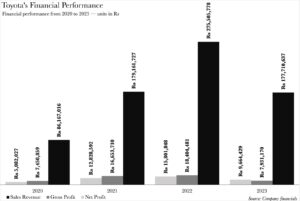

On 25th August, Toyota Pakistan unveiled their annual earnings, revealing the extent of the damage inflicted upon the company by the crisis that has engulfed the automotive industry. Toyota’s revenue plummeted by 35%, from Rs 275.5 billion in fiscal year (FY) 2021-22 to a mere Rs 177.7 billion at the close of FY 2022-23. The company concluded the year with a staggering 39% year-on-year decrease in final earnings, from Rs 15.8 billion to Rs 9.6 billion.

Across all major measures of financial performance, Toyota has been dealt a devastating blow, with sales revenue, gross profit, and net profit plunging to four-year lows. This represents the most severe setback since its results during the COVID-19 pandemic.

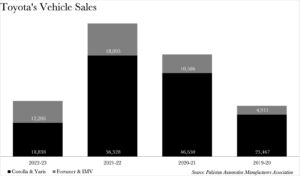

Despite this precipitous decline in revenue and net profit, it pales in comparison to Toyota’s overall collapse in sales during the same time period. According to data provided by the Pakistan Automotive Manufacturers Association (PAMA), Toyota sold a total of 31,104 vehicles across FY 2022-23 compared to 74,553 vehicles sold across FY 2021-22, representing an astonishing 58% contraction.

One reason why Toyota’s losses are not as catastrophic as they could have been is due to the composition of Toyota’s vehicular sales. Fortuner and IMV sales accounted for a remarkable 39% of total sales, the highest they have ever been in the past four years. As a result, while Toyota sold fewer vehicles overall, it managed to sell a higher proportion of more expensive vehicles than ever before.

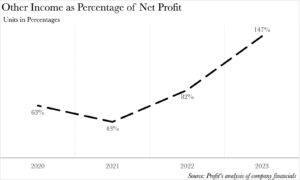

This is not the only instance of Toyota barely managing to keep its head above water. The company’s other income category witnessed the most pronounced relative increase over the past four years as well. Toyota’s other income for FY 2022-23 stood at an impressive Rs 14.1 billion, a 10% increase from the Rs 12.9 billion recorded in the preceding year. At Rs 14.1 billion, this is the highest other income recorded over the past four years. More significantly, the ratio of other income to net profit is now more skewed than it has ever been, with other income exceeding net profit for the first time in Toyota’s annual report.

Other income now stands at an astounding 147% of net income, whereas it was only a mere 43% just two years ago. Similarly, other income also exceeded gross profit and operating profit which stood at Rs 7.9 billion and Rs 2.75 billion respectively. To put that into perspective, Toyota earned more money from investing in capital and debt markets than it did from actually selling cars.

With a forgettable year out of the way, what does all of this mean for the giant going ahead? Well, it might have a silver bullet for its woes.

Living on a prayer

The media is teeming with rumours about the long-awaited Toyota Corolla Cross. As luck would have it, at the time of writing, Toyota has issued a new press release this very day to whet the appetite of onlookers about their upcoming vehicle. And perhaps, rightfully so.

If we consider Toyota’s profits from its car business — its other income is too massive for us not to take it seriously — then the Corolla Cross provides a turning point. We’ve already established that Toyota is now relying on larger volumes of its more expensive vehicles being sold relative to its more affordable options to mitigate for lower nominal volume. The Corolla Cross is more expensive than Toyota’s two sedans in every market it exists.

Honda’s upswing in sales with its HR-V, and the overall C-SUV craze provide us with convincing proof for there being demand for the Corolla Cross immediately upon launch. The Corolla Cross also happens to be a hybrid, and Profit has already covered how another hybrid already has the market by the jugular.

Read more: A year on: Will the hybrid match the crossover craze

The anticipated estimates put the launch of the Cross at somewhere between the end of 2023, and the start of 2024. Will it be a success? Who knows. Could it benefit from the new skewed profitability ratio Toyota is witnessing in its profit and loss account? Perhaps. Could it reinforce other income? Most likely if they can sort their advanced bookings out, and add to their newfound investment talents.