KFC’s infamous Colonel Sanders’ recipe is arguably one of the best kept culinary secrets in the world. No one has been successful in unveiling or even replicating the recipe in over seven decades. We fathom that embarking on an adventure to unpack the colonel’s recipe would be a fruitless endeavour, so we settled on uncovering KFC’s next best kept secret. Its revival in Pakistan!

KFC loyalists stood on the sidelines for almost a decade and a half, watching their favourite fast food chain experience a painfully slow death. From cold food to shabby restaurants, abysmal service and unjustified pricing, nothing was right with KFC.

Until we saw the brand, quite unexpectedly, resurge from the depths.

This is a story that explores how amidst the complex web of Pakistan’s unstable economic conditions, a general lack of customer service culture at the bottom, and the prevailing seth culture at the top that plagues much of the Pakistani business landscape, KFC managed to defy the odds, charting its path to success.

For the sake of narrative prowess, let’s start from the beginning.

1997: Pakistan gets the first taste of the Colonel’s crispy fried chicken

In 1997, KFC made its debut in Pakistan through a Belgian company called the Artal group. The response was nothing short of spectacular. The first ever KFC outlet in Gulshan Iqbal, Karachi saw long line-ups of excited customers for months to come. The craze was almost like a fever and the demand was so high that they would run out of Zinger burgers hours before closing time.

Things were looking good till May 1998, when Pakistan conducted its nuclear tests, complicating the country’s foreign relations and jolting its economy. The subsequent US sanctions made it difficult for KFC to operate, since it was completely backward integrated, whereby it would import a lot of its raw materials, instead of outsourcing from local vendors.

This shock caused serious operational difficulties, forcing Artal to sell their assets to Arif Naqvi’s Cupola group in 2001.

Cupola was effectively managing the brand amidst challenges, including the 2008 economic crisis. However, since the founders of Cupola had other business interests that diverted their focus, KFC started getting compromised with every passing day. Things started going south in 2004 and its reputation continued to dwindle.

Until only a few years ago, when KFC made an unexpectedly strong comeback.

A big managerial change

By 2014, KFC’s problems had multiplied and the American multinational fast food corporation Yum! Brands that own KFC’s global franchise, started getting concerned. Fearing that KFC Pakistan’s bad reputation might bleed into the brand image of the global franchise, Yum! urged KFC Pakistan to fix their issues. The pressure from the top resulted in a big managerial change, with an entirely new team that was to reset the course of the brand’s fate.

In conversation with Profit, KFC Pakistan’s CEO Raza Pirbhai recalled that, “The brand was in horrible shape when I took over as the Chief People Officer in 2014. They had over 55 outlets but none of them made any sense. They were all losing money, the restaurants were debilitating, the service was bad, and KFC had lost the grace and talent that it once possessed.”

But there was hope.

“I sy this to my people; KFC is a crocodile brand. No matter how hard you try to kill it, it finds a way to survive. If it could have survived the last 15 years, it could endure and thrive through further transformations,” Pirbhai shared.

Within a span of five years after the new management took over, Pakistan witnessed a brand new KFC. All of a sudden, their restaurants were cleaner and brighter, their staff was nicer, the prices were appealing and the food had actually started tasting finger lickin’ good!

How did they do this?

The first step was identifying the problems. AC Nielsen conducted an in-depth study for KFC that confirmed their doubts. Their troubles were a combination of a negative perception of the brand’s appearance, pricing, and positioning.

Initially, KFC was priced and marketed as an upscale establishment, competing with brands like McDonald’s. The premium pricing did not align with their international brand image, that of being a Quick Service Restaurant in the food pyramid. What they needed was to become an everyday brand.

“We changed our positioning strategy entirely. For example, we stopped hosting birthday parties and events because we did not want to be an occasional brand,” Pirbhai explained.

They switched their focus from following the path of fast-food giants like McDonald’s; instead, started building KFC as a neighbourhood store competing with local fast food restaurants.

Pricing and positioning: The volume game

KFC’s pricing has perhaps been the biggest question mark in this entire discourse.

Their revised prices were so threatening that they made competitors quake with fear and envy.

But it also spiked their curiosity.

