As the country draws closer to the date of its 16th general elections on February 8, 2024, all eyes are set on the political scene, with the public anxiously anticipating the outcome of these contentious polls.

However, preceding this event is the first meeting of the Monetary Policy Committee (MPC) in 2024 scheduled for Monday, January 29, where the fate of the policy rate will be decided.

The government is facing significant pressure from the private sector to reduce rates; however, according to experts, the necessary prerequisites for a rate cut have not yet been met.

Profit has covered the rate outlook in its article: Has the policy rate peaked or will the SBP wait out an impending round of inflation?

Adding to the predicament is the inflation outlook which is still uncertain given the external and domestic economic and political landscape.

The dicey situation feeds into speculation around the rupee’s value. While over the last three months, the rupee has gradually appreciated, the downside risk pertaining to the currency remains high in the near term, as highlighted by the International Monetary Fund’s (IMF) first review under the Stand By Arrangement (SBA).

The forex market

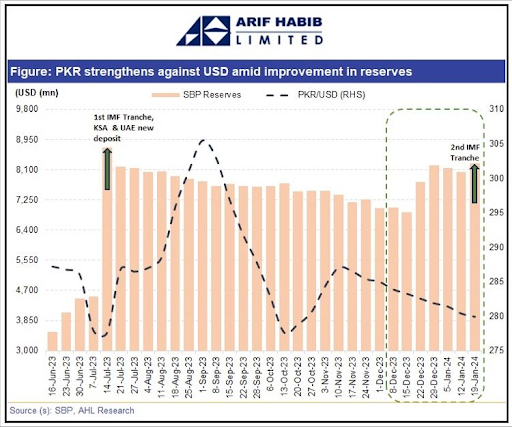

Pakistan avoided a default by securing a last-minute staff-level agreement from the IMF for a SBA on June 30, 2023. At the time, the country’s forex reserves plummeted to approximately $ 4.5 billion, covering not even a month’s worth of imports.

However, the currency market had other plans, as even after the disbursement of the much needed funds, speculators ran rampant and the rupee lost significant value, breaching the Rs 300 mark. This trend was curbed in September 2023, as a nationwide crackdown on speculators led to a sharp correction in the market.

This action was also necessitated by the fact that the IMF SBA required Pakistan to maintain the gap between the interbank and open market rates at a maximum of 1.25%. The idea behind this condition is simple: the IMF suspected that the State Bank of Pakistan (SBP) in the past has been coercing the banks into keeping the dollar rate artificially low in the interbank market. The IMF was apprehensive about this intervention, as it encouraged imports and discouraged exports, worsening the dollar reserve situation.

Therefore, post corrective measures, the rupee gained value significantly and the exchange rate outlook remained positive in the short run. The exporters also became cognizant of the trend and ran to the forward market to hedge their risk.

By selling the forward contracts, exporters can lock in a specific exchange rate for their future export transactions. This allows them to protect themselves against potential upward movements in currency exchange rates.

This trend continued through September and October of 2023, and slightly picked up in early January of 2024. However, since then, the forward market has dried out as the short run expectation is that the rupee will stabilize around the current Rs 280 mark against the greenback.

The external situation

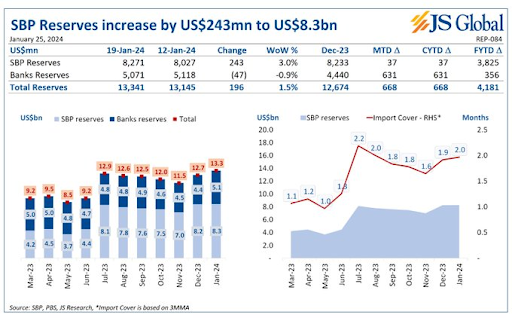

The SBP reserve situation has gradually improved, as post the signing of the SBA in July, multilateral and bilateral flows have been unlocked, easing the liquidity situation. The current reserves levels are around $ 8.3 billion after the disbursement of the latest IMF tranche.

