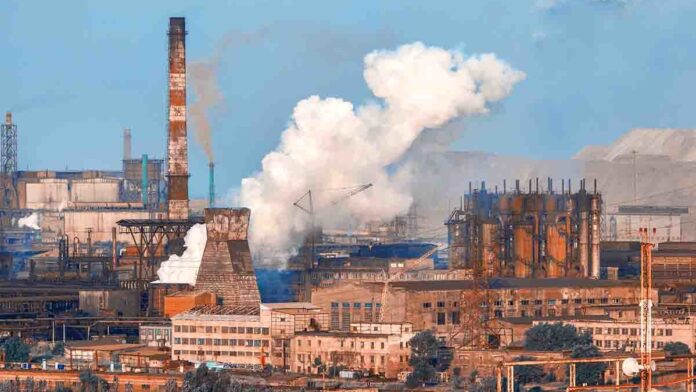

ISLAMABAD: Steel producers from all over Pakistan are crying foul over claims that steel manufacturers in the erstwhile FATA and PATA regions have been evading taxes giving them an unfair advantage over other steel producers in the country.

The claims came to the fore on Wednesday when the Pakistan Association of Large Steel Producers (PALSP) said they had uncovered “a shocking case of tax evasion in the Newly Merged Districts (NMDs)” that were formerly known as FATA and PATA.

In a letter addressed to the finance minister, PALSP claimed that steel manufacturers in NMDs had misused tax exemptions granted to the regions to evade taxes worth over Rs 150 billion over the past five years.

What is the claimed tax evasion?

In 2018, FATA and PATA were merged as districts of Khyber Pakhtunkhwa. Up until this point, FATA was administered from the President’s office in Islamabad and PATA by the Governor’s office in KP. To ease the integration of these areas into the general constitutionally framework of the country instead of special status, many industries were offered tax exemptions in these regions to bring them up to speed.

According to the Finance Act 2018, sales tax exemptions were provided exclusively for goods manufactured and consumed within the NMDs for a five-year period. This exemption aimed to support the people of NMDs during their transition into the formal economy until June 30, 2023.

PALSP’s study claims that there was widespread abuse of these exemptions by opportunistic individuals who are not residents of the NMDs. These individuals have formed partnerships or employed NMD representatives in several industries, including the long steel industry, flat steel industry, ghee industry, and pipe manufacturing, among others.

Saqib Riaz, Chairman of PALSP, expressed his concern over the situation, stating, “The misuse of sales tax exemptions in the NMDs has caused significant losses to the national exchequer and unfairly favored a select group of manufacturers. This undermines fair competition principles and impedes the growth and development of domestic steel producers. Over the past five years, more than 1 billion USD has been allocated to these manufacturers, prioritizing their interests while neglecting the overall impact on the economy.”

The scale of the issue

The severity of the issue is evident in the long steel industry alone. The NMDs’ steel industry, with its sanctioned load from PESCO/TESCO, has the capacity to produce 944,851 tons of steel, accounting for approximately 25% of Pakistan’s total steel consumption. Surprisingly, the actual steel consumption within the NMDs amounts to a mere 2% of Pakistan’s total steel consumption, indicating that around 92% of the steel produced in the NMDs is being smuggled to settled areas without paying sales tax.

The association estimates that this rampant tax evasion has resulted in an annual loss of Rs 30.61 billion to the national exchequer, and an alarming total of approximately Rs 150 billion over five years in the long steel industry alone. The recovery required in other sectors is projected to be even more substantial, amounting to hundreds of billions of rupees. Furthermore, it is crucial to note that the supply of electricity to steel and ghee industries in NMDs was not exempt from sales tax, further contributing to the recoverable amount, which runs into billions.

The Chairman of PALSP emphasized the need for immediate action, stating, “It is crucial to ascertain the value of this tax evasion and promptly recover the funds. The recovered funds can be utilized for the betterment of the nation, including investments in infrastructure, technology, and education, to promote sustainable economic growth.” PALSP urges the Finance Minister to take immediate action in determining the value of this tax evasion and ensuring its recovery in the interest of the national exchequer. It is imperative that the businessmen and tax officials involved in this malpractice are held accountable.

Disturbingly, as per the association influential owners of steel and ghee mills in the NMDs are making efforts to lobby for a retrospective waiver of this recoverable tax solely for their personal vested interests, disregarding the welfare of the common people in the NMDs.

The association calls upon the government to address this issue promptly and take decisive action to recover the billions lost to tax evasion in the NMDs.

Yamas Furniture is the leading office furniture dealer in Karachi, Pakistan. We offer a wide range of office furniture at competitive prices. Our products are made from high-quality materials and are designed to last. We offer a variety of styles to choose from, so you can find the perfect furniture for your office. Contact us today to learn more about our products and services.