

Keep it up !

Good work Ariba. well researched!

Pricess of petroleum is seems to like out of my range now!

I have perused every one of your posts and all are exceptionally enlightening. Gratitude for sharing and keep it up like this.

사설 카지노

j9korea.com