“Recently, the rupee has been stable with the current account remaining in the manageable range, even turning surplus in the last few months. Moreover, the latest tranche received from the IMF helped boost reserves, resulting in the rupee remaining stable”, remarked Sana Tawfik, deputy head of research at Arif Habib Limited.

According to the IMF’s latest review report, the open market premium has largely been eliminated, although interbank trading volumes have weakened significantly in recent months. Even though import payments, repatriation of dividends and profits have picked up, nonetheless, concerns about insufficient foreign exchange via banks amongst businesspeople and foreign investors persist.

The reserve situation is a key driver in the rupee stability. To maintain this equilibrium, banks have been instructed by the central bank to match the export receipts and import payments. Additionally, there are still restrictions on import of certain items, and repatriation of profits has not been fully restored.

“While Pakistan has been able to achieve a nearly balanced current account since August 23, it is a result of administrative measures where banks have been asked to match their import related USD needs with export proceeds,” read a report by Akseer Research.

So what will become of the rupee?

Analysts have cautioned against unfavourable developments which could reduce SBP’s foreign reserves. These include the inability to secure a fresh IMF program, and delayed support from friendly countries backed by changing geopolitical preferences. This would likely negatively impact investor confidence in the country’s macroeconomic outlook.

In its outlook for 2024, JS Global labeled the Pakistani rupee as the poster child of risks cautioning that any adverse move on international commodities, IMF, or inflation will reflect in the value of the rupee.

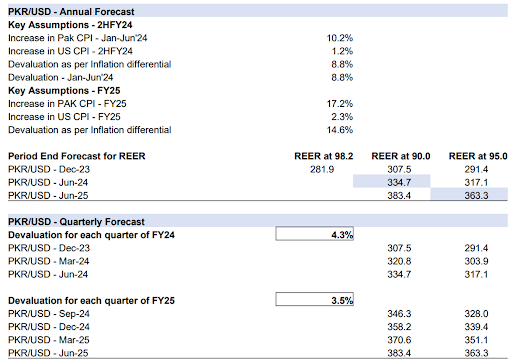

As per Tawfik,“Going forward, as demand picks up so does import, which we believe would still be in a managed way along with debt repayments. This is likely to put some pressure on the Pakistani rupee. We expect that the rupee might hover in the range of 310-315 per USD by June 2024. Any further inflows from multilateral creditors, however, will provide a breather.”

Additionally, analysts at Akseer Research believe that due to substantial external financing needs, a limited export base, and upcoming negotiations for a longer-term IMF program after the general elections in 2024, the country will likely need to maintain a relatively undervalued currency. They anticipate the Real Effective Exchange Rate (REER) to remain around Rs 95.

“The country will not have the resources necessary to defend its domestic currency while simultaneously meeting its obligations to repay interest payments and make settlements for imports. The rupee is expected to depreciate by 6% during 2024-25 on the back of high demand for USD. Premature discount rate cuts by the SBP would worsen the current account deficit, which in turn would affect inflation and the value of the currency,” remarked Nida Gulzar Siddiqui, Economist at Ktrade.

“To keep the exchange rate stable, the SBP shouldn’t cut the discount rate too soon. Instead, they should leave things as they are until inflation starts to slow down and falls just below the current policy rate. The market is predicting that the first cut will take place in March or April of 2024 since that is when the SBP has announced its subsequent MPC meetings,” she added.

While the SBP’s monetary policy stance remains crucial for broader economic cohesion and rupee stability, the divergent fiscal position presents a significant challenge. The growth of net domestic assets, which refers to the availability of rupee liquidity in the financial system, has outpaced the growth of net foreign assets, which represents dollar liquidity. This can be attributed to the injection of substantial amounts of money into the system, necessitating the need for fiscal discipline to curb this trend.

Well elaboration about rupees stability