They say never ask a man’s salary. So we will not. But what about the people who are supposed to disclose it in their financial statements? It is not asking if these figures can be found in the companies’ own disclosures. Profit carries out an exhaustive analysis of more than 200 brokerage houses operating in Pakistan and sees how much the CEOs are actually being valued by the companies they are running.

Oh Captain, My Captain

Before the story delves into the numbers and figures, let’s quickly discuss what the role of a CEO actually is. Imagine a captain of a ship. The expertise of the captain is not how to steer the ship or even how to power the ship towards its destination. The real expertise of the captain is to provide direction and a sense to the whole crew to pull together.

The task at hand of the captain is to make sure that the whole crew works in unison with each other and to provide a vision that needs to be fulfilled. Mind you, that does not necessarily mean that he will be successful. Far from it. The role of the CEO is to bind the team into one. Before setting out on the journey, the captain does not know how many storms will have to be weathered and what challenges will be faced. The singular purpose is to make critical decisions that will help reach the common goal at the end.

Similarly, the CEO of the company has to provide a common purpose to the company which will lead to success in the future. The CEO is elected by the board of directors and the shareholders of the company and carries the mandate to drive the company towards success. The CEO is answerable to both the shareholders and the board and is the liaison between the management running the company and the board of directors to make sure everyone is onboard with the vision of the company.

The small matter of salaries or remuneration

When a CEO is appointed or elected by the shareholders through the board of directors, the matter of salaries or remuneration is assigned to the board of directors. Based on the judgment of the board, the remuneration is decided upon by the board. Sometimes, a committee can be created under the board which opines over the decision and then sets the remuneration of the CEO that will be paid out at the end of the year.

This compensation package of a CEO can be broken down into different elements. The first part of the salary will be basically an amount that is categorized as the managerial remuneration which the board allots. On top of that, the board can provide additional allowances which form a part of the compensation that is given.

The board of directors can hand out a bonus to the CEO or give some commission based on the performance of the CEO. This is a measure of how well the CEO has performed and is pegged to a metric that the board decides.

In addition to that, medical allowance, house rent allowance, utilities allowance, car allowance, traveling and boarding allowance can also be given to the CEO in addition. Lastly, a contribution to a provident or retirement fund can also be made by the company for the CEO and a listed company might also consider compensation in terms of stock options as well.

Operations of a brokerage house

In simple terms, the goal of any brokerage house is to be the middleman in the market who facilitates buyers to meet sellers. Once the two sides come together and a transaction takes place, the broker is able to earn a small part as commission. Imagine a market where millions of trades are taking place. As the broker keeps adding these small commissions, they end up becoming a big amount at the end.

In order to maximize their revenues and profits, brokerage houses can also invest in money market instruments like T-Bills or equity instruments which provide capital gains or provide dividends to shareholders. Big brokers can also provide underwriting services to help their corporate clients during IPOs or carry out consultancy for them. Based on this, the revenue model of a brokerage house comprises earning brokerage commission on trades they facilitate, dividend income, interest income and any other consultation fees that the broker might have collected from its corporate clients.

Methodology

In order to carry out this research, the complete list of brokers registered and licensed by the Pakistan Stock Exchange was taken. Of the more than 200 brokers who are registered, 100 companies were extracted for whom the relevant data could be found. The data consisted of the performance of the companies for the last two years based on their assets under management (AUM), equity, revenues and compensation of CEO only.

BMA Capital Management Limited, Foundation Securities (Private) Limited and Topline Securities have not disclosed the notes pertaining to the CEO compensation which is why they have not been included in the analysis. Representatives at these companies were asked to provide this information, however, they failed to provide these details.