It is way beyond competitive pricing, almost teetering on the edge of predatory pricing. It flipped the game completely, blurring the McDonald’s and Burger Kings of the world into the background and putting KFC in direct competition with small local players, such as the likes of Yasir Broast, Fried Chick, Jaan Broast, and other local players selling chicken broast.

A simple price check validates this. We used Foodpanda to determine the price of comparable portions of Yasir Broast and KFC’s broast offerings. The platform and delivery fee is not included in the prices; just what the restaurant charges and tax with payment on cash.

A quarter sized broast (choice of leg or breast piece) from Yasir Broast that comes with a bun and small fries costs Rs 565 plus Rs 90 VAT, totaling Rs 655. In comparison KFC’s Crispy Box that includes two pieces of its flagship fried chicken, fries, coleslaw and a drink will set you back Rs 650 plus the same Rs 90 VAT, making it a hefty meal for a mere Rs 740.

If one adds a 34 ml Pepsi to the Yasir Broast order for Rs 100, the total goes to Rs 755, Rs 15 more than KFC’s order.

Why wouldn’t then anyone going out for a family dinner choose KFC over Yasir Broast?

Concerning questions arose, with some suspecting foul play, such as tax evasion to explain KFC’s low prices, while others believed they were incurring losses to gain market share.

“The secret lies in volumes. Our strategy is to increase volumes not margins. If we are successful at achieving the sort of market penetration that we aim to achieve, the margins will automatically come,” Pirbhai revealed.

According to Pirbhai, it is important to understand Pakistan’s economy to understand KFC’s market penetration strategy. “You can spread only horizontally, by increasing volumes because expanding vertically, i.e., by increasing prices will not work in an economy like ours. If we want to be a brand that has 250-300 outlets, we will need to cater to more people and that ultimately comes down to pricing.”

So what KFC essentially did was to become affordable enough for the masses. And why would someone land at Jaan Broast when they could eat at a KFC for the same price?

“We are basically selling broast and also competing with others selling broast, because what else is KFC? When we were revising our pricing strategy, we compared it to broast only. So, if you can get broast from a local shop for Rs 250, we introduced our two pieces chicken and chips for Rs 250.”

So, what exactly is KFC’s volume game and how does it cover their margins?

Pirbhai explained how local seths underestimate the vast market potential and population opportunity. “It took me quite some time to explain this to our vendors too.”

“Our beverage and poultry partners insisted on a five year contract but we convinced them to deal in volumes. We let them quote a large volume of their choosing and we then asked them to give us a discount on that. They quoted a hefty number, thinking that we won’t be able to meet that even in six years. We are likely to finish that volume within three years and they will have to revise the contract again,” he added.

According to Pirbhai, the volume has grown so much that even four vendors, including K&N’s, Sabroso, Big Bird and Menu, combined struggle to cover KFC’s poultry requirements.

The bottom of the pyramid, with a 250 million population, offers significant untapped potential. While there was still some focus on the top five to ten percent, KFC now has a different strategy and targets the broader market.

When they set off to create an ‘everyday brand,’ the main aim was to cater to all, which was aided by dividing the menu into tiers. They did not come in and slash their prices to appease the masses. Instead, they designed a menu that had something for everyone.

“We implemented a menu ladder with different price tiers. Our low-end menu offers everyday value items like the krunch burger, 2-piece chicken and chips, zingeratha, and rice and spice. We maintained the mid-range options with value meal combinations including fries and a drink. Additionally, we introduced a high-end meal layer featuring our family festival bundles,” Pirbhai highlighted.

