Since its inception, the Special Investment Facilitation Council (SIFC) has looked to expand itself and take over the reins of the economic underpinnings of the country with limited success. The military and bureaucracy based chimera has looked to stimulate the economy while looking to bring in investment from foreign countries. And now the council is trying to take on one of Pakistan’s most persistent issues: circular debt.

As talks begin between the IMF and Government of Pakistan resume, one of the salient features of the talks is going to revolve around the circular debt and measures taken to decrease it. The circular debt at the end of January stood at Rs. 5.7 trillion, with the power sector accounting for Rs. 2.703 trillion and the gas sector contributing Rs. 3.022 trillion. Despite past measures, such as tariff increases, little progress has been made in addressing it.

How did we get here?

The circular debt is an ever growing monkey on the back of the government which has been persistent in the energy sector for the last 3 decades.

In the power sector, circular debt is the payment withheld by the Central Power Purchasing Agency (CPPA) due to cash flow deficit leading to cash flow problems for other players in the supply chain.

The main causes of circular debt according to the Arif Habib Pakistan Strategy 2024 report are: “Inadequate sector governance, Delays in tariff determination and notification, Lag in fuel price adjustments, Insufficient revenue recovery from both government and private consumers, High Transmission and Distribution (T&D) losses.”

Poor collections revenue collection of power distribution companies (DISCOs) from private and government customers along with delayed and incomplete tariff differential subsidies (TDS) payment by the government to DISCOs and K-Electric adds to the shortfall in inflows.

This sets in motion a series of outstanding receivables in the books of multiple companies in the supply chain including fuel suppliers, generation companies and transmission companies.

Further, the accumulation of gas circular debt is also a pressing concern, exacerbating the challenges faced by the already fragile gas distribution sector. Initially, a significant portion of the circular debt was attributed to natural gas, but recently, the share of RLNG has also been increasing. The differential margin, which is the difference between the tariff approved by the government and the tariff recommended by OGRA, adds to the mounting debt.

Additionally, issues like Unaccounted For Gas (UFG) and gas theft further contribute to the amount that needs to be recovered from the government. Subsidized tariffs, combined with delays in subsidy release, weaken the ability of distribution companies to repay RLNG suppliers such as PSO and PLL.

UFG refers to gas loss that occurs due to various technical factors as gas travels from fields to end consumers. It is calculated by comparing the metered gas volume injected into the transmission and distribution network (Point of Dispatch/Delivery) with the metered gas delivered to consumers (Consumer Meter Station) during a financial year. Adjustments for self-consumption and other factors in the operations of gas utilities are also taken into account while determining UFG. OGRA, as the regulator, establishes the UFG benchmark for both Sui Companies. Any UFG percentage or value that exceeds the fixed benchmark is considered disallowed and is deducted from the revenue of the gas utility companies.

Source: PACRA

In the past, gas was provided with inadequate pricing being implemented. This meant that the revenues being generated were not able to cover the cost of providing those services.

Sui was taking gas from Exploration and Production (E&P) companies like Oil & Gas Development Company Limited (OGDCL), Pakistan Petroleum Limited (PPL) and Government Holdings (Private) Limited (GHPL) but was not able to pay the total cost of fuel. Further, RLNG was being supplied by Pakistan State Oil (PSO).

As per an analysis note published by AKD research,“The gas sector circular debt, in particular, has surged over the past three years due to stagnant gas prices, increasing well-head costs, and the diversion of expensive RLNG to the fertilizer sector and households. Presently, the gas circular debt stock is around Rs. 3.0 trillion (including Late Payment Surcharge), and its burden is primarily borne by the three major fuel suppliers such as OGDCI, PPL, and PSO, with total receivables on their balance sheets as of 1QFY24 amounting to Rs. 595 billion, Rs. 543 billion and Rs. 510 billion respectively.”

What is in the new plan?

The new plan relates to addressing the circular debt primarily in the gas sector. Its objective is to rationalize tariffs, eliminate cross subsidies, and inject cash into the system.

The IMF will be informed about the new program, and there are already indications that the Fund will approve the plan. As per the news flow. the proposal involves injecting Rs 645 billion into the system, which will be provided by the Ministry of Finance (MoF) as a supplementary grant.

In the past, budgeted grants were used to settle the receivables which were piling up. The new plan will create a dual solution to the problem by addressing liabilities and receivables of the company at the same time.The budgetary grants will adjust the receivables and will also make sure that these grants go towards the power sector.

The scheme will work in this manner. Let’s start by assuming that the government passes a grant. The grant will be given to the Gas distribution companies (Sui Cos) who will then be able to adjust their receivables by transferring them to pay off gas suppliers. Once the payments are received by suppliers, they will be able to pay out dividends to its investors which includes the Government of Pakistan (GOP).

Given GOP’s majority stake in the sector, the funds will actually cycle back to the national treasury which will recoup the majority of the cash injection which was carried out in the beginning.

Numbers to back the plan

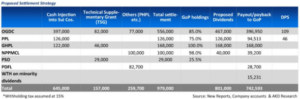

AKD Research has looked to quantify the impact of this plan and its impact on the listed companies of OGDC and PPL in addition to other companies which will see a cash injection owned wholly by the government.

Additionally, a technical supplementary grant alongside debt support through other entities will add to the settlement amount. A technical supplementary grant involves reallocating funds from one budget area to another, without increasing the total budget.

Once the cash injection takes place, OGDC will see an inflow of Rs. 556 billion which will decrease its receivables. As the company comes flushed with funds, the company will give out dividends of Rs 467 billion from which Rs 397 billion will go to the government while Rs 70 billion will be earned by the shareholders other than the government. This will come to around Rs. 109 per share.

Similarly, PPL will be able to give out dividends of Rs. 126 billion from which Rs. 95 billion will go to the government while Rs. 32 billion will be given to the minority shareholders. This will come to around Rs. 46 per share in the form of dividends.

The injection will also pay off some of the outstanding amounts that Sui owes to PSO, against the purchase of RLNG, which will improve the financial and liquidity situation at PSO.

Further, the tax on dividend paid out to minority shareholders is expected to amount to Rs. 15 billion which will again be raised by the FBR on behalf of the government.

Muhammad Ali, caretaker minister for energy, power and petroleum, has defended this move by saying that this is a new move to deal with the circular debt issue. This measure will mean that the Finance Ministry will have to release funds for only two days and will actually end up getting a large chunk of this grant back into its coffers.

sifc has plan to ruin everything.

LNG was never affordable…. time to burn local coal

not addressing the real issue, circular debt will mount again.

To reduce cir ular debt, if issue is for releasing funds for two days, the scheme is not bad. However, come what may, there should be no accomolation of circular debt in future.

The whole world is burning coal, what is issue with us.

an even easier way, buy gas from Iran.

buy gas from iran..tell america we hve to pay off their debt. either they write off the loans or we buy gas from iran.