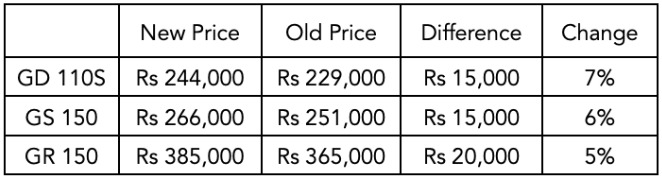

LAHORE: Pak Suzuki Motor Company has followed suit after Atlas Honda and Yamaha increased the prices of their entire portfolios earlier this week. The new prices are as follows:

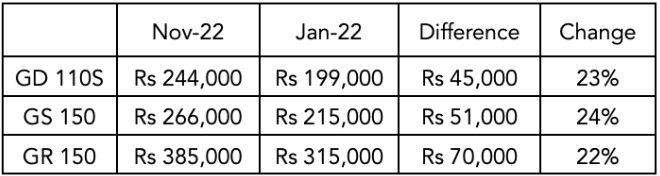

The new round of upward price revisions increases the prices on average by 6 per cent or Rs16,667. Looking across the calendar year, this is Suzuki’s fourth price increase for 2022. Prices have increased by 23 per cent or Rs55,333 on average across 2022.

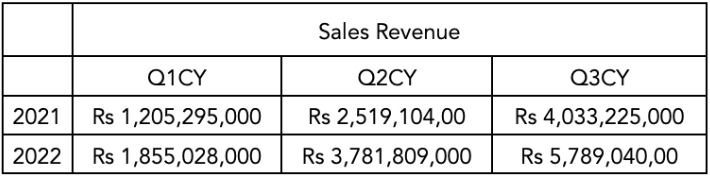

Interestingly, Suzuki’s decision has not led to a reduction in year-on-year (YoY) volume similar to the ones seen by Honda Atlas and Yamaha. Suzuki’s nine month volume, based on figures released by the Pakistan Manufacturers Association (PAMA), has increased by 30 per cent YoY from 22,858 units sold to 29,823 units sold. The additional 6,965 units subsequently translates to a 47 per cent YoY increase in sales revenue from Rs7.7 billion to Rs11.42 billion. However, Suzuki’s final earnings have contracted over this time period.

Suzuki’s final earnings have contacted YoY by 94 per cent from Rs639 million to Rs38.3 million. Herein lies the problem. The additional sales volume has not translated into similar profitability per unit with the company seeing a YoY decline in both final earnings in both Q2CY22 and Q3CY22. The most likely explanation for the dip in profitability despite the massive increase in sales revenue is that Suzuki cost structure has not handled the inflationary pressure across Pakistan. This is even more so likely given that Suzuki’s earnings dipped from Q2CY22 onwards, which is also when higher inflation rates began to set in.

Contextualizing Suzuki’s annual price increase may elucidate upon why they increased their prices by the amount that they did. Suzuki’s aforementioned annual increase of 23 per cent across it’s portfolio pales in comparison to Yamaha’s 50 per cent, and is even below that of Atlas Honda’s 26 per cent despite catering to a market more akin to Yamaha than Atlas Honda. The difference is likely due to Yamaha being the most generous of the Big 3 in terms of its financing options.

Keeping the annual increase in line with that of Atlas Honda may, however, also be excessively prudent on Suzuki’s part. Annual sales have indicated that Suzuki’s customers are better able to absorb the price increases. If anything Suzuki has managed to increase the demand for their motorcycles, irrespective of the price they charge. The 23 per cent increase may similarly be easily absorbed by its customer base. However, such an increase may not be able to bridge the dip in actual profitability particularly given that Pakistan is still in the midst of double digit inflation that is unlikely to go down in the immediate months to follow.

Honda CD 70

Thanks for sharing information Suzuki participated when the price of motorbikes increased. I’m surprised by this.

may I buy honda 70?

It’s good to find what I need, thanks.

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post.

Best work you have done, this online website is cool with great facts and looks. I have stopped at this blog after viewing the excellent content. I will be back for more qualitative work.

I know this is one of the most meaningful information for me. And I’m animated reading your article. But should remark on some general things, the website style is perfect; the articles are great. Thanks for the ton of tangible and attainable help.