On Tuesday, 25th July, the Thar Coal Energy Board convened for its 25th meeting — chaired by Sindh Chief Minister Syed Murad Ali Shah. The Board approved a levelised tariff of $37.36 per ton for the financial close stage petition for 7.8 million tons per annum of Block-I, operated by Shanghai Electric, and a levelised tariff of $30.40 per ton for the contract stage petition for 11.2 million tons per annum of Block-II, operated by Sindh Engro Coal Mining Company.

In addition to the tariff approvals, the provincial government decided to lay a railway track from Thar coalfields to the main railway line for supplying coal to other power plants and factories.

How important is all this?

“This is a monumental achievement. The annual foreign exchange savings generated by these projects surpass an astounding one billion dollars per year,” declares independent economic analyst Arslaan Arif Soomro. “By expanding the scope of the mines and integrating them with the railway infrastructure, Pakistan can produce electricity at a significantly reduced cost, while concurrently addressing its balance of payment challenges,” Soomro elaborates.

So how exactly will these savings work out? Furthermore, what even is a levelised tariff?

What is a levelised tariff

A levelised tariff is a methodology employed to recuperate the entire cost of a project over its lifespan. It is a fixed rate proffered by the bidder for a specified number of years, typically ranging from 25-30, commencing from the date the project is commissioned. In this particular instance, the levelised tariff would represent the average price of Thar Coal emanating from Blocks I and II. However, it is imperative to note that levelised tariffs do not reflect the current rates at which the coal is accessible.

“The ready access rate for coal from Block I is approximately $37, while for Block II it stands at roughly $45,” elucidates Fahad Rauf, Head of Research at Ismail Iqbal Securities. “The levelised tariffs demonstrate how the price of coal will be relatively high in the initial years due to various ancillary costs such as debt repayments, but will subsequently diminish over the course of its life cycle,” Rauf expounds.

So, what are the savings that have been touted?

Stemming forex outflows

“The paramount advantage is the conservation of foreign exchange,” elucidates Rauf. “Let’s hypothesise, for instance, that if I utilise an indigenous resource and it incurs a cost of Rs 10, assuming that I am providing electricity to the consumer at Rs 10. That is still more advantageous than me importing the more affordable variant of that resource for say Rs 8 because I would need to pay for that in foreign exchange,” Rauf expounds.

“The Rs 8 resource would undoubtedly benefit customers, but the indigenous resource, on the other hand, conserves foreign exchange. The saving is tantamount because the dearth of foreign exchange is what has been Pakistan’s primary economic failing recently,” Rauf continues.

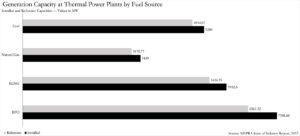

Coal accounts for a staggering 33% (7398.88 MW) of the total installed capacity across Pakistan’s thermal power plants according to National Electric Power Regulatory Authority’s (NEPRA) state of the industry report (2022). According to the same report, coal also accounted for 33% (6561.52 MW) of reference capacity across the plants.

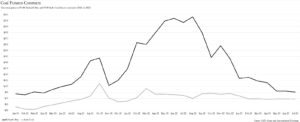

Pakistan imports almost 19 million tons of coal annually (having tripled since 2015), half of which is consumed by the power sector according to the International Growth Centre. Subsequently, it is safe to say that there is a large room for stemming forex outflows.

“This is not to say that there are no foreign exchange outflows associated with Thar coal,” Rauf points out. “You have various Chinese companies involved in the project, and there is foreign debt associated with it as well. Subsequently, there will still be some outflows. However, your human resource and the fuel you generate from it will not have dollar-denominated costs. If you were to import the coal instead then you would have a dollarised supply chain,” Rauf adds further.

Pakistan benefitting as a whole is always advantageous. However, can consumers expect any direct benefits from this development?

Should we expect any cost savings in our electricity bills?

“The primary consumers for Thar Coal are power generation companies,” Rauf elucidates. In terms of power generation, there are two kinds: those located in Thar, and those outside Thar. The former are set to be the immediate beneficiaries.

“As the coal mines augment their production capacity, they can spread their fixed costs over a larger quantity of coal produced,” elucidates Waqas Ghani, Deputy Head of Research at JS Global Capital. “This would result in a decline in the average cost of production per tonne of coal,” he continues. “With reduced production costs, the mine-mouth power plants that utilise coal from Thar coalfields to generate electricity can reap the benefits,” Ghani concludes. Those outside of Thar will also benefit, when the decision is weighed against the alternatives and the associated transportation costs to procure said alternatives.