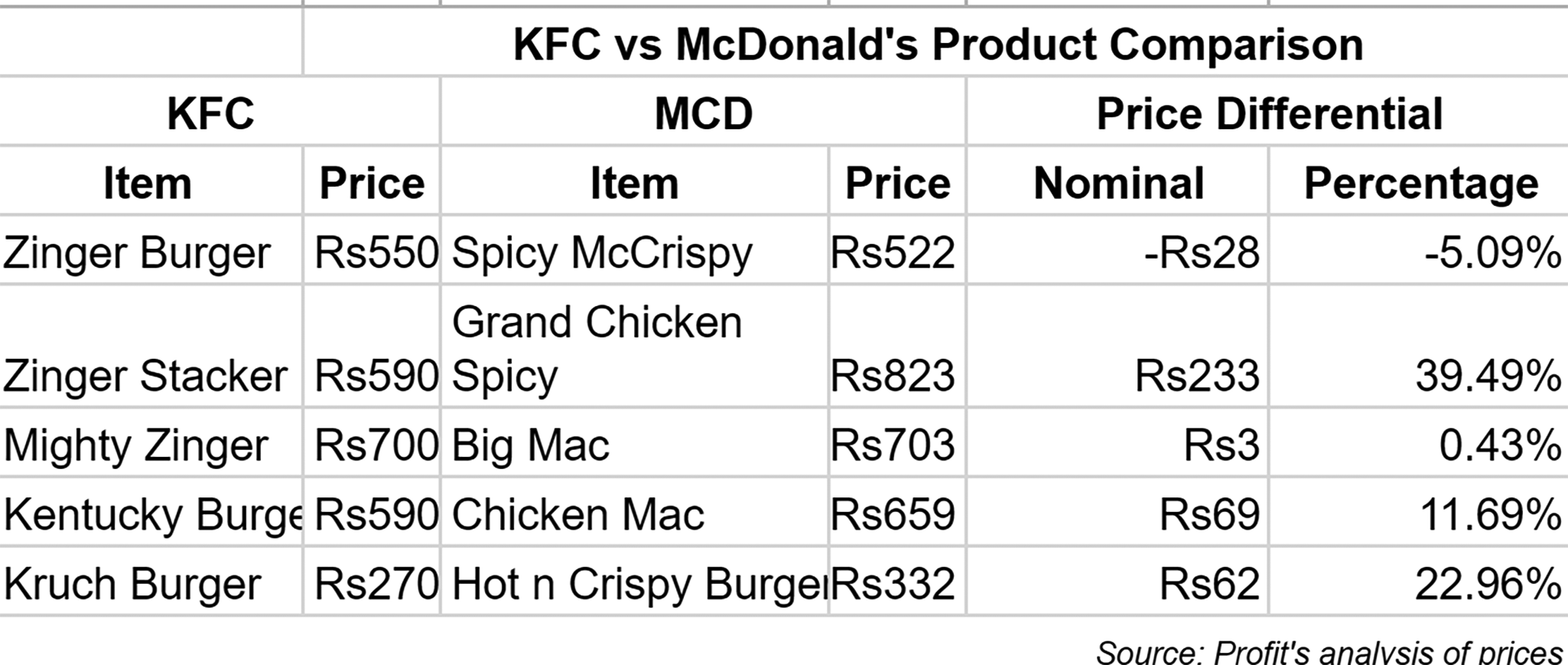

Profit compared the prices of similar products from KFC and McDonald’s, only to discover that the price differential is not much. However, KFC’s value meal additions have given it the impression of an extremely affordable restaurant, when in reality the regular menu is not that cheap.

It is safe to assert that the competition felt the heat from KFC’s new pricing strategy. KFC’s competitively priced value bundles eventually forced competitors to offer similar deals, in order to retain their market share.

You can get KFC’s Family Festival meal that includes 4 Zinger burgers, 4 pieces of Hot and Crispy Chicken, 2 Dinner rolls and a 1.5 Litre drink, sufficient for a family of four to five people in just Rs 2450.

Similarly, McDonald’s Chicken Plus Share Bag, includes 2 Chicken Big Mac Burger, 2 McChicken Burger, 2 Medium Fries, 6 Pieces Of Chicken McNuggets And 4 Medium Drinks in just Rs 2009! These prices are unbelievable, considering current inflation rates. However, competitors can either choose to introduce such high value options or lose out on a huge chunk of their market share.

Increased volumes and reduced prices helped KFC revise their entire positioning, transforming from a premium international fast food restaurant to a mainstream and affordable one.

KFC’s new objective was to offer clean, delicious, affordable and conveniently accessible food.

But what else did they fix apart from their pricing? Well, they had a glow up!

KFC gets a makeover

One of the problems with KFC that AC Nielsen had identified was the brand’s appearance. To address this, KFC invested in improving both the physical infrastructure of their brick and mortar, as well as their online experience.

Globally, KFC outperforms McDonald’s in taste, while McDonald’s excels in providing a superior overall experience. Although KFC’s restaurants may not be extravagantly designed, their taste surpasses any comparison. But they tried doing something new with KFC Pakistan.