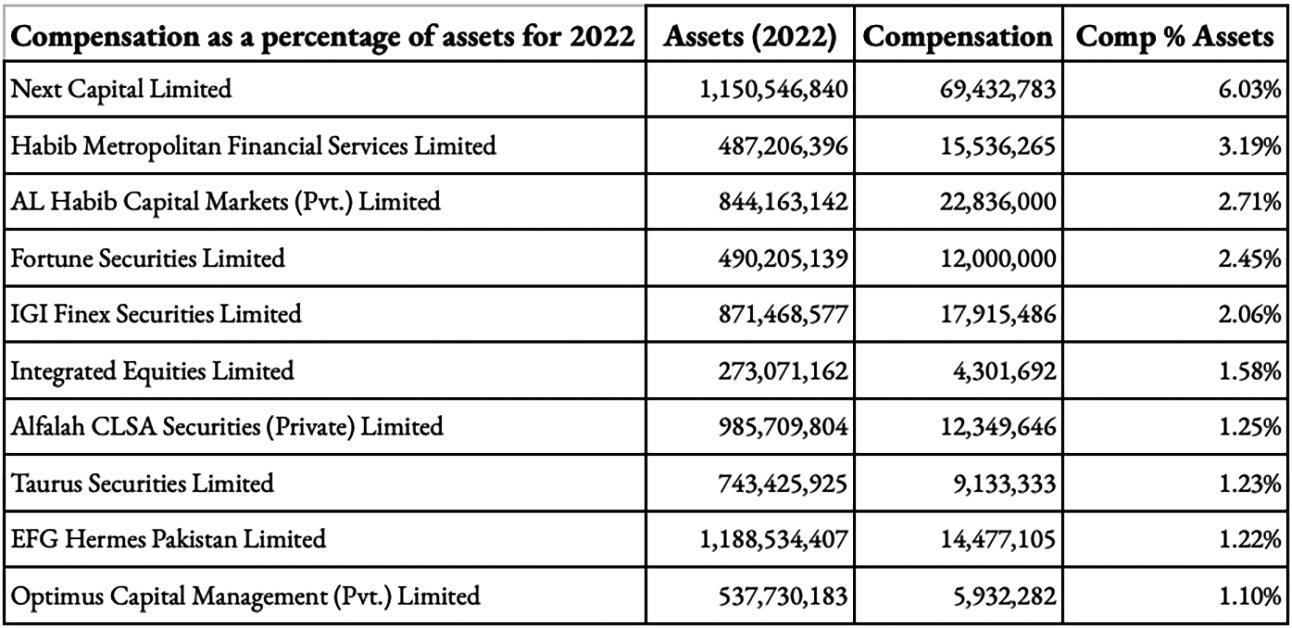

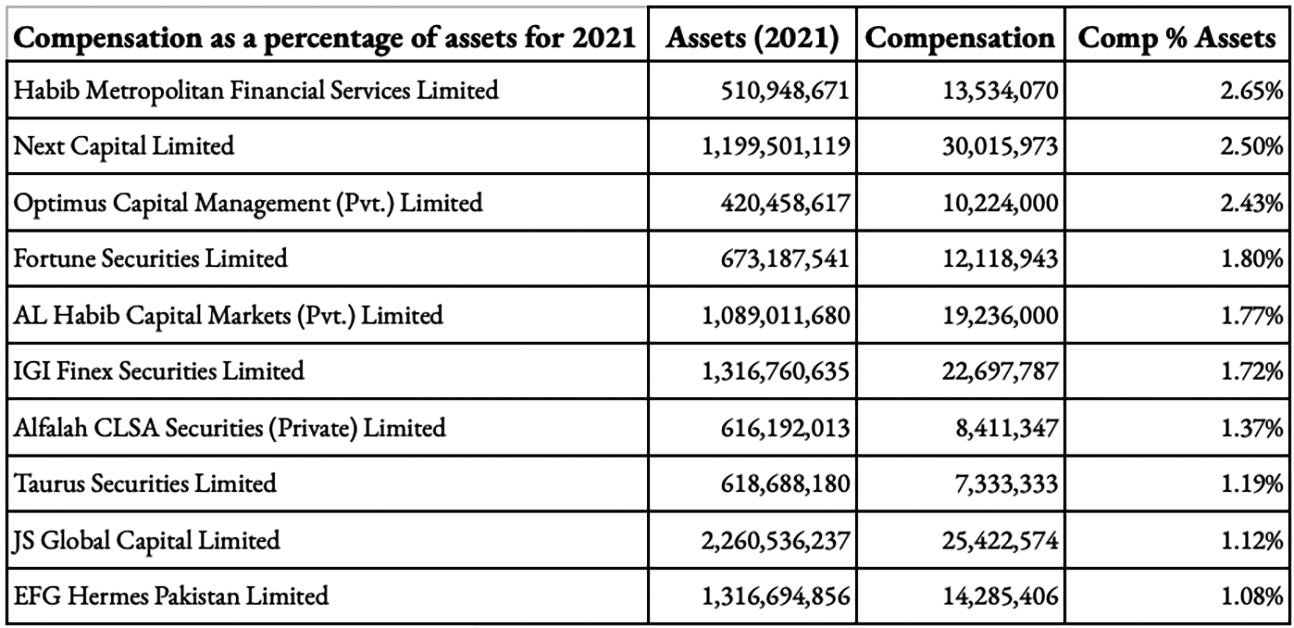

Once this had been done, the compensation of the CEOs was taken as percentage of the AUM and the following table was generated.