“In Karachi, there is Lucky Electric. They purchase from them. They incur transmission costs, which are around $10,” he explains. “Instead, if they were to order coal from Indonesia, for example, which is similarly priced, then they would have to incur maritime freight costs which are higher,” Rauf continues. “Similarly, imported coal is subject to custom duties and other charges such as port handling,” he adds.

“In Rupee terms, if I talk about Lucky Electric, if they purchase coal from Thar now and purchase coal from Indonesia at the same dollar price, then there would be a saving of around 15-20% because the transportation cost from here is lower and local coal is not subject to duties,” Rauf expounds.

“When power generation companies reap the benefits of utilising Thar Coal, the electricity they produce and supply to the grid will be more economical,” Rauf continues. “More affordable electricity will ultimately benefit the consumer. This is a comprehensive chain of advantages,” he elaborates. “Due to the significant decline in international prices, the price gap that previously existed has diminished. If the benefit was 30-40% previously — after accounting for transportation and other costs — it now stands at 15-20% due to the collapse in the price of foreign coal,” Rauf muses.

Finally, how can we discuss coal without talking about the cement industry?

Does the cement industry gain from this?

“At present, cement manufacturers predominantly rely on Afghan coal, or coal procured from Dara Adamkhel, or Dukki, Balochistan. Despite Thar coal being more cost-effective in comparison to other coal varieties, its lower calorific value renders it unsuitable for utilisation in cement production — at least for the foreseeable future,” asserts Ghani.

In a similar vein, Soomro states, “It is perhaps premature to make a definitive pronouncement. I know that Power Cement is conducting experiments with it. Thar coal possesses a higher moisture content and, as such, Pakistan requires drying technology on a larger scale to render it more viable.”

Moreover, Rauf emphasises that there are also supply-side constraints that exacerbate the aforementioned issues. “The supply of coal is commensurate with the demand from power generation companies. In instances where there is surplus coal from power generation — for whatever reason — then perhaps its utilisation for cement manufacturing can be investigated,” Rauf exclaims.

Thar coal can be turned into a slurry and used in furnace oil plants as coal slurry. Thar coal can be dried and used in imported coal plants

It’s still bizarre knowing that people don’t know they can get their money sent to scammers back, or recover their lost crypto wallet or phrase key and lots more. I used to think otherwise also but everything is attainable when you are dealing with pros and reliable digital asset recovery hackers and programmers. Have you ever lost money to scammers via crypto fake currency investments websites, online romance scams, phishing, loan scam, lottery scam, or whatever? don’t panic, I bring good news to you all, CYBER GENIE HACK INT’L are out there helping people regain their lives and businesses back by recovering funds they had sent or lost to scammers no matter how long it must have been. I only came to realize you can recover money from scammers after I had sent some crypto scammer $410.000.00 to assist me to invest. When I couldn’t get through to him anymore, I hired Cyber Genie guys, and they got my funds back. I am happy I had an encounter with these internet pros. Do you want to reach them, use their info attached here…

email: CYBERGENIE(@)CYBERSERVICES( . ) CO M…

w/a: +1 (252) 512-0391…

Lignite prosperities, calorific values etc not discussed ?

Many of us tend to rely on our instincts more than we trust the advice of others, and while that can be acceptable, it doesn’t apply to every situation. I had a personal experience where I was introduced to a bitcoin mining platform by an Instagram broker. Unfortunately, it turned out that the broker was an imposter using someone else’s pictures to deceive people and take advantage of them financially. Despite my friends’ warnings at the golf club about the risks involved, I ignored their advice and invested with the platform. Initially, the withdrawal process went smoothly, but when I upgraded my account to the platinum plan, things took a turn. I invested a substantial amount of £317k and expected a payout within two weeks, as was the usual withdrawal span. However, I discovered that my account had been restricted, and I was asked to pay a fee to regain access. Frustrated, I shared my situation with my friends, and one of them, Mike, recommended a hacker who had previously helped him track his wife’s phone during a cheating incident. Without hesitation, I contacted the hacker and, in a short period of time, they gained access to my account, withdrew my funds, and closed the account. It taught me the importance of working with the best team to achieve the best results. I can confidently say that VIRTUALHACKNET is the right team for handling such cases. They can be reached via email at V I R T U A L H A C K N E T @ G M A I L . C O M and on Telegram at @ Virtualhacknet.