“During our efforts to revitalise KFC, our primary focus was on ensuring the product’s exceptional taste because that is what we are known for. But then we were like, why not have the taste but also create a memorable experience?” Pirbhai shared.

So, KFC went and got another research done, this time on their brand persona. The feedback compared the brand to an old-time but popular actress who has now become irrelevant. So, despite its style, there were clear signs of ageing and diminishing grace in KFC’s brand image. To provide a better experience, the brand perception that KFC required was that of a vibrant rockstar.

So they transformed their physical locations, revamping existing stores and opening new ones, all with a vibrant, youthful and fresh aesthetic. But offline is not the only experience, therefore next on the makeover list were KFC’s digital platforms. “We fixed up the stores but we also strategised for better online communication and marketing. We wanted a youthful image, which is now evident in all aspects of our customer interactions and KFC’s advertising,” Pirbhai explained.

And that is how KFC became younger, cooler and better.

Ripples of culture change

None of what we have discussed so far would have been possible without a mindset and culture change within the organisation.

In order to achieve what the new KFC aimed to achieve, i.e., good quality, affordable food and a pleasant experience, they required better service, the prerequisite for which was a better staff and a positive attitude.

“We created a new team from scratch so we could induct the kind of people with whom a transformation of this scale could be possible. Changing attitudes across the board can be difficult, especially once people are set in their ways,” Pirbhai highlighted. So, KFC replaced their staff and brought in new people.

“We inducted new people at every level, who then worked towards fostering the kind of attitude we wanted, training the rest layer by layer. We provided a safe work environment, empowerment and autonomy, and equipped our team with the tools for growth, instead of going about with the same old seth-styled strategies,” he elaborated.

Finding and empowering the right kind of people at the right time was perhaps the best move KFC made, which enabled their entire transformation journey. The new managerial team that KFC hired in 2014, was unlike any other multinational company’s leadership in Pakistan. It comprised individuals who had a shared experience of starting from scratch and progressing within the restaurant industry.

It is rare, in an HR professional’s career cycle, to end up in an executive role. But Pirbhai had been a culture and people driver for many years, starting as a kitchen assistant at Pizza Hut, he rose up the ranks to become a general restaurant manager to an area manager to the head of HR within Pizza Hut. His experience with both people and operations made him the ideal person to be made the Chief People Officer of an evolving KFC.

“The rest also had humble beginnings, either in KFC only or at Pizza Hut. Notably, the current COO, Humayun, and the CBO, Sohail, both originated from KFC Pakistan. Our collective background in the food industry gave us a clear vision for identifying and fixing the problems,” he shared.

What made this team ideal for changing the organisation’s culture was that they understood people, as well as the intricacies of day to day operations, something that executive level staff is usually far detached from.

What KFC was able to pull off after taking a chance on Pirbhai and his teammates proves Pirbhai’s earlier assertion correct. When a capable team is provided with the right tools and empowerment, unexpectedly great things can happen!

Pirbhai refuses to call himself and his team a bunch of geniuses but he asserts they are the most passionate group of people, who might not always have all the right answers but possess the utmost passion to run the food business. “So, we are able to find the answers somehow,” he concluded proudly.

It was not just the brick and mortar of KFC that saw these transformations. With the digital space evolving, KFC had to worry about the online market, as well. For that, their service on every platform and for every kind of customer had to be the best.

FoodPanda is one platform they utilise, however they never completely gave their last mile to FoodPanda. “It’s only in a few limited locations, where FoodPanda gets the last mile and that is also only because we believe we need to maintain some relationships,” Pirbhai explained. They encourage customers to contact them directly, either through their online app or through the call centre extension, making sure that their customer service is better than ‘the FoodPandas of the world’.

How successful has the new strategy been?

On face value, KFC’s improvements are evident, but how successful has this transformation been in financial terms?

In the absence of publicly available financial data, one will have to take KFC and its detractors’ word on the matter.

While competitors are adamant that KFC is sustaining losses in exchange for market penetration, Pirbhai insists that the transformation has resulted in profitability.

The following metrics can be used to verify KFC’s claims of profitability.

Firstly, the global recognition that KFC’s revival has received is a tell-tale sign of good fortunes. KFC Pakistan now ranks number one globally in terms of sales growth and has garnered accolades for sales and brand performance among KFC franchises across 143 countries.