Based on a brief snapshot, it can be seen that Next Capital gave out more than 6% of its assets as compensation to its CEO while the next highest compensation was 3.19%, 2.71% and 2.45% for Habib Metropolitan Financial Services Limited, Al Habib Capital Markets (Private) Limited and Fortune Securities respectively.

When a similar analysis is carried out for the previous year, it can be seen that Habib Metropolitan Financial Services Limited led with a payout of 2.65% of its assets in terms of its compensation for its CEO. It was followed by Next Capital, Optimus Capital Management (Private) Limited and Fortune Securities with 2.50%, 2.43% and 1.8% respectively.

In absolute rupee terms, it can be seen that the highest paid CEO in 2022 was from Next Capital earning a staggering Rs. 69.432 million while the second highest was Rs. 22.8 million from Al Habib Capital Markets and IGI Finex Securities Limited was third with Rs. 17.9 million in compensation. The compensation paid out by Next Capital was more than the compensation paid out by the next four brokerage houses combined. For 2021, the highest paid CEO was again Next Capital earning Rs. 30 million with JS Global Capital paying its CEO Rs. 25.4 million and IGI Finex Securities Limited were third paying out Rs. 22.7 million compensation.

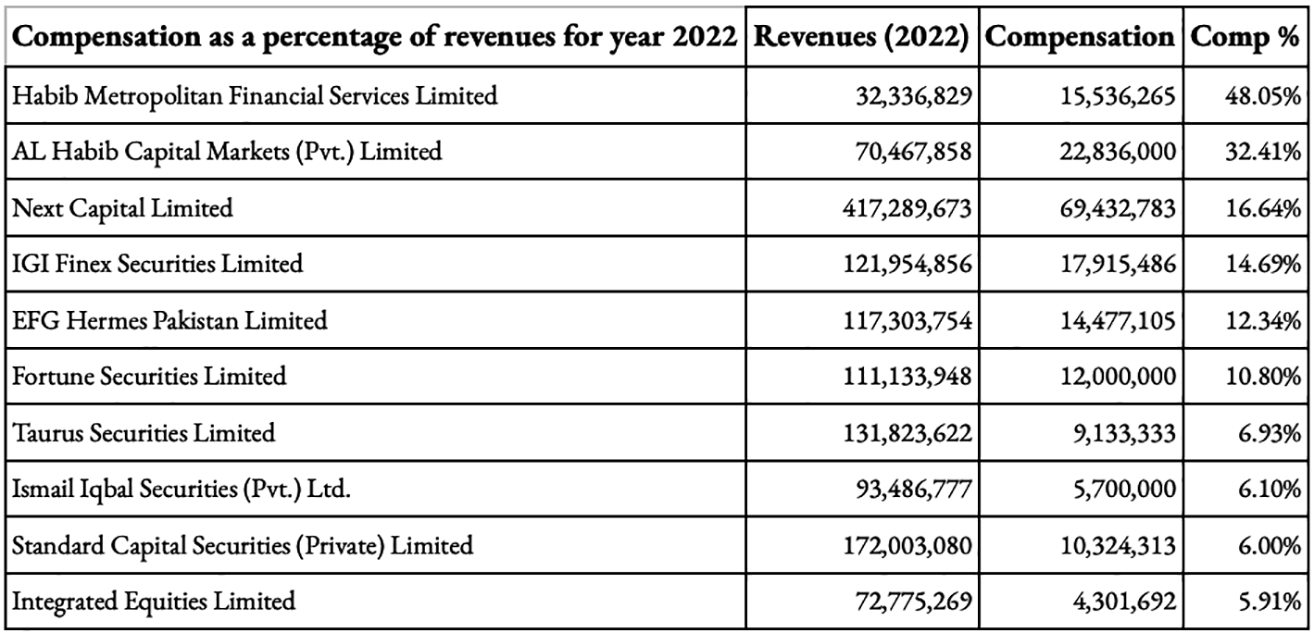

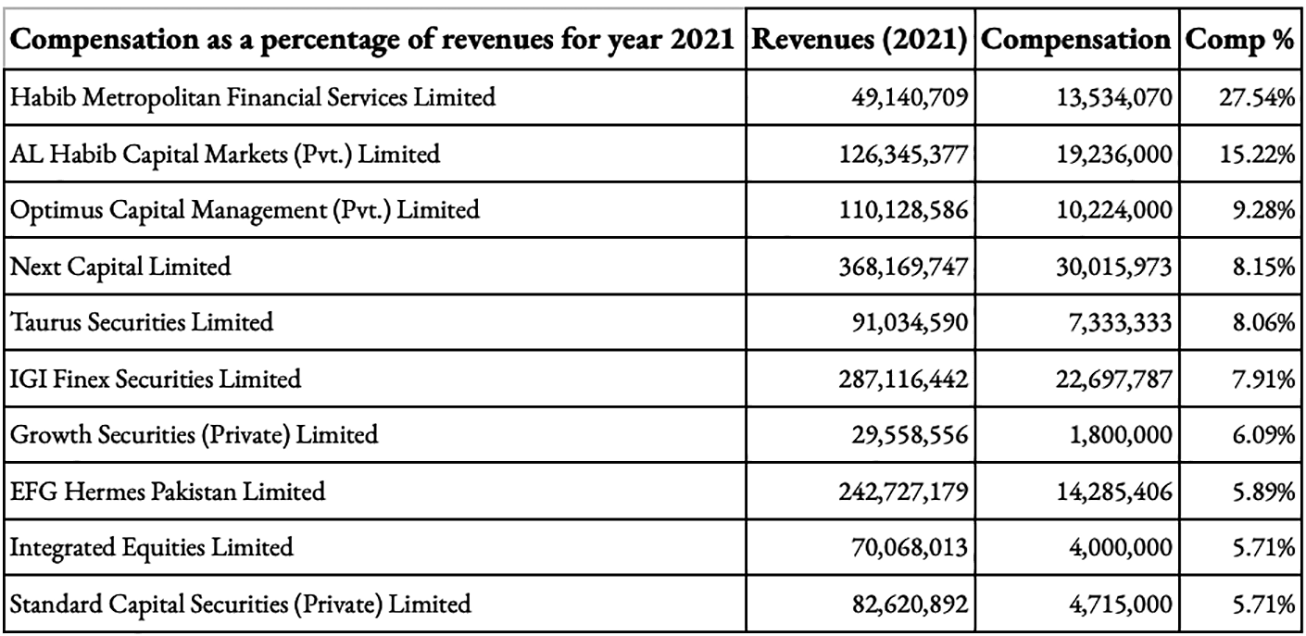

In terms of revenues earned by each of the brokerage houses, the analysis shows the following

