On Saturday, Pakistan International Airlines (PIA) announced via social media platform X that the Government of Pakistan had intervened to alleviate its financial woes. The government facilitated the release of vital funds through banking channels, providing a much-needed lifeline for the beleaguered airline.

PIA refrained from disclosing specific figures but confirmed that these funds would be allocated to settle long-standing dues. These encompass payments for aircraft and engine leases, spares support, and handling payments at foreign stations. The airline also hinted at ongoing restructuring efforts, indicating a strategic approach to surmount their financial challenges.

“PIA is ensnared in a web of financial challenges,” stated Abdullah Khan, the Head of Marketing & Corporate Communications at PIA. “These challenges are, however, not due to elevated administrative costs,” he continued, “but because of financial obligations that have snowballed over the last two decades.

“Even during the first half of the year, PIA has managed to post an operational profit,” Khan unveiled. “However, due to the colossal costs of repaying principal and interest on liabilities amounting to a staggering Rs 742 billion, it inevitably slips back into the red,” he concluded with a note of finality.

Glancing at PIA’s financials

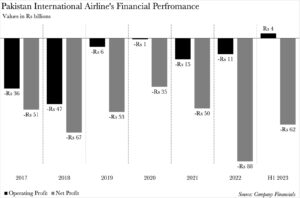

The question of whether the government’s financial injection can serve as a panacea for PIA’s financial ailments remains a contentious issue. Yet, one can hardly fault Khan for his exuberance. PIA is currently basking in a rare moment of glory, having managed to pivot from a six-year losing streak to an operating profit this year.

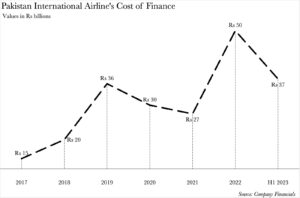

However, as Khan astutely observes, these gains have not translated into a net profit for PIA. The national carrier has found itself in the red, with losses amounting to Rs 62 billion just halfway through 2023. These losses, Khan points out, can be traced back to PIA’s burgeoning finance costs, which skyrocketed to Rs 37 billion in June.

To put this into perspective, PIA’s finance costs for the entirety of 2022 stood at Rs 50 billion — a record high over the past six years. Yet, barely halfway into 2023, PIA has already incurred a staggering 74% of this cost. In PIA’s defence, its soaring borrowing costs can be attributed to the State Bank of Pakistan’s decision to hike the policy rate to unprecedented levels in 2023.

However, this does not account for why PIA has consistently racked up such exorbitant borrowing costs over the past six years.

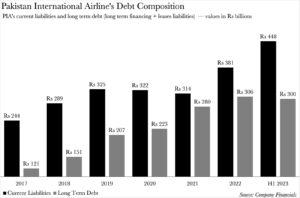

A closer look at PIA’s debt composition reveals a stark contrast between its short-term and long-term debt. The former has consistently outstripped the latter each year for the past six years.

If we factor in PIA’s advances from its subsidiaries and deferred liabilities (including pension obligations and vehicle redelivery expenses), its long-term liabilities do surpass its current liabilities. However, when it comes to the structure of PIA’s debt, short-term debt takes precedence over long-term debts. This is noteworthy because ideally, debt should not be structured in this manner.

The longer the maturity term of the debt, the lower the interest rate that is subsequently attached to it. This presents PIA with a potential silver lining. The more funds it can allocate towards reducing its short-term debt — currently standing at Rs 448 billion — the more it stands to gain from reductions in borrowing costs.

However, not everyone shares PIA’s optimism about its turnaround strategy.

A public with no faith left

“Every time PIA registers a deficit, it’s akin to daylight robbery. Its debt structure is inconsequential; the sheer magnitude of the total debt stock renders it insurmountable. It’s a veritable abyss for taxpayer money and borrowed funds, a burden our future generations will be saddled with,” proclaims Yousuf Farooq, the Director of Research at Chase Securities.

He adds, “In its current state of operation, PIA is a sinking ship, leaving lenders in a quandary. The citizens of Pakistan are left with no choice but to bankroll this debacle until privatisation ensues.”

This then segues into the second facet of the debate concerning PIA’s profitability. There’s no denying that PIA has achieved the unthinkable by managing to turn an operating profit. Whether PIA can sustain its winning streak for the remainder of the year remains a mystery. However, this presents a conundrum akin to the chicken and egg problem.

Is it necessary for PIA to generate a net profit before taxpayers can finally concede that the national flag carrier has the potential to be profitable? Or does it necessitate this current financial infusion to safeguard any glimmer of hope for a profit this year from being extinguished — especially with the spectre of another policy rate hike looming ominously on the horizon?

Great info

Not possible

Maybe