Another yardstick to determine profitability is KFC’s impressive revenue growth, which according to Pirbhai, has increased more than fourfold since 2014. Moreover, despite the challenges posed by the Covid-19 pandemic, the company managed to open 14 new stores, marking a significant milestone post-rebranding, which would have been unlikely if the business had been unprofitable.

However, to not miss the forest for the trees, the real feather in KFC’s cap is that it has transformed Pakistan’s fast food industry, particularly the one around burgers, into a duopoly. Whilst, KFC’s competitors across the spectrum merely lambast whether it might be profitable, KFC, instead, has spent this time chipping away at their only other competitor in this duopoly. So much so, that it is the one with a cult following, media buzz and a dynamic brand.

The mere fact that KFC is being discussed in this light, would have been unfathomable ten years ago.

The industry is now at an impasse. While competitors wait for KFC’s pricing tactics to take the steam out of Pirbhai’s locomotive, KFC might just capture the entire market and have the last laugh.

Hi there. I am a resident of bahria town phase 8 Islamabad. KFC’s nearest branch is in bahria phase 7 which adjacent to bahria phase 8. My major concern is that they have closed their delivery to phase 8 almost 1.5 year now. Why is that so? So many customers KFC loses only because of delivery and orders food from McDonald’s. So please make sure that my concern is addressed to higher management of KFC so that they can come up to any solution. Thanks

Nicely covered. The one critical element left on this is the financial implications; it is hard to imagine that bottom line figures will be in positive, comparing the investment done & the prices being dragged down. Price wars have always helped brand in short term benefits but its the real story lies in long term achievements or losses.

We will have to wait for real pictures to unfold

Always been curious about how KFC made a comeback in the PK market – this article answers all of my questions! Kudos to the writer.

The choice you have written on it is excellent. I might be again

Did the comeback involve investing lots more $ into the revival campaign for rebuilding the brand? Who owns KFC now?

A very depth insight how this brand turned around when Mr,Irfan Mustafa took over and his son Mr,Haris Mustafa as a partner with cupola and made a huge difference in everything build a successful road map to drive further. Great Masha Allah Great success Team.

A very depth insight how this brand turned around when Mr,Irfan Mustafa took over and his son Mr,Haris Mustafa as a partner with cupola and made a huge difference in everything build a successful road map to drive further. Great Masha Allah Great success Team.

it’s been my pleasure reading an in depth story of the rebirth of KFC in Pakistan. BEST wishes to PirBhai and his doer’s Team of committed professionals. Bravo !👌

The strategy for revival of KFC is quite similar to what Atlas Honda achieved with its iconic two-wheeler Honda CD 70 in what I guess was late 2000. They had all been wiped out by Chinese influx of copycat versions of their well respected motorcycle brand. Their CEO Saquib Shirazi took stock of the situation and went about to unleash one of the most amazing resurrection of any brand in the country. The whole value chain pitched in to reduce price from Rs.68,500 to 59,500. Sorry, I am quoting from memory and numbers could be somewhat different. However, actual strategy is important. Supply chain and marketing were totally revamped. ‘5S dealerships’ concept introduced in Pakistan was first of its kind anywhere in Honda worldwide. Honda sales have never looked back since then. I am intrigued by the similarities in the two success stories. Wonder if this strategy is taught in some business school. But it is the execution that is critical. It is easier said than done.

This was the best analysis I have ever read about a Pakistani business. Proud of KFC Pak 👌🏼

One of the best analysis on organizational transformation I’ve read. Seen the journey from afar but the indepth analysis offers so much of learning for other companies that are struggling. Great stuff Nisma!

very nice insights

Hi there. I am a resident of bahria town phase 8 Islamabad. KFC’s nearest branch is in bahria phase 7 which adjacent to bahria phase 8. My major concern is that they have closed their delivery to phase 8 almost 1.5 year now. Why is that so? So many customers KFC loses only because of delivery and orders food from McDonald’s. So please make sure that my concern is addressed to higher management of KFC so that they can come up to any solution. Thanks

ผู้ให้บริการเกมคาสิโน ที่ได้มาตรฐานระดับสากลเป็นเกมที่เข้าถึงง่าย เล่นสนุกเดิมพันต่ำ แต่ได้เงินสูง