It can be seen that Habib Metropolitan Financial Services paid out an eye-watering 48% of its operating revenues as compensation to its CEO. This means that for every rupee the company earned, it gave out 48 paisas to its CEO. The revenue figure is before any expenses have been deducted that the company has incurred. Al Habib Capital Markets (Private) Limited, Next Capital and IGI Finex Securities Limited follow it with 32.4%, 16.6% and 14.7% respectively.

For the year 2021, Habib Metropolitan Financial Services Limited is again leading the charts with 27.5% of its revenues given out as CEO compensation for the year. It is followed by Al Habib Capital Markets, Optimus Capital Management (Private) Limited and Next Capital with percentages of 15.2%, 9.3% and 8.2% respectively.

Profile of CEOs

In the analysis carried out, there are a few brokerage houses which have come up again and again. Now that you know the company, let’s get to know each of the CEOs a little better. The names of the CEO are ordered based on the compensation they earned as a percentage of the assets of the company.

Najam Ali is CEO and a director at Next Capital. He has worked in the industry for more than 30 years where he has been part of the capital markets in different capacities. Before joining Next Capital, he was the CEO at JS Investments Limited (JSIL) where he saw JSIL achieve its highest rating of AM2 Plus. He has also served as Chairman of Mutual Funds Association of Pakistan (MUFAP) twice.

Mr. Ali was the founding CEO of Central Depository Company (CDC) which is the first and only security depository serving the capital markets. He also played a role in the establishment of the National Clearing and Settlement System which was used by all the stock exchanges of Pakistan. He has served as a member of the Corporate Leaders Advisory Board of Institute of Business Administration (IBA) Karachi for 7 years and is a serving government nominee at the Council of Institute of Chartered Accountants of Pakistan (ICAP).

During the year, the company saw the CEO change as the baton was passed from Manzar Mushtaq to Ather Husain Medina. Ather Husain Medina is the current CEO at Habib Metropolitan Financial Services (HMFSL). He has done his MBA from IBA and holds a bachelor in computer sciences from National University of Computer and Emerging Sciences in Karachi. He has been working in the financial sector for more than 29 years. Previously, he served as the Head of Research at HMFSL and has also worked as a director of business development at Bank Islami Pakistan Limited (BIPL) Securities, Head of Business Development at Invest Capital Investment Bank Limited, Chief Investment Officer at Alfalah GHP Management Limited and Atlas Asset Management Limited. He also served as the Chief of Operations at Atlas Asset Management.

Aftab Q. Munshi was the founder CEO of JS Global Capital and joined the Al Habib group in 2005. He had been working as head of Equity Operations, Equity Sales and Compliance at the JS group for 12 years. He has also served as a director and company secretary of Confidence Financial Services Limited, Confidence Mutual Fund and director at Security Stock Fund Limited previously. Munshi is a qualified management accountant and corporate secretary and has been part of different committees and councils related to professional institutes and bodies operating in Pakistan. He has been a Member Evaluation Committee of ICAP/ICMAP for Best Corporate Report Awards. He is a qualified director certified by Pakistan Institute of Corporate Governance (PICG) and a certified member of Institute of Capital Markets (ICM) He is also part of MENSA International.

Aftab Q. Munshi was the founder CEO of JS Global Capital and joined the Al Habib group in 2005. He had been working as head of Equity Operations, Equity Sales and Compliance at the JS group for 12 years. He has also served as a director and company secretary of Confidence Financial Services Limited, Confidence Mutual Fund and director at Security Stock Fund Limited previously. Munshi is a qualified management accountant and corporate secretary and has been part of different committees and councils related to professional institutes and bodies operating in Pakistan. He has been a Member Evaluation Committee of ICAP/ICMAP for Best Corporate Report Awards. He is a qualified director certified by Pakistan Institute of Corporate Governance (PICG) and a certified member of Institute of Capital Markets (ICM) He is also part of MENSA International.

Anis ur Rahman has over 30 years of experience in Equity Research and Fund Management. He started his career as an equity researcher at KASB Securities and later became the head of research. He moved onto Merrill Lynch/Smith New Court as Director Research and then headed the research department at societie Generale Securities in Singapore. Rahman has served as CEO at Elixir Securities and ABL Asset Management. He has also served at National Bank of Pakistan as Head of Equity Investments managing the largest equity portfolio among commercial banks in Pakistan. Academically he has done an MBA from IBA and is a Certified Financial Analyst (CFA) charterholder.

Anis ur Rahman has over 30 years of experience in Equity Research and Fund Management. He started his career as an equity researcher at KASB Securities and later became the head of research. He moved onto Merrill Lynch/Smith New Court as Director Research and then headed the research department at societie Generale Securities in Singapore. Rahman has served as CEO at Elixir Securities and ABL Asset Management. He has also served at National Bank of Pakistan as Head of Equity Investments managing the largest equity portfolio among commercial banks in Pakistan. Academically he has done an MBA from IBA and is a Certified Financial Analyst (CFA) charterholder.

Rizvi has over 15 years of experience in the field of management, corporate strategy, business development, merger and acquisitions (M&A), capital market, financial/treasury management and corporate governance. His background has been in implementing significant change management initiatives and business turnaround strategies with a specialization in the Financial Sector. Previously, he has also served as the CEO of IGI Investment Bank and Group CEO overseeing IGI Insurance, IGI Investment Bank and IGI Securities. Professionally, he is a Chartered Accountant accredited from the Institute of Chartered Accountants of Pakistan (ICAP).

Watoo has been working in the field of project development and financial management in business sectors as varied as airline, telecom, financial services, real estate, media, independent power producers, textile, packaging, fertilizers and health care in Pakistan, Bangladesh, Iran and Sri Lanka. He was the Chief Operating Officer with JS Private Equity and Group Director Finance at Worldcall Telecom Limited. He also served as the head of corporate finance at Crosby Pakistan, financial controller at Kohinoor Energy Limited and Southern Electric Company Limited. He is a fellow member of ICAP and Institute of Chartered Secretaries and Managers Pakistan and has articled with A.F. Fergusson.

Watoo has been working in the field of project development and financial management in business sectors as varied as airline, telecom, financial services, real estate, media, independent power producers, textile, packaging, fertilizers and health care in Pakistan, Bangladesh, Iran and Sri Lanka. He was the Chief Operating Officer with JS Private Equity and Group Director Finance at Worldcall Telecom Limited. He also served as the head of corporate finance at Crosby Pakistan, financial controller at Kohinoor Energy Limited and Southern Electric Company Limited. He is a fellow member of ICAP and Institute of Chartered Secretaries and Managers Pakistan and has articled with A.F. Fergusson.

Atif Mohammed Khan is CEO and Director at Alfalah CLSA Securities (Private) Limited. He has over 24 years of experience in equity brokerage and capital markets. He joined Alfalah CLSA in 2015 when the company was going through a period of reorganization. Previously, he has served as Managing Director and CEO at Foundation Securities, Head of Equities at KASB Securities and Head of Sales at FC ABN Amro Equities. He has been credited with being part of the largest oil and gas M&A in Pakistan advising United Energy Group to acquire BP’s Pakistan business in 2011. He also set up two of the largest online trading platforms used in the country, Foundation EDGE and KASB Direct.

Atif Mohammed Khan is CEO and Director at Alfalah CLSA Securities (Private) Limited. He has over 24 years of experience in equity brokerage and capital markets. He joined Alfalah CLSA in 2015 when the company was going through a period of reorganization. Previously, he has served as Managing Director and CEO at Foundation Securities, Head of Equities at KASB Securities and Head of Sales at FC ABN Amro Equities. He has been credited with being part of the largest oil and gas M&A in Pakistan advising United Energy Group to acquire BP’s Pakistan business in 2011. He also set up two of the largest online trading platforms used in the country, Foundation EDGE and KASB Direct.

Syed Zain Hussain holds a Bachelor’s Degree from the SouthEastern University in Marketing. He has more than 20 years experience as a stock broker and fund manager. Under his guidance, the company has been able to become one of the reputable brokerage houses in the industry.

Saad Iqbal has over 10 years of experience in equity sales, trading and has served in the investment advisory capacity. He has worked as Head of Institutional Sales and Trading at Next Capital and was part of the team which carried out a successful IPO for Ittefaq Steel. Prior to working at Next Capital, he had worked as Institutional Sales Trader at KASB Securities. He holds a Bachelor’s in Accounting and Finance from Atkinson, York University and he is a CFA Charterholder.

Saad Iqbal has over 10 years of experience in equity sales, trading and has served in the investment advisory capacity. He has worked as Head of Institutional Sales and Trading at Next Capital and was part of the team which carried out a successful IPO for Ittefaq Steel. Prior to working at Next Capital, he had worked as Institutional Sales Trader at KASB Securities. He holds a Bachelor’s in Accounting and Finance from Atkinson, York University and he is a CFA Charterholder.

Ovais Ahsan has been working more than 15 years in the capital markets of Pakistan with a specialization in equities sales and trading. He has held senior positions in global and domestic investment banks and brokerage firms varying from JP Morgan, Renaissance Capital and JS Global Capital. He was part of the team at JP Morgan which was voted as the No. 1 team by Asia Money poll for sales trading in Pakistan for 2007-2008. He has joined Optimus Capital Management from Renaissance Capital which is based in Dubai and was involved in equity trading business for countries in the MENA and Frontier Asia region.

Ovais Ahsan has been working more than 15 years in the capital markets of Pakistan with a specialization in equities sales and trading. He has held senior positions in global and domestic investment banks and brokerage firms varying from JP Morgan, Renaissance Capital and JS Global Capital. He was part of the team at JP Morgan which was voted as the No. 1 team by Asia Money poll for sales trading in Pakistan for 2007-2008. He has joined Optimus Capital Management from Renaissance Capital which is based in Dubai and was involved in equity trading business for countries in the MENA and Frontier Asia region.

Most of the CEOs are owners of the companies. Hence, this debate is